- Polygon’s RSI has reached oversold levels after falling to 23 amid intense selling pressure.

- 91% of Polygon wallet holders were experiencing losses at the time of writing, indicating bearish market sentiment.

Polygon [POL] is in a steep downtrend after dropping 12% in 24 hours to trade at $0.457 at the time of writing. Amid this decline, trading volumes rose 33% to $248 million per CoinMarketCap.

Polygon has been facing bearish pressure as its price has fallen around 33% over the past 30 days.

This performance has negatively impacted wallet profitability, with the percentage of wallets experiencing losses increasing to 91%.

When many portfolios experience losses, it creates negative market sentiment that results in further price declines. Furthermore, holders could choose to sell to minimize their losses, which would result in additional pressure on the sell side.

With these bearish conditions continuing, are there signs of a recovery, and could this trend reverse?

RSI shows that Polygon is oversold

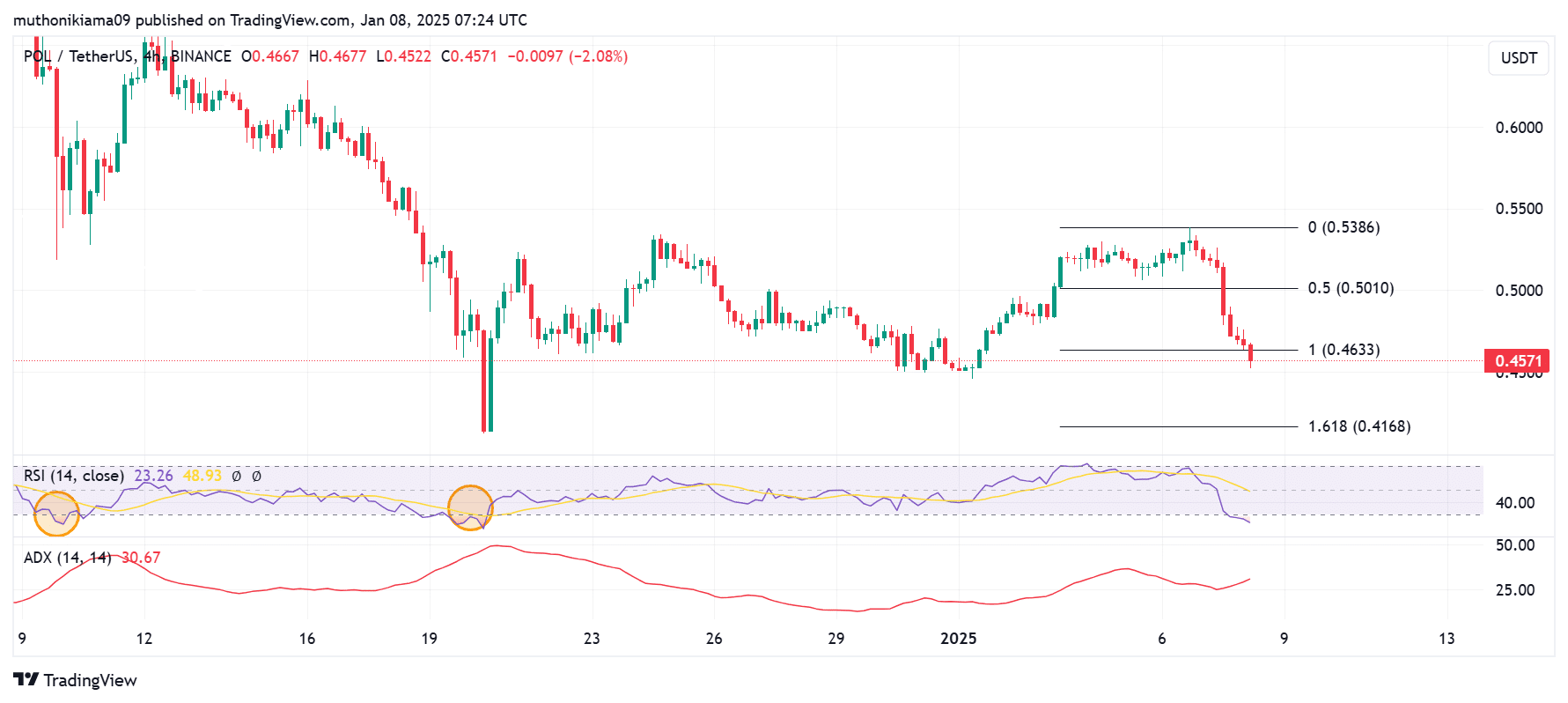

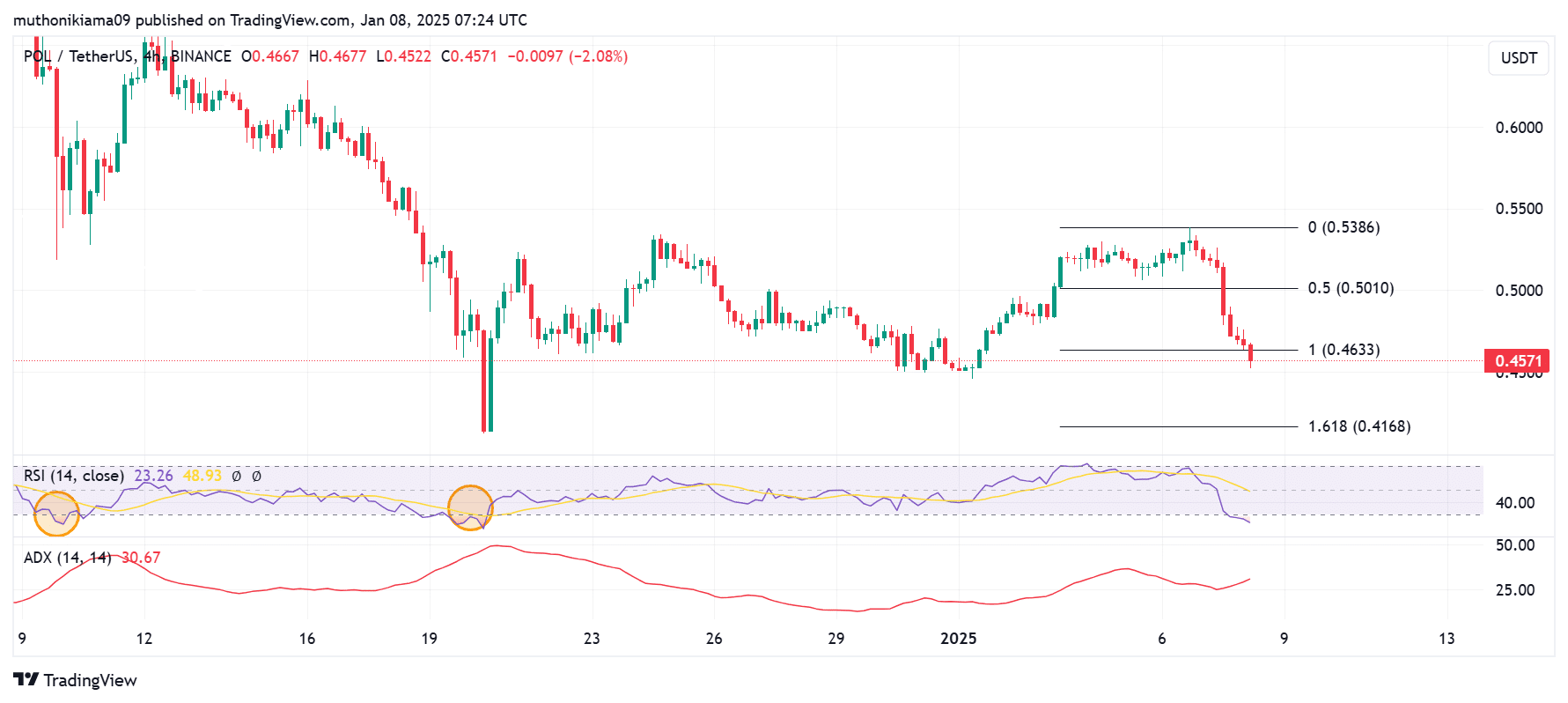

Polygon’s Relative Strength Index (RSI) on the altcoin’s four-hour chart shows that the token is oversold. This statistic has dropped to a value of 23, which is the lowest since mid-December.

An oversold RSI usually precedes an upward correction. Furthermore, if we look at past trends, POL tends to start a rally when the RSI reaches the oversold level. As such, the altcoin could be primed for a recovery.

However, the Average Directional Index (ADX) has yet to confirm the end of the downtrend.

In fact, the ADX line is rising, which is an indication that the ongoing bearish trend is strengthening and the POL could fall to the Fibonacci level of 1.618 ($0.416).

Source: TradingView

However, if selling pressure eases as buyers view the oversold RSI as an ideal entry point, it could result in a bullish reversal, pushing the price towards $0.538.

dApp activity is increasing

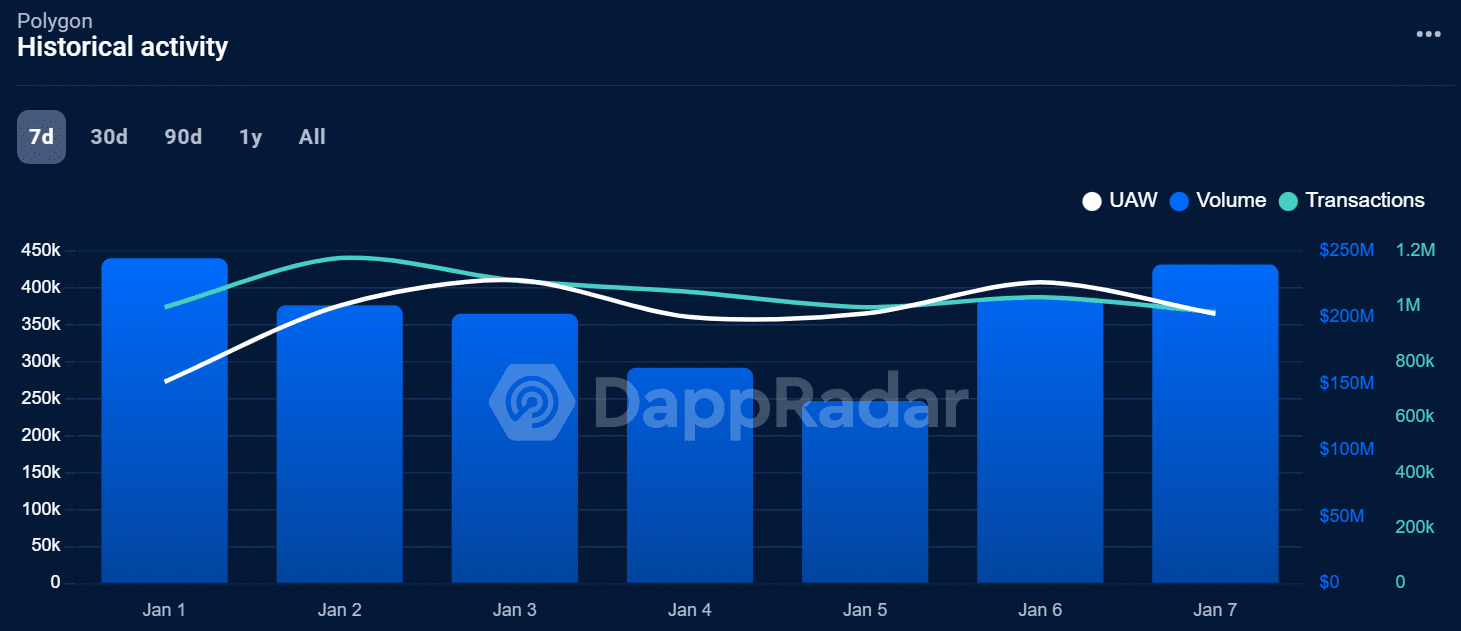

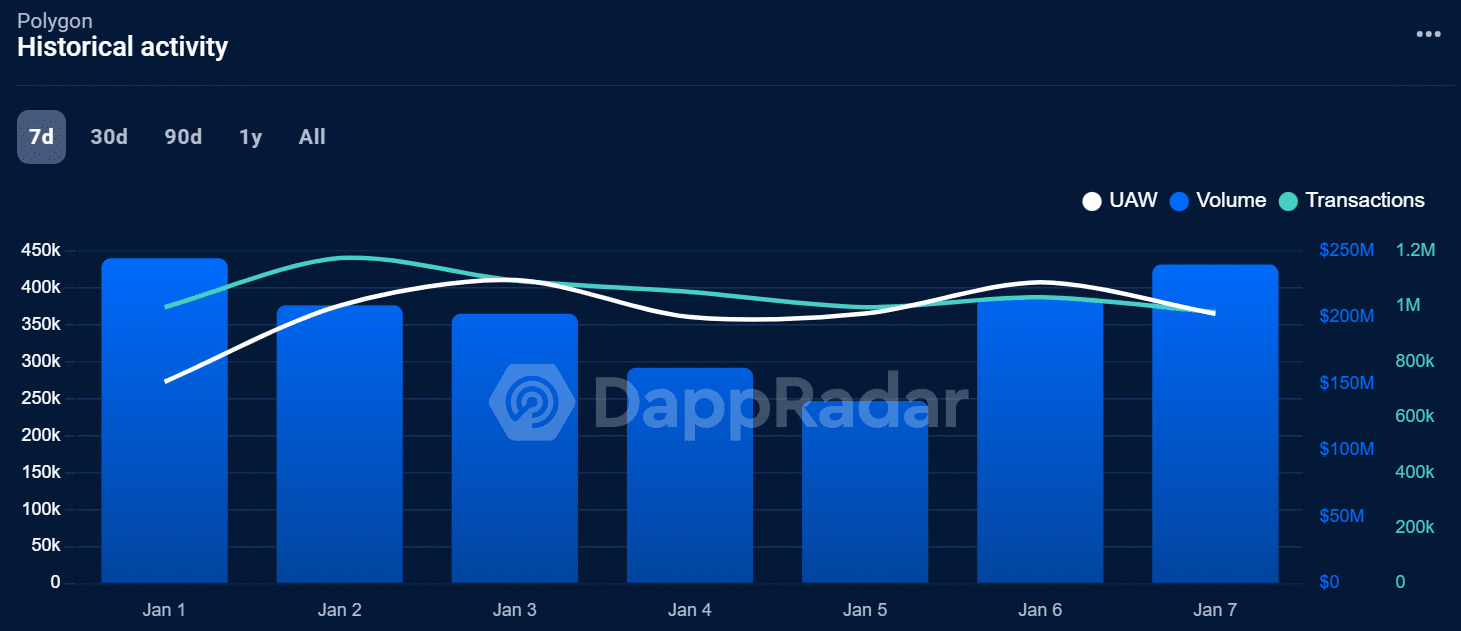

Data from DappRadar shows that dApp volumes on the Polygon network have increased significantly. In the past few hours, these volumes increased by 18% to $244 million, reaching a six-day high.

Source: DappRadar

However, despite this increase, transactions had fallen below $1 million, while the number of Unique Active Wallets (UAWs) also fell.

Additionally, Polygon’s monthly dApp volumes are still down 37%, suggesting the long-term outlook remains bearish.

Read Polygon [POL] Price forecast 2025–2026

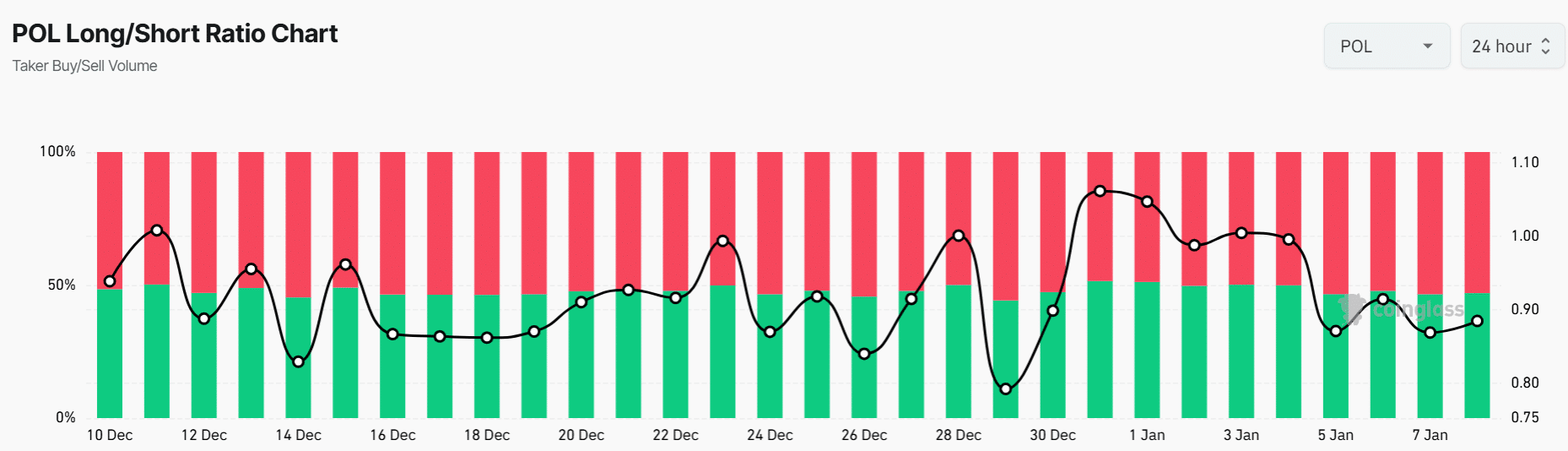

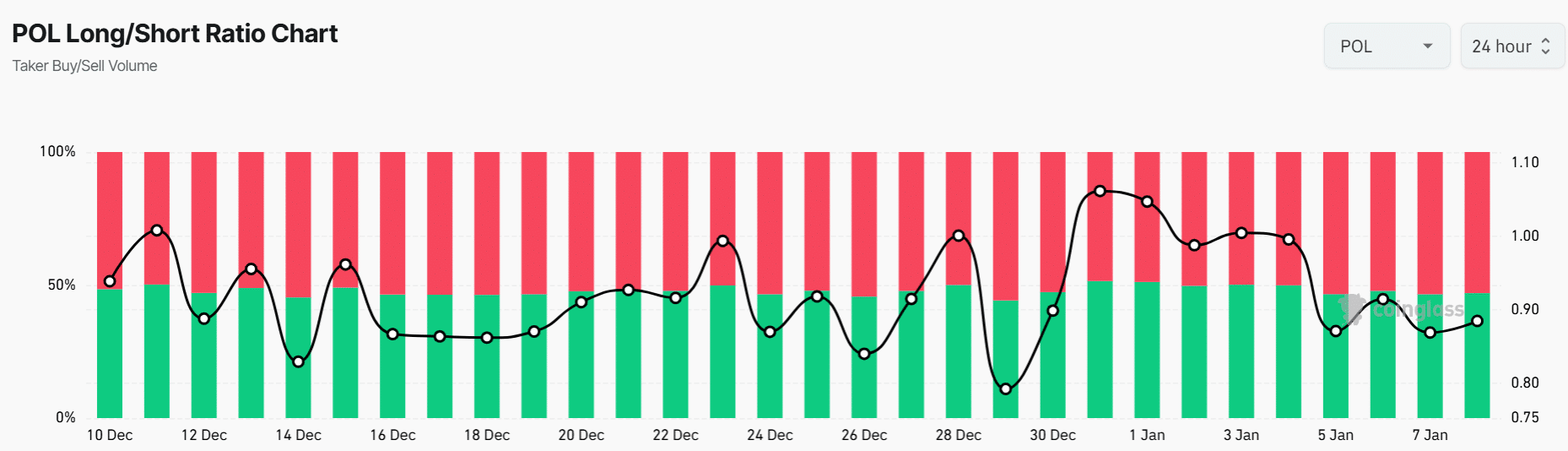

The Long/Short ratio shows bearish momentum

Polygon’s Long/Short Ratio showed momentum was bearish at the time of writing, having fallen to 0.885. This decline indicated that the number of short positions was slightly greater than the number of long positions.

Source: Coinglass

Short traders tend to increase their bets when momentum is bearish. However, an influx of short positions could increase the risk of a short squeeze, which could result in forced buying activity.