- The revival of ADA is generating a lot of attention in the institutional world, with Grayscale taking the lead

- This move is likely related to ADA’s impressive price increase in late 2024, which saw ADA increase by more than 300%

After closing 2024 at $0.80 and at the time of writing at $1.14, Cardano traded [ADA] has clearly caught the attention of investors, especially with the ADA/BTC pair turning green. With altcoins competing for capital appreciation and Bitcoin moving towards a ‘risky’ zone, could Cardano emerge as the leader in the next altcoin cycle?

Cardano’s long-term future looks bright

There’s no doubt about it: the past week has been incredibly profitable for Cardano. HODLers who came through the tough fourth quarter strong are now reaping the rewards with impressive gains.

What’s even more exciting? The resurgence of ADA is attracting the attention of institutional investors. The largest in shades of gray multi-asset fundthe Digital Large Cap Fund (GDLC), has quietly added ADA back to its portfolio.

After a stunning 300% surge in the second half of 2024 that took the ADA to $1.33, this move could be huge.

In fact, Grayscale now owns more than $11 million in ADA, and that number could grow even further if GDLC is approved as an exchange-traded fund (ETF) – something Grayscale submitted for October 2024.

With Bitcoin [BTC] and ether [ETH] With we already seeing huge gains from ETF exposure, adding Cardano to the list would be a breakthrough moment.

But what is the near-term future for ADA?

The charts don’t lie: Cardano has started the new year as a standout artist. With a 30% gain, Cardano has outpaced its rivals, and the breakout against BTC in the ADA/BTC pair revealed that investors are increasingly seeing it as a top choice for diversification.

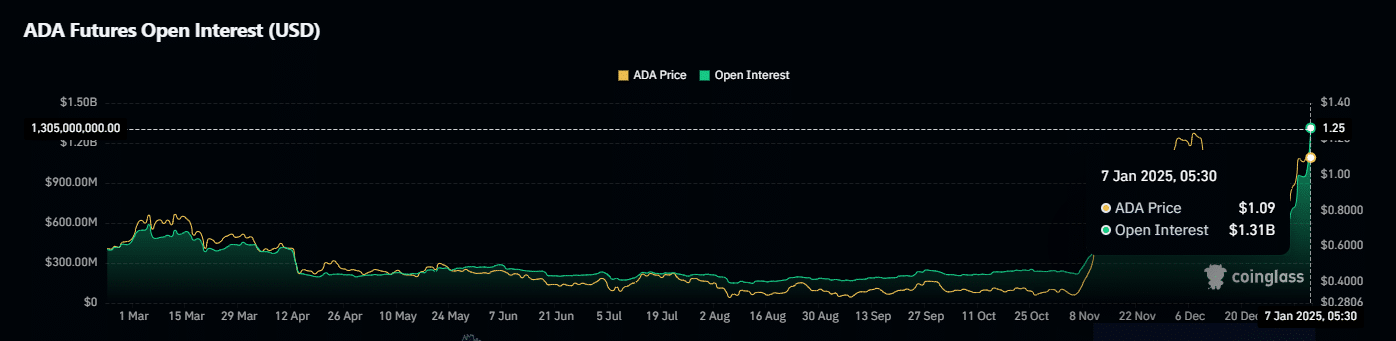

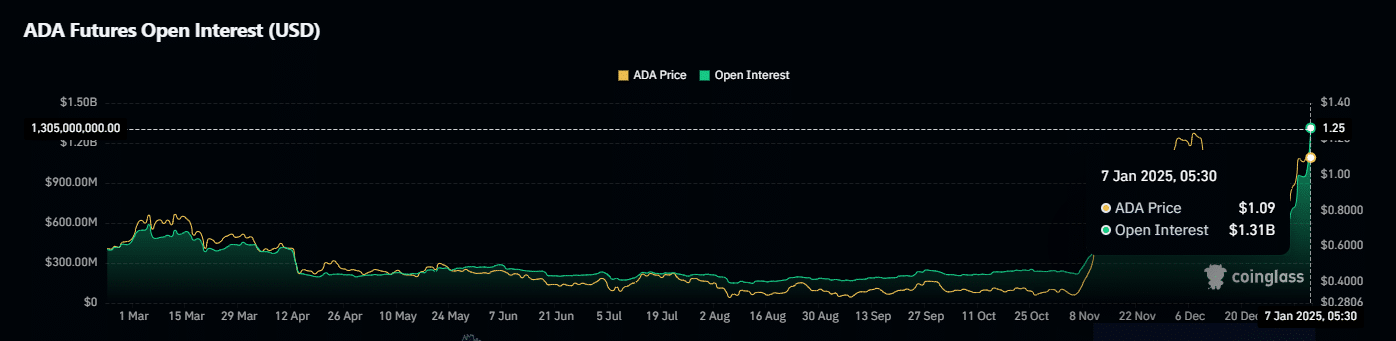

This rally also saw Open Interest (OI) rise 11% to an impressive $1.31 billion. To put that in perspective, ADA’s press-time OI was even higher than when it reached its annual high of $1.24 during the “Trump pump.”

Source: Coinglass

But here’s the catch: to maintain this upward momentum, whales must continue to push for accumulation.

With the difference between short and long liquidations being razor thin, even a small shift could send Cardano into a tailspin, squeezing the longs out.

Read Cardano (ADA) price forecast 2025-26

Still, with trading volume up 30% and spot outflows increasing, ADA could easily rise to $1.50 in the near term.

If this trend continues, Cardano could easily lead the next altcoin cycle – especially with Bitcoin dominance seeing a death cross, indicating a shift that could open the door for altcoins to shine.

![Review or Cardano [ADA] can outperform, break $1.50 and enter the altcoin market?](https://free.cc/wp-content/uploads/2025/01/Ritika-3-1000x600.webp)