- Polygon leads in terms of inscription activity on EVM chains.

- MATIC has seen an increase in demand for new products in recent days.

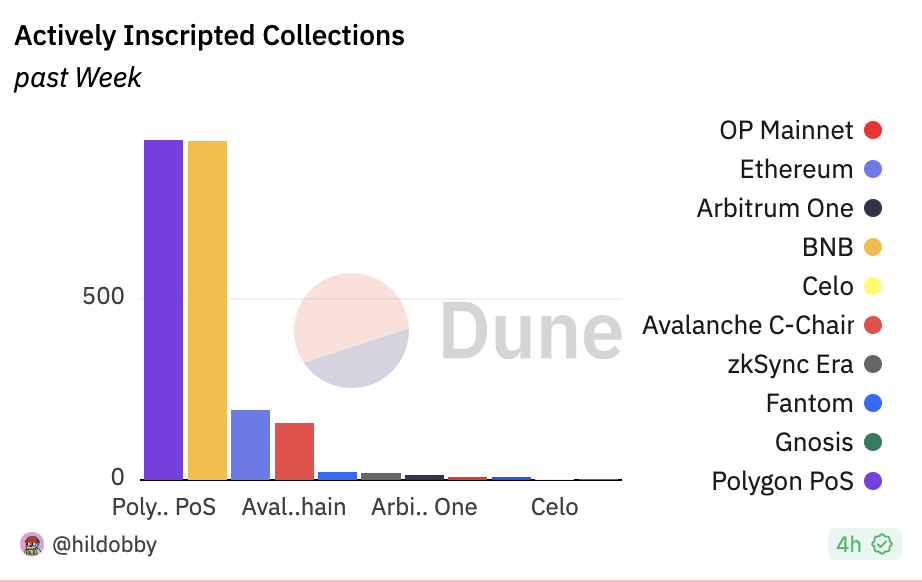

Polygon [MATIC] has become the leader in inscription activity on Ethereum Virtual Machine (EVM) chains, data from a Dune Analytics dashboard showed.

The Polygon-based non-fungible token (NFT) collection POLS, which launched on the network in November, works similarly to Bitcoin Ordinals, which has seen increased activity in recent days.

The Dune Analytics dashboard tracks enrollment-related activities on EVM-compatible chains such as Polygon, BNB Chain [BNB]Ethereum [ETH]Avalanche C Necklace [AVAX]Phantom [FTM]zkSync, Arbitrum [ARB]Optimism [OP]Basic, Celo and Gnosis.

Of all these chains, Polygon has the highest number of actively subscribed collections over the past week, a total of 938. The Layer 2 (L2) network is closely followed by the BNB Chain, which has seen 936 enrolled collections over the past seven days.

Furthermore, Polygon has seen the highest number of inscription-related activities during the same period. The L2 is responsible for 66.46% of all activity related to inscriptions on EVM chains in the past week.

The Polygon network has the highest number of subscriptions among EVM chains, with more than 109 million subscriptions from over 133,000 users. By comparison, Fantom is in second place, with 26 million registrations from 29,000 users.

As expected, increased demand for POLS over the past week has resulted in Polygon experiencing the highest amount of gas costs spent on inscriptions among EVM chains.

According to data from the Dune Analytics dashboard, the chain is responsible for more than 25% of all gas costs spent on EVM chain sign-ups over the past seven days.

MATIC on the daily chart

After a brief period of decline, MATIC’s Chaikin Money Flow (CMF) regained its place above the zero line.

The indicator tracks the buying and selling pressure of a specific asset over a period of time. When it rises above the zero line and returns a positive value, it means more money is flowing into the asset than is flowing out.

Is your portfolio green? look at the MATIC profit calculator

On the other hand, a negative CMF value indicates that more money is flowing out of the asset than in. This indicates selling pressure and a possible downtrend.

At the time of writing, MATIC’s CMF was on an upward trend, reaching a value of 0.08. This meant an influx of funds as new demand for the altcoin began to gain momentum.