- QNT test $ 96.80 Resistance, and an outbreak can activate a rally to $ 121.60.

- Exchange Reserves Signal Potential Sell pressure, but liquidations above $ 98 can cause a sharp move.

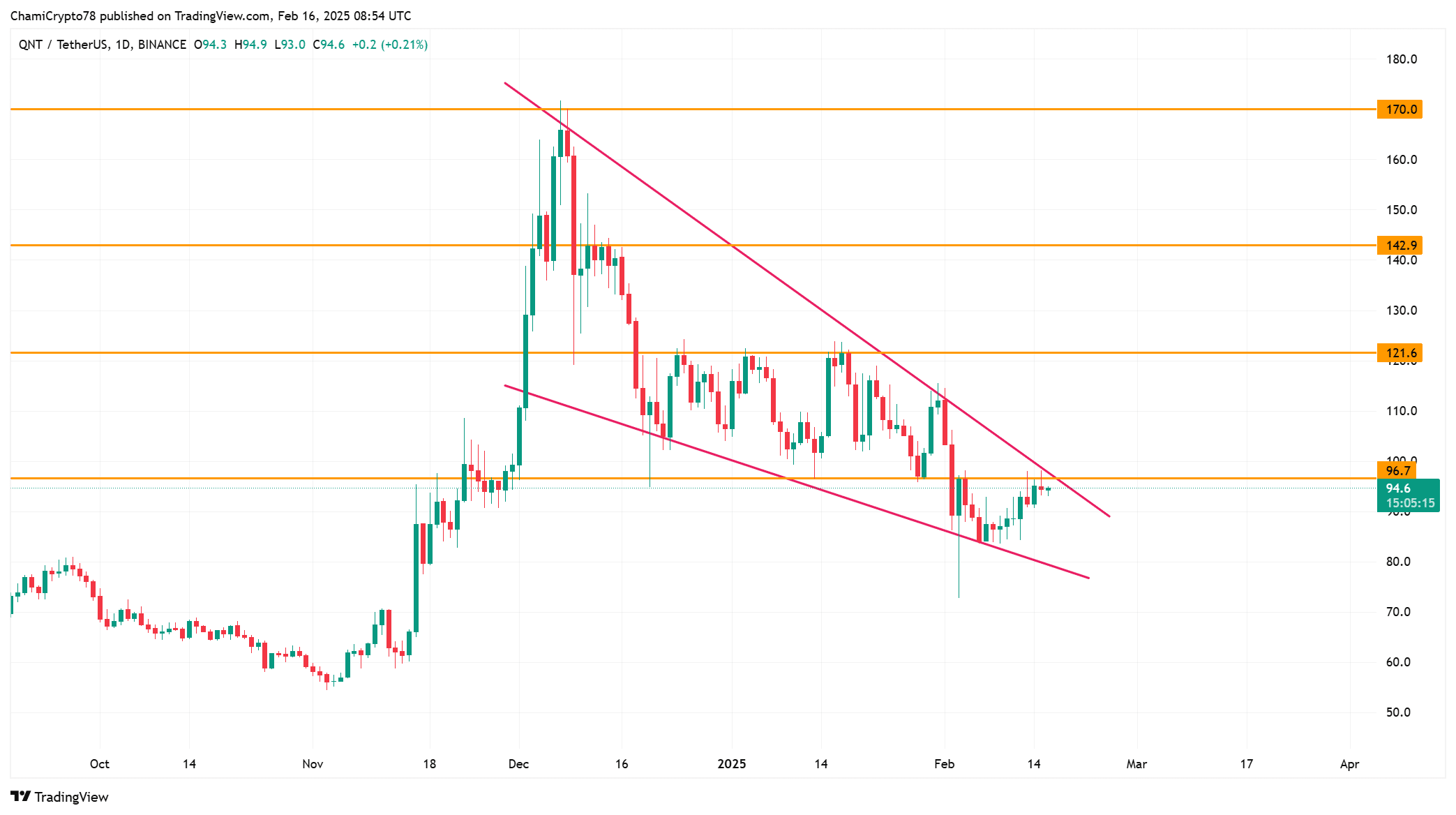

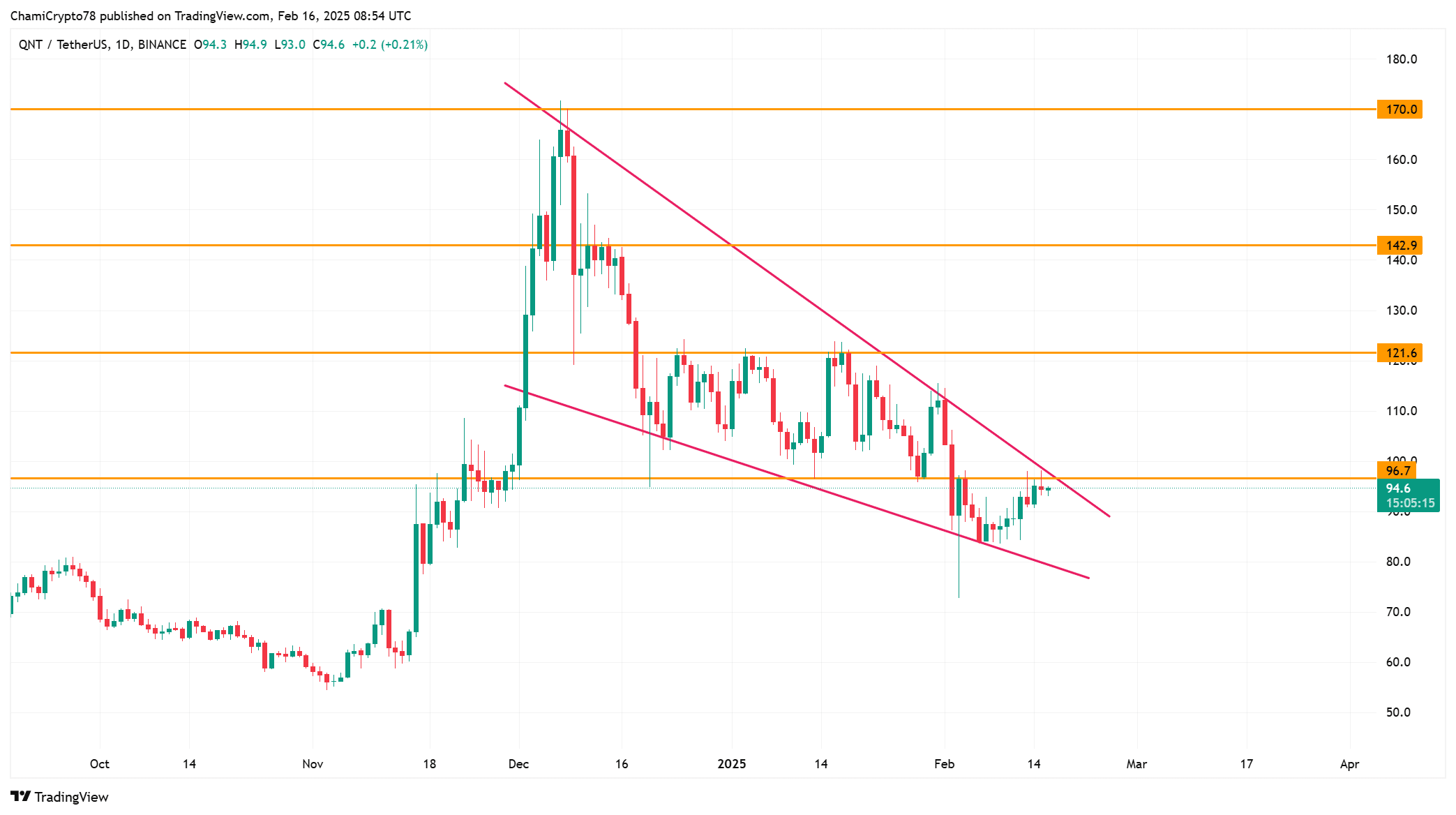

Quantity [QNT] Test a key resistance level at $ 96.80 and an outbreak can cause a strong rally. At the time of the press, QNT traded at $ 94.68, with 1.28% in the last 24 hours.

Bulls must recover this level to confirm a trend shift. However, not breaking through the breaking can lead to a decline. Will q not push higher or face another rejection?

QNT Price at a turning point

QNT has moved in a falling wedge, a bullish reversing pattern. The resistance of $ 96.80 has repeatedly rejected the price stitches, making it an important level to look at.

If bulls can push above it, the momentum could build, causing Q NNT to drive to $ 121.60. A further outbreak can extend the profit to $ 142.90 or even $ 170.00.

However, not breaking not to break can cause a withdrawal to $ 85.00, where there is strong support. Moreover, Bitcoin’s movement will influence the direction of QNT.

Buyers must maintain pressure to prevent a new decline. If the volume increases in the vicinity of resistance, QNT could soon confirm an outbreak.

Source: TradingView

What do the statistics reveal?

Data on chains presented mixed signals. Net network growth had risen by only 0.29%, which reflects a weak acceptance. Bullish Momentum could weaken without new users.

However, 1.11% of holders remained in profit, which suggests a positive sentiment.

Moreover, the concentration levels remained unchanged, which means that whales neither accumulated or sold. In the meantime, major transactions have fallen by 3.61%, with reduced institutional participation.

If whales aggressively enter the market, QNT could win the push that is needed for an outbreak.

Source: Intotheblock

Increasing the offer or hidden accumulation?

The exchange reserves are somewhat increased by 0.02%, indicating a potential increase in sales pressure.

When reserves climb, there are more coins available for acting, which increases volatility. If this trend continues, Quant may have difficulty maintaining support levels.

However, if the reserves decrease, this may indicate accumulation, which reduces sales pressure. In addition, market participants must keep a close eye on spareers.

A decrease in reserves would confirm that investors instead of selling instead of selling. This can enhance the bullish outlook.

Source: Cryptuquant

Will forced liquidations stimulate volatility?

The Binance liquidation heat showed significant liquidation clusters between $ 96 and $ 98. If quant goes into this zone, forced liquidations can cause rapid price movement.

An outbreak above $ 98 could push Q NNT to $ 100, because Short Sellers are liquidated.

However, if rejection takes place, Quant can come back in the direction of $ 90, where there is strong support of liquidity. In addition, traders must expect volatility in the vicinity of these levels.

Large liquidation clusters often result in sudden price fluctuations. If bull Momentum preserved, QNT could confirm an outbreak.

Source: Coinglass

Quant is at a critical point and breaking $ 96.80 will determine the next step. A successful outbreak can push the price to $ 121.60. However, if the rejection occurs, QNT can fall to $ 85 – $ 90.

Bulls must push through the resistance with strong volume to attach a bullish trend.