- Peter Schiff criticized MicroStrategy’s shares despite them hitting an all-time high.

- The market value of MicroStrategy’s Bitcoin portfolio rose to over $40 billion, despite the volatility.

Peter Schiff, a leading crypto critic, has refocused on Michael Saylor’s company, MicroStrategy.

In a recent post, Schiff issued a stark warning about shares of MicroStrategy (MSTR), which recently hit an all-time high following the company’s ambitious plan to turn it into a trillion-dollar Bitcoin. [BTC] bank.

This marks another example of Schiff’s continued skepticism toward companies deeply invested in cryptocurrency, especially BTC.

On October 22, he posted on X (formerly Twitter):

“$MSTR has to be the most overvalued stock in the MSCI World Index. When it finally crashes, it will be a real bloodbath!”

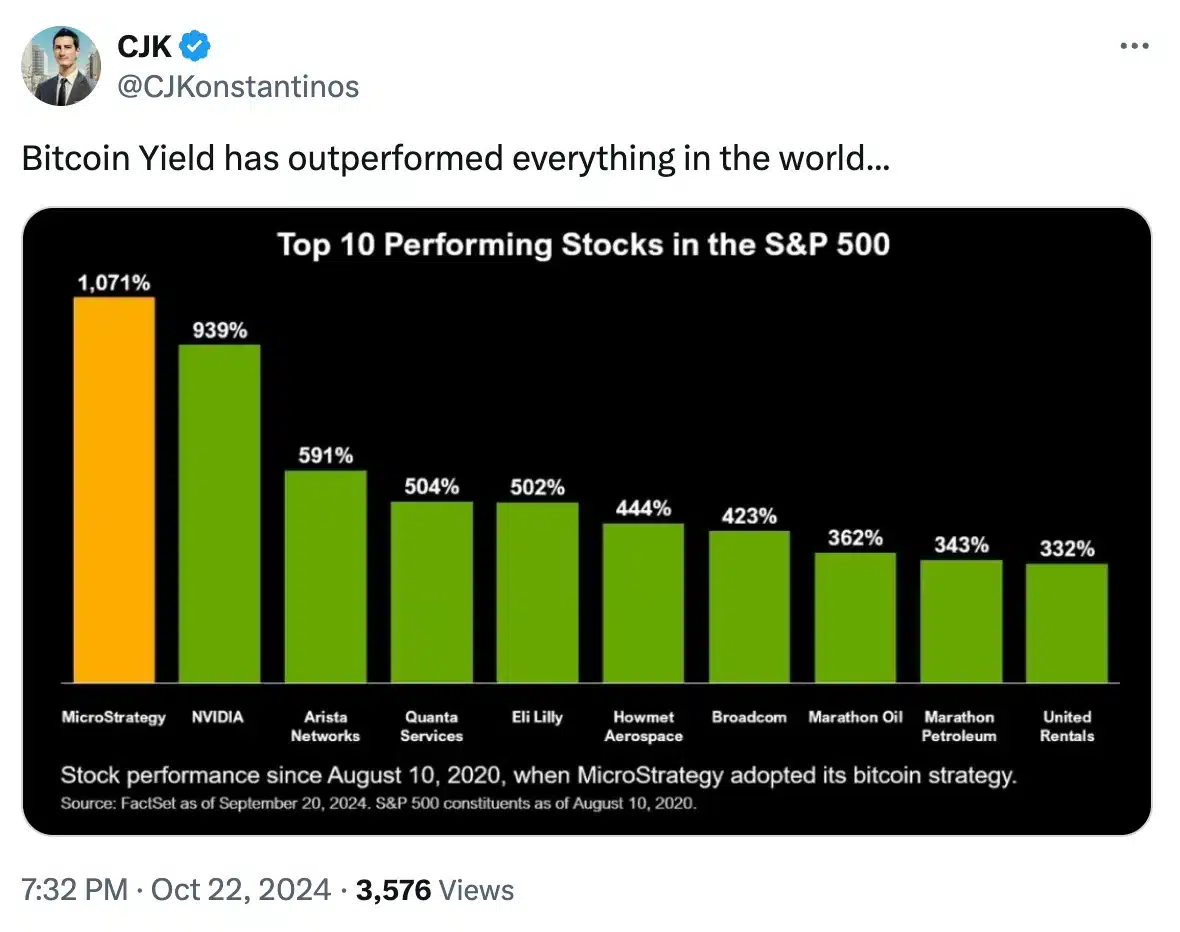

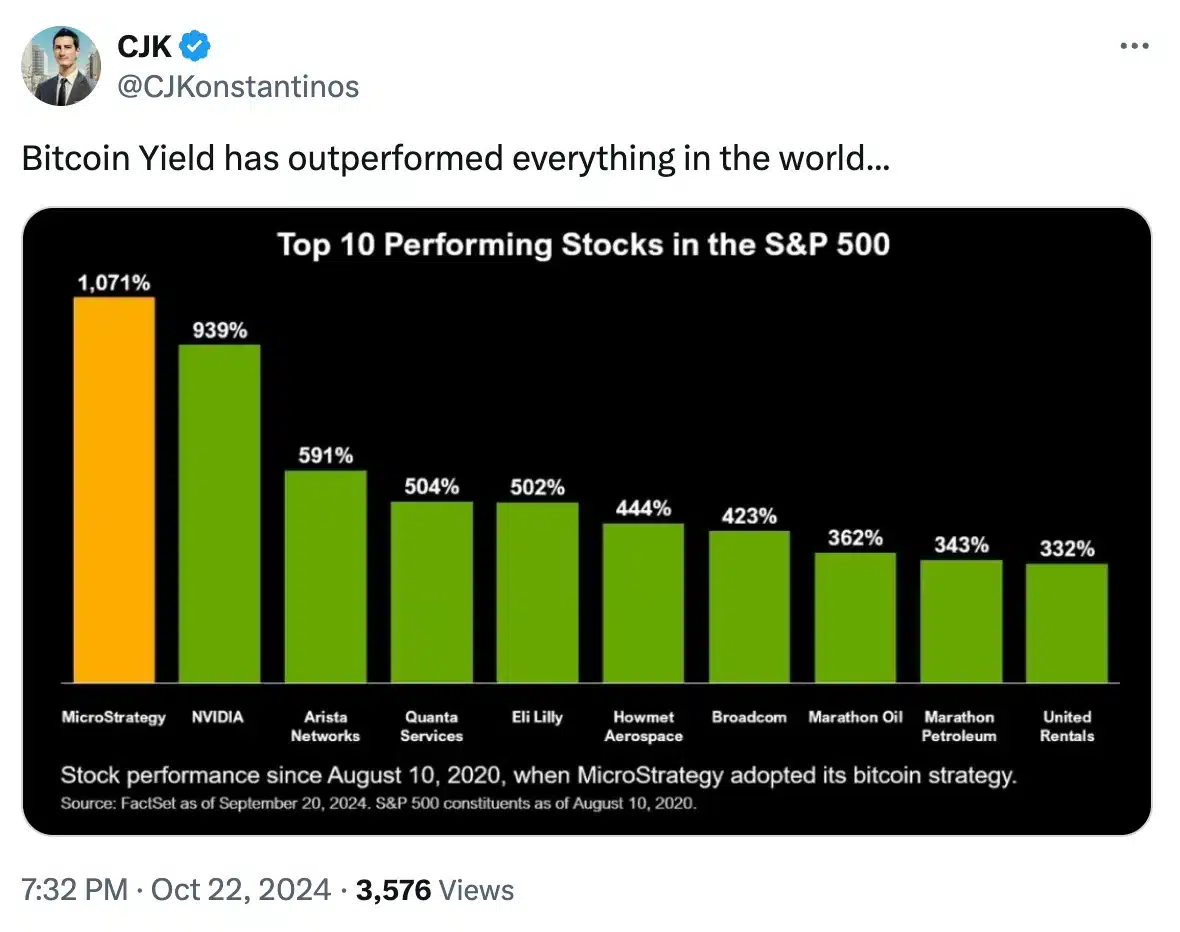

However, the warning was largely taken with a grain of salt, as highlighted by CJ Konstantinos in his recent post in which hhe said,

Source: CJK/X

However, Schiff continued his argument, reaffirming his points and claiming:

“Bitcoin does not generate returns. You can sell it to generate capital gains, you can write calls against it to generate income, but Bitcoin itself has no returns. Even worse, if you own it in an ETF, you pay custody fees.”

Why is Schiff against Bitcoin?

Schiff, a longtime proponent of gold and outspoken opponent of cryptocurrencies, has consistently expressed his skepticism toward Bitcoin.

He has often argued that BTC is a speculative asset that lacks the intrinsic value found in traditional investments such as gold.

This has made him a prominent figure in the ongoing debate between Bitcoin proponents and those who believe in traditional finance.

On the other hand, MicroStrategy’s strategic pivot towards BTC has proven to be very lucrative.

Over the past four years, the company has seen its market value increase from $1.5 billion to more than $40 billion. This growth is largely attributed to Michael Saylor’s bold decision to invest heavily in Bitcoin.

This move has positioned MicroStrategy as a major Bitcoin player, controlling 252,220 BTC.

Schiff makes a joke at Saylor

During a recent discussion about the BTC stolen from the Silk Road market, Peter Schiff humorously took aim at Michael Saylor.

Schiff joked that Saylor should consider borrowing $4.3 billion worth of Bitcoin from the government to further strengthen MicroStrategy’s already massive BTC holdings.

This sarcastic comment highlights Schiff’s ongoing criticism of Saylor’s aggressive Bitcoin strategy, while subtly mocking the company’s deep commitment to growing its cryptocurrency assets.

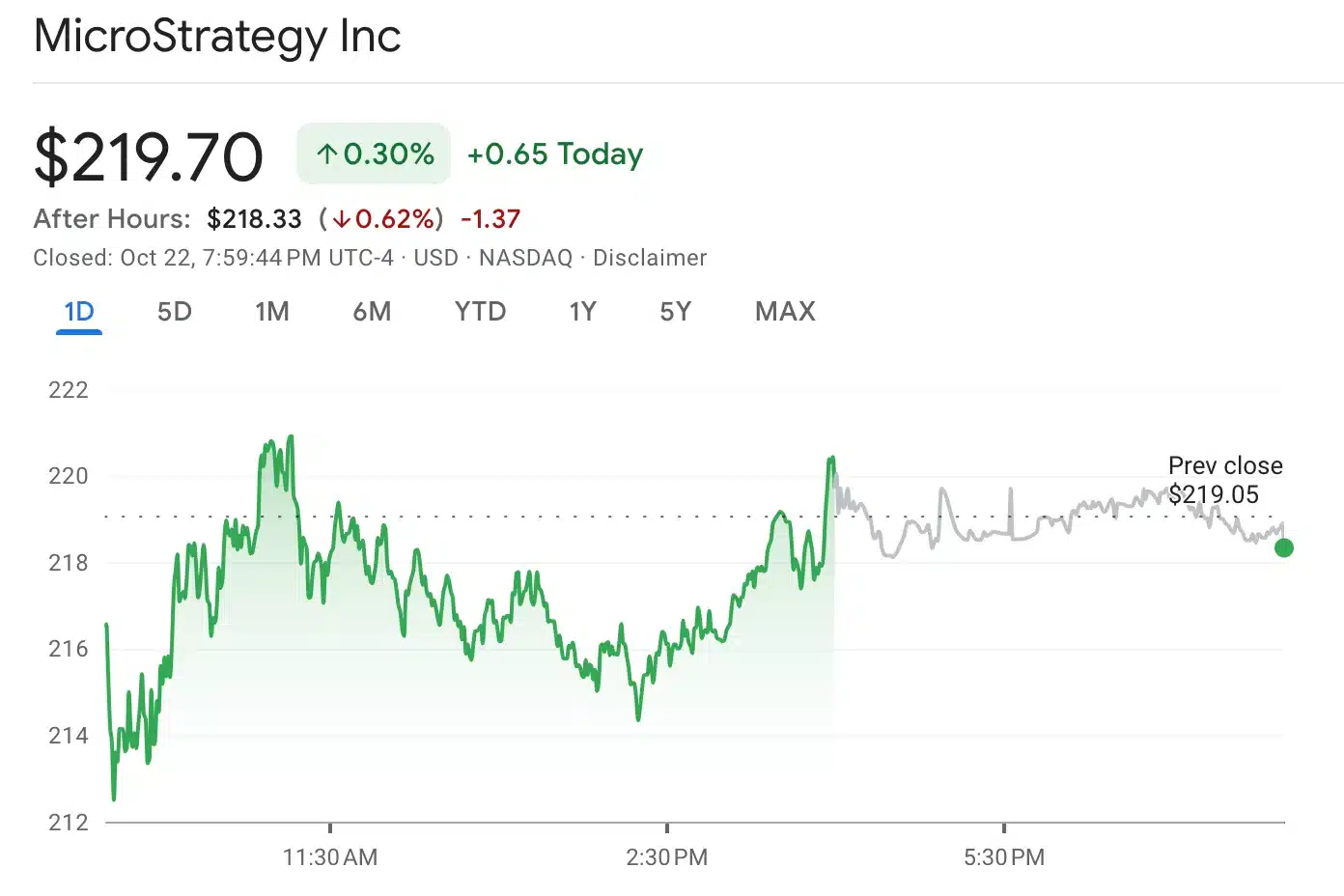

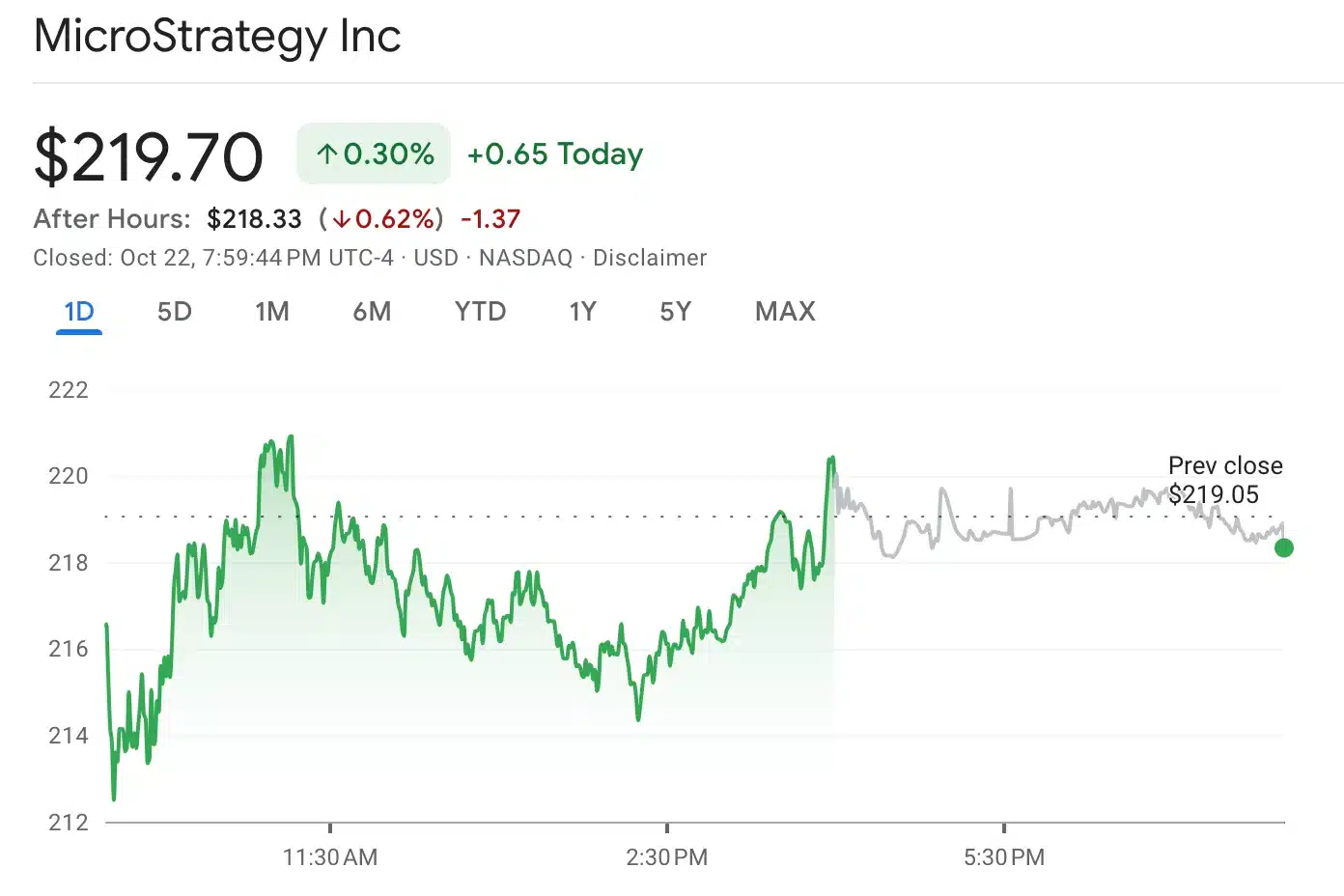

Amid such talk, MicroStrategy’s share price rose modestly by 0.30%, to $219.70. This reflects investors’ stable confidence in the company’s BTC-focused strategy.

Source: Google Finance

On the other hand, Bitcoin saw a slight decline of 0.93% over the past 24 hours, reaching $66,947.37 at the time of writing. CoinMarketCap.