A Coinbase researcher says the impact of a potential green light for US spot Bitcoin (BTC) on the exchange is already “partially priced in” for the top crypto asset.

In a new analysis, David Duong, head of institutional research at the crypto exchange, says: say that the difference between the performance of Bitcoin and the altcoin market indicates that market participants are already anticipating the adoption of one or more BTC ETFs.

According to Duong, Bitcoin may not rise as much as traders expect when a spot-based ETF takes center stage because the highly anticipated event is already partially priced in.

“That makes it less clear how much more Bitcoin could outperform if there were a favorable decision from the U.S. Securities and Exchange Commission (SEC).”

Duong also says that if a BTC ETF is approved, it could take some time to see significant inflows, compared to a previous approval of a gold ETF.

“For example, the SPDR Gold Shares ETF (GLD) pioneered the U.S. gold exchange-traded market when it launched on November 18, 2004, almost 19 years ago. In retrospect, GLD has been a very successful financial product with total assets of $51.4 billion, according to Bloomberg. However, looking at the numbers, GLD attracted just $1.9 billion in net inflows (inflation-adjusted to today’s dollars) within the first 30 days of launch and grew that within the first 12 months of its existence only up to $4.8 billion.”

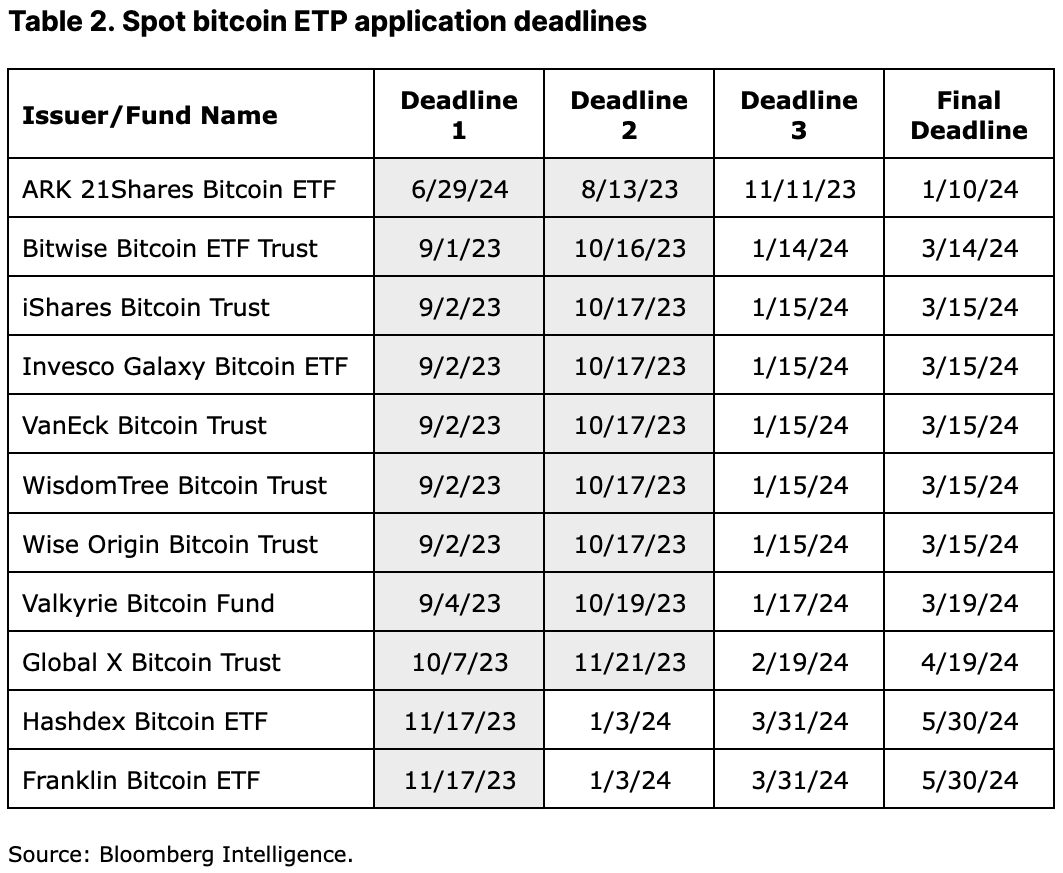

The US Securities and Exchange Commission (SEC) postponed decisions in late September on a slew of BTC ETF filings, including BlackRock’s.

However, the last deadline for the SEC to review one application, the ARK 21 Shares Bitcoin ETF, is January 10.

Duong says the deadline for the ARK 21 Shares Bitcoin ETF could encourage the SEC to make decisions on some applications this year.

“We believe that, barring a US government shutdown, it is entirely possible that the SEC will make a decision before the end of the fourth quarter of 2023. Otherwise, the SEC will find itself in the awkward position of potentially delaying its decision on some of the filings on January 3, 2024, right after the holidays, and then making a final decision on the single ETF filing day deadline on January 10 . If we send mixed messages, we believe the SEC could decide to hear these filings collectively in December 2023.”

Don’t miss a beat – Subscribe to receive email alerts straight to your inbox

Check price action

follow us on Tweet, Facebook And Telegram

Surf to the Daily Hodl mix

Generated image: Midjourney