Ethereum (ETH), the world’s second largest cryptocurrency, is showing robust momentum as its price rebounds and regains levels above $2,000.

This bullish trend is gaining momentum in tandem with major developments at the U.S. Securities and Exchange Commission (SEC). The regulator is conducting discussions on the possible approval of a spot Ethereum Exchange-Traded Fund (ETF).

This pivotal development has brought optimism to the Ethereum market, as the prospect of an ETF introduces new opportunities for mainstream adoption and investment, further fueling Ether’s current upward trajectory in value.

Ethereum’s ascending triangle: bullish breakout potential

Over the course of several months, Ethereum’s price has been in a consolidation trend that has resulted in the formation of an ascending triangle. Although the technical formation is bullish in nature, this is only true after a profitable breakout.

Trend lines connect the equal highs and higher lows of the ascending triangle configuration. This arrangement indicates that investors are becoming more confident and buying the dips at a faster pace.

ETHUSD currently trading at $2,066 on the daily chart: TradingView.com

Interestingly, today’s charts show that there are no “dips” to buy as Ethereum crossed the vaunted $2,000 level and welcomed December on a high note.

Ethereum is not only keeping pace, but is also rising to unprecedented heights. The price of ETH is currently up 3% to $2,100, and investors and enthusiasts are excited about the possibility of a rally to $3,000 or even higher.

Ether’s impressive success against Bitcoin, which outperforms the alpha cryptocurrency by almost 5%, is a key indicator of this. Key on-chain signals imply that ETH may continue to outperform BTC this month.

Fidelity Filing fuels Ethereum optimism

The first indication of a bullish move was a break over the psychological barrier of $2,000, although there have been many swings around this level. More specifically, ETH is trading between the weekly support level of $1,930 and the second quarter high of $2,140. This is the fourth week in a row that this has happened.

#Ethereum Discover ETF filings by Fidelity!

Confirms my statement afterwards #Bitcoin gains its shine, we see Ethereum rising to $3,500 in the first quarter of 2024.

— Michaël van de Poppe (@CryptoMichNL) November 30, 2023

Crypto analyst Michael van de Poppe has expressed optimism about Ethereum in light of the Fidelity filing. Given this entry, he reaffirms his belief that, following Bitcoin’s meteoric rise, Ethereum is positioned to reach $3,500 in the first quarter of 2024.

Source: Santiment

In a related development, research shows that there has been a significant increase in the accumulation of Ethereum whales. On-chain data indicates that the largest Ethereum wallets are showing a positive pattern indicating a major change, according to Santiment.

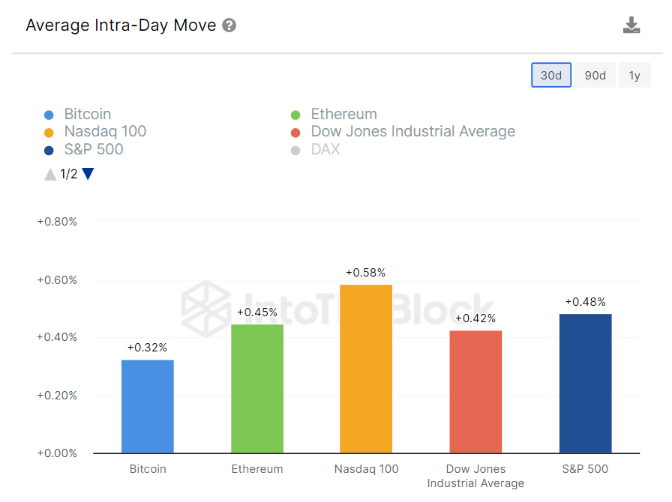

ETH Price Volatility Trends vs. Bitcoin. Source: IntoTheBlock

Meanwhile, Ethereum has an astonishing 30-day average intraday volatility score of 0.45%, surpassing Bitcoin’s 0.32%, according to recent research from IntoTheBlock.

Investment strategies may need to change due to this change in volatility dynamics, which would highlight the dynamic prospects of the Ethereum market.

(The content of this site should not be construed as investment advice. Investing involves risks. When you invest, your capital is subject to risk).

Featured image from Freepik