- Ripple has seen an increase of 490% for three years in active addresses that considerably surpasses Bitcoin

- Is XRP switched to a speculatively active instead of a Value store?

The Cryptocurrency market has undergone remarkable shifts in the participation of the retail trade. Ripple [XRP] has registered an increase of 490% in active addresses in the past three years, which performs better than Bitcoin [BTC] over the same period.

It is remarkable that half of this expansion took place in Q4 last year, so that a three -month increase of 460% was aimed – Bitcoin’s profit over 61% surpassed Until his highlight of $ 108,364.

Momentum even took place when Ripple Q1 closed for the opening price of the new year, while Bitcoin ended the quarter of 10.71%.

However, XRP shown irregular price action on the 1D price card, so that the key resistance levels do not broken.

In contrast to Bitcoin, which has to do with clear sales pressure, XRP seems to have introduced a “retail-driven” speculative loop, as identified by Ambcrypto.

Fomo Frenzy takes over

Five years after the long -term legal battle, Ripple’s victory over the SEC could not deliver the outbreak that many had expected.

Despite an intraday increase of 11.56% on the news, XRP was re -confronted with a strong resistance at $ 2.60, which marked his second rejection at this key level in March.

At the time of writing, XRP consolidated around $ 2, a historically validated level of support that is often preceded for bullish reversations-one prospects that are further confirmed by statistics on chains.

The outflows of the exchange have increased by 1.74%, with a total of 2.23 billion XRP included at $ 2.06, which is indicated a potential supply ban, while another FOMO-driven battery phase unfolds.

Source: Cryptuquant

Supplementary, Speculative capital inflow speed up.

Open interest (OI) has risen by 1.06% to $ 3.65 billion, while the estimated risky lifting tree positions in derivatives markets have risen by 1.14%, indicating a growing risk of risk among loom traders.

These factors collectively strengthen the risk of dip-buying activity, because the liquidity of bid-side is enhanced in the midst of intensifying FOMO driven by the retail trade.

But is this rally structurally healthy? While one 490% rise in the participation of the retail trade has strengthened an important liquidity zone for $ 2, it also indicates an overheated speculative demand environment.

Does this increase the chance of increased volatility and potential price inspections?

Ripple’s market positioning in Q2

Especially the Top three most dominant whalehorts Stay far under their earlier accumulation peaks, which strengthens an extensive distribution phase.

This persistent pressure on sale has created a structural liquidity overhang that suppresses the capacity of XRP to reclaim the critical level of resistance of $ 3.

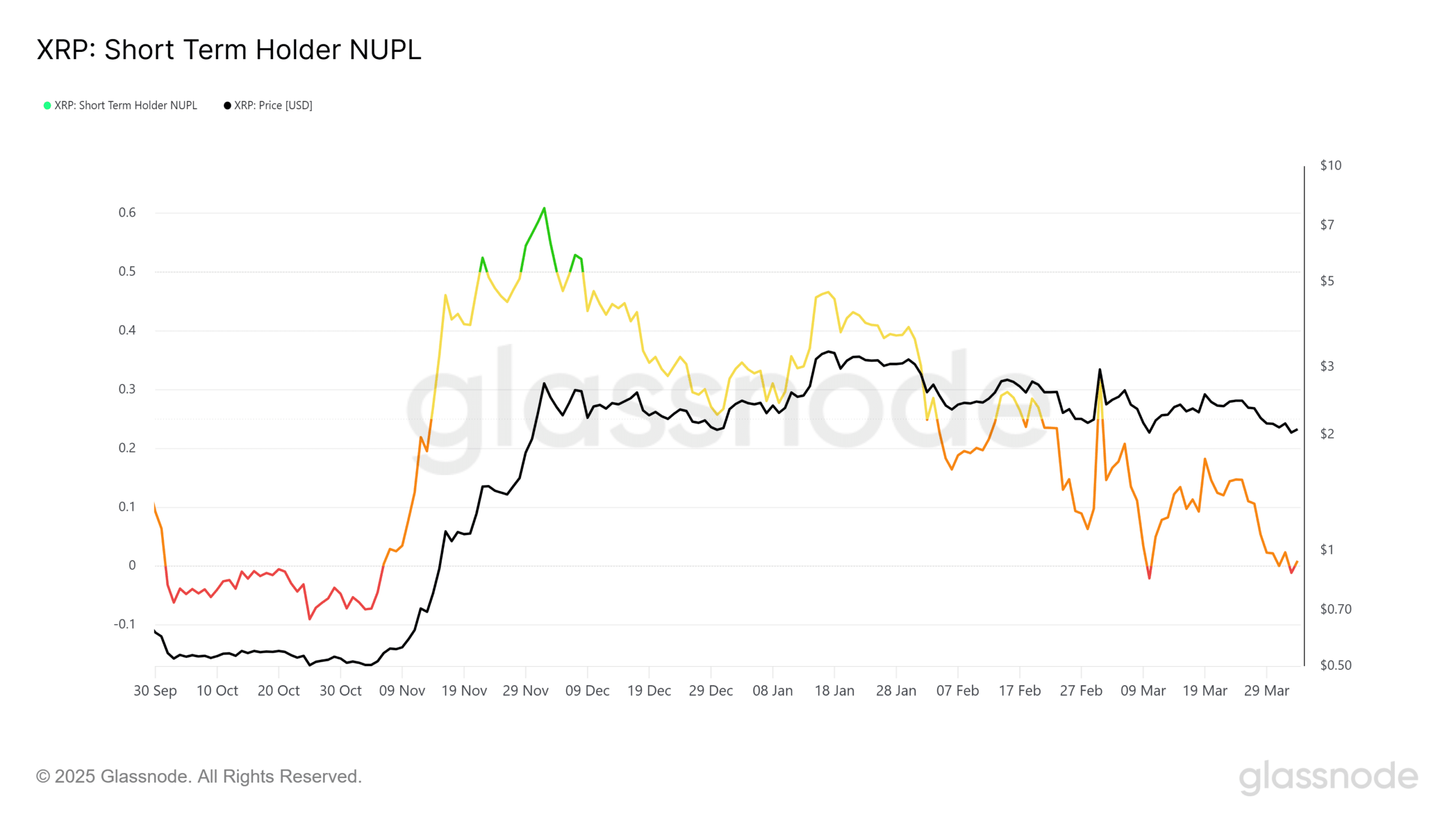

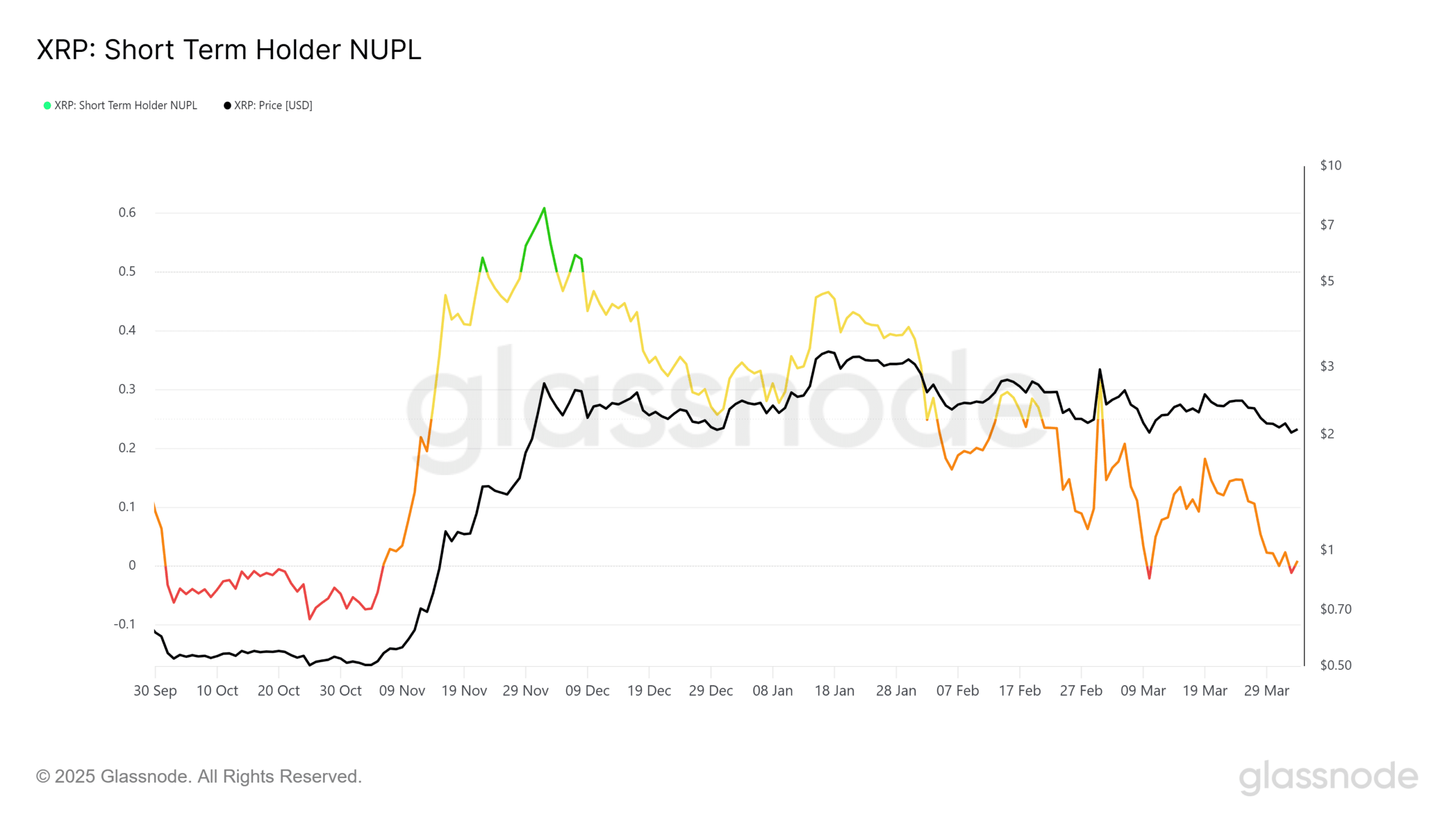

A B2 -breakout seems structurally weak. The net non-realized profit/loss (STH-NUPL) in the short term confirms increased volatility.

Historically, STH-NUPL turns every time Ripple approaches the resistance level of $ 2.60, in the capitulation zone, so that the outputs are considered weakly after speculative FOMO-driven intake.

Source: Glassnode

This suggests a highly powered market structure driven by the retail trade, where early profit maker with important break life points inefficiencies from the delivery side-side side-side worsens out.

Consequently, XRP remains accessible, so that the necessary question absorption is not generated that is necessary for a persistent outbreak outside the resistance.

Unless the liquidity of the buy-side strengthens at important resistance levels, Ripple probably remains trapped in a speculative feedback loop dominated by the retail trade, which means that a $ 3 recovers in Q2 increasingly unlikely.