- Bitcoin could fall by 6.5% to achieve its next support at $ 77,400 if it remains below 200 EMA.

- Ethereum could fall by 15% if it breaks an important level of $ 1,780.

The rate voltage already influences the cryptocurrency market, with assets that experience a huge fall in price, while investors take strategic action prior to today’s announcement.

Rate fears in the cryptomarket

Since the presidential inauguration of Donald Trump in the United States, the general cryptocurrency market has fallen considerably and it has been set for further decrease, because his rates do not finally display signs of finally.

On April 2, a Crypto analyst Share a message on X (formerly Twitter) stating that Bitcoin ETFs saw an outflow of $ 157.8 million, while Spot Ethereum ETFS saw an outflow of $ 3.6 million on 1 April.

This indicates that investors withdraw their money from this assets. Large outflows are often seen as a bearish board, because they can create sales pressure and lead to further price decreases.

In the meantime, the mail on X also noted that settings reduce the risk of today’s rate announcement.

Current price momentum

Despite these uncertainties, BTC and ETH remain positive, with a profit of 1% and 0.35% respectively in the last 24 hours, in contrast to other cryptocurrencies.

According to Coinmarketcap data, BTC traded nearly $ 84,300, while ETH traded near $ 1,860. However, the price profits of the active proved to fade because the daily card flashed signs of a possible decrease.

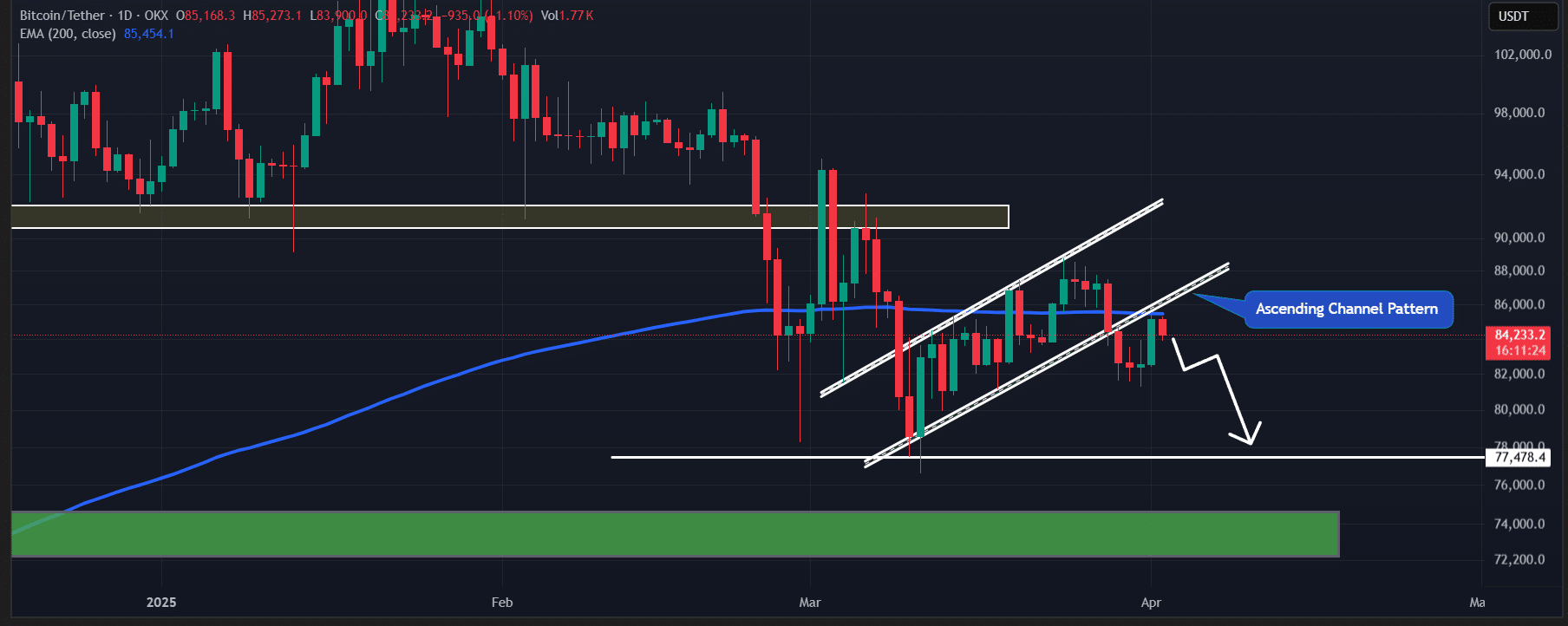

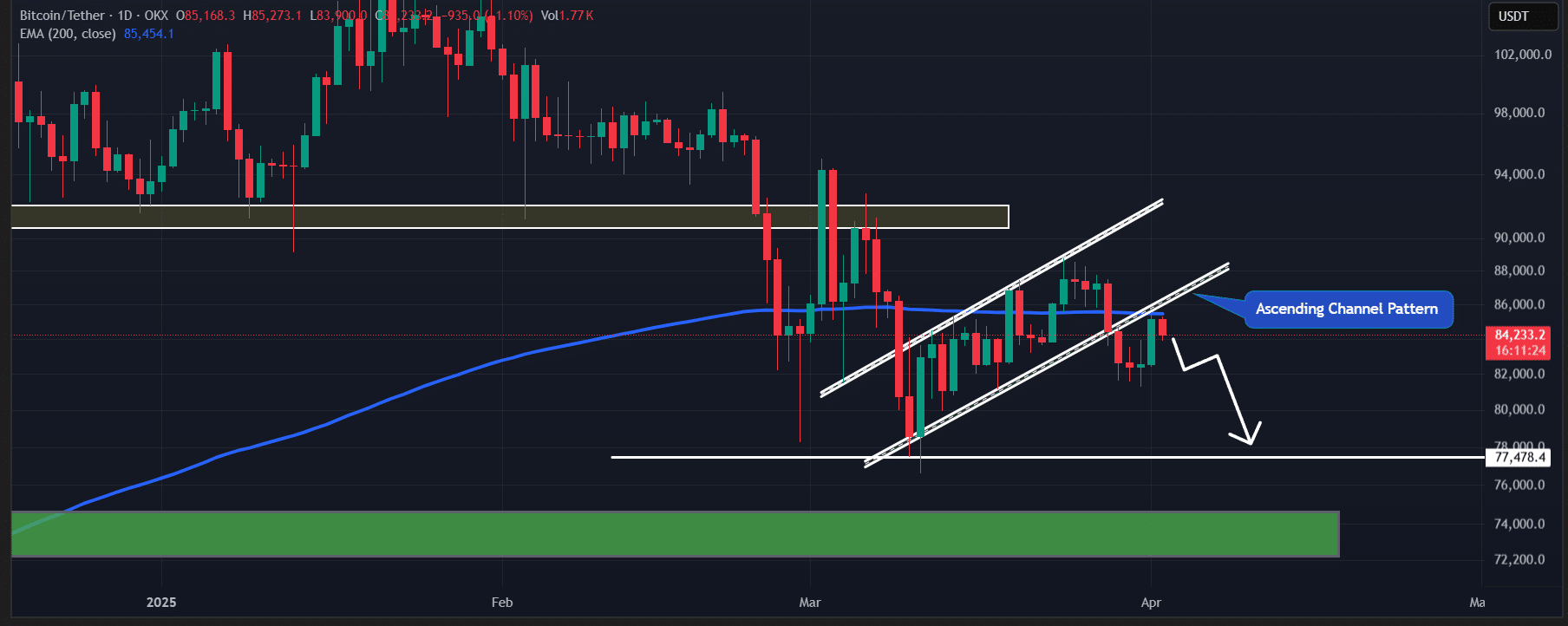

The King Coin has successfully re-tested the breakdown of the rising channel pattern and is now confronted with a price decrease after resistance to the 200-day exponential advancing average (EMA) on the daily period.

On the basis of recent price action and the current market sentiment, if BTC remains below the 200-day EMA, there is a strong possibility that it could fall by 6.5% to achieve its next support at $ 77,400.

The graph indicates that the most important level of BTC is the 200-day EMA in the daily period.

Source: TradingView

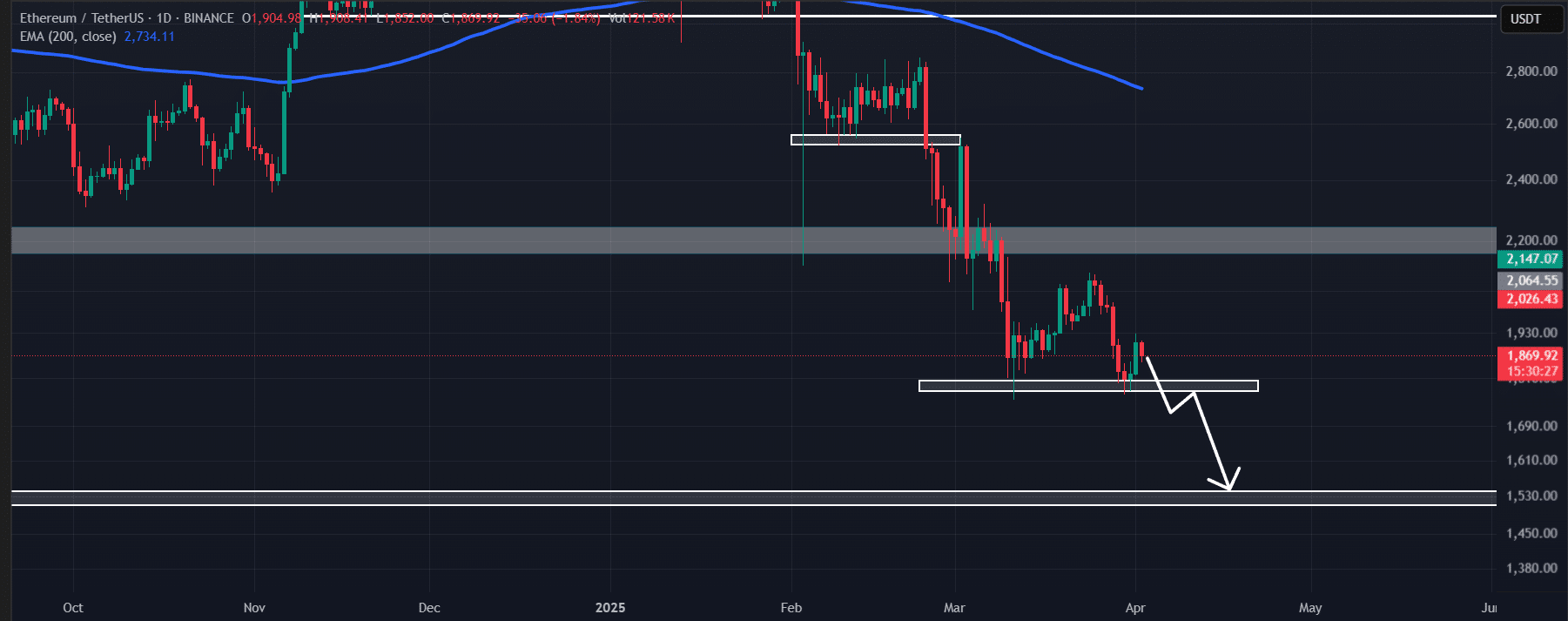

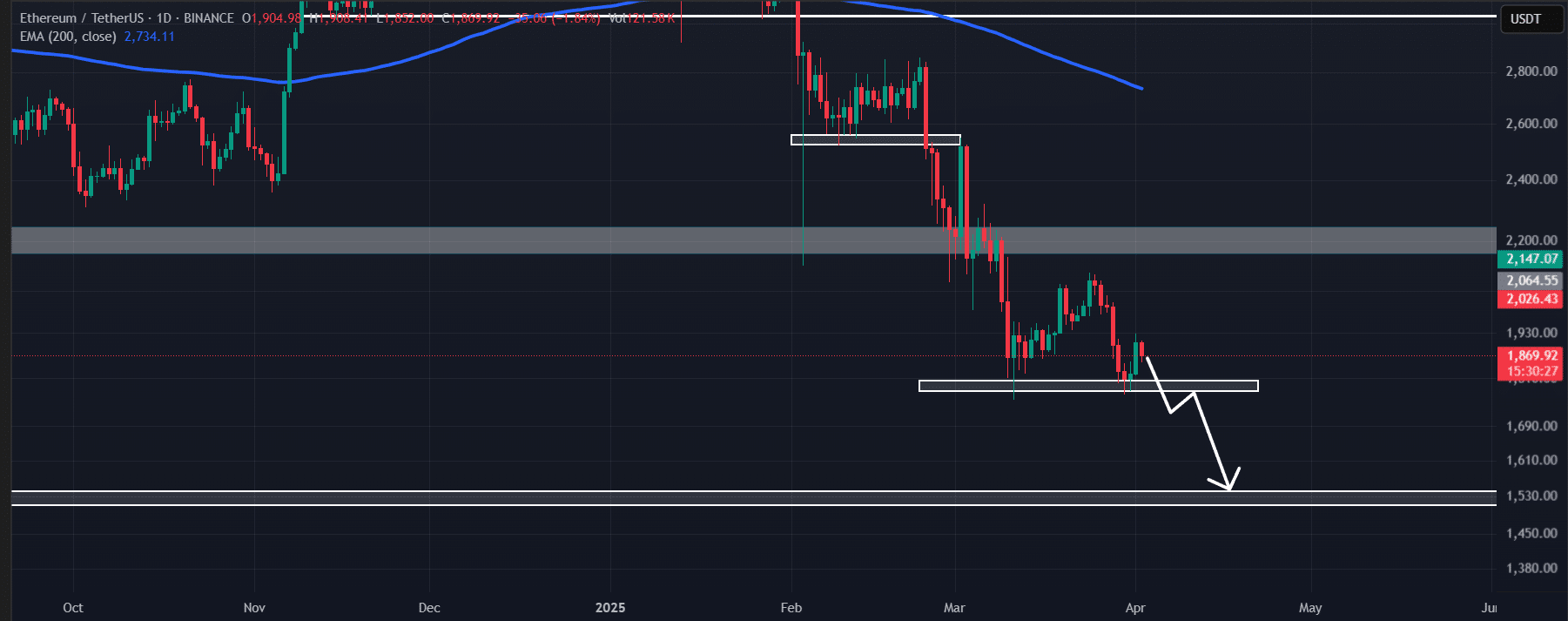

Ethereum price analysis and key levels

In the meantime, Ethereum was also near an important level at $ 1,780. If ETH continues to fall and breaks this level, there is a strong possibility of a competitive decrease of 15%, which may cause the price to fall at $ 1,550.

The Ethereum Daily Chart indicates that $ 1,780 is an important level that can determine the next step of ETH.

Source: TradingView

Traders’ Bearish View on BTC and ETH

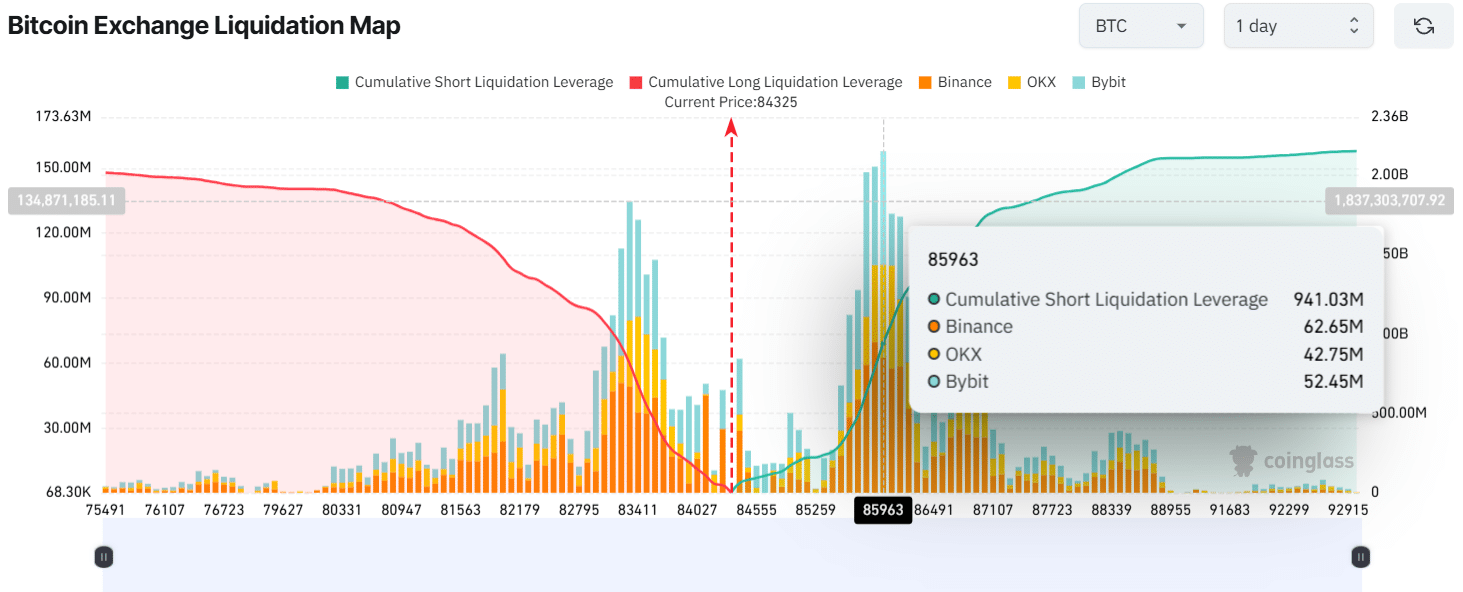

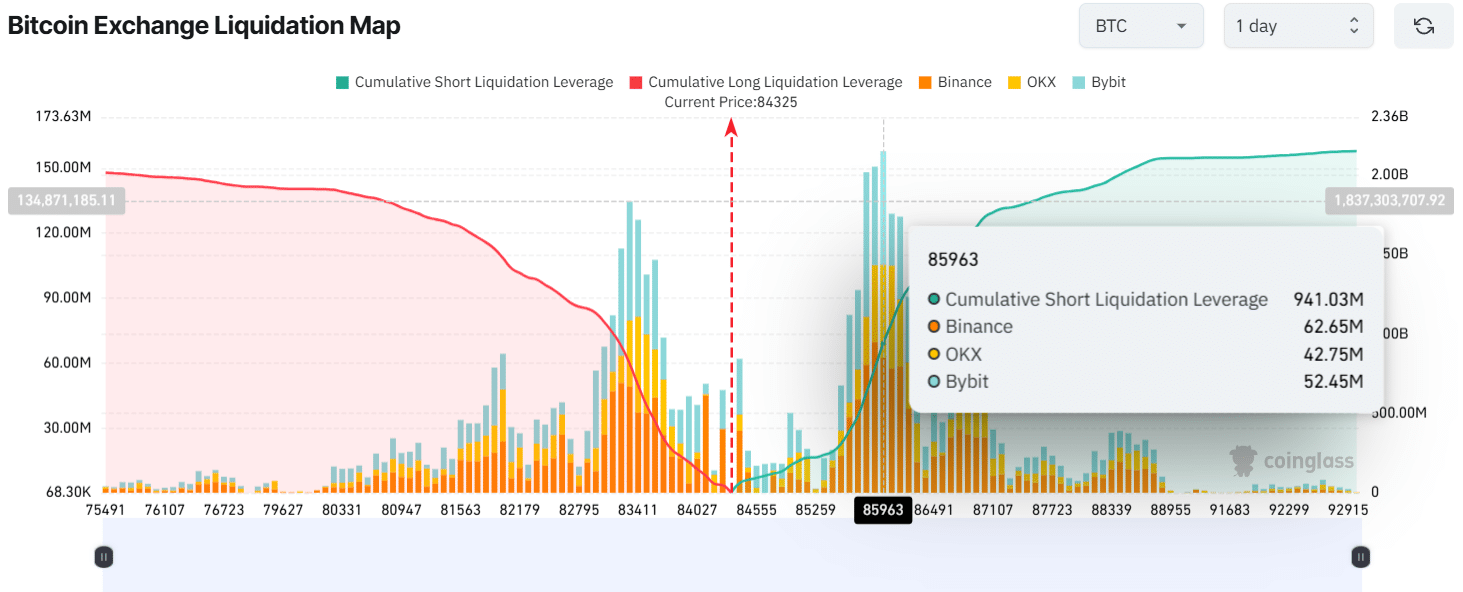

Data from the on-chain analysis company Coinglass shows that traders were used too much at the time of the press, with key levels at $ 83,320 at the bottom and $ 85,960 at the top.

They have built $ 811 million and $ 941 million in long and short positions respectively, indicating that bears are currently in control.

Moreover, the higher bets on short positions have the potential to push the price lower, which is a red flag for BTC.

Source: Coinglass

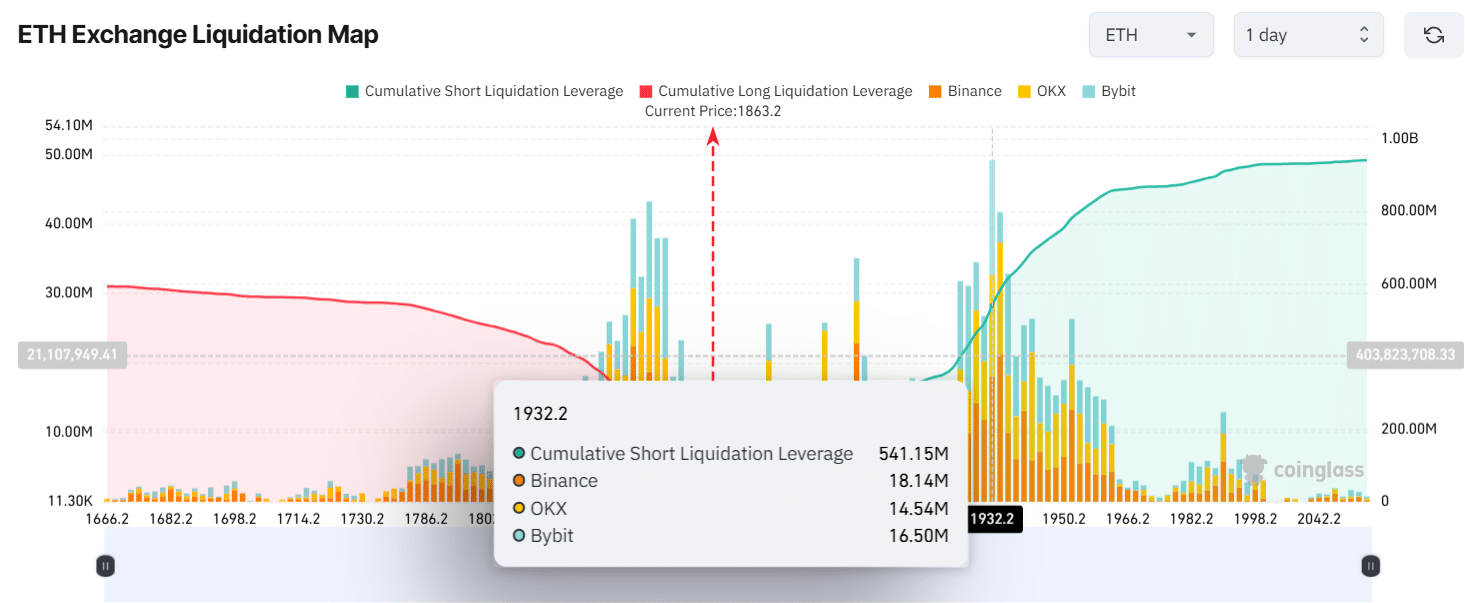

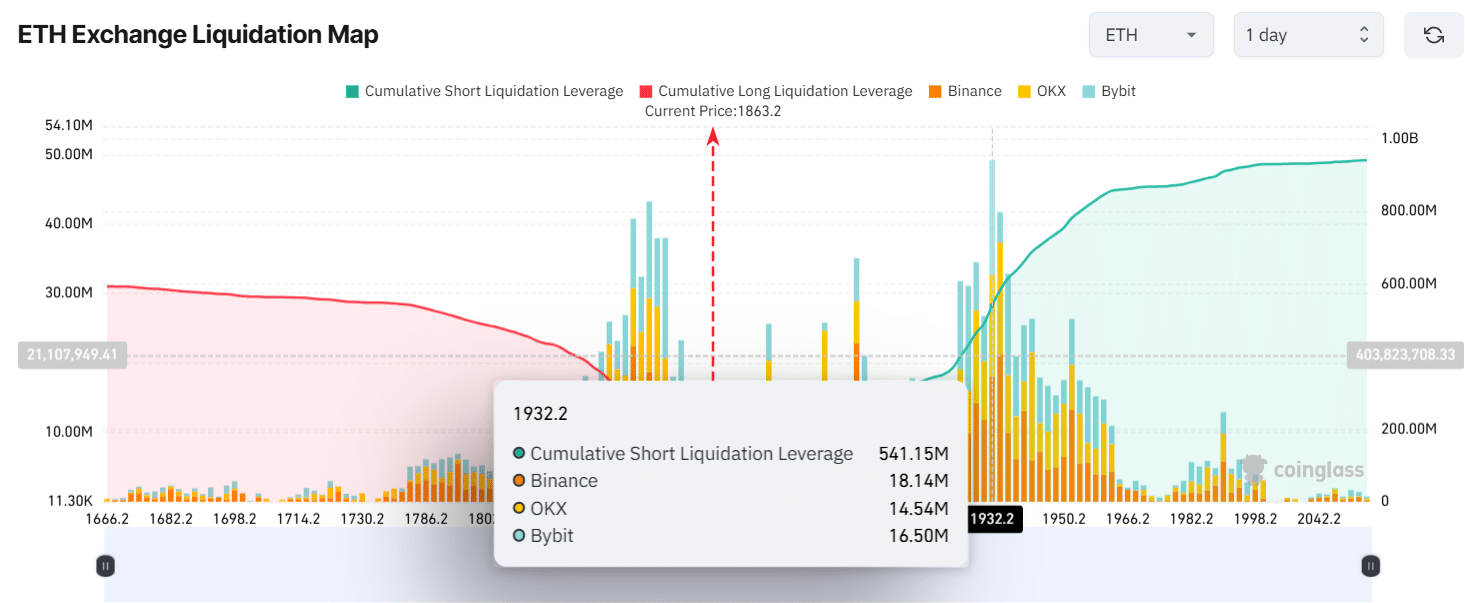

On the other hand, traders looked strong arary on ETH.

Data shows that the over-delivery levels of ETH $ 1,932 and $ 1,840 were, with traders built $ 541 million in short positions and $ 185 million in long positions in the last 24 hours.

This indicates that bears are currently in control, possibly due to the upcoming rate announcement.

Source: Coinglass