The popular Solana-based meme coin, Popcat (POPCAT), is poised for a notable price drop as it shows bearish price action on the daily time frame. The meme token has received a lot of attention from crypto enthusiasts in recent days due to its impressive performance.

POPCAT technical analysis and upcoming levels

According to CoinPedia’s technical analysis, POPCAT has formed a bearish head-and-shoulders price action pattern on its daily time frame. This speculation follows today’s notable price drop of 7.5% from a previous level, which now appears to form the first shoulder of the H&S pattern.

Based on the recent price action, the pattern will be successfully confirmed if POPCAT experiences another price drop and reaches the $1.2 level. According to the meme coin’s daily chart, $1.15 appears to be the neckline of the H&S pattern. If POPCAT crosses this level and closes a daily candle below it, there is a good chance that the coin could fall by more than 20% in the coming days.

However, this bearish statement only holds true if POPCAT closes a daily candle below the $1.15 level, otherwise it will be voided.

Bearish on-chain metrics

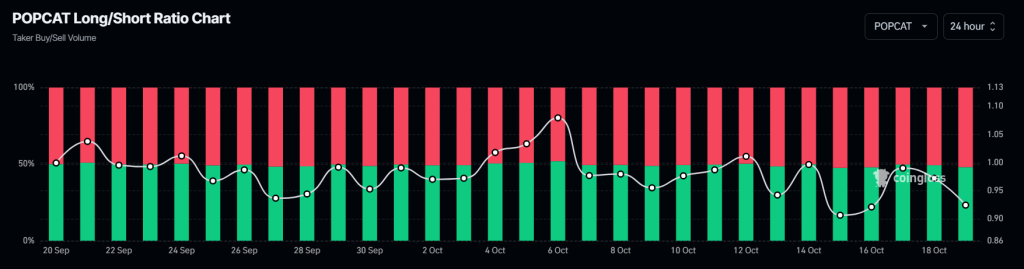

On-chain metrics further support POPCAT’s negative outlook. According to the on-chain analytics company Mint glassPOPCAT’s Long/Short ratio currently stands at 0.92, indicating strong bearish sentiment among traders. Furthermore, open interest has fallen 7.9% in the last 24 hours and 3.5% in the last four hours.

This drop in the meme coin’s open interest suggests traders are exiting their positions or facing potential liquidation due to the continued price decline.

Combining these on-chain metrics with technical analysis, it appears that bears are currently dominating the asset and could drive the price decline in the coming days.

POPCAT’s current price momentum

At the time of writing, POPCAT is trading around $1.28 and has experienced a price drop of over 7% in the last 24 hours. During the same period, trading volume fell by 40%, indicating lower investor and trader participation, likely due to the formation of bearish price action.