RNDR, Render’s native token, is making waves amid the ongoing market correction as it appears poised for notable upside momentum. This speculation is driven by RNDR’s bullish price action pattern, significant trader and investor participation, and overall positive market sentiment.

Render (RDNR) Technical analysis and upcoming level

According to CoinPedia technical analysis, RNDR has recently broken the bullish double bottom price action pattern and is now targeting the next resistance level at $10. However, this breakout occurred in a shorter time frame (four hours), causing the token to shift to the bullish side.

Render (RNDR) price forecast

Based on the recent price action and historical momentum, there is a high probability that the RNDR could rise 18% to reach $10 in the coming days. Moreover, on a daily time frame, the altcoin appears bullish and shows the potential to rise by 35% to reach the $12 level soon.

Bullish on-chain metrics

In addition to technical analysis, traders have shown strong interest and confidence in RNDR, as reported by the on-chain analytics company Mint glass.

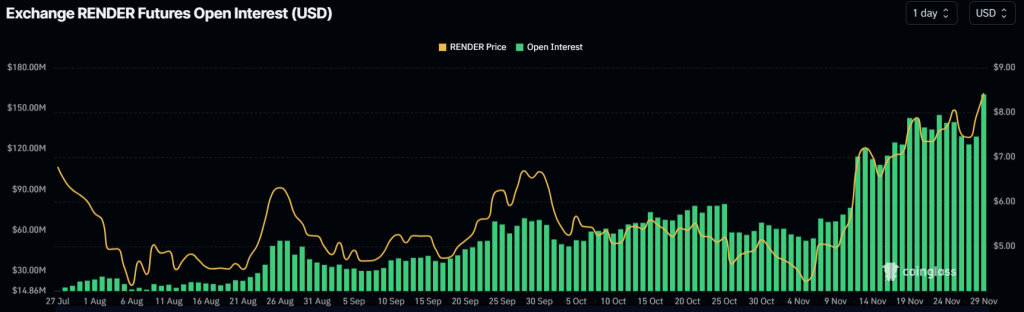

According to the data, RNDR’s open interest (OI) is up 29% in the last 24 hours and 12.8% in the last four hours. This growing merchant participation has pushed RNDR to an all-time high of $160.30 million.

This growing interest not only signals the construction of new positions, but also shows traders’ faith and trust in the token.

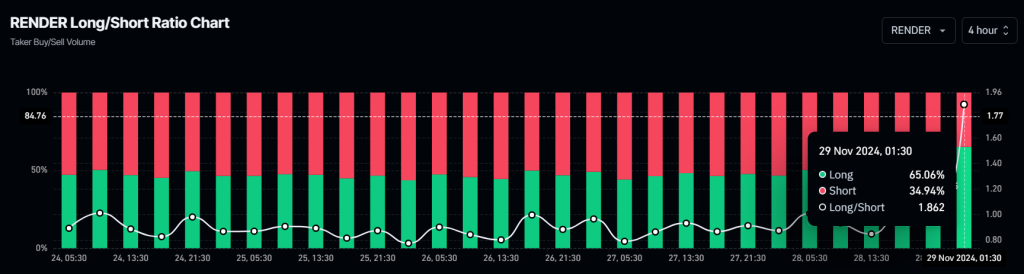

Moreover, RNDR’s Long/Short ratio currently stands at 1.86, indicating strong bullish sentiment among traders. According to the data, 65% of top RNDR traders have long positions, while 35% have short positions.

Traders and investors often use a combination of rising open interest and a Long/Short ratio above 1 as a signal when building long positions.

Current price momentum

Currently, the majority of the major cryptocurrencies are struggling to gain momentum, while RNDR ranks third in terms of price gains. At the time of writing, RNDR is trading around $8.50 and has registered upward momentum of over 9.25% over the past 24 hours. Meanwhile, trading volume rose 98% over the same period, indicating notable trader and investor participation amid the asset’s bullish outlook.