Polkadot, the computing platform known for its interoperability and scalability, has shown remarkable growth across key metrics in the second half of 2023, as outlined in a recent report. report by Messari.

Outpacing the Growth of the Crypto Market

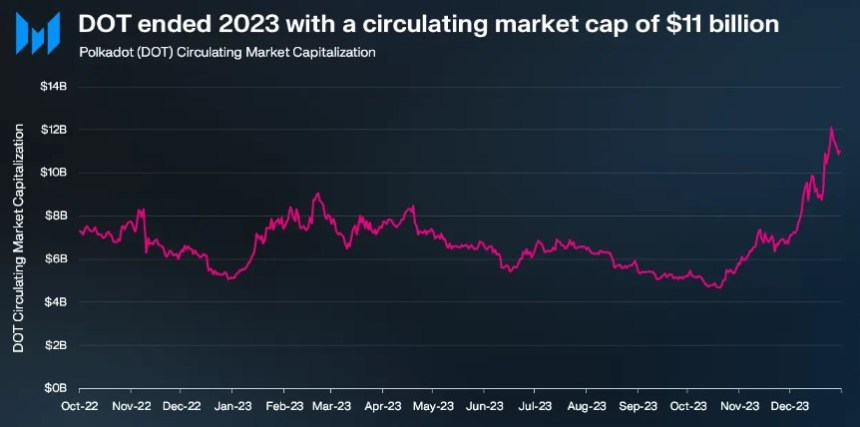

According to Messari’s findings, Polkadot’s circulating market capitalization saw a remarkable growth of 111% quarter-over-quarter (QoQ), reaching an impressive $8.38 billion.

This growth exceeded the overall crypto market growth of 54% during the same period. Furthermore, Polkadot’s year-over-year (year-over-year) change was 94%, solidifying its position at the top of the market. 15 crypto projects by market capitalization.

In terms of revenue, Polkadot witnessed a substantial 2,880% quarter-over-quarter increase, generating $2.8 million in Q4 2023. This increase was primarily attributed to the significant increase in extrinsic revenue, driven by the introduction of Polkadot Inscriptions.

Messari suggests that even excluding Inscriptions’ four-day peak, Polkadot’s revenue would have doubled from the previous quarter. It is worth noting that Polkadot’s revenues tend to be relatively lower compared to its competitors due to the structural design of its network.

Polkadot is witnessing a significant increase in active addresses

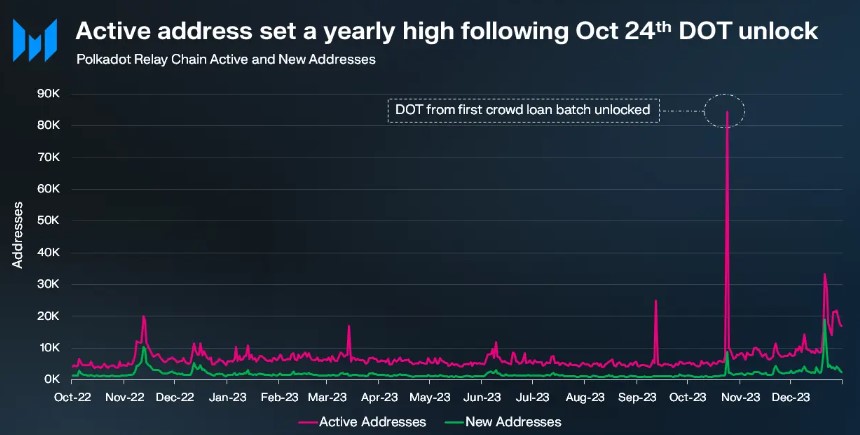

Following the launch of OpenGov – the governance module and framework within the network – in June, the Polkadot Relay Chain experienced a sharp increase in account activity, largely due to increased participation in governance.

Because the Relay Chain is critical in facilitating governance processes, it experienced a spike in numbers active addresses on October 24, when users claimed their locked DOT tokens from the first series of parachain auctions held two years earlier.

During the fourth quarter, the Polkadot Relay Chain averaged more than 10,000 daily active addresses, representing a significant 90% quarter-over-quarter increase. Excluding the October 24 activity related to claiming DOT tokens, the average number of active addresses still saw a significant 70% increase in QoQ, reaching 9,000.

Additionally, Cross-Chain Message (XCM) transfers on the platform increased 150% quarter-on-quarter, driving a highest ever of 133,000. The total number of active XCM channels nearly tripled in 2023, reaching 203 by the end of the year.

According to Electric Capital’s rankings, Polkadot has 800 full-time and 2,100 total developers, making it one of the largest crypto ecosystems in terms of developer participation.

DOT price shows mixed performance

Despite the notable growth in key metrics demonstrating the network’s expansion, Polkadot’s price native tokenDOT has not followed suit and, despite positive developments, has even experienced a decline over a longer period of time.

Currently, DOT is trading at $6.7420, which represents a slight price increase of 0.3% in the last twenty-four hours, coupled with a gain of 9% since the beginning of the year.

However, over the past fourteen and thirty days, the token has registered a price decline of 6% and 22%, highlighting the absence of bullish momentum and catalysts that could propel DOT to higher levels.

Although it hit a 19-month high of $9.5711 on December 26, the subsequent price drop has led DOT to a critical juncture, potentially wiping out gains over the past year.

If the current level and the nearest support at $6.3229 fail to halt further price declines, DOT could potentially fall towards the $5.4830 level, which could serve as the next one. great support in the token’s 1-day chart.

Conversely, if DOT surpasses its highest resistance at $7.0392, the next target would be to break the short-term downtrend structure, facing the resistance at $7.5332 and another resistance at $8.1631. This would pave the way for a new phase of consolidation at the highest level in 19 months.

Featured image from Shutterstock, chart from TradingView.com

Disclaimer: The article is for educational purposes only. It does not represent NewsBTC’s views on buying, selling or holding investments and of course investing involves risks. You are advised to conduct your own research before making any investment decisions. Use the information on this website entirely at your own risk.