NEAR Protocol, a Blockchain Operating System (BOS), showed remarkable growth in the third quarter of 2023, defying the challenging conditions of the overall cryptocurrency market.

According to a recent report by Messari, key metrics for NEAR Protocol have risen significantly over the past month, buoyed by recent price increases in the crypto market.

Increasing the number of transactions drives revenue growth for NEAR

According to the report, despite a moderate downturn in the crypto market, with XRP and Grayscale faced with court decisions in their favor, NEAR Protocol showed resilience. Total crypto market capitalization fell by 5.8% Bitcoin (BTC) and Ethereum (ETH) saw declines of 7.5% and 10.0% respectively.

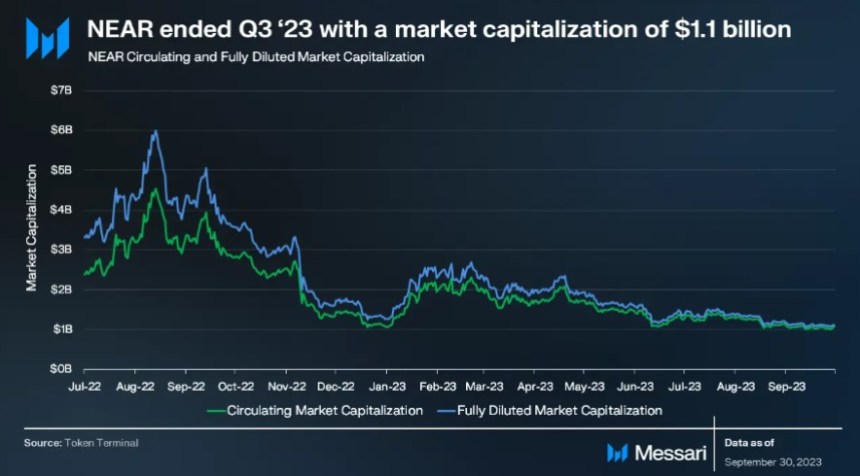

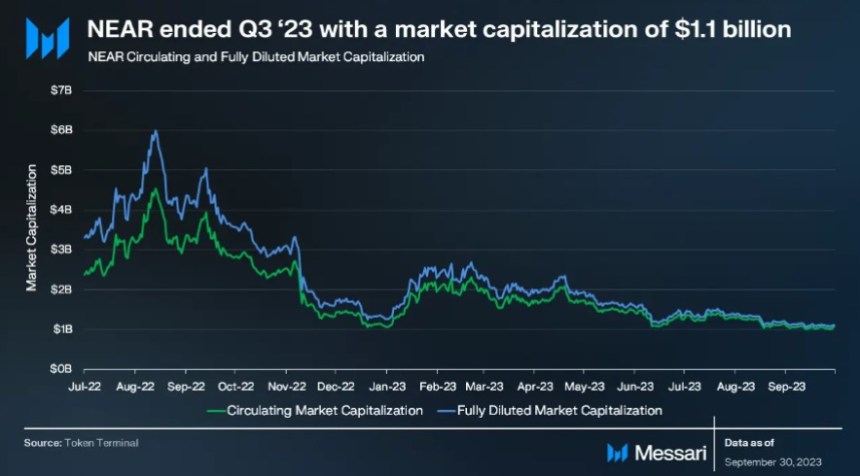

Within this context, NEAR’s circulating market capitalization fell 14% quarter-on-quarter (QoQ) to $1.08 billion, while its fully diluted market capitalization fell 17% quarter-on-quarter to $1.12 billion.

Nevertheless, NEAR Protocol retained its position as the 40th largest crypto protocol Market capitalization by the end of the quarter.

One of the highlights in Q3 ’23 for the protocol was revenue growth, which rose 9% quarter-over-quarter from $98,000 to $108,000. Average transaction costs remained at a low level of $0.001 throughout the quarter.

In terms of network activity, NEAR recorded substantial growth in addresses during the third quarter of ’23. Active addresses increased 350% quarter-over-quarter to reach 260,000 daily active addresses, while new addresses increased 274% quarter-over-quarter for a total of 51,000 daily new addresses.

This growth was primarily fueled by the launch of KAIKAINOW, NEAR’s leading application, and supported by contributions from the Web3 health and fitness app, Sweat Economy, and Aurora, a solution that enables the execution of Ethereum contracts in a “more performing environment” in the NEAR ecosystem.

TVL drops to $52 million in Q3 2023

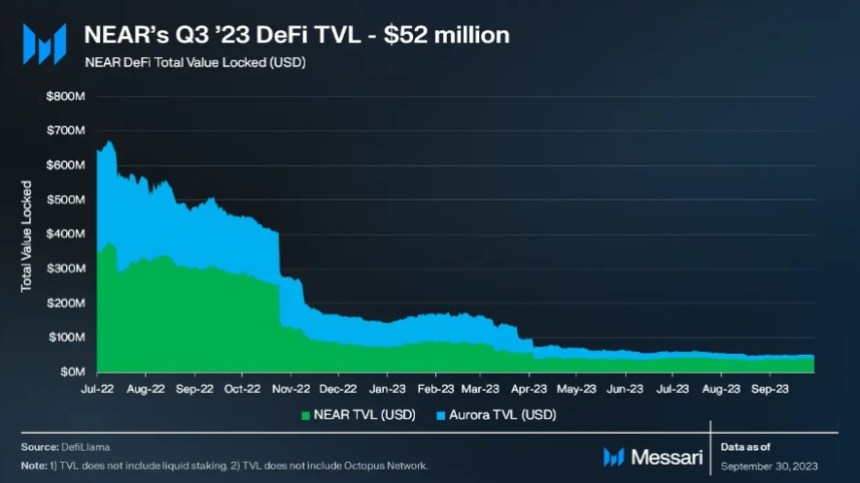

According to Messari, NEAR’s Total Value Locked (TVL) experienced a 13% quarter-over-quarter decline, reaching $52 million by the end of the quarter. NEAR ranks about 35th among blockchains in terms of TVL.

Within the NEAR Network’s TVL, NEAR’s contribution was $41 million (80%), while Aurora contributed $11 million (20%).

In terms of DEX trading volume, NEAR reported an average daily volume of $1.3 million, maintaining stability compared to the previous quarter. NEAR ranks approximately 30th among DEX trading volumes.

CLOSE TO stable currency Market capitalization saw a 27% quarter-over-quarter decline, mainly due to reductions in USDC and USDT. However, the native USDC was launched on NEAR during this period, while USN, Decentral Bank’s phasing-out stablecoin, remained unchanged.

NEAR Token’s bullish momentum continues

In terms of price action, as observed in the 1-day chart below, NEAR Protocol’s token, NEAR, has broken a long-term downtrend that started on July 20 and ended on August 18, leading to a phase of accumulation.

However, on October 19, the token initiated an uptrend, resulting in a significant gain of 12% over the past 30 days, 22% within the fourteen-day time frame, and 22.3% in the past week. Currently, the token continues its rally and is up 2.6% in the past 24 hours, bringing its current trading price to $1.23.

When looking at the year-to-year period, the token remains significantly below its 2022 peak and experiences a 60% decline during this period. Furthermore, if NEAR is to regain its 2023 annual high, which stood at $2.83 and was reached in April, the bullish momentum must continue.

It remains to be seen whether the token can maintain its current bullish momentum and reach a new annual high, capitalizing on the rallies that the market’s largest cryptocurrencies will witness in the coming months, to generate further gains.

Featured image from Shutterstock, chart from TradingView.com