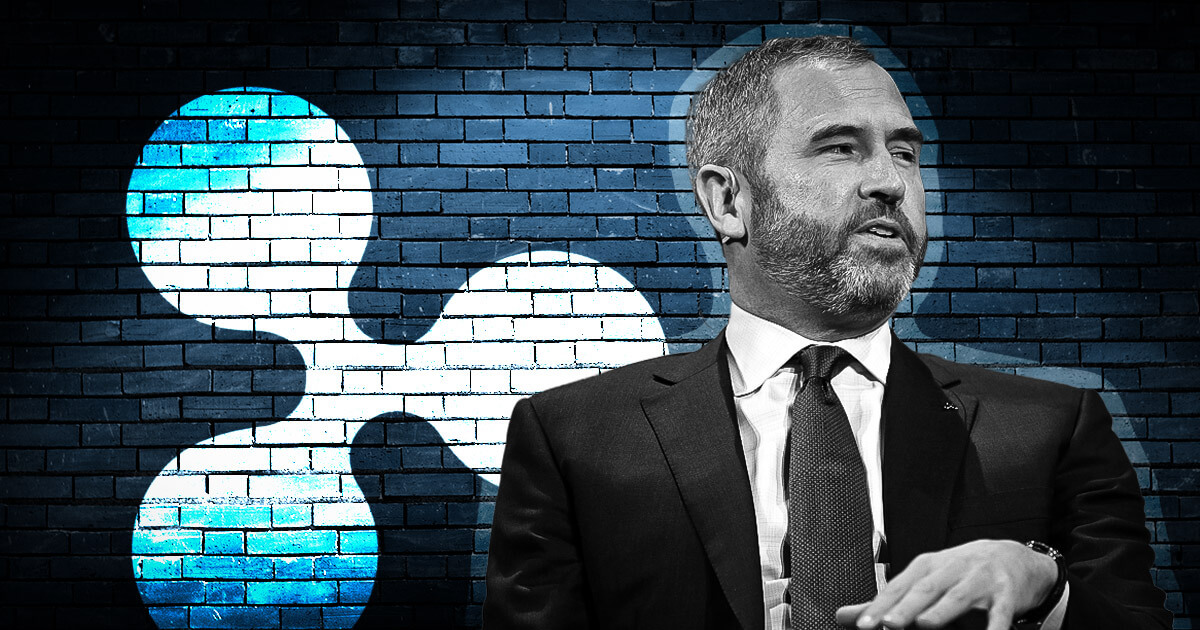

Ripple CEO Brad Garlinghouse said the US SEC’s actions towards the crypto industry have failed to protect investors and he must reassess his regulatory strategy.

Speaking to CNBC’s Dan Murphy at the Ripple Swell conference in Dubai, Garlinghouse expressed concern about the SEC’s focus and wondered:

“Who are they protecting on this journey?”

The CEO said the watchdog’s enforcement approach to regulating the crypto industry has only stifled growth. He added that the industry needs a new, tailor-made regulatory framework that properly takes into account the nuances of digital assets.

Court ruling against SEC

The criticism comes after a multi-year legal battle between Ripple and the SEC, which accused the blockchain company and its executives of committing $1.3 billion in securities fraud by selling XRP to retail investors.

However, in a crucial victory for Ripple in July, a judge ruled that XRP is not a security, marking a major development in the ongoing case.

The CEO also referenced a recent win for Grayscale, a digital asset manager, in the context of a Bitcoin ETF application. He emphasized that the federal judge presiding over the case had criticized the watchdog for being “arbitrary and capricious.”

According to Garlinghouse:

“In general, judges tend to be quite in the middle and try not to be dramatic – those are damning words.”

Garlinghouse said the watchdog may finally reassess its regulatory strategy, saying the enforcement approach of filing lawsuits alone has not worked in its favor and has only served to stifle innovation in the US.

Federal laws needed

Garlinghouse expressed hope that the regulatory stance on the digital assets industry will shift to a more positive tone following these legal developments. He said the government must take a more proactive approach to overseeing the sector, starting with new laws on digital assets.

He added that the US must move beyond a situation where crypto regulation is determined through lawsuits if the industry is to thrive in the country. He called for the introduction of federal laws regulating digital currencies by Congress, emphasizing the need to break with the current pattern of regulation through enforcement.

Garlinghouse reiterated that XRP should not be considered a security, emphasizing that federal laws can provide clarity and stability for the industry.

While the legal battle continues, the next major step in the Ripple-SEC case is the remedy discovery process, with the SEC having 90 days from November 9 to conduct related discovery, according to a proposed schedule.