Reason to trust

Strictly editorial policy that focuses on accuracy, relevance and impartiality

Made by experts from the industry and carefully assessed

The highest standards in reporting and publishing

Strictly editorial policy that focuses on accuracy, relevance and impartiality

Morbi Pretium Leo et Nisl Aliquam Mollis. Quisque Arcu Lorem, Ultricies Quis Pellentesque NEC, Ullamcorper Eu Odio.

Este Artículo También Está Disponible and Español.

Bitcoin traders prepare for a border and potentially turbulent week. From threatening rates to BTC-bid activities of the size, here are five important factors that market participants need to maintain their radar.

#1 American rates are ready to escalate on April 2

The global stage is braced for what US President Donald Trump called ‘Liberation Day’ on 2 April. According to the Kobeissi letter (@kobeissiletter), the plan of the administration for ‘mutual rates’ promises to be a river basin moment in the current international trade disputes.

“President Trump has been discussing for weeks this Wednesday 2 April. writes Via X.

These rates will be laid on top of a whole series of existing American tasks that include steel, aluminum, Canadian goods, Mexican goods and a lot of Chinese import. The Kobeissi letter indicates that 25% taxes on car import and on countries that buy Venezuelan oil will also be in force this week. With retaliation measures from Canada, China, the EU and Mexico in the pipeline, they warn of a ‘massive trade war’, intensifying the uncertainty for the world markets.

Related lecture

In addition to trade data, the inflation pressure was able to take on the inflation pressure in the coming days due to higher consumer costs for imported goods. With reference to an increase in the Economy Policy Uncertainty Index, the Kobeissi letter emphasizes: “Policy uncertainty is currently above just about every crisis in modern American history. We see ~ 80% higher uncertainty levels than 2008. As a result, market changes are increasing and we expect an extremely volatile week.”

Add the latest threats of President Trump with regard to Iran – where “secondary rates” and potential levies on Russian oil are on the table – and there are several international speed points that can feed market volatility.

#2 Bitcoin whale activity

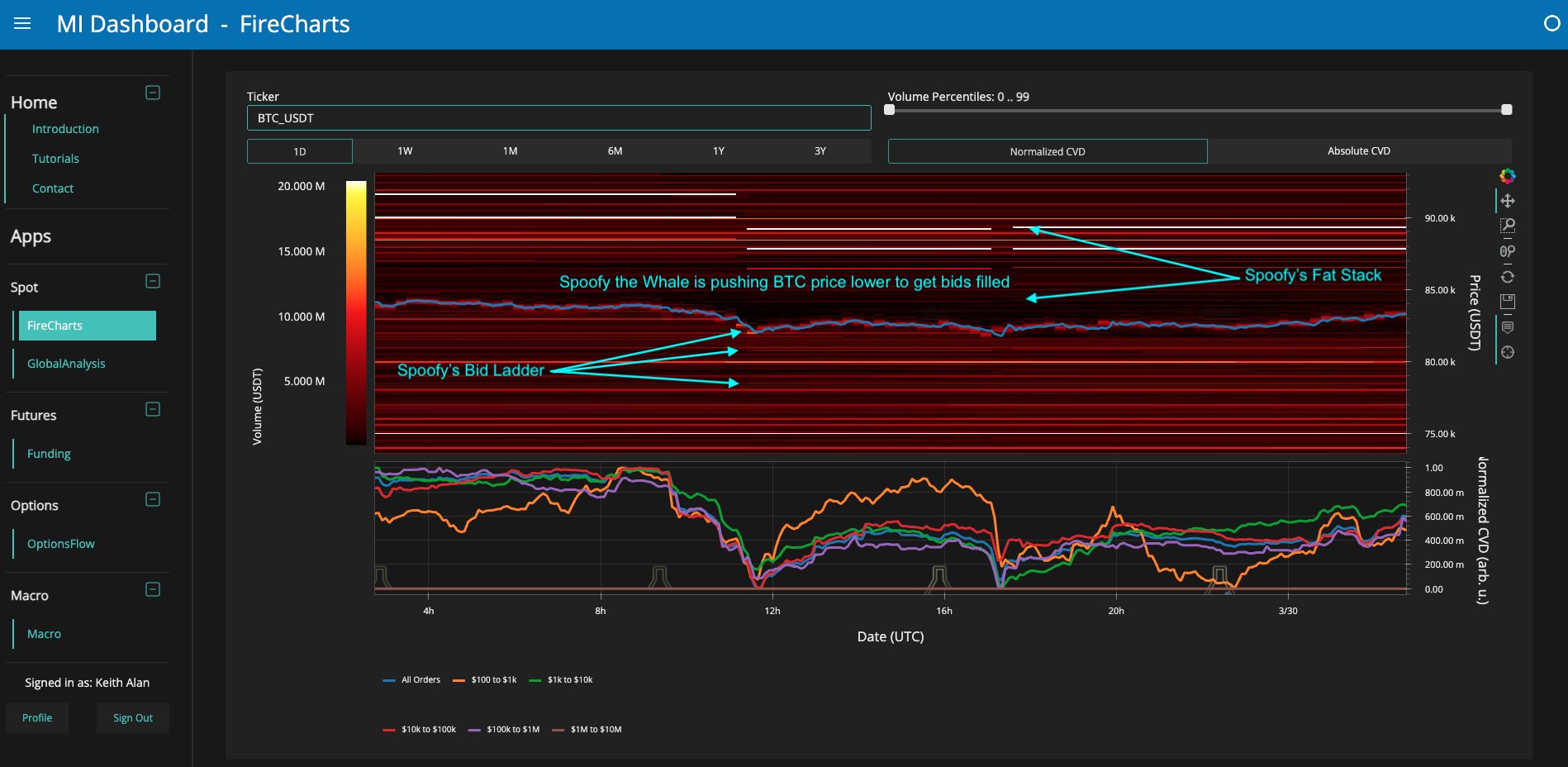

Large-scale liquidity maneuvers remain a central point in the Bitcoin Arena. Keith Alan (@Kapproductions), co-founder of material indicators, drawn attention to a potential whale strategy in action that was assigned to a figure he calls ‘Spoofy the whale’.

“My first indication that something was going on came up with a series of micro movements that seemed to be a bit different than his typical price adjustment of his huge blocks of question liquidity. With a further look, I noticed that a ladder of BTC Bid -Liquidity perfectly lit and moves that it is to have no real way of lugging liquidity. Been to be the spell that has been bought, it is bought from their own bid and has bids to $ 78k, ”Alan written On Sunday.

He also noted that the convergence of various news events – the weekly closing of Sunday, the monthly closing of Monday and the expected rate implementation Midweek – that can catalyze further price fluctuations. Although recognizing BTC could still be lower, he understood the apparent dedication of the whale to gather at the current level: “In the large schedule of things, nothing of this BTC price does not mean lower, but it does mean that the whale price has oppressed the BTC price in the past 3 weeks, a DCA strategy to buy this dip and I am.”

#3 Bitcoin Beerarish flag breakdown

Technical analyst Kevin (@kev_capital_ta) is warning Traders to keep a close eye on the crucial support levels after a bearish flag breaking: “We followed this bearish flag pattern throughout the week and as we can see, we had a breakdown of that weakness. If BTC here loses the golden bag at $ 81k and follows $ 70k -then the measured displacement is the measured displacement. “Measured movement.”

Yet Kevin states that, given the widespread negative sentiment around 2 April (“Armageddon Day” in some corners of the media), there is a possibility to be a conflicting turn: “Will the rate implementation on 2 April a rare” selling the rumor buying the news event “?”

Related lecture

He added: “A little long liquidity at the level of $ 78k $ 80k, but a lot of juice in the range of $ 87k- $ 89k (dark yellow) for market makers to handle off just before the CNBC has proclaimed” Armageddon Day “on 2 April. Makes me asking.”

#4 Accumulate seasoned players

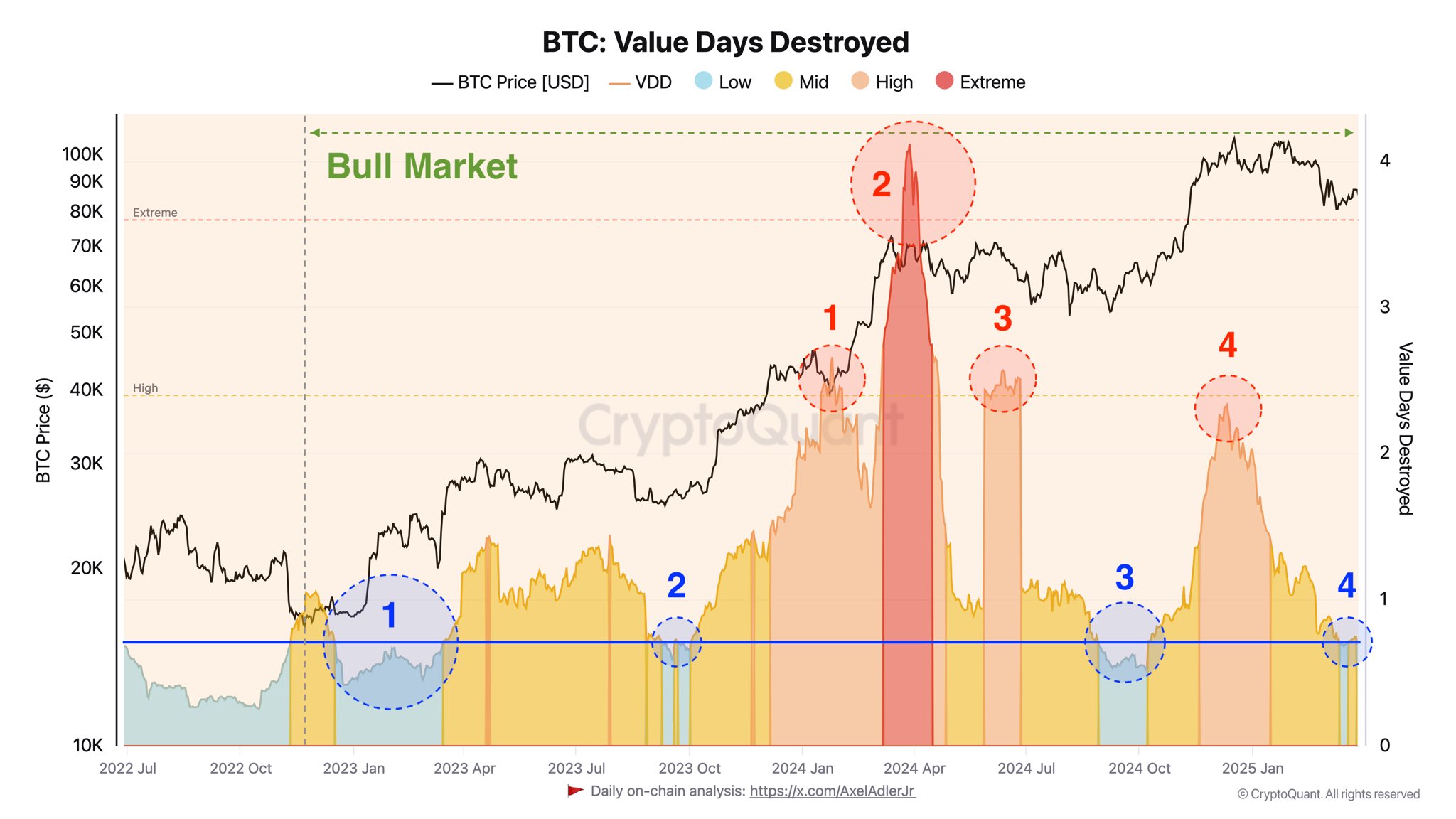

From the perspective on the chain, Axel Adler JR, an analyst at cryptquant, perceive Those experienced market participants move to a new battery phase. Coming from the Value Days Destreed (VDD), Indicator, Adler identifies a series of four different accumulation periods since the beginning of 2023, making the current cycle ripe for potential upward upward upward:

“The absence of considerable sale in the current phase shows the confidence of these experienced players that the current BTC price level is not favorable for taking a profit.” Adler emphasizes that historical data demonstrates that low VDD periods often precede price increases, which suggests macro factors, including global economic policy shifts, the market sentiment not derailed in the medium term.

#5 cme gap

Finally, traders must view the CME (Chicago Mercantile Exchange) GAP formation, which has been a remarkable function in the Bitcoin price action. Stretch capital (@Rektcapital) marked The recent filling of a gap between $ 82,000 and $ 85,000: “BTC has filled the general CME GAP area from $ 82k -$ 85k. Moreover, Bitcoin will probably develop a brand new CME gorge this weekend … that BTC could set BTC for a move to at least $ 84k next week.”

CME -Hiates often act as magnets for price action, and the analysis of stretching Capital suggests a possible retracement to fill newly formed gaps or a continuation movement that takes BTC higher, depending on how broader market forces unfold this week.

At the time of the press, BTC traded at $ 82,010.

Featured image made with dall.e, graph of tradingview.com