- If XRP can break above $ 3, this will make the current main and shoulder pattern invalid, so that the Outlook Bullish may be reversed.

- XRP’s Flip to Bullish is hindered as the stablecoin reserves between exchanges increase, so that the profit on the market is demonstrated.

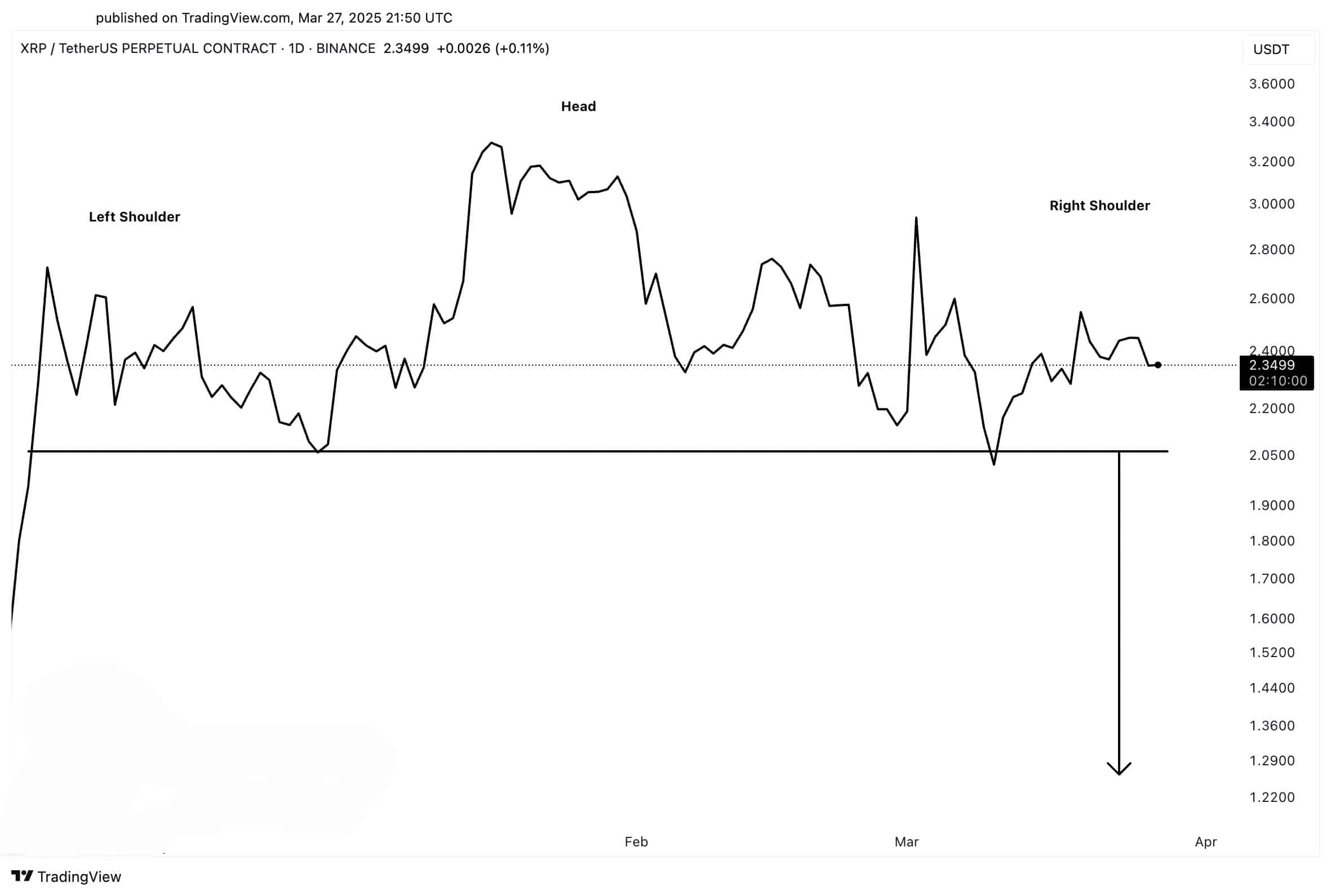

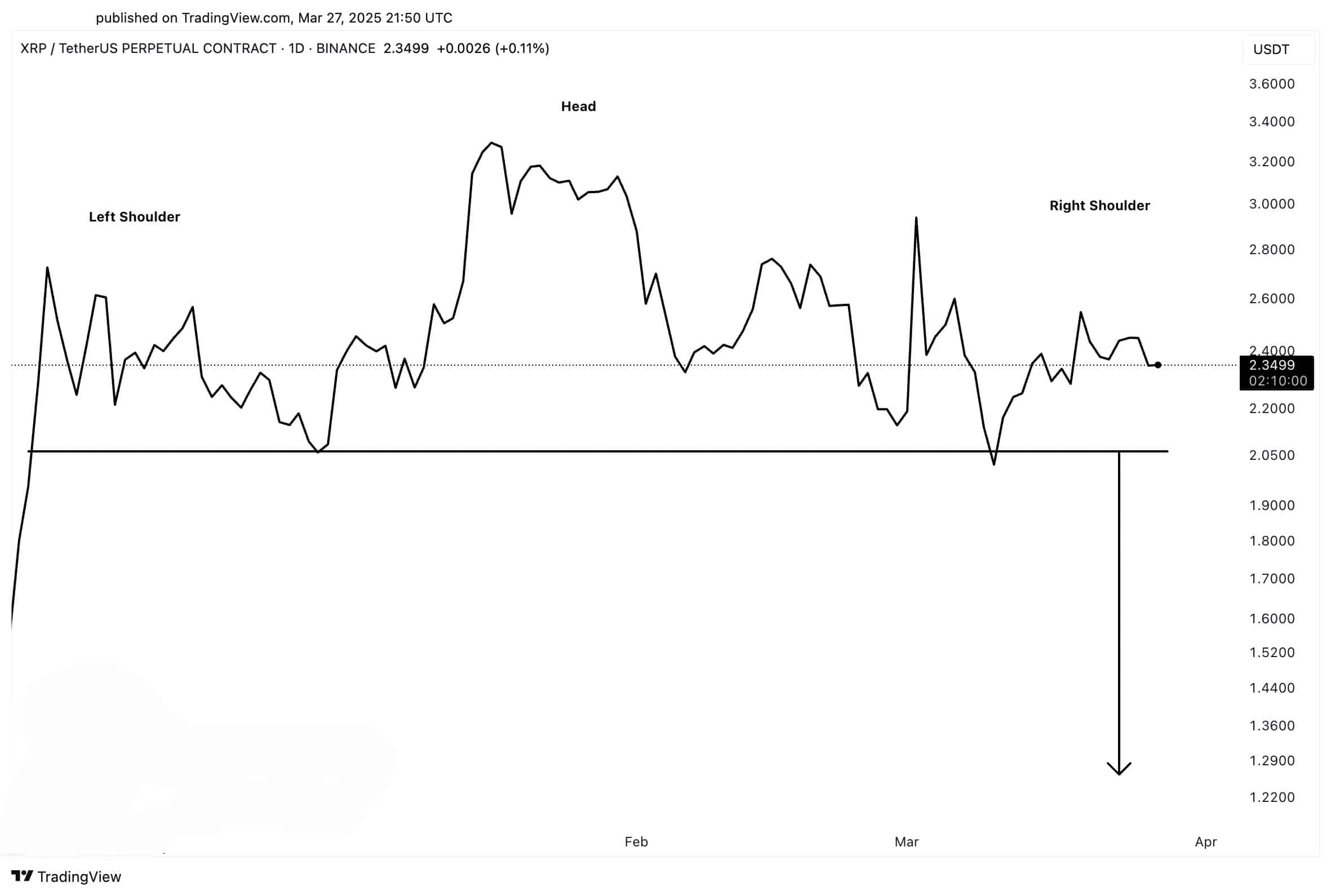

Ripple[XRP] Developed a traditional Bearish pattern, head and shoulders signaling of an oncoming Bearish Trend that had his most important point of support at $ 2.05.

A proven breakdown under this section can cause rapid depreciation to push the XRP prices to the $ 1.30-$ 1.20 region, which corresponded to a rather turning point.

XRP that is higher than $ 2.05 may slow down the bearish breakdown, because short upward movements can occur between $ 2.40 and $ 2.60 before the price continues its descent.

Source: TradingView

A price movement above $ 3 would cancel the validity of the main and shoulder structure, which changes the general market sentiment to Bullish. XRP price could test this point as a resistance to $ 3.40 and $ 3.60 before it shows an increased movement potential.

The upcoming trade sessions can be essential because continuous bulk purchases are needed to cancel both the Bearish pattern and exceeding important resistance levels.

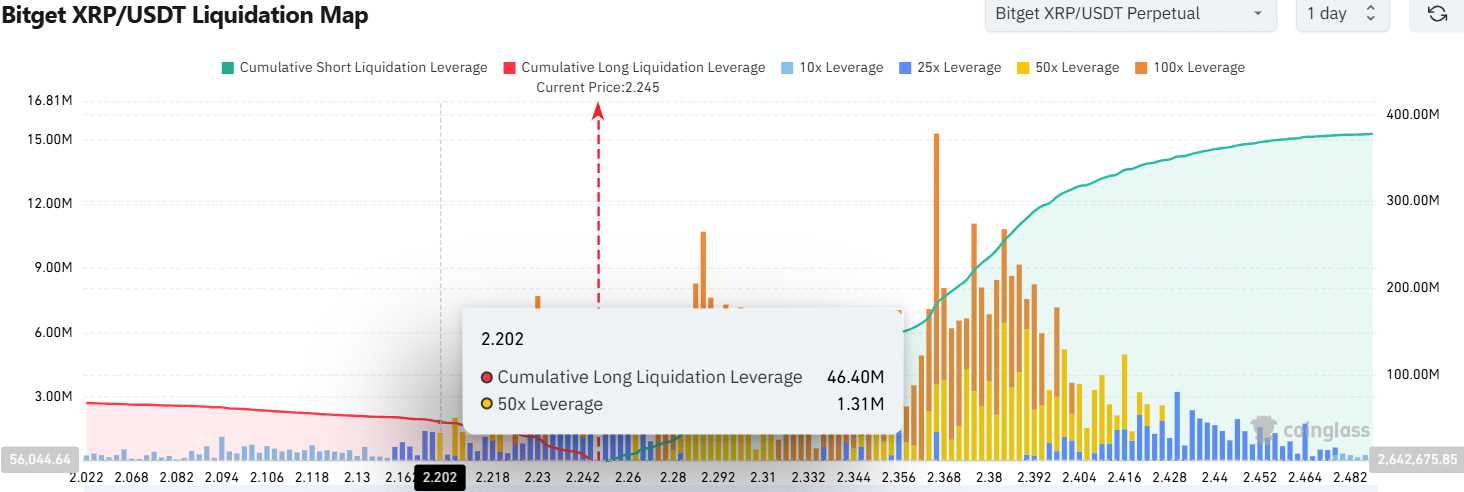

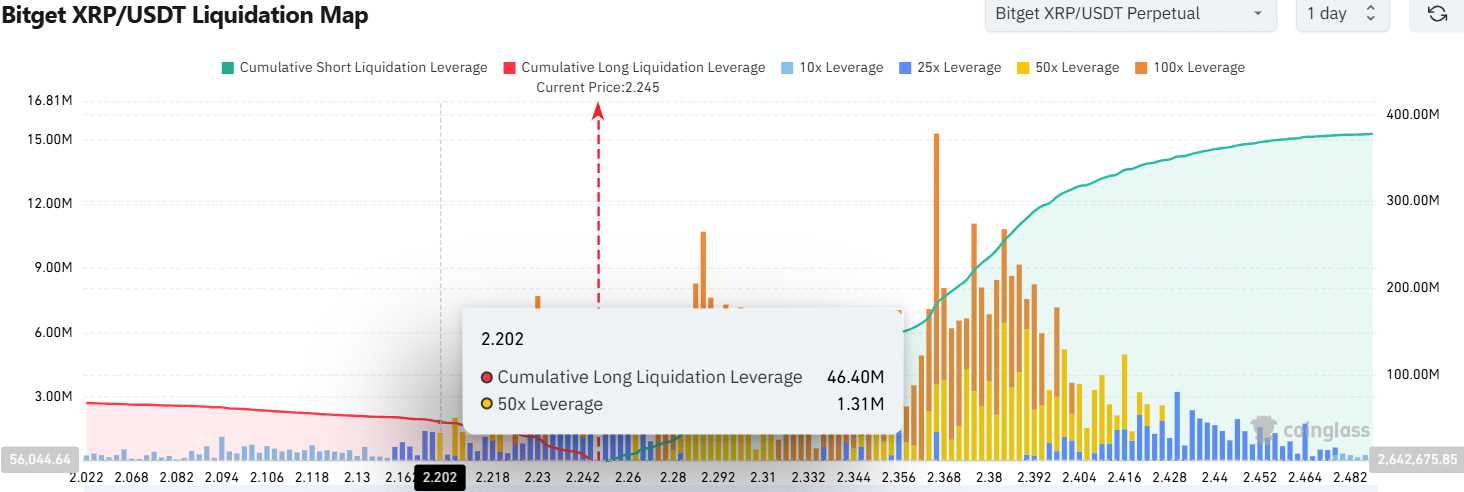

Long liquidations and PPeak peak

The bearish pattern is supported by the increase in the cumulative long liquidation -lever value to $ 46.4 million in $ 2.20 zone.

The number of forced liquidations among long traders could reach this peak, which would enhance the rising sales pressure in the market.

At the same time, lifting tree positions continued to rise, which demonstrates the increasing negative sentiment and thereby increases the chance of a continuous down.

XRP for $ 2,245 struggled to break support, which could activate liquidations and push the price to $ 2.10 or lower.

As soon as XRP affects the $ 2.20 liquidity zone, liquidations can aggressively wipe out leverage traders, which accelerates the price decrease.

Source: Coinglass

Stablecoin also reached $ 32.8 billion in 24 hours at all stock markets, from the moment of press. This indicated that several market participants sold their participations for profit, such as Ali noticed on x (Previously Twitter).

Strong sales pressure became more likely because of the reduction of bullish indicators. The increasing reserve companies from Stablecoins could activate the XRP prices to break the support at $ 2.05.

An absence to defend the support level would lead to the price between $ 1.30 and $ 1.20.

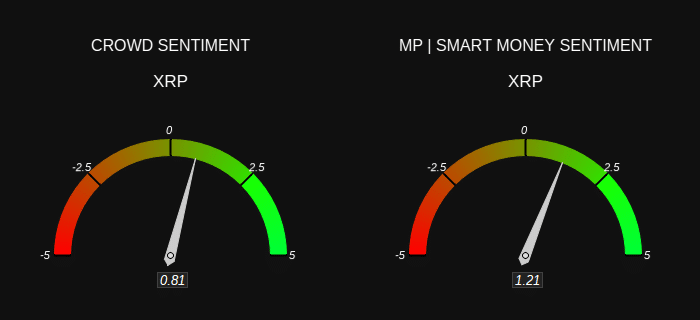

Can Sentiment Flip XRP’s bearish signals?

The bearish sentiment against XRP because of its head and shoulders deteriorated pattern because of the liquidity that flows from the market. Sentiment for XRP, however, pointed to bullishness. The sentiment of the public achieved a value of 0.81, while Smart Money sentiment was 1.21.

Data showed that retail and institutional traders had a preference during this time to resolve price movement. However, these may not be sufficient to change the Bear Conditions.

This is because smart money often uses manipulation to lure investors prior to considerable price decreases.

Source: Cryptuquant

XRP that does not break through the resistance can cause a liquidity swing, so that the prices push down until experienced traders leave before the market expansion starts.

Market sentiment exhibited optimism, although extra price decreases were probably due to liquidation risks.

![Ripple [XRP]: If bearish stack signals, will $ hold $ 2.05? – Levels to view are …](https://free.cc/wp-content/uploads/2025/03/Lennox-20-1000x600.png)