- Dot, at the time of the press, was the testing of key resistance levels, which underlined the potential for bullish movement

- Rising social volume and liquidations pointed to larger market interests and volatility

Polkadot [DOT] Has attracted the attention of investors, because its inflation continued to fall to 7.78%. This reduction came on the back of a decision driven by the community aimed at creating a more sustainable Tokenomics model for the future.

At the time of the press, DOT was traded at $ 5.12 after an increase of 5.53% in the last 24 hours. That is why the price action of the crypto has asked a lot – is now the right time to invest in Polkadot?

Dot on the move – Is this the start of a bullish run?

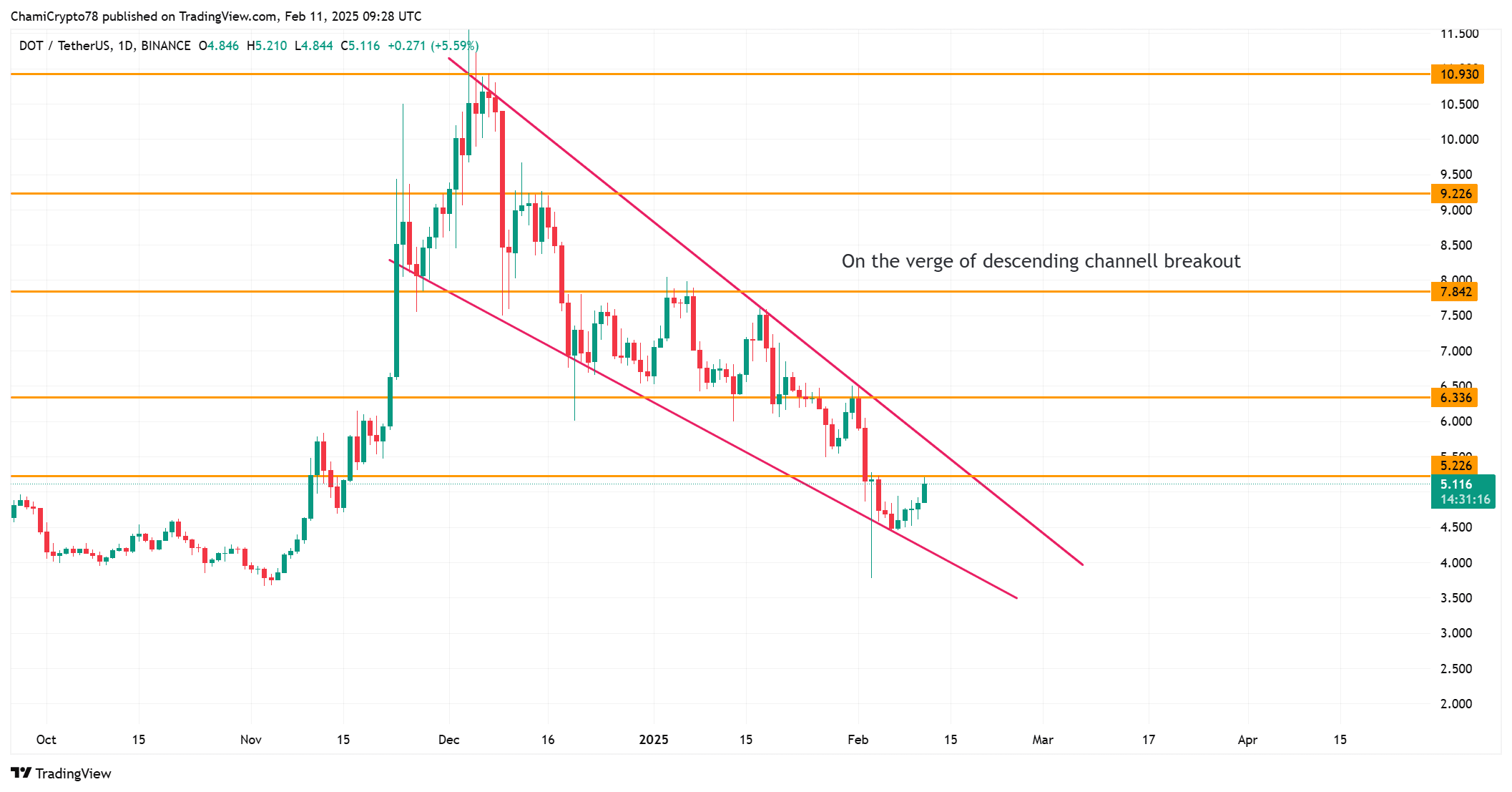

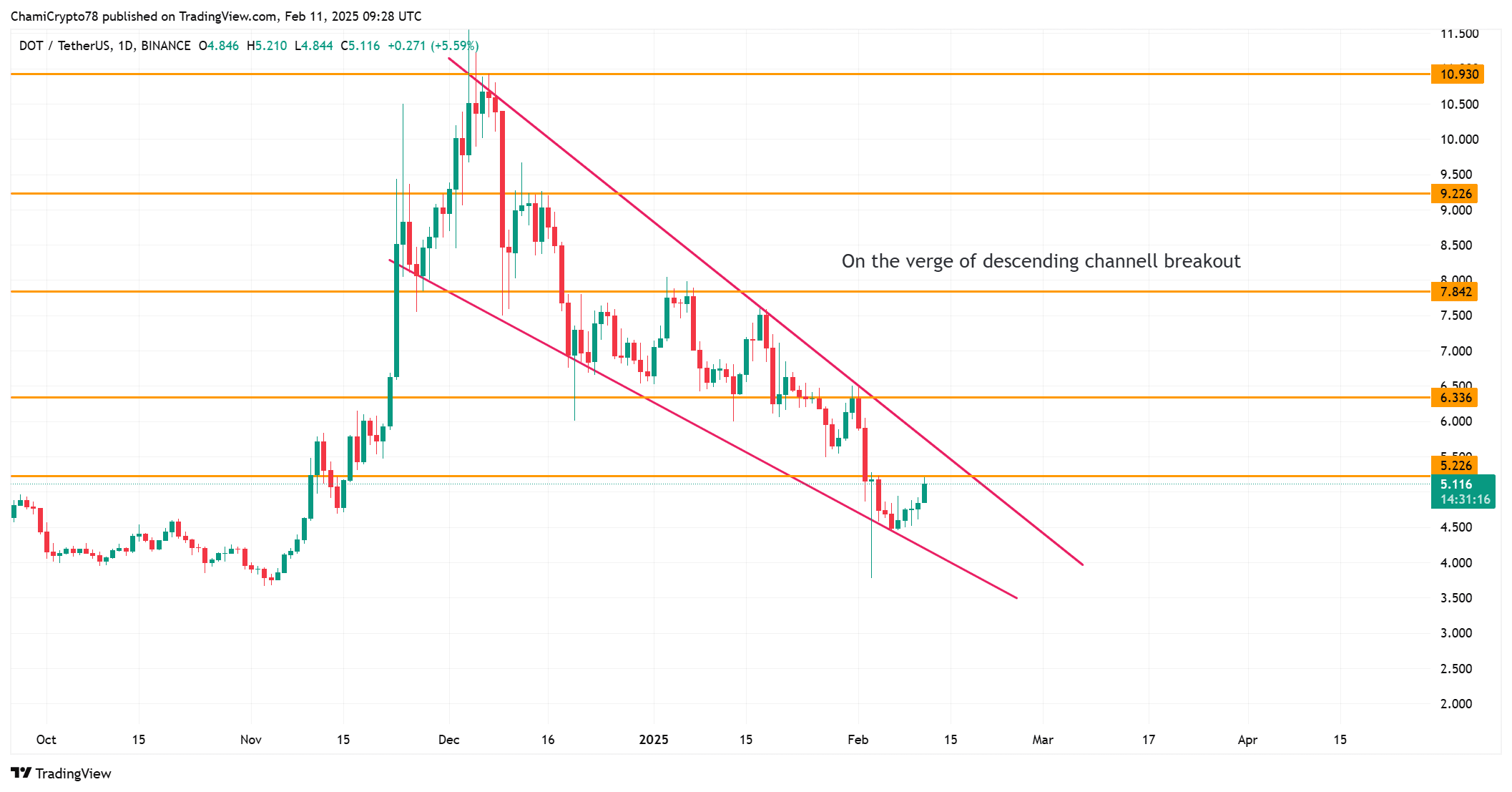

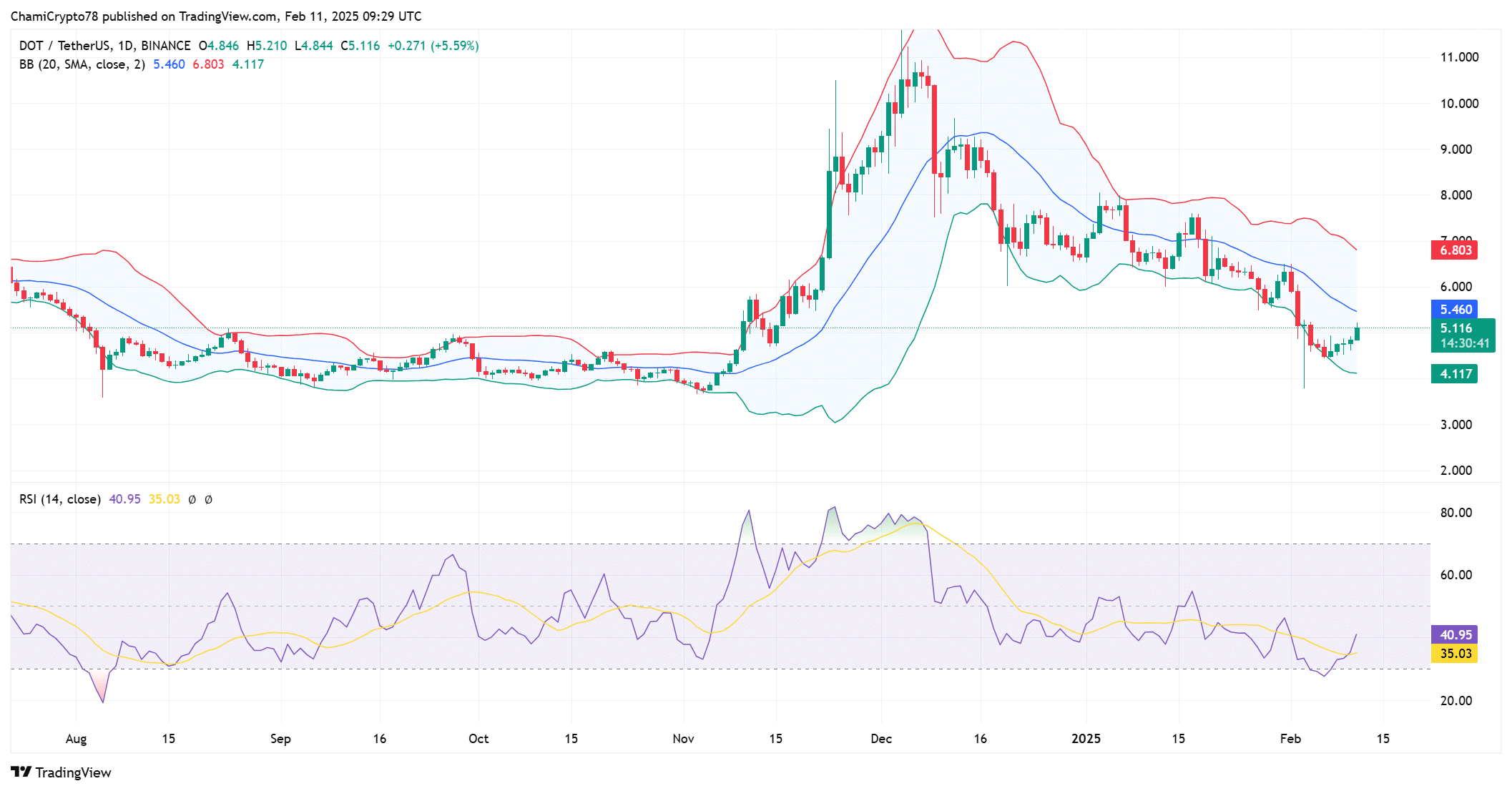

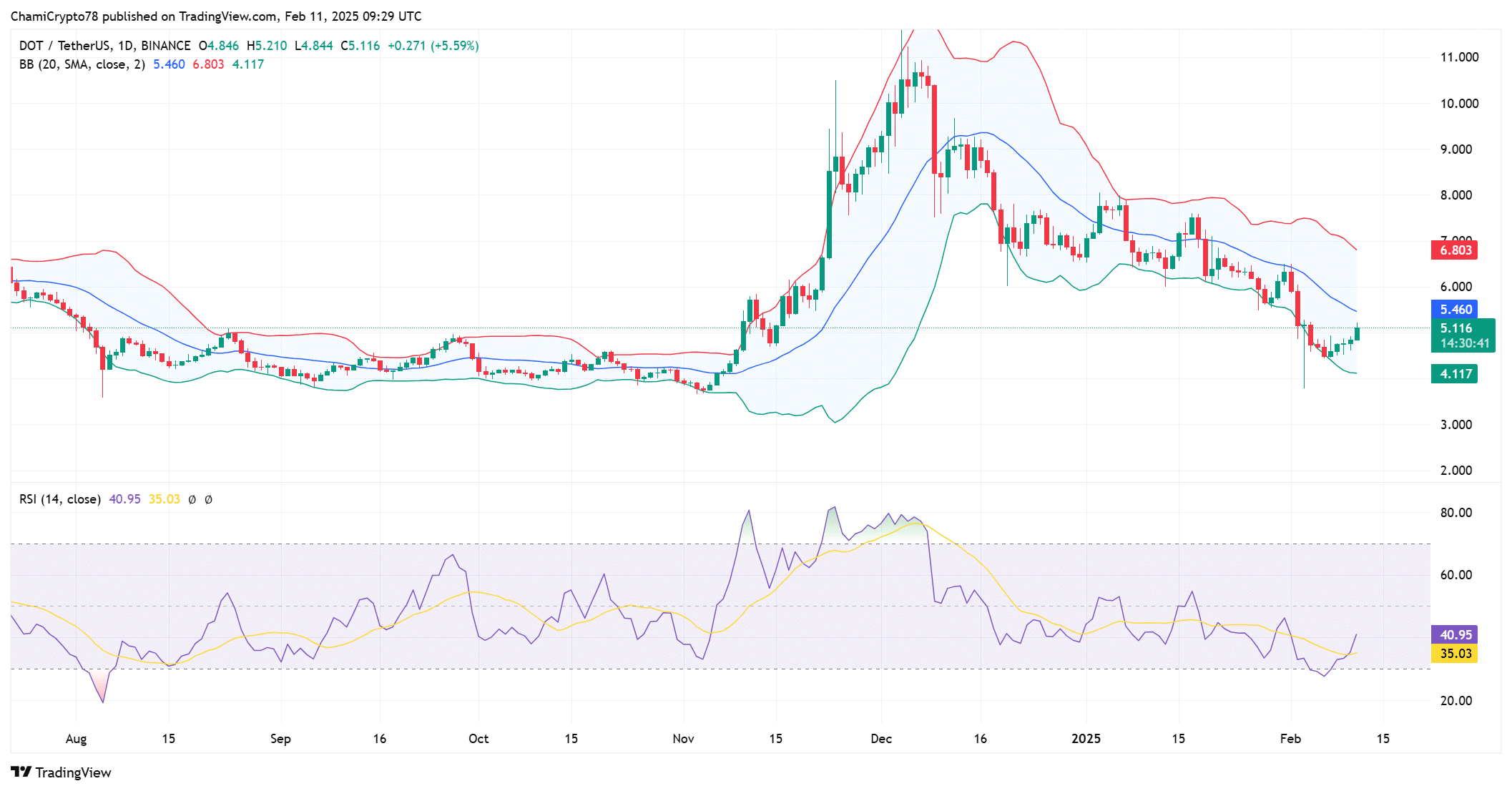

Polkadot registered an increase of 5.53%and pushed the price closer to the most important resistance levels near $ 5.20. A successful breakthrough above this level could open the door for further price action to $ 5.50.

However, if the price is struggling to overcome resistance, a withdrawal to support zones for $ 4.90 or $ 4.50 could occur. Traders must be careful with an outbreak or a retracement, because this will dictate the next potential movement for DOT.

Looking ahead, the price forecast for Polkadot remains optimistic, especially if the current bullish momentum applies. If Dot successfully breaks above $ 5.20 and remains above the most important support levels, we can see the higher levels test, making it possible $ 5.50 or further.

However, an absence to break resistance can cause a retracement to lower support levels, such as $ 4.90 or $ 4.50.

Source: TradingView

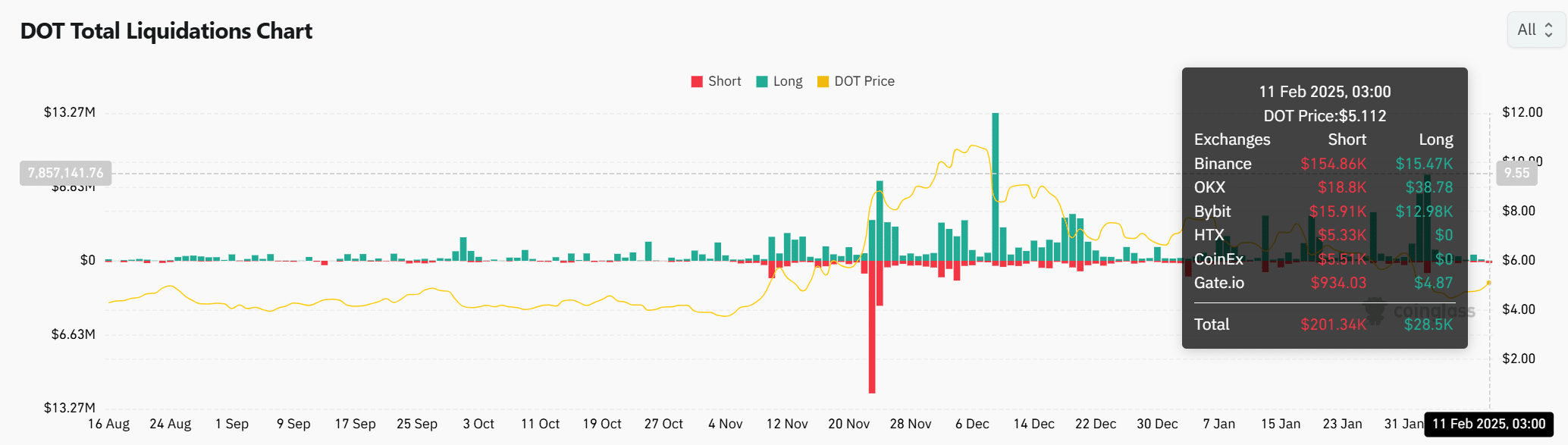

Liquidations Surge – What does it mean for the market?

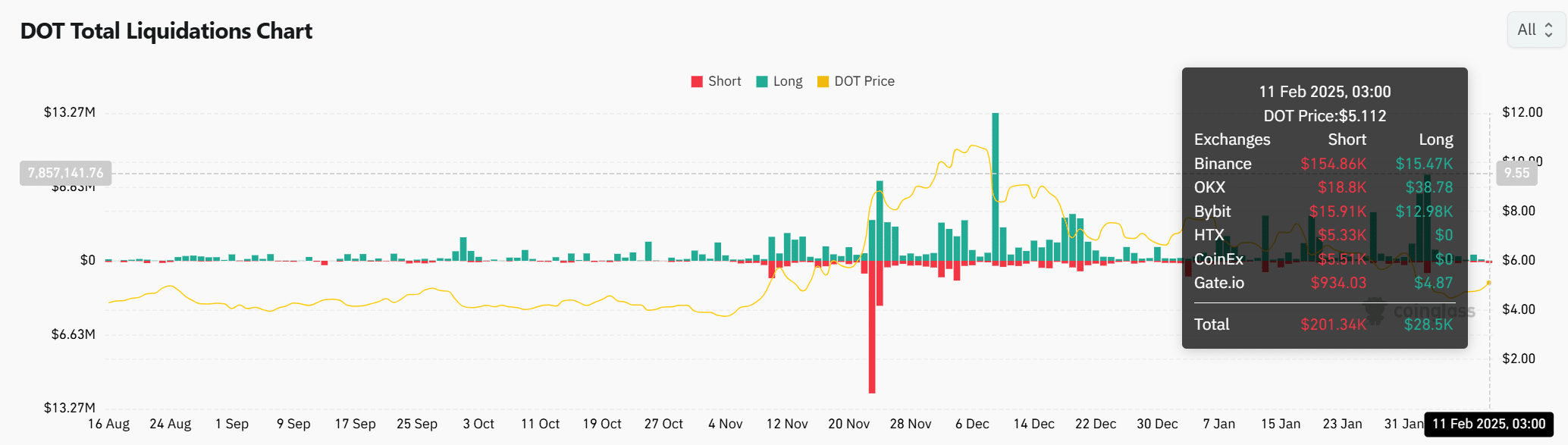

Polkadot has recently seen an increase in the total liquidations, so that volatility in the market indicates increased volatility. Large liquidation volumes are a sign that traders respond quickly to price movements.

Although high liquidations indicate the market participation, they also point to the potential for fast market corrections. Investors must be careful because sudden price movements can create both risks and opportunities for people who enter or leave positions.

Source: Coinglass

Will the technical indicators indicate an outbreak?

The relative strength index (RSI) for DOT had a lecture of 40.95, indicating that the market may approach neutral territory. A movement above the 50-mark can indicate a high purchasing pressure and lead to an outbreak.

In the meantime, the Bollinger tires have been cited, which suggests that Dot could be on the edge of a considerable price movement.

If the price breaks above the upper Bollinger band, a walk can push a dot to higher levels when buying activity. On the contrary, a drop below the lower tire could indicate a period of consolidation or withdrawal.

Source: TradingView

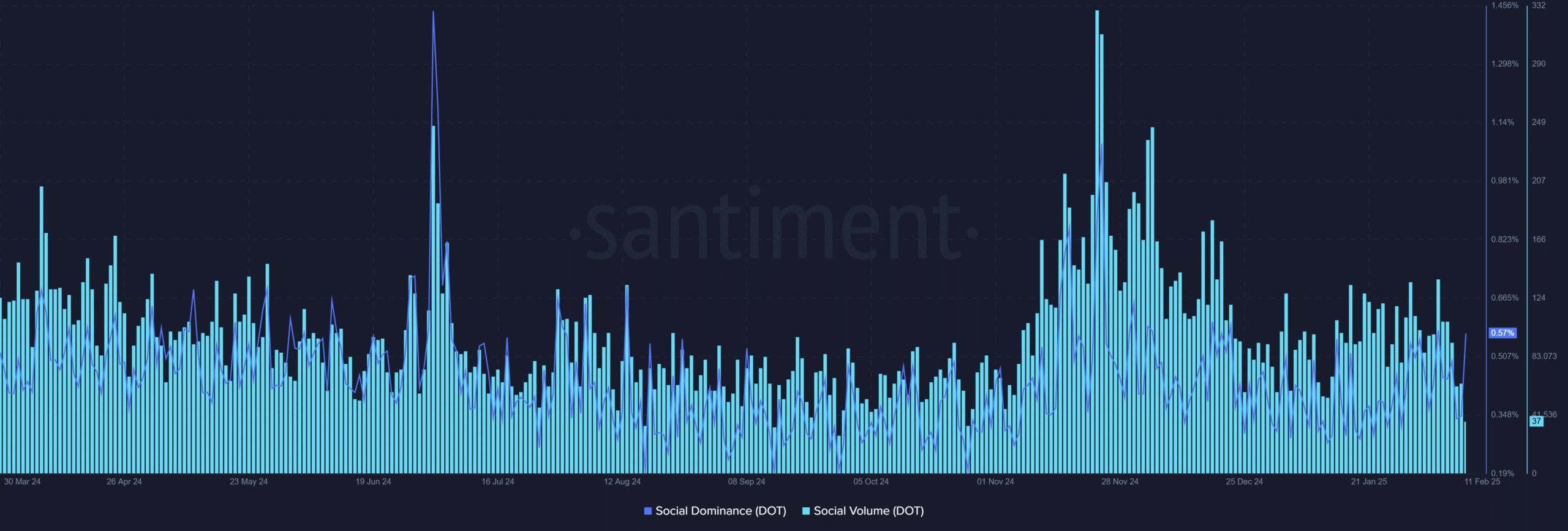

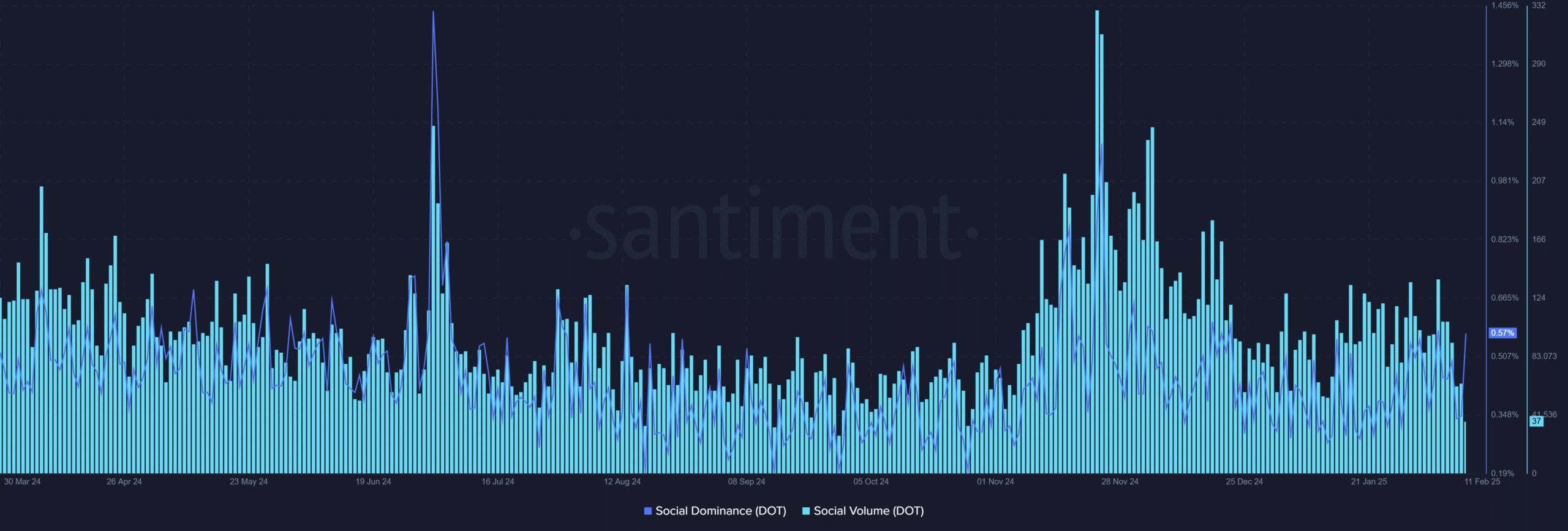

Social Volume Skyrockets – What does it mean for DOT?

The social volume and social dominance of Polkadot have also increased steadily, which reflects the growing interest and involvement within the crypto community. As the social volume increases, this often translates into a higher market consciousness and it can stimulate more demand for actively.

Rising social dominance further suggested that Polkadot has won a grip at investors, making it an attractive active in the current market. Such an increase in social activity can add fuel to the fire, so that the price of DOT is propelled higher.

Source: Santiment

Is the right time to buy now?

With the price action of Polkadot that shows promise, a falling inflation percentage and growing social interest, this can be the right time to consider buying.

Read polkadot [DOT] Price forecast 2024-2025

If DOT breaks the key resistance levels and continues its bullish momentum, it can see further price increases to $ 5.50 or more. However, the volatility remains a factor and careful monitoring is needed.