- Polkadot’s breakout from a falling wedge pattern signals a bullish reversal targeting $6.5.

- Strong technical indicators and a rising social rate support DOT’s upward momentum.

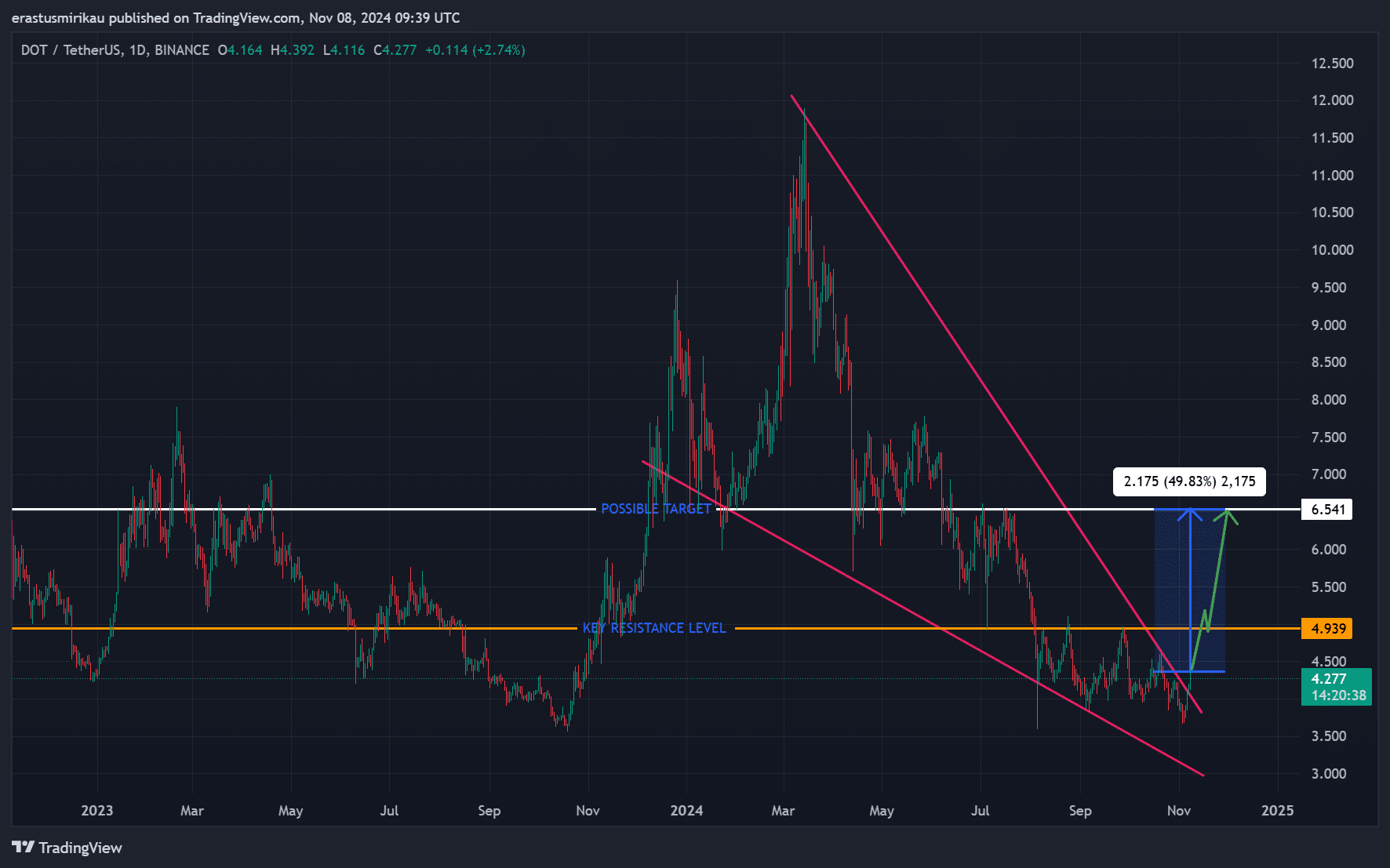

Polka dot [DOT] has recently broken out of a long-standing falling wedge pattern, indicating a bullish reversal after a long-term downtrend. As a result, optimism is growing around the potential for a strong rally, with key resistance levels and an ambitious price target in sight.

DOT is trading at $4.28 at the time of writing, reflecting a 4.98% increase over the past day. Furthermore, its market capitalization has risen to $6.49 billion, indicating growing investor interest, while 24-hour trading volume has increased by 7% to $245.96 million.

This increase in volume and price suggests that the breakout is gaining attention and could potentially give Polkadot a significant upside if it remains above critical levels.

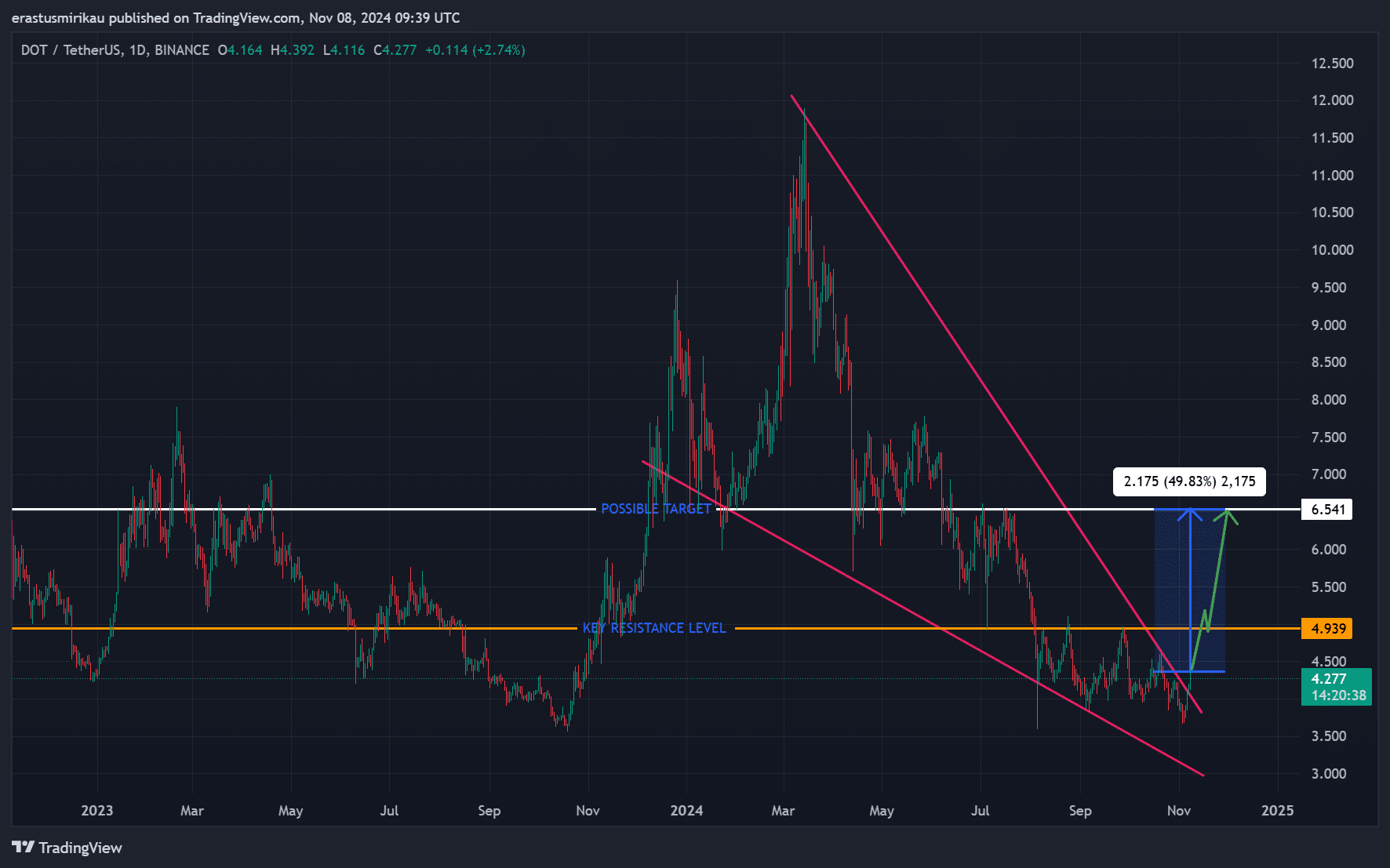

Chart Analysis: Key Resistance and Possible Target for DOT

Breaking the descending wedge pattern, DOT has risen past a long-held descending trendline, which has acted as resistance since early 2024. However, the crucial resistance level is just above the current trading price, around $4,939.

Should DOT reach this level, it could set its sights on the possible target of $6,541, which represents a potential gain of 49.83% from the breakout point.

Therefore, if Polkadot maintains its current upward momentum and establishes support above $4,939, the potential to reach $6.5 becomes more plausible.

Source: TradingView

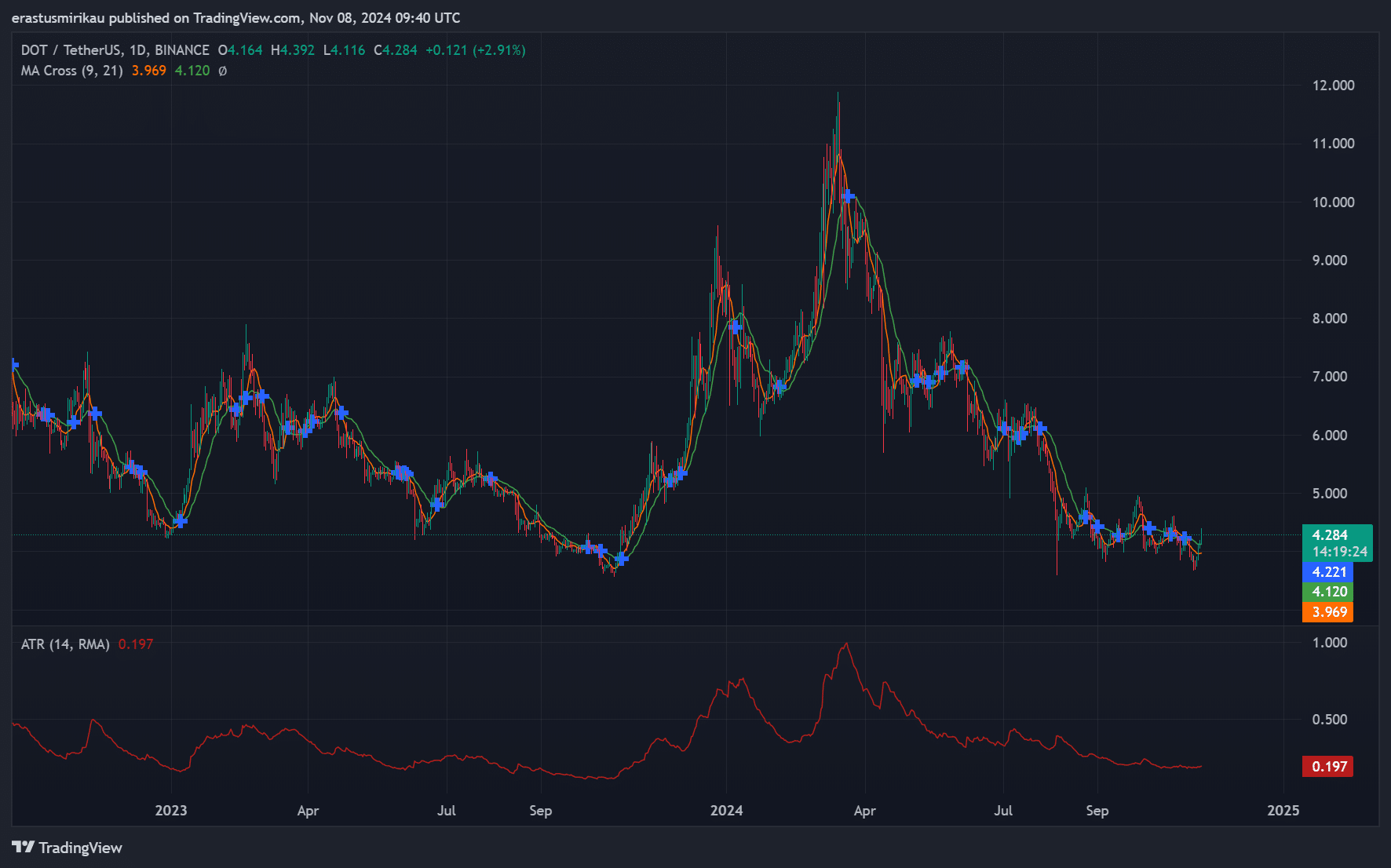

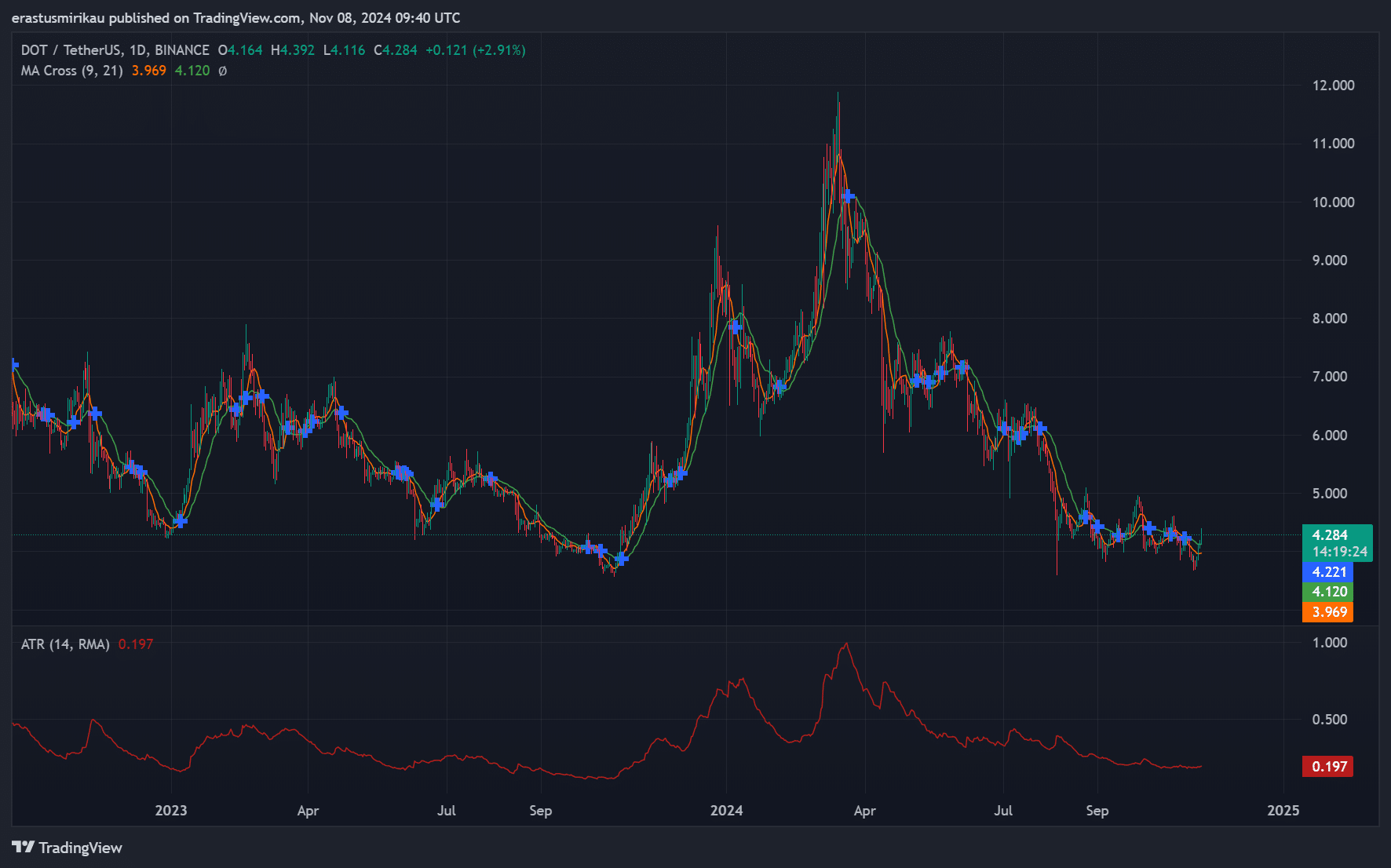

Technical indicators: Moving averages and low volatility favor bulls

DOT’s daily chart recently showed a bullish moving average (MA) crossing between the 9-day and 21-day MAs, usually a reliable signal of an uptrend.

This MA cross therefore matches the breakout pattern and strengthens the bullish outlook for DOT. Such a crossing often attracts further buying interest, further fueling the recent rally.

The current Average True Range (ATR) for DOT is 0.197, indicating low volatility. Historically, low ATR values often precede large price swings.

This compression in volatility therefore suggests that Polkadot could be preparing for a more substantial move if it maintains its recent momentum.

Source: TradingView

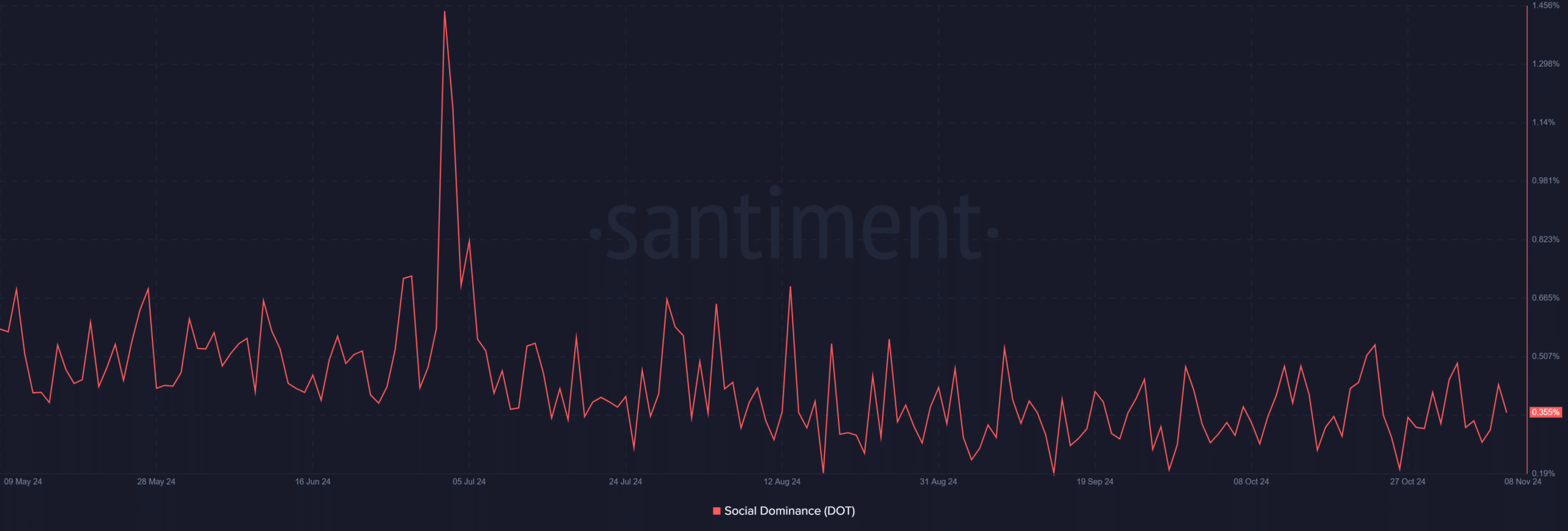

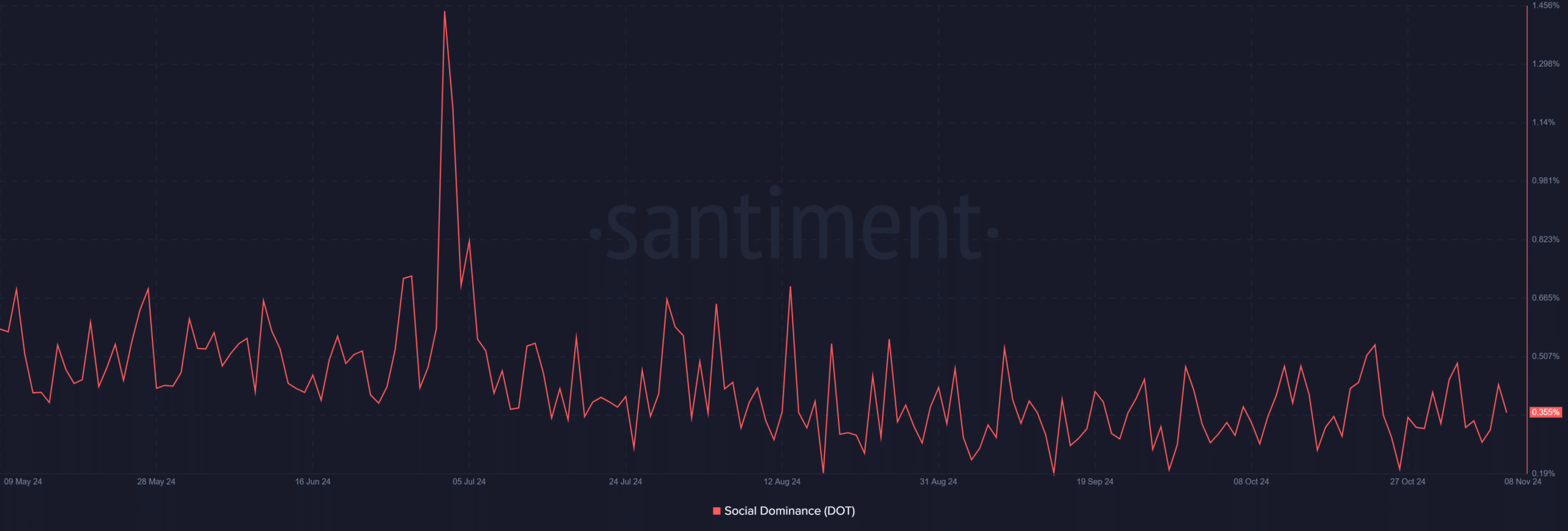

Social dominance: increasing interest in Polkadot

Polkadot’s social dominance, currently 0.355%, has shown recent spikes, indicating growing interest within the crypto community. Consequently, greater social engagement often comes with greater purchasing pressure, supporting further gains.

Source: Santiment

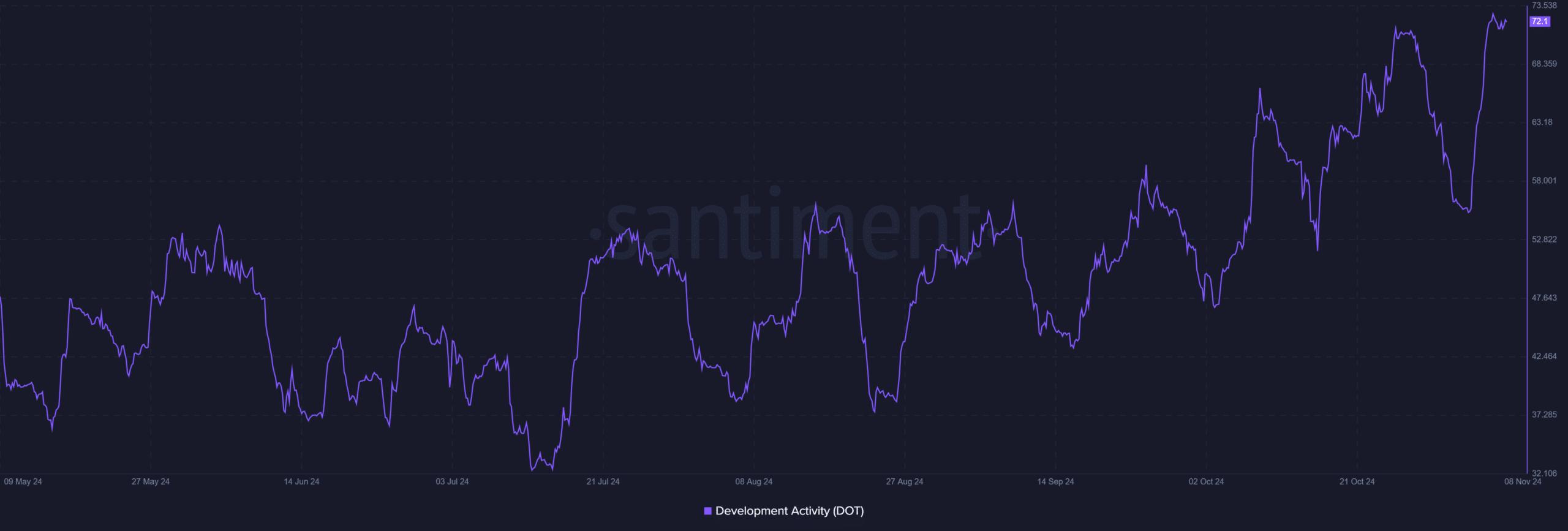

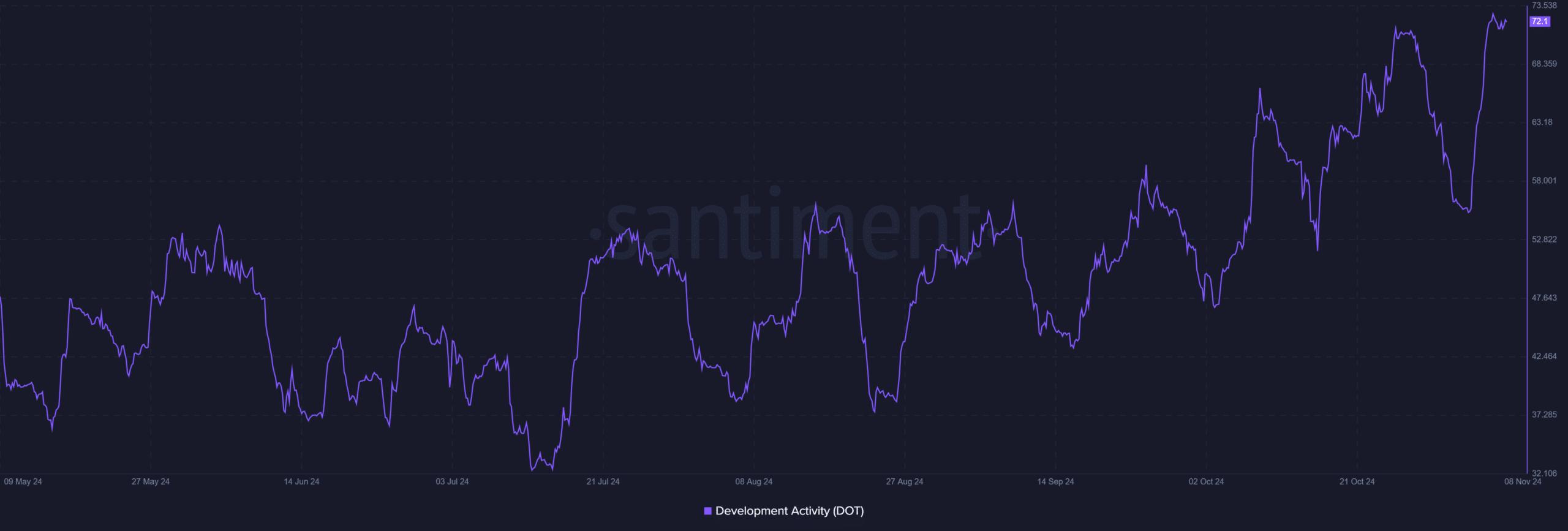

Polkadot’s development activity score was 72.10, a healthy metric indicating active development on the platform. High development activity often reflects the team’s strong commitment to long-term growth, which can in turn boost investor confidence.

Therefore, continued development activities provide a solid foundation for Polkadot’s continued bullish story.

Source: Santiment

Read Polkadot [DOT] Price forecast 2024-2025

Could DOT reach $6.5 soon?

The breakout of the falling wedge, supportive technical indicators and increasing social and development activities all point to promising prospects for DOT.

If DOT is able to establish support above $4,939, a rally to the $6.5 target seems feasible. The coming weeks could therefore be crucial in determining whether DOT can reach this bullish milestone.