- Quant’s price is now under pressure despite strong bullish sentiment signals

- Foreign exchange reserves have fallen, but open interest has also declined

Quantitative [QNT], at the time of writing that seemed to be the case show strong bullish sentiment from both retail and institutional investors, indicating optimism about a possible price reversal. In fact, Market Profhit’s data is on a X message (formerly Twitter) highlighted a public sentiment score of 2.07, while smart money sentiment stood at 0.86.

However, despite this optimistic outlook, QNT was trading at $65.05, having fallen 2.39% at the time of writing. This raises a crucial question: will the bullish sentiment be enough to reverse the prevailing downtrend?

QNT Price Action Analysis – Can It Provide Support?

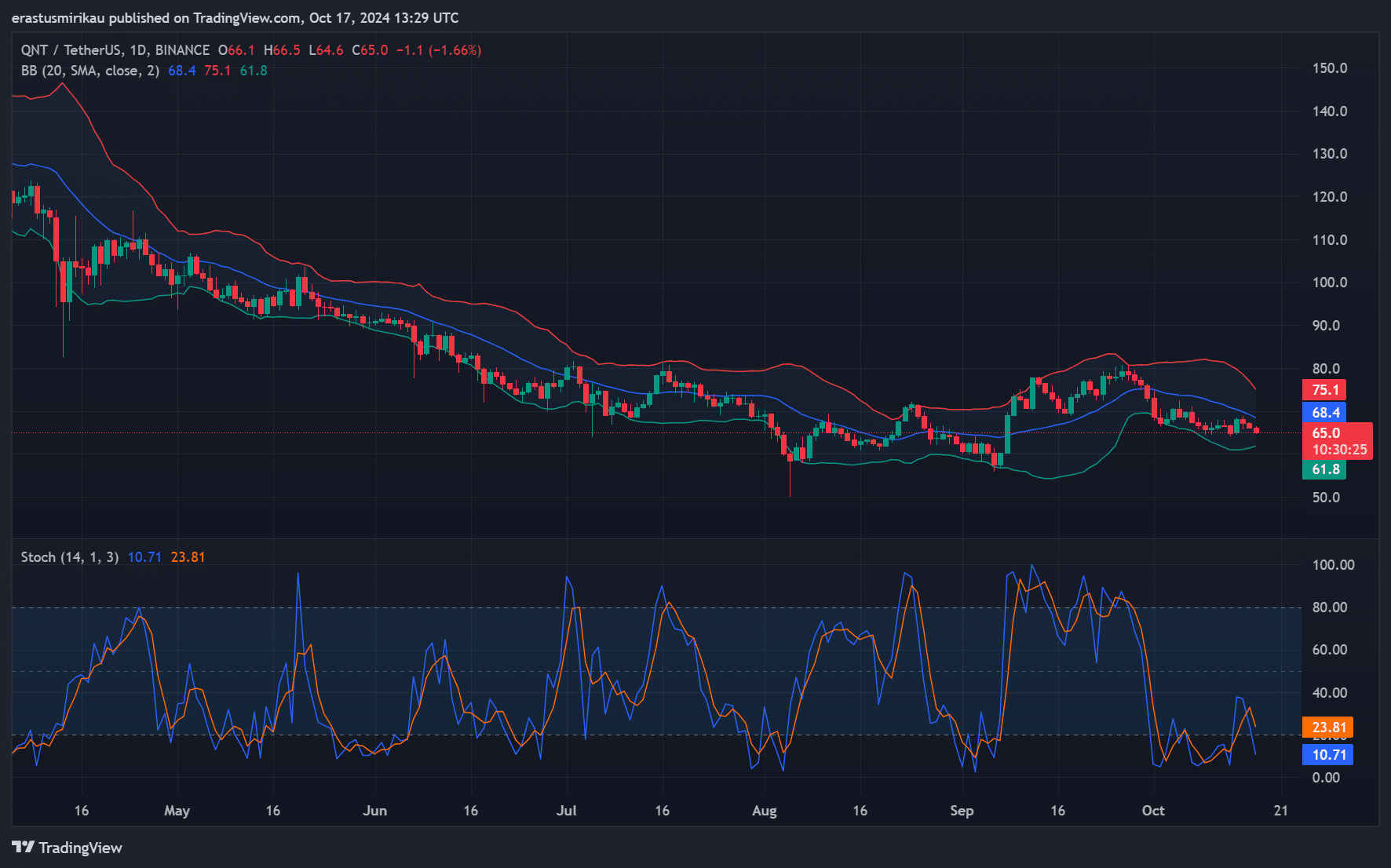

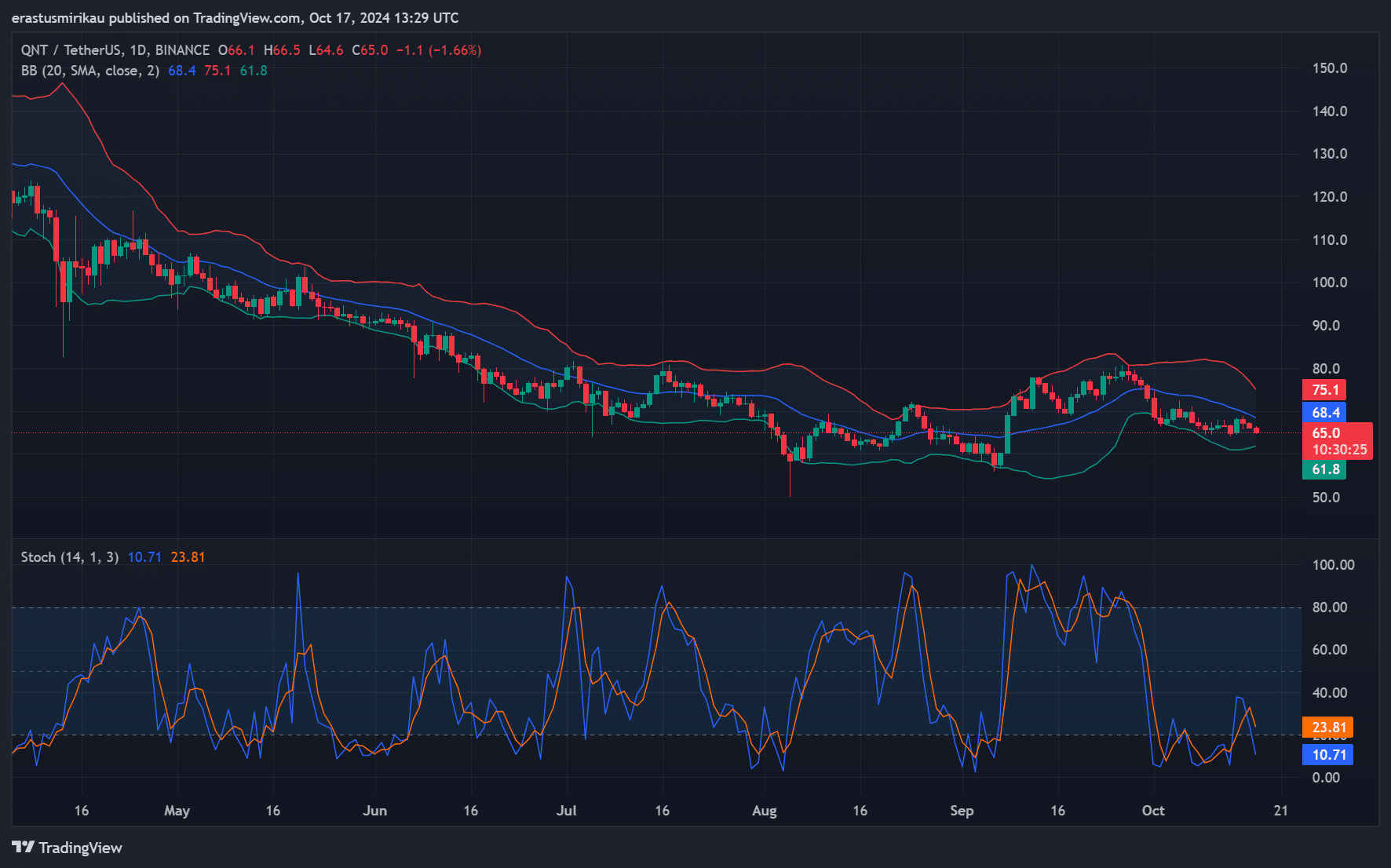

QNT has seen its price steadily decline since it failed to break the resistance at $80 in September. At the time of writing, the price was near the lower Bollinger Band level of $61.80, a critical support zone. The stochastic RSI further highlighted bearish momentum, with oversold conditions highlighted by the blue line at 10.71.

Although the asset appeared oversold, the price action highlighted that sellers remain in control. If Quant can maintain support, a turnaround could occur. However, a drop below $61.80 could lead to further selling pressure.

Source: TradingView

Stock market flow analysis – Is the selling pressure decreasing?

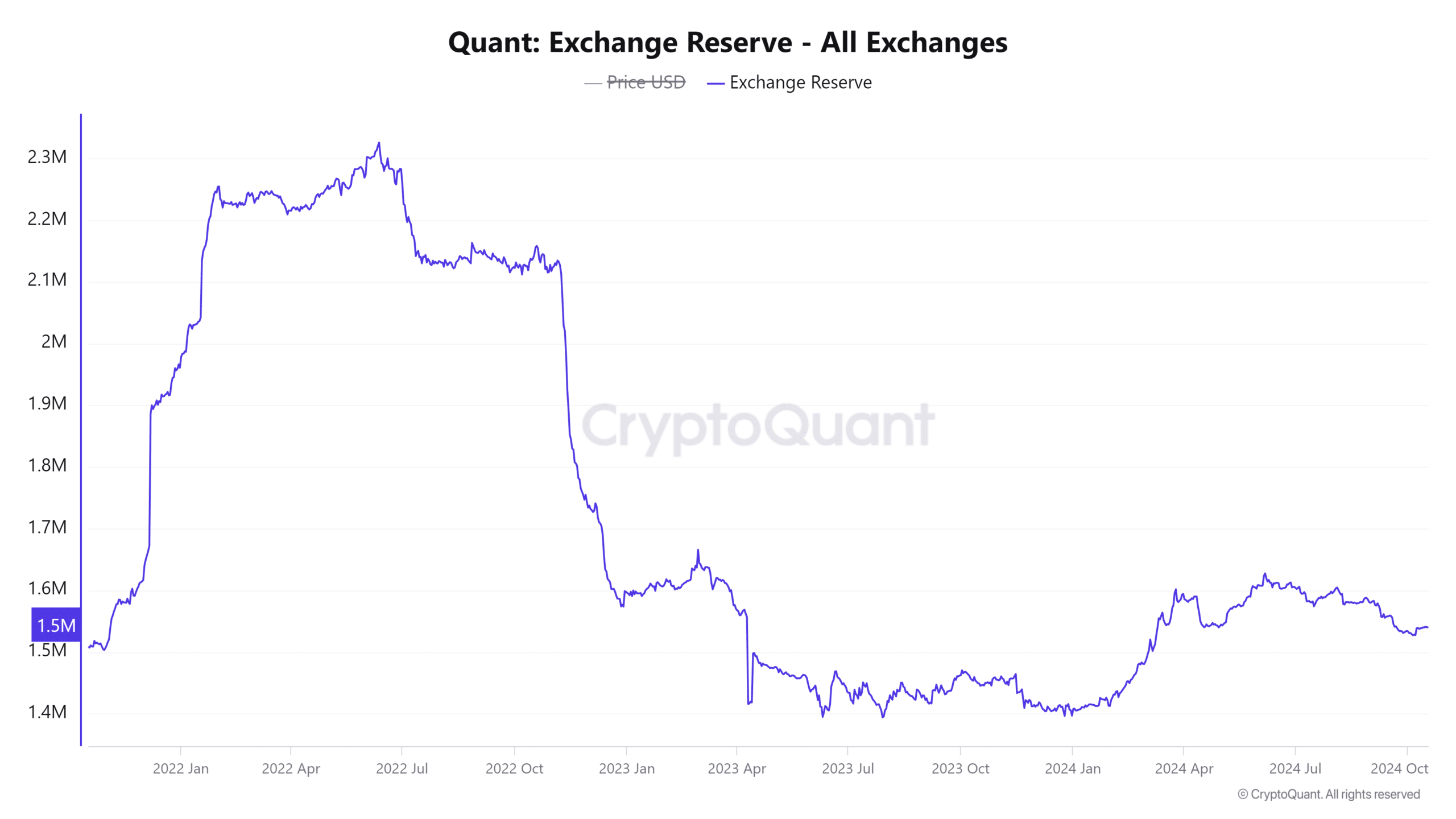

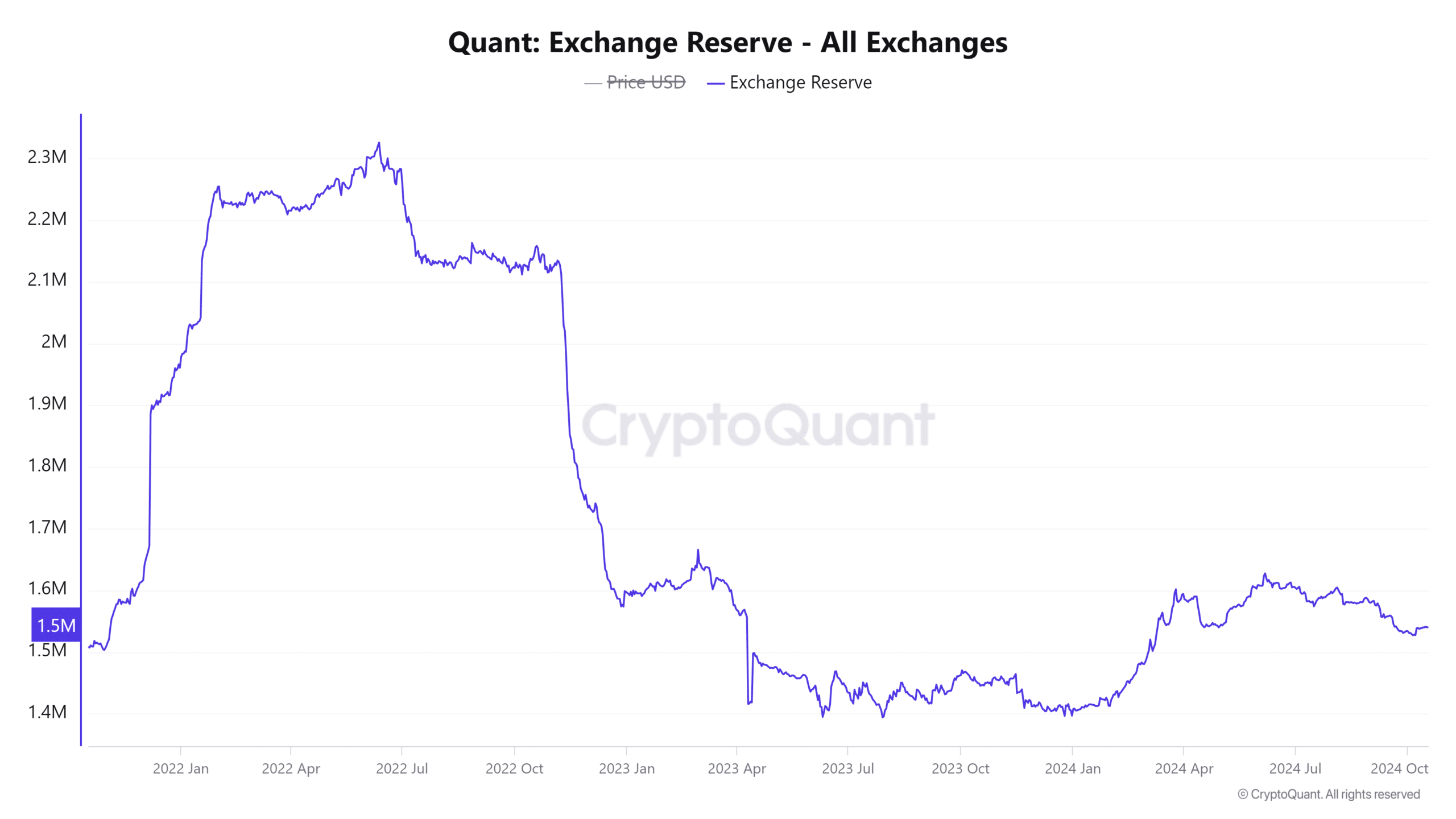

Looking at currency reserves, QNT has seen a slight decline, with 1.54 million tokens currently on exchanges – down 0.21% in the last 24 hours. Consequently, this decline may indicate reduced selling pressure as fewer tokens are sent to exchanges.

However, this must be closely monitored. If foreign exchange reserves start to rise again, this could mean renewed sales activities. While this reduction in reserves provides some relief, it is still unclear whether it will be enough to halt the ongoing downward trend.

Source: CryptoQuant

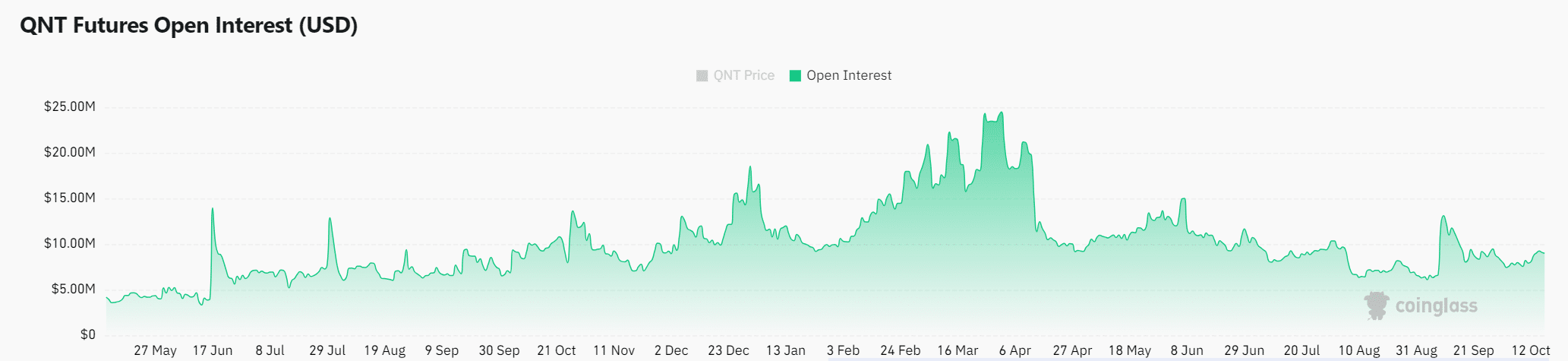

QNT open interest analysis – Is market confidence wavering?

Quant’s open interest also fell 7.39%, to $8.49 million. This decline could indicate a lack of confidence as traders close positions instead of opening new ones.

Consequently, a sustained decline in Open Interest could further strengthen bearish sentiment as fewer traders are willing to bet on price recovery. On the other hand, if Open Interest stabilizes, it could pave the way for bigger price moves.

Source: Coinglass

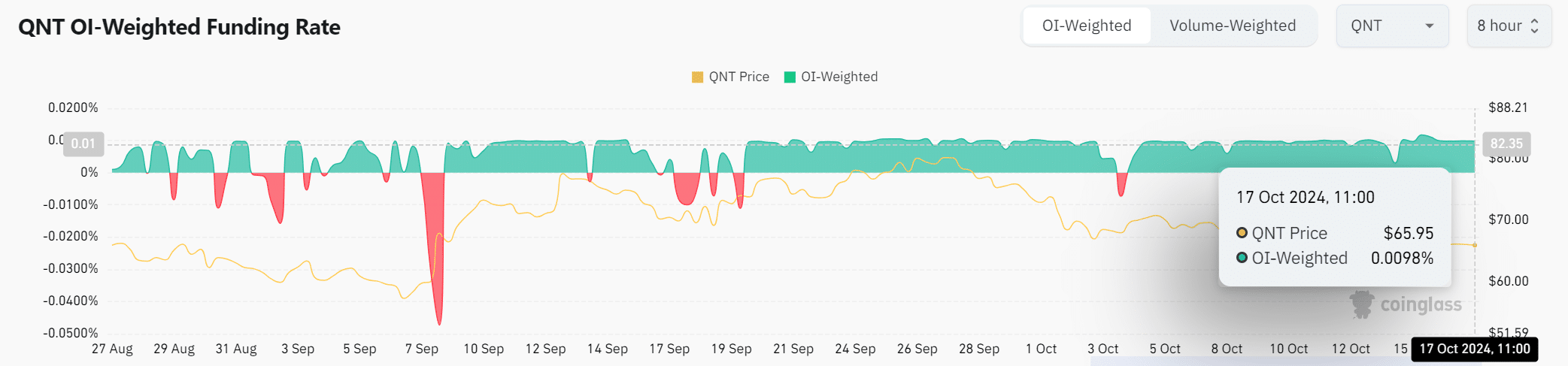

QNT OI Weighted Funding Rate – Is There Still Optimism?

Finally, the OI-weighted funding rate was slightly positive at 0.0098%, showing that long positions are being maintained. While this is a sign of optimism, it is not strong enough to indicate a clear shift in market sentiment. Although long traders are still waiting for a price increase, this may not be enough to make big gains in the short term.

Source: Coinglass

Read Quants [QNT] Price forecast 2024–2025

Despite bullish sentiment from both retail and smart money, Quant’s technical and on-chain metrics suggested caution. Declining Open Interest and continued price pressure indicated that bullish sentiment has not translated into stronger price action.

Therefore, while QNT has potential, it may need additional technical confirmation before a breakout on the charts occurs.