- Raydium saw steady demand during its price action within the range.

- The short-term bullish target was the liquidity position of $8-$8.2.

Raydium [RAY] saw a 62% gain over the past eight days. The rise of official Trump [TRUMP] on the Solana [SOL] chain also likely boosted demand for RAY, but the rally started before the launch of the TRUMP meme coin.

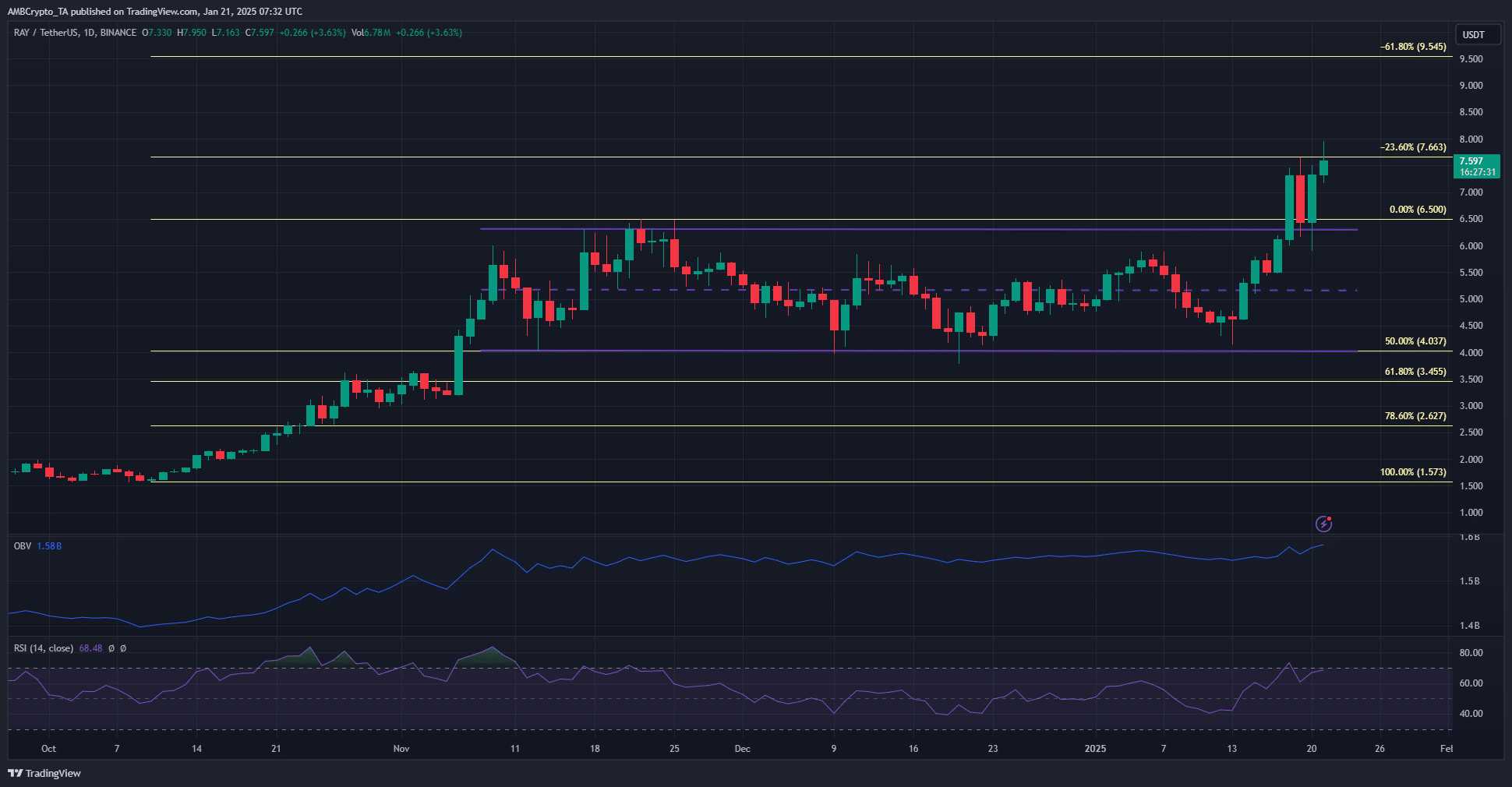

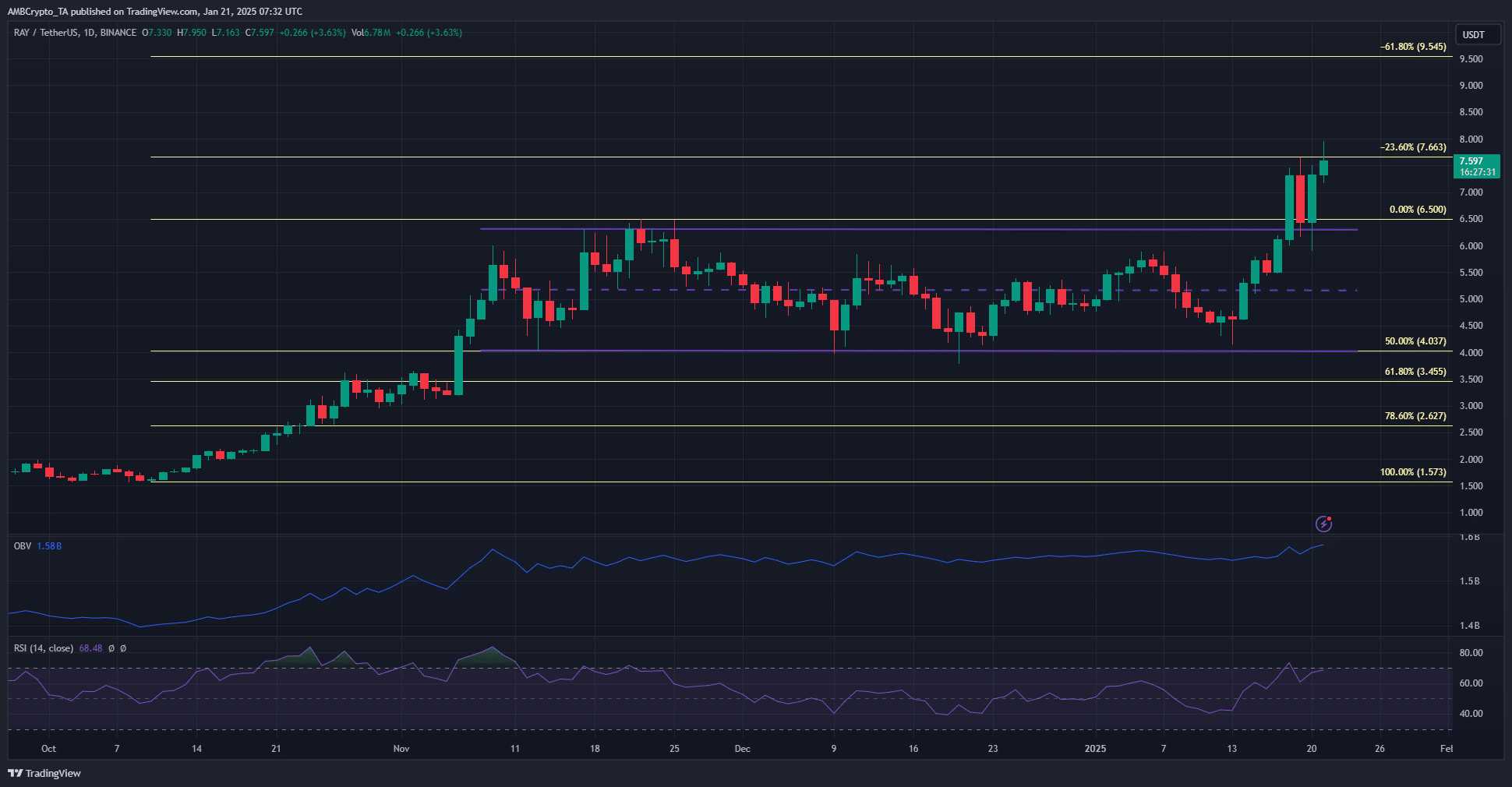

Since November, the price has traded within a range of $4.02 to $6.3. This range was broken on January 18 and the highs were retested as a support zone.

Raydium breaks the distance formation and sails higher

Source: RAY/USDT on TradingView

The strong demand for Raydium was reflected in the price charts. Despite the bandwidth formation, the OBV continued to rise over the past two months. This was a sign of continued buying pressure.

Furthermore, the breakout outside the range highs occurred during high trading volume, indicating conviction. The Fibonacci retracement and extension levels were plotted based on the October and November rally from $1.57 to $6.5.

This showed that the next targets for RAY bulls were $7.66 and $9.54. The daily RSI was above 60 and showed strong bullish momentum.

Combined with the steady buying pressure, Raydium would likely head towards $9.54 in the coming days and weeks.

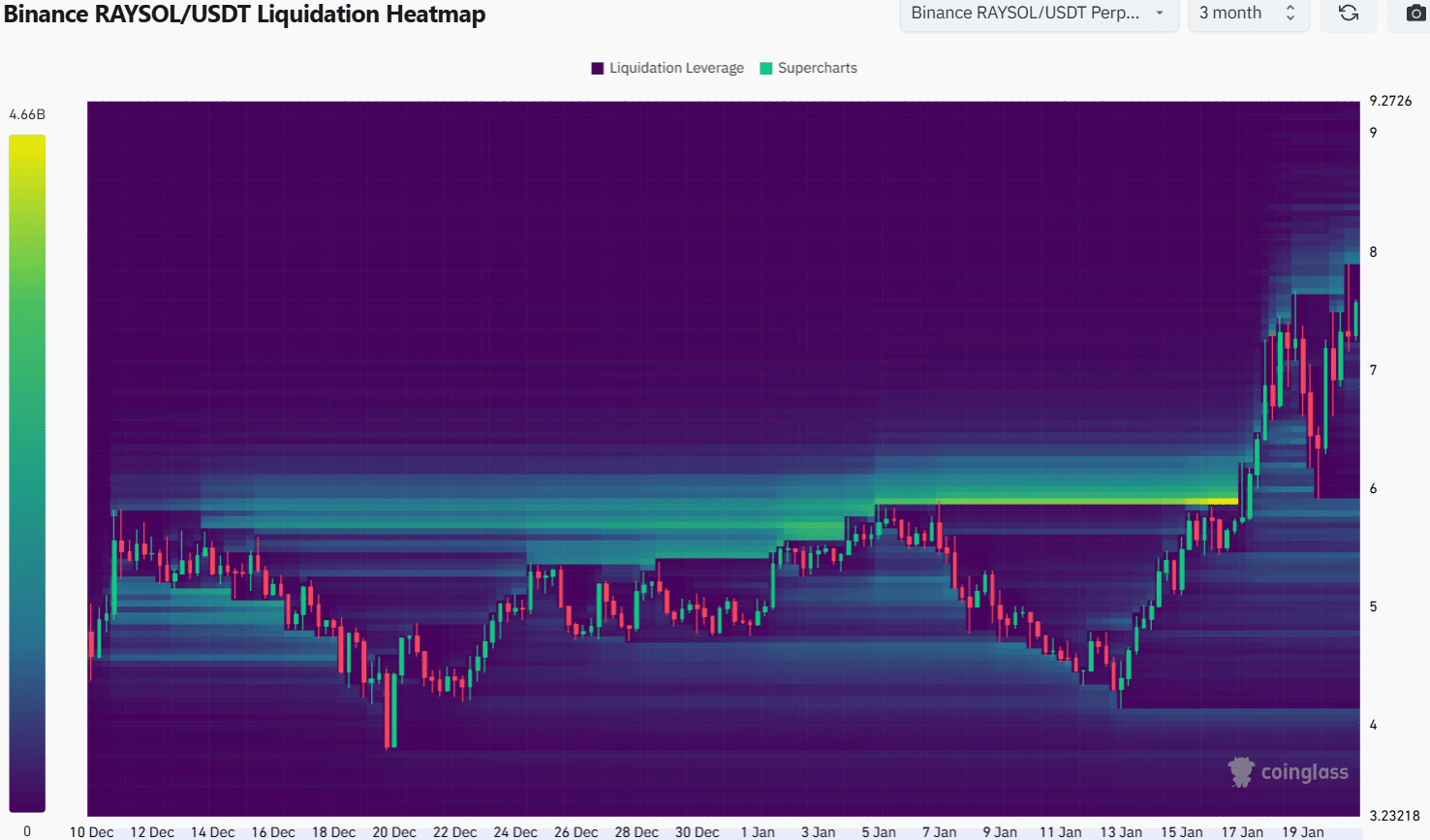

The three-month liquidation heatmap highlighted a liquidity position of $8 and another of $7.12. Below that, $7 was another magnetic zone.

Since the recent move has already retested the range highs at $6.3, another immediate dip to $7.12 was unlikely.

Instead, a move towards $8 and then a reversal and a breakout into the $7-$7.1 region seemed more likely.

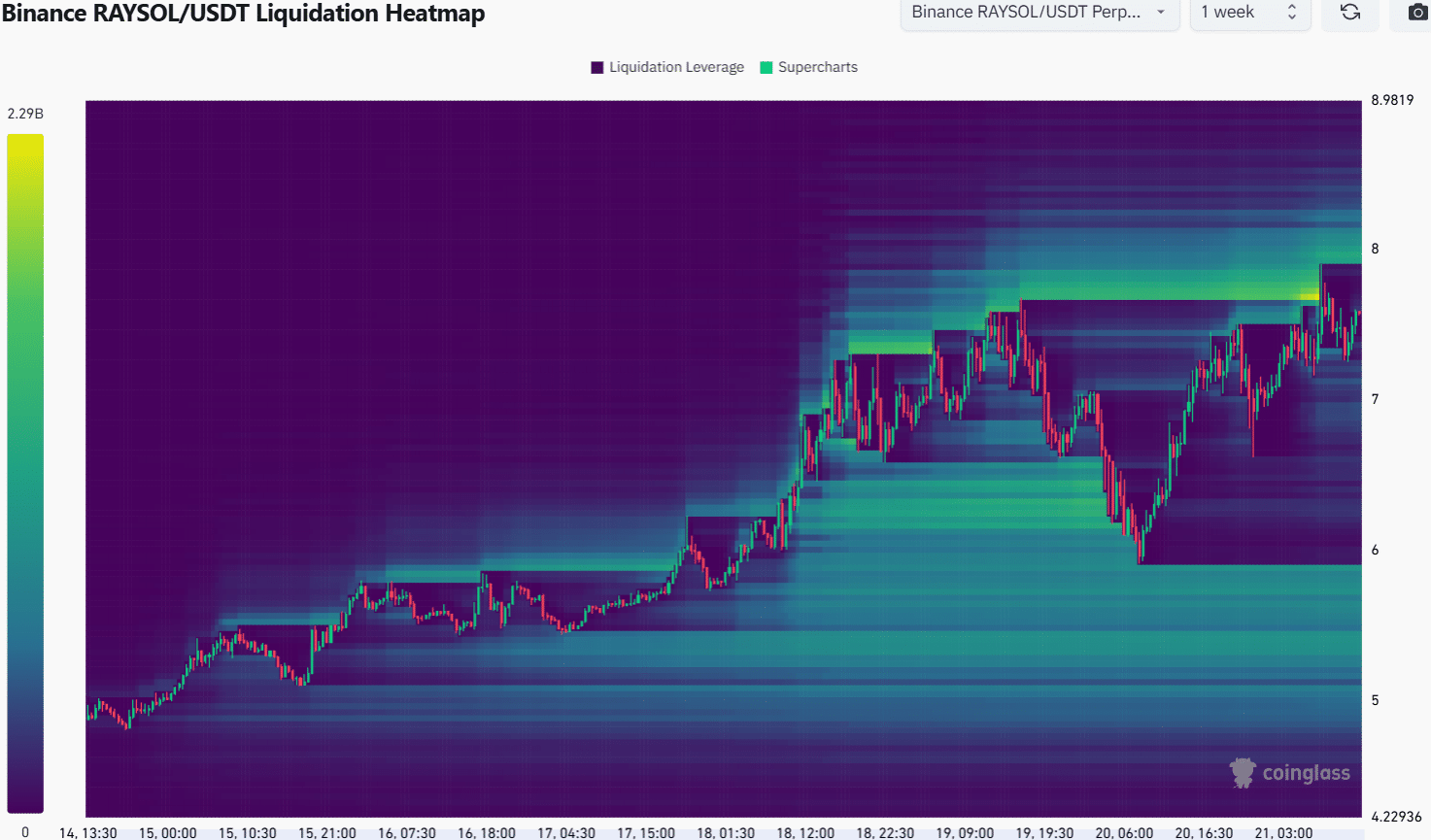

The one-week liquidation heatmap also highlighted the $8 liquidity pocket. It made it clear that the $7.93-$8.21 had a noticeable density of liquidation levels that could pull RAY prices towards it.

Read Raydium’s [RAY] Price forecast 2025-26

To the south, the $7.12 and $6.96 levels were less rosy as there were fewer liquidation levels.

A move to $8 and a few days of consolidation could lead to long liquidation levels in the south, which could later knock out Raydium prices before continuing the upward move.

Disclaimer: The information presented does not constitute financial advice, investment advice, trading advice or any other form of advice and is solely the opinion of the writer