- Smart money has turned bullish on Quant after the token formed a double-top pattern on the four-hour chart.

- If buyers remain active, QNT could rise to $128.

Quantitative [QNT]At the time of writing, it was trading at $117, after gaining more than 10% in 24 hours. Trading volumes were also up 53% to $30 million per CoinMarketCap, while the token’s market capitalization rose to $1.41 billion.

Amid these gains, so has smart money turned bullish on QNT, per market prophet. This is despite the fact that public or retail sentiment is bearish.

One of the factors that could fuel positive sentiment among experienced investors is the bullish outlook on Quant’s lower time chart.

QNT is gearing up for a rally to $128

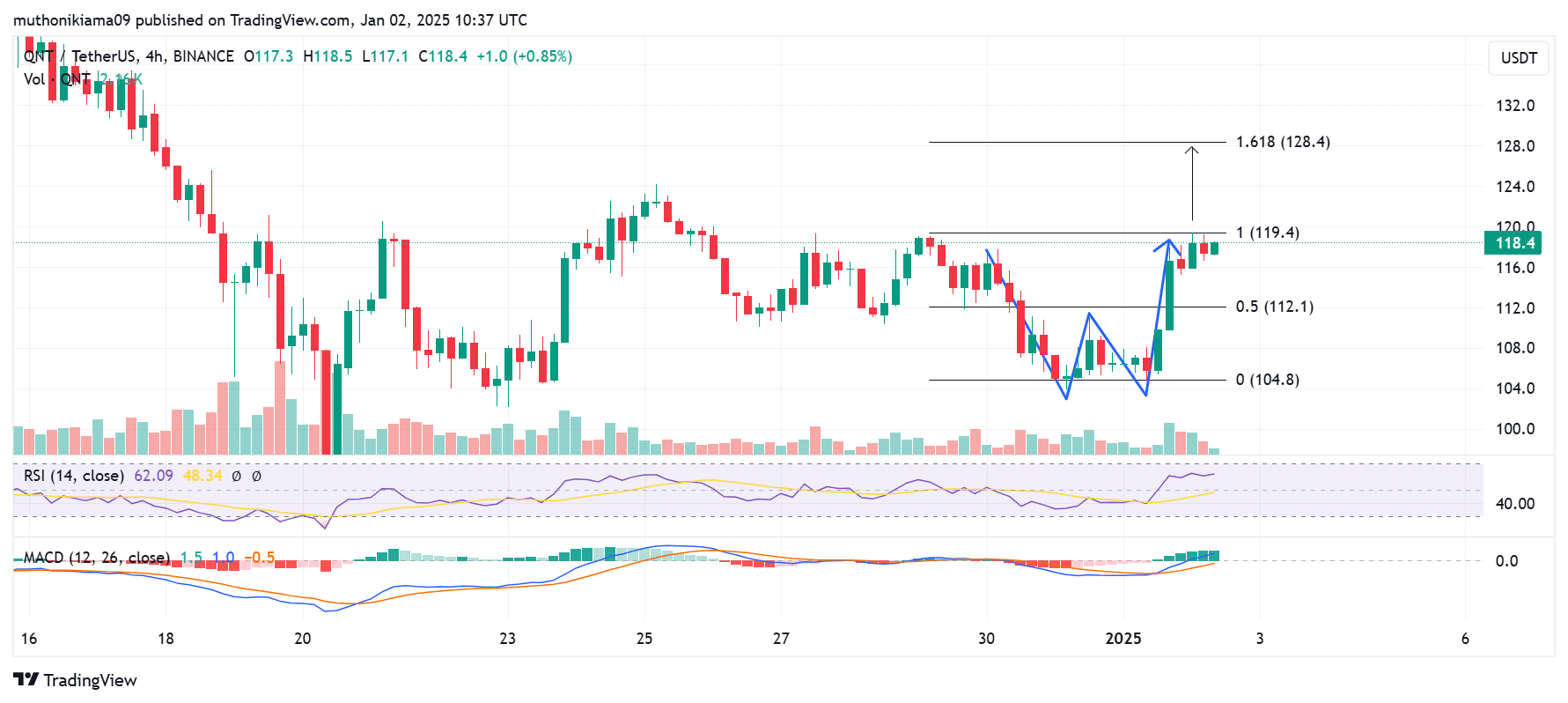

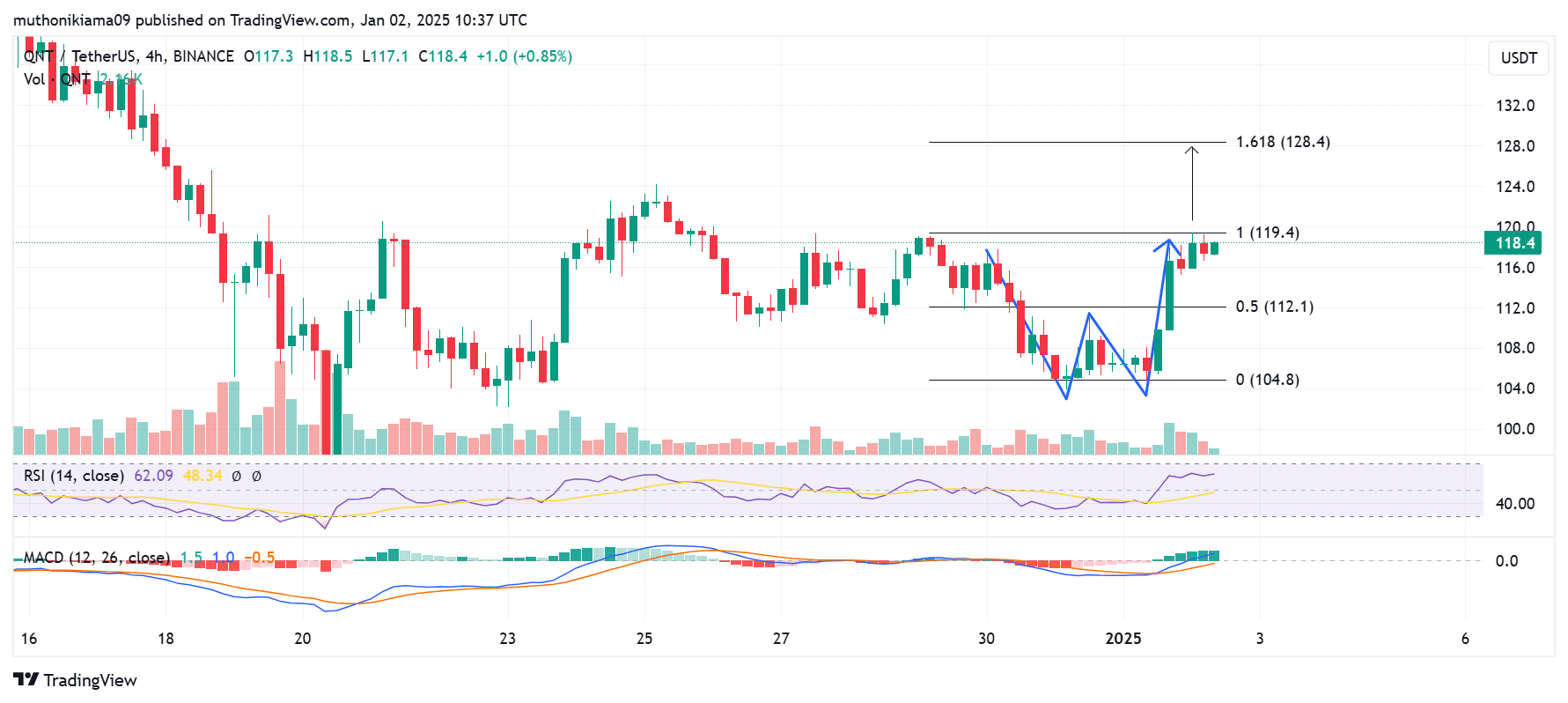

Quant’s four-hour chart showed the altcoin had completed a W pattern, which often signals an upcoming uptrend.

Moreover, with strong volumes, the token had surged past the neckline of this pattern, showing bullish momentum.

Quant faces strong resistance at the second peak at $119. If it manages to reverse this level, the altcoin could rally to mid-December levels above $128.

Source: TradingView

The Relative Strength Index (RSI) confirmed this bullish thesis with a reading of 62, indicating that buying pressure was higher than selling pressure at the time of writing.

This indicator also showed an upward trend, indicating increasing buyer interest.

The Moving Average Convergence Divergence (MACD) line also formed a bullish crossover after turning positive.

The shortening MACD histogram bars further confirmed that buyers are re-entering the market, which could help break the resistance at USD 128.

Is a falling MVRV good for the price?

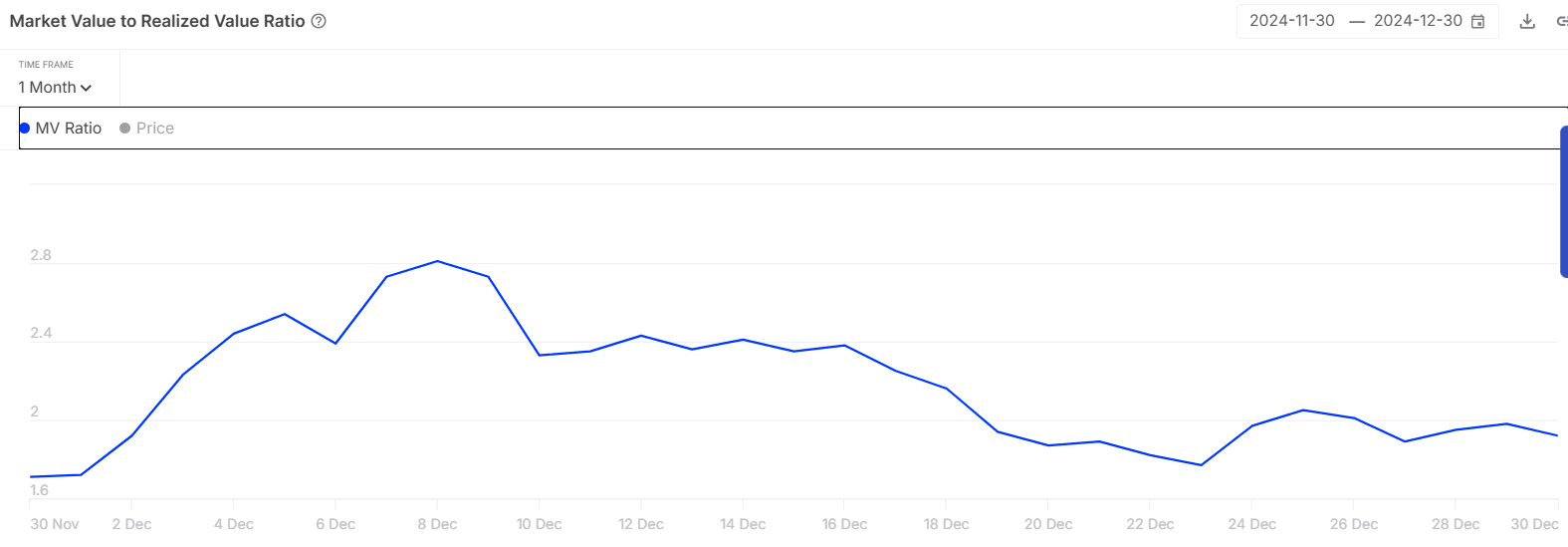

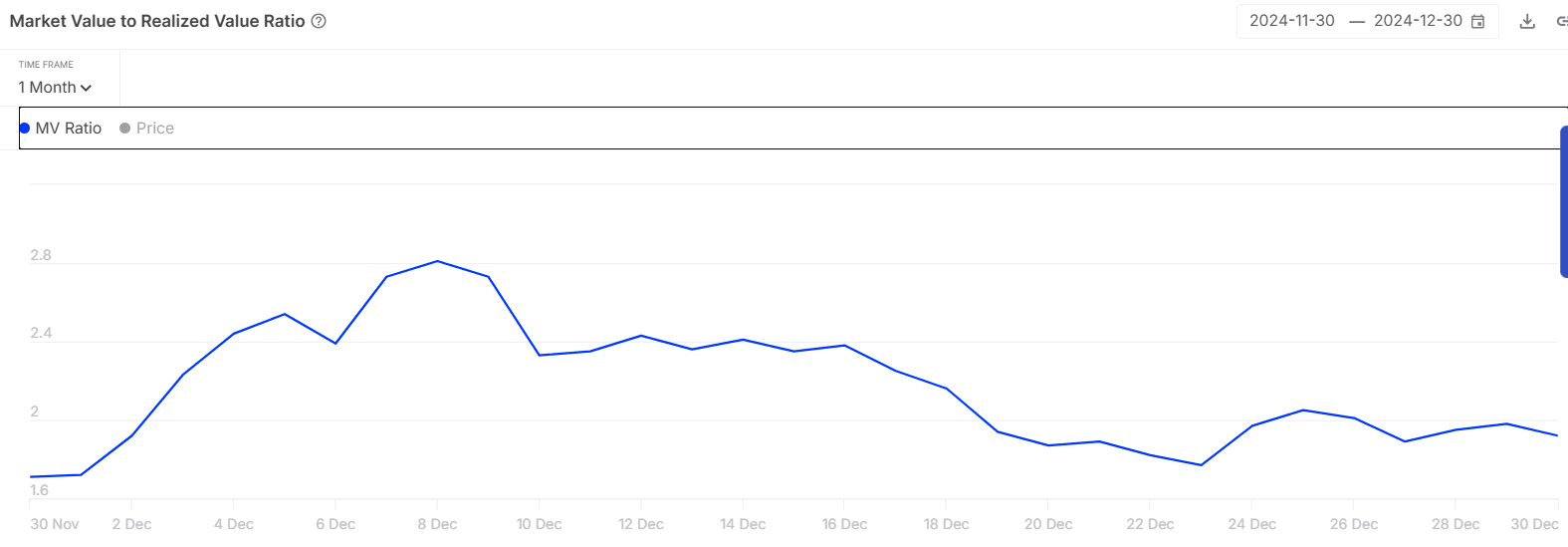

Quant’s market value to realized value (MVRV) ratio has seen a sharp decline over the past month. During this period the ratio decreased from 2.81 to 1.92.

A declining MVRV shows that QNT holders have become less profitable. In fact, wallets making a profit have dropped from 85% to 39% within the same period.

Source: IntoTheBlock

While this decline could indicate that QNT is not at risk of being overvalued, it could result in a sharp increase in selling pressure if these portfolios choose to sell to minimize losses.

A decline in profitability could lead to bearish sentiment.

Read Quants [QNT] Price forecast 2025–2026

Important level to watch

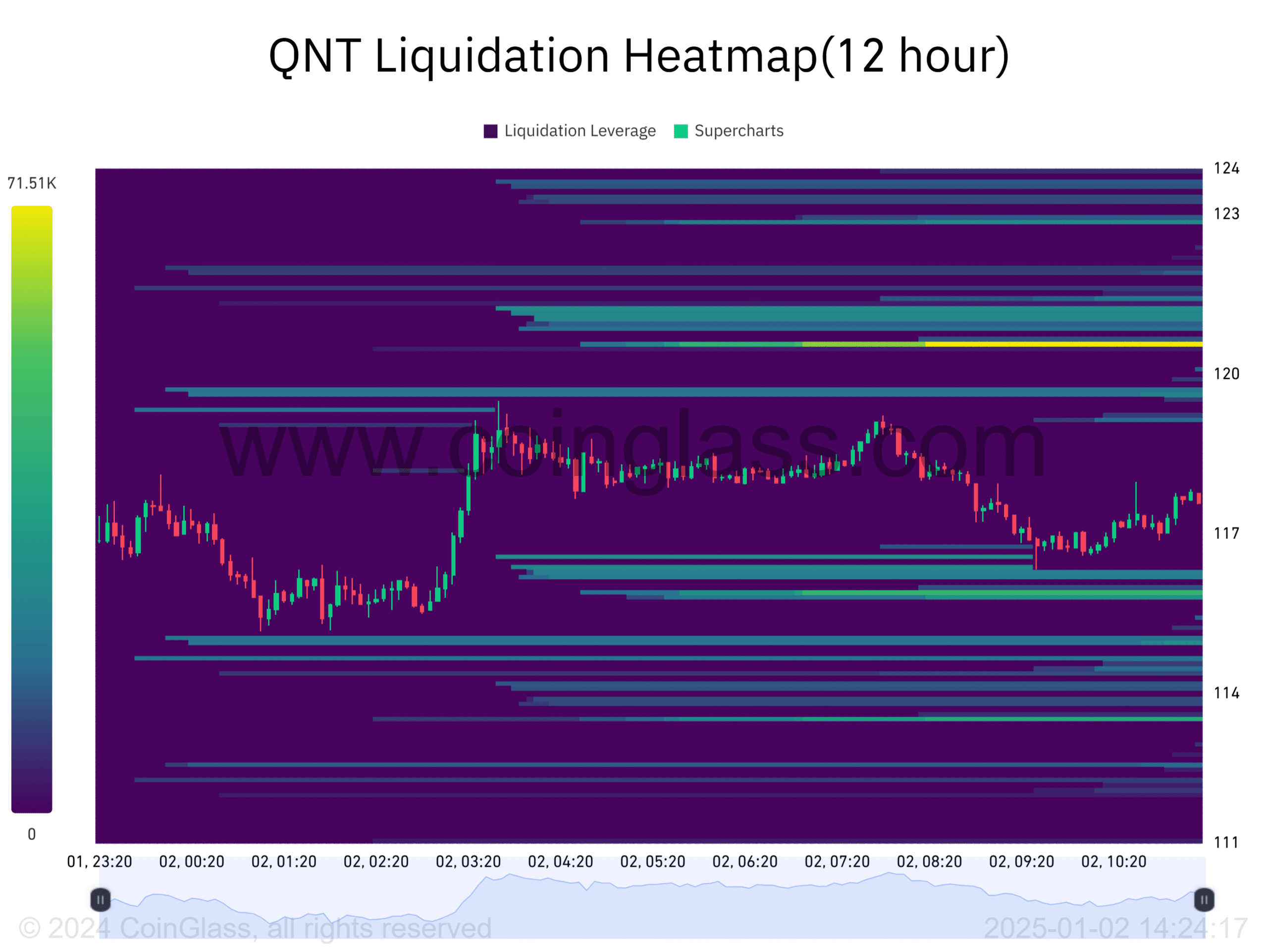

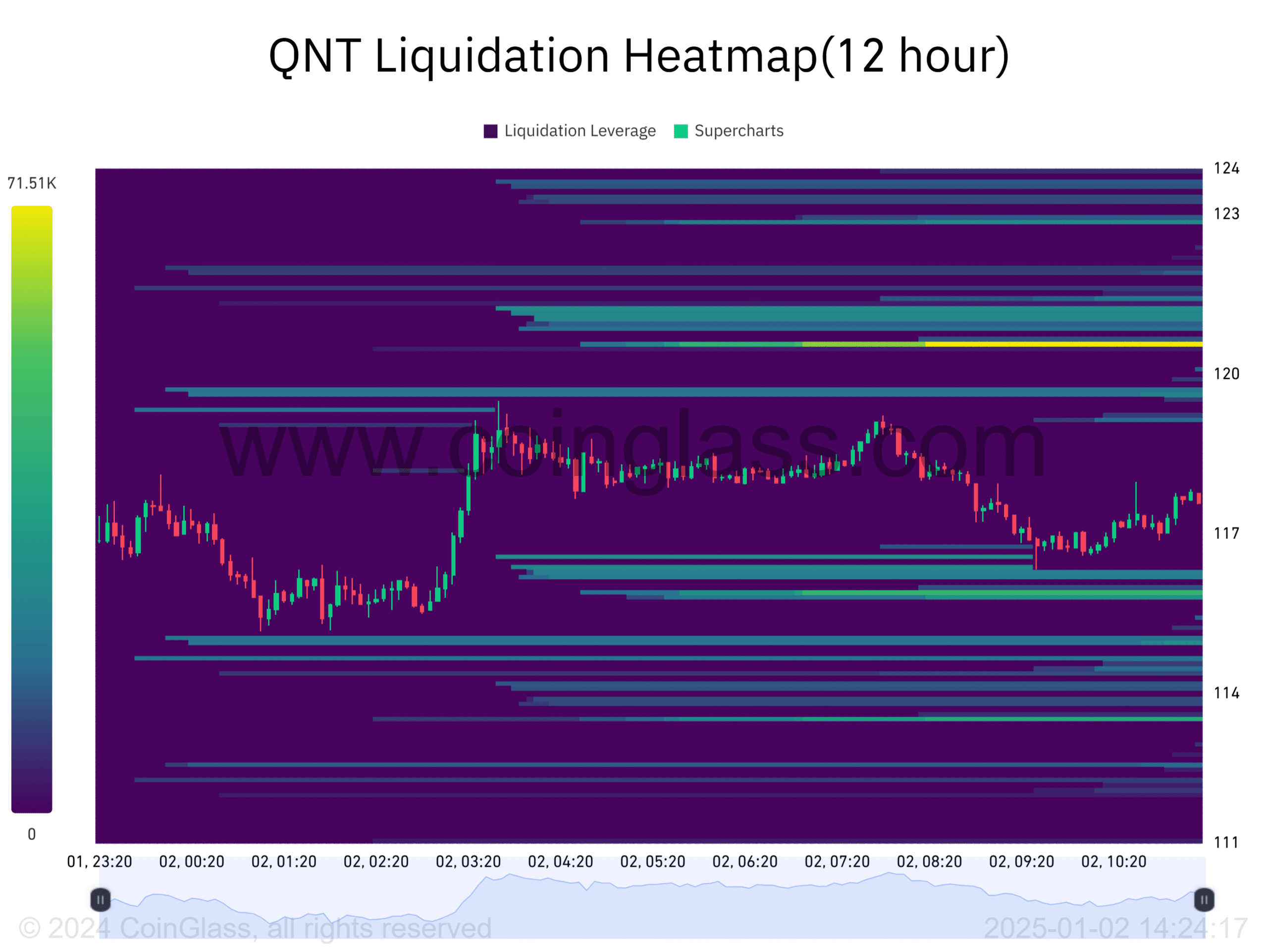

Quant’s liquidation heatmap showed that there was a cluster of liquidations at $120. This level could act as a magnet zone if risk traders choose to close their positions as the price rises.

Source: Coinglass

If QNT rises and the $120 open positions are liquidated, it could lead to a short squeeze where short sellers will turn to buyers. This will result in an upward trend.

![Quantitative [QNT] price prediction: as THIS turns bullish, will there be $128?](https://free.cc/wp-content/uploads/2025/01/Editors-8-1000x600.webp)