The XRP price has been treading water in recent days. After surging by over 52% in just 18 days from mid-October to early November, the price is currently in a clear consolidation phase on the shorter time frames. However, a look at the 1-month chart of the XRP/USD trading pair shows that the XRP price has had strong bullish months.

In that sense, Crypto analyst Egrag has done the same drawn highlighting an extremely rare phenomenon in the monthly XRP price chart. The pattern in question is a series of three consecutive monthly green candles, which has only been documented twice in cryptocurrency history.

With the market approaching its monthly close today, confirmation by a close above $0.5987 could mark the third monthly green candle for XRP. “Get ready – within the next time [few] hour we are ready to seal another three consecutive green candles,” Egrag noted.

Here’s what this could mean for the XRP price

Egrag delves into the details and explains two different historical precedents after such formations. In the first scenario, a five-month consolidation phase was observed after XRP recorded three consecutive green candles from March to May 2017.

However, the consolidation phase had an extremely bullish effect. Afterwards, the XRP price experienced a staggering 1,500% increase in just two months. Egrag suggests that if XRP’s price action were to mimic this historical pattern, investors could expect a potential surge to $10 starting April 1, 2024.

The second instance of Egrag covers the period from December 2015 to February 2016. During this time, the price increased by approximately 102% in three consecutive green months. What followed was a longer consolidation phase of twelve months. But the wait was worth it again.

In March 2018, the XRP price embarked on an extraordinary 8,000% rally. A replication of this scenario would imply a potential increase in the price of XRP to $50 starting on November 1, 2024.

Egrag in particular offers an average price target of $30. He said: “The XRP army remains stable, the average of these two targets comes to $30, you know I always whisper to you my secret target of $27. Hallelujah, the anticipation is palpable!”

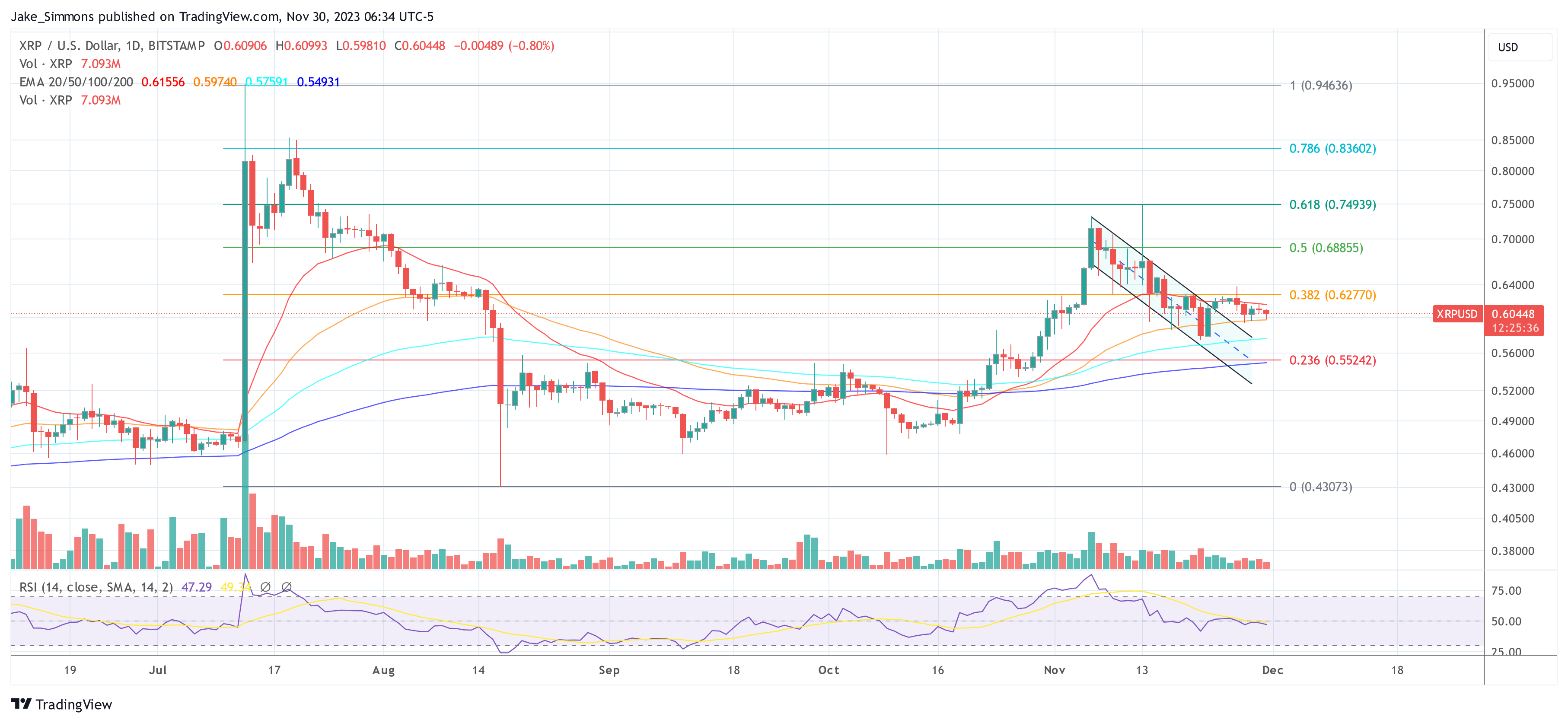

Price analysis: 1-day chart

At the time of writing, XRP was trading at $0.60333. A week ago, the price managed to break out of a downtrend channel. However, the bullish momentum quickly disappeared after the price was rejected at the 0.382 Fibonacci retracement level at $0.627.

Related reading: Bitcoin decouples from XRP, BNB, but correlates with Dogecoin and Cardano

The XRP price has been in a tight range between the 20-day and 50-day EMA (Exponential Moving Average) for four days now, with a breakout either down or up getting closer. In the event of an upside breakout, the $0.627 price level would be decisive. Next, the price could reach the 0.5 Fibonacci retracement level at $0.688.

However, if a downside breakout occurs, a 100-day EMA of $0.575 would be the first support. This must hold to prevent the price from falling to the Fibonacci retracement level of 0.236 at $0.552, which is also close to the 200-day EMA. The convergence of both indicators points to a price level that the bulls must defend at all costs.

Featured image from iStock, chart from TradingView.com