The Chainlink rally has slowed lately; here’s what the various LINK on-chain metrics look like to see if the wave has hope for a restart.

Chainlink has registered some decline in the past 24 hours

Just over the weekend, Chainlink was hovering above $16, but the winds seem to have shifted for the coin in recent days as it has registered some pullback.

In the last 24 hours alone, LINK has fallen about 6%, pushing its price below $14. The chart below shows how the cryptocurrency has performed over the past month.

LINK appears to have gone down in the last two days | Source: LINKUSD on TradingView

As shown above, Chainlink experienced sharp bullish momentum during this period before this latest plunge as the asset’s value more than doubled. Despite the decline, LINK is still up over 90% over the past month, which is an impressive return.

Naturally, investors may now be wondering whether assets have already peaked for this rally or whether more will follow soon. It’s hard to say anything about that, but perhaps data about the chain can provide some hints.

LINK activity has been relatively high lately

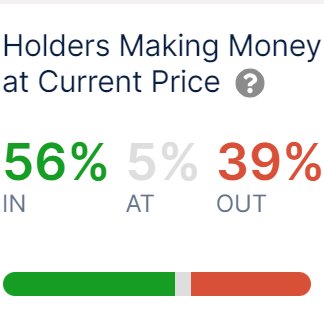

In a new after On X, the market information platform IntoTheBlock shared the data of some Chainlink on-chain indicators. First, when the company published the post, about 56% of investors in the assets were sitting on some profit.

Looks like 39% of the holders had been underwater | Source: IntoTheBlock on X

The cryptocurrency was then hovering at higher levels than it currently is (although not too high), so more LINK addresses would have entered a state of loss by now.

In general, profit investors are more likely to sell at any given time, so if a large number of them are in the green, the chances of a sell-off can increase. Some Chainlink investors are currently reaping their profits, but the profitability ratio is still not that much skewed towards profits.

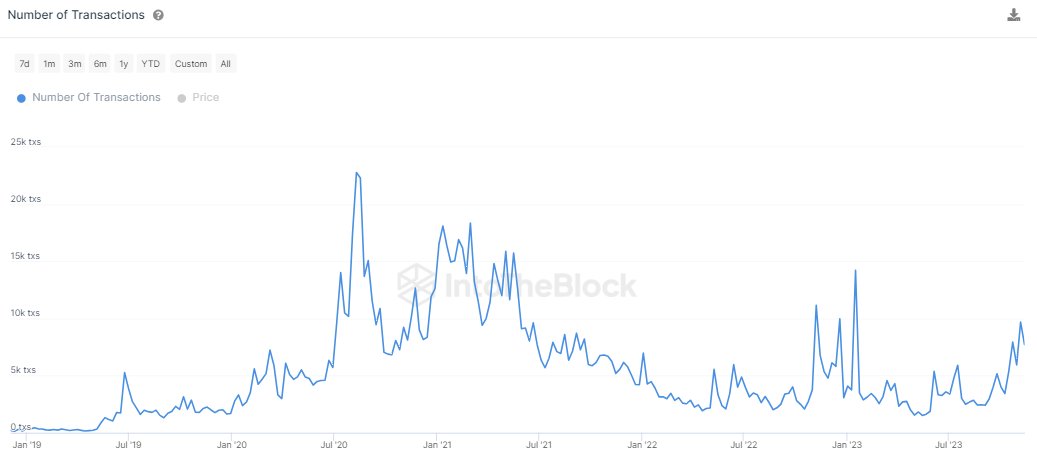

Next, IntoTheBlock talked about the number of transactions on the network.

The value of the metric seems to have been going up recently | Source: IntoTheBlock on X

“The Chainlink network is showing many positive signs in terms of transaction data,” the intelligence platform says. “It is remarkable that we are seeing a healthy increase in the number of transactions.”

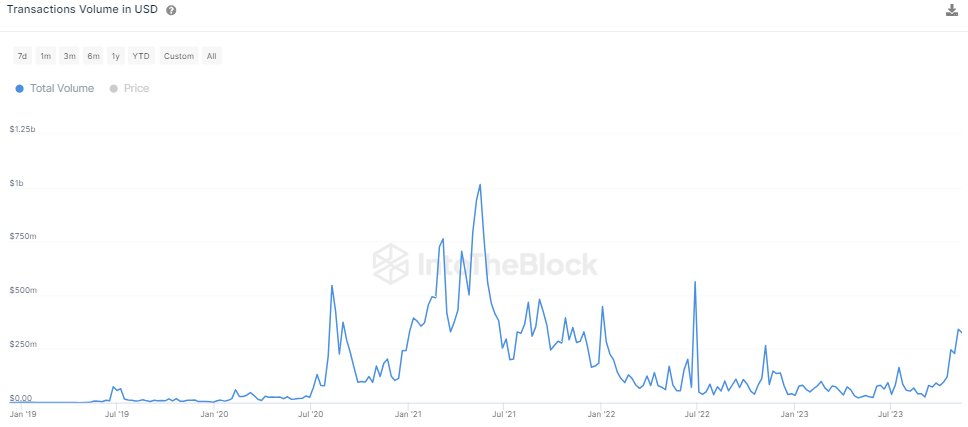

Transactions are up 436% from monthly lows, and as usual, volume is up alongside this increase.

LINK volume hit $515 million last week | Source: IntoTheBlock on X

If transaction activity is high, it indicates that there is interest in the asset, and so the price action should not get out of hand yet. However, the volatility resulting from this activity can go either way, as the asset already shows.

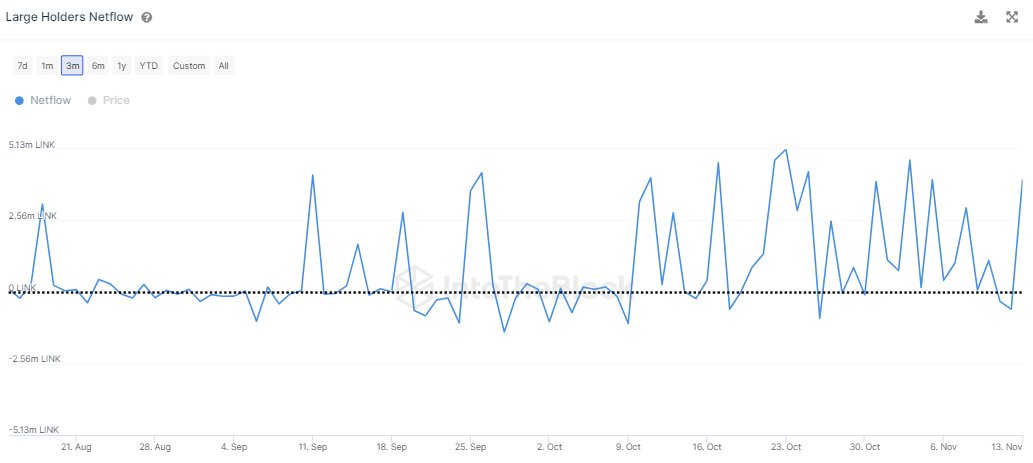

One metric that could point more clearly in a direction for the cryptocurrency is large holder net flow, which tracks the past month’s net accumulation/distribution behavior for LINK holders who own more than 1% of the supply.

The metric's value has been positive recently | Source: IntoTheBlock on X

As visible in the chart, major Chainlink holders have been buying recently, which could potentially be a positive sign for the asset. This does not necessarily mean that the rally will start again soon, but it does provide some support for the idea.

Featured image from Shutterstock.com, charts from TradingView.com, IntoTheBlock.com