Ripple Chief Legal Officer Stuart Alderoty has called for an investigation into former US Securities and Exchange Commission (SEC) director Bill Hinman. The call comes in the wake of the court-ordered release of a trove of documents by the SEC, which has been embroiled in a legal dispute with Ripple since 2020.

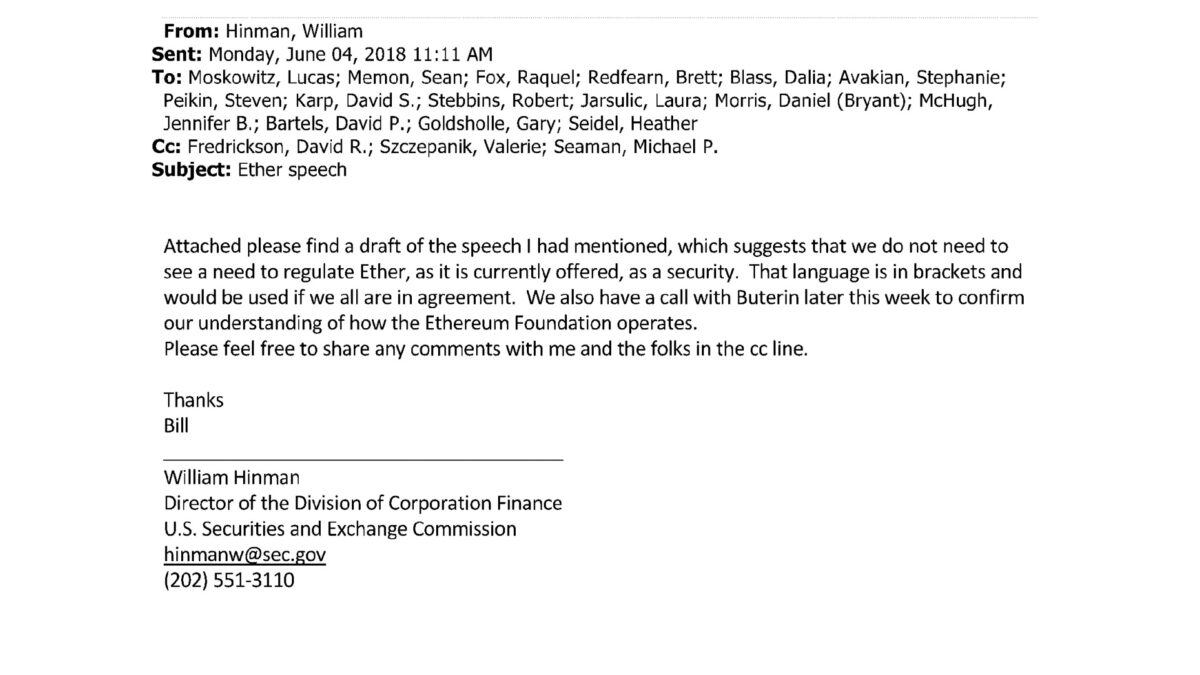

The documents, recently sealed by a judge, reveal conflicting thoughts and opinions within the SEC regarding the regulation of the crypto industry. They largely relate to a speech by Hinman in June 2018, in which he stated that Ethereum (ETH) should not be considered a security because it was “adequately decentralized”.

13/ An investigation needs to be conducted to understand what or who influenced Hinman, why conflict (or at least the appearance of conflict) was ignored, and why the SEC praised the speech knowing it would cause “greater confusion” .

— Stuart Alderoty (@s_alderoty) June 13, 2023

However, Web3 enthusiasts — including several figures involved in current affairs with the SEC — see this statement as inconsistent with the regulator’s subsequent decision to sue Ripple Labs over its alleged $1.3 billion sale of XRP as an unregistered security. The documents have led the wider crypto industry to accuse the SEC of arbitrarily applying securities laws to a range of digital tokens, demonstrating a clear lack of internal cohesion regarding blockchain-enabled technologies and generally being out of touch with and unsuitable for adequate regulation the industry.

Challenge the regulatory legitimacy of the SEC

In a Twitter thread Alderoty outlines his thoughts on the matter, claiming that Hinman “invented factors” to consider when determining what “adequately decentralized” really means. He also urged the SEC to remove the speech from its website and launch an investigation into the former executive.

An investigation needs to be conducted to understand what or who influenced Hinman, why conflict (or at least the appearance of conflict) was ignored, and why the SEC praised the speech knowing it would cause ‘greater confusion’ ,” Alderoty wrote.

Ripple’s legal chief also argued that the unsealed documents, including emails and other digital records, show disagreement among SEC officials over certain aspects of Hinman’s speech and that the executive ignored their concerns. Alderoty cited parts of the documents where the agency’s head of Trading and Markets expressed concern that the extensive list of factors in Hinman’s speech could lead to more confusion about what constitutes a security.

The meaning of the Howey test

One of the reasons the Web3 community is rebelling against the documents is that Hinman’s comments, along with those of other SEC employees, are in stark contrast to those of SEC Chairman Gary Gensler, who has outspoken about how the organization relies on the Howey test to consider the legal classification of crypto tokens. While Gensler has said the SEC considers “most crypto tokens” to be investment contracts under the Howey test, claiming that the legal framework already exists to consider cryptocurrencies, these new documents reveal that numbers within the SEC’s own walls are not unified. are in this thinking. .

That such disagreement and discussion exists even among the SEC’s own staff is perhaps unsurprising; even SEC Commissioner Hester Peirce has long criticized Gensler’s regulation-by-enforcement approach to the industry.

14/ And finally, Hinman’s speech should never again be used in a serious discussion of whether or not a token is a security. Unelected bureaucrats must faithfully apply the law within the limits of their jurisdiction. They cannot – as Hinman tried – make a new law.

— Stuart Alderoty (@s_alderoty) June 13, 2023

Alderoty is far from the only voice critical of the Gensler-led body in what is starting to look more and more like an all-out regulatory war on crypto; on June 12, GOP lawmakers introduced the SEC Stabilization Act, which calls for Gensler’s removal from the SEC.

As the SEC continues to ramp up legal efforts with the largest cryptocurrency exchanges out there, the Ripple case and subsequent call for an investigation into Hinman’s actions highlight the ongoing debate and confusion surrounding the regulation of the crypto industry.

The debate is far from academic; Crypto.com recently announced it would close its US institutional services, and venture capital giant Andreessen Horowitz (a16z) revealed it will open a crypto-focused office in the UK in the coming months. How these developments ultimately play out is likely to have a significant impact on the future of the industry.

Editor’s Note: This article was written by an nft now contributor in collaboration with OpenAI’s GPT-4.