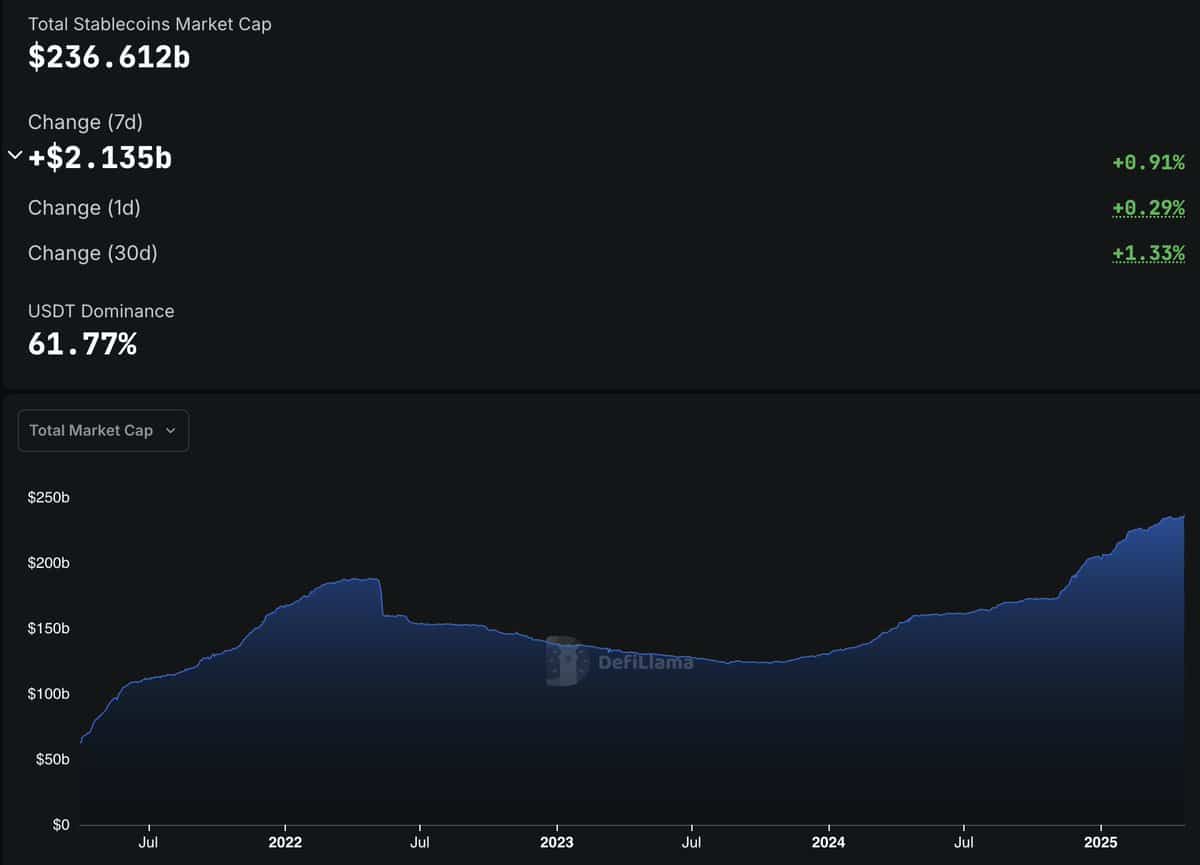

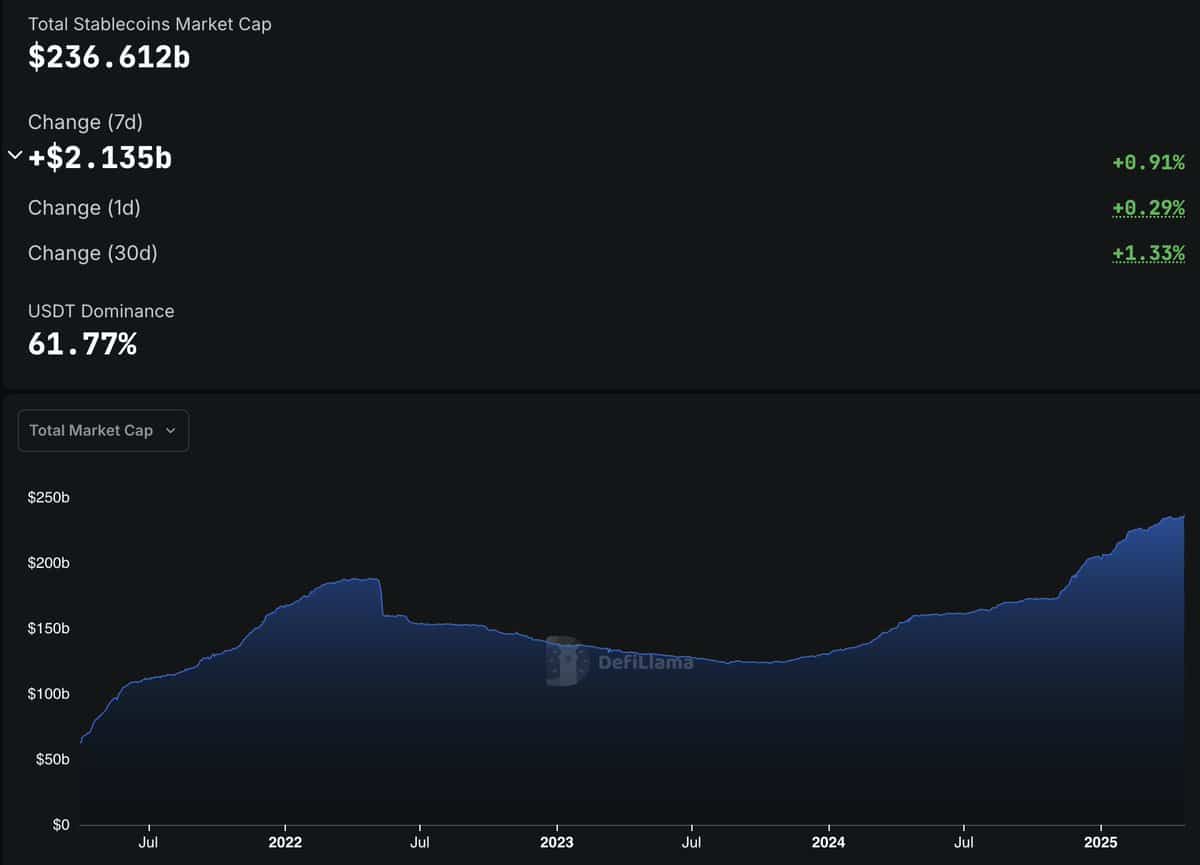

- Stablecoin Supply stands for a record of $ 236.6 billion.

- Bitcoin leads the rally with a weekly increase of 10% as the Altcoins Market Cap rises by 16%.

According to Defillama data, the total delivery of Stablecoins increased With $ 2,135 billion in the past week, which brought the cumulative offer to a record -breaking $ 236.6 billion.

The consistent inflow of stablecoins indicates rising liquidity, which can be seen as a dry powder ready to enter risk activa such as Bitcoin [BTC] And altcoins.

Historically, an increase in the Stablecoin range has often preceded markettrallies, because it reflects increased purchasing power on the Altcoins and BTC.

Source: Defillama

Bitcoin Rallies 10% If Bullish Momentum applies

Bitcoin rose by 10% to $ 93k last week, powered by a strong rebound of a critical technical support zone.

Of course the market sentiment remained around BTC Bullish, where participants now strive for the psychological milestone of $ 100k. This rally is not only technical, because the growing capital flows have their leg.

The reverse correlation between BTC and Stablecoin Supply also supports the view that more investors diversify their portfolios to take Bitcoin long positions.

Altcoin Market follows BTC’s lead

The wider Altcoin market has not been left. Since bouncing a weekly demand zone, the total Altcoin market capitalization has risen by 16% on weekly graphs.

At the time of writing, the total Altcoin market capitalization, exclusive Ethereum [ETH] And BTC, was $ 821 billion.

In fact, the heavy rebound reflected the power of Bitcoin and underlined the dependence on the Altcoin market of the directional bias of BTC.

Although altcoins remains possible in the beginning, they usually talk in one as soon as Bitcoin stabilizes or consolidates. The set -up is currently suggesting that if BTC remains in strength, a stronger Altcoin season can be on the horizon.

Source: TradingView

Market sentiment becomes bullish

With Bitcoin leading and stablecoin reserves at record levels, the general market sentiment Bullish leans. Market participants seem to be more positive and capital rotation in Crypto assets.

While Bitcoin calculated to $ 100k, Altcoins seemed ready to ride on the secondary wave.

That said, the interplay between Stablecoin -Install, Bitcoin -Dominance and Altcoin activity would be crucial in the coming weeks.

If the cycle from the past repeats, the current speed can mark the start of a wider Altcoin rally – one that thrives under the shadow of Bitcoin’s dominance.