- A Newly Identified Whale, ‘0x8f5’, Withdrew 280 Billion $PEPE Tokens Worth $5 Million from Binance

- Whale accumulation has historically been a bullish precursor, especially in low-cap tokens

An analysis of recent on-chain data revealed an increase in PEPE accumulation by cryptocurrency whales – a sign of renewed interest in the popular memecoin.

In fact, a newly identified whale, “0x8f5,” 280 billion PEPE tokens withdrawn worth $5 million from Binance, marking a major transaction in the token’s ecosystem. This trend indicates strategic positioning by wealthy investors, likely in anticipation of a potential rally or market event.

Historically, whale activity in meme-based tokens has often preceded price volatility, catching the attention of traders looking to profit from these moves. Although sentiment around PEPE has shifted into bullish territory recently, traders are advised to remain cautious. Especially since whale-driven accumulation can also lead to a quick sell-off once profit targets are met.

Market performance

At the time of writing, PEPE appeared to be showing resilience in a volatile crypto market, trading near the critical support level of $0.0000019. Recent increases in trading volume indicated increasing interest from both retail and institutional participants.

Whale accumulation has historically been a bullish precursor, especially in low-cap tokens, as it often reflects confidence in the asset’s potential.

Broader market factors, such as Bitcoin’s stability and the recovery of altcoins, have likely contributed to PEPE’s current performance. However, traders should remain vigilant for external economic developments or regulatory announcements that could impact market dynamics.

The main focus for PEPE traders is whether it can hold its support zone or expect further declines towards $0.0000015 on the chart.

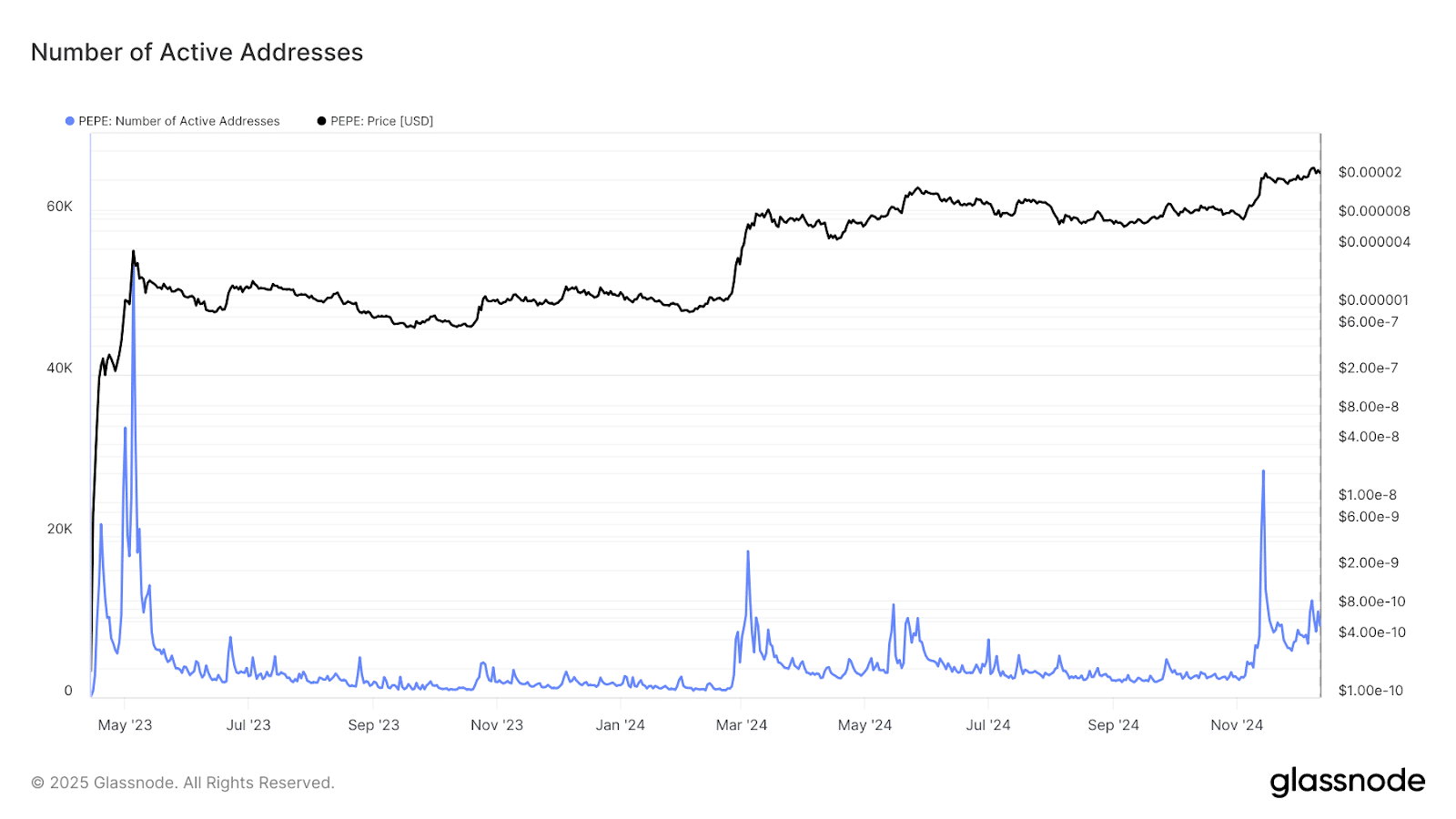

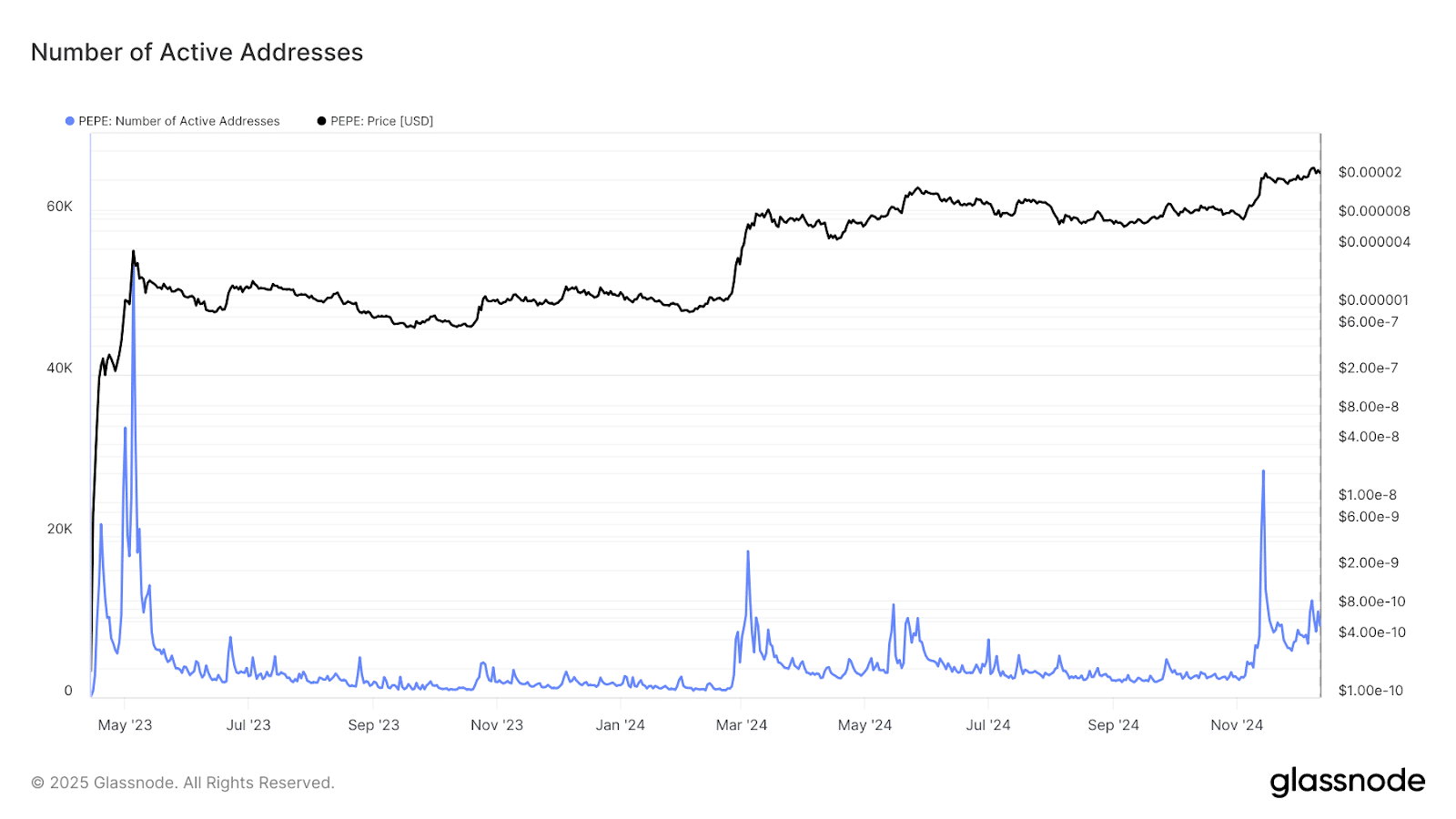

Active address analysis

Data from the chain also showed a 15% increase in active wallet addresses – a sign of increasing engagement among users. This metric often correlates with price volatility because it indicates increased participation in the market.

Source: Glassnode

A continued increase in the number of active addresses could support a bullish outlook, especially if accompanied by consistent trading volume. However, traders should remain cautious, especially as spikes in active addresses can also highlight distribution by larger holders to smaller traders.

If activity levels decline, PEPE may experience reduced liquidity, which could lead to sideways or bearish price movements on the charts.

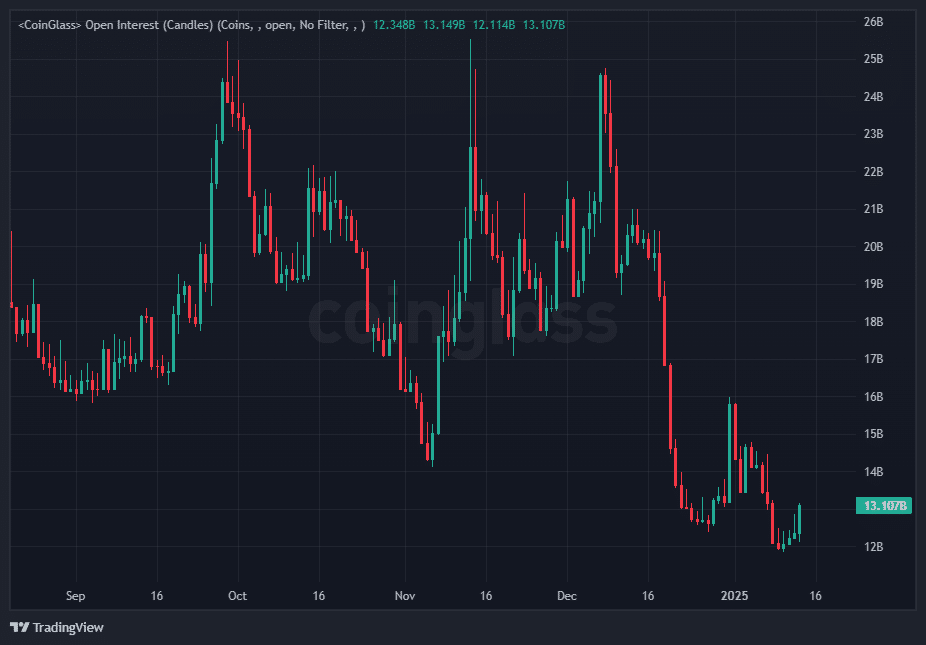

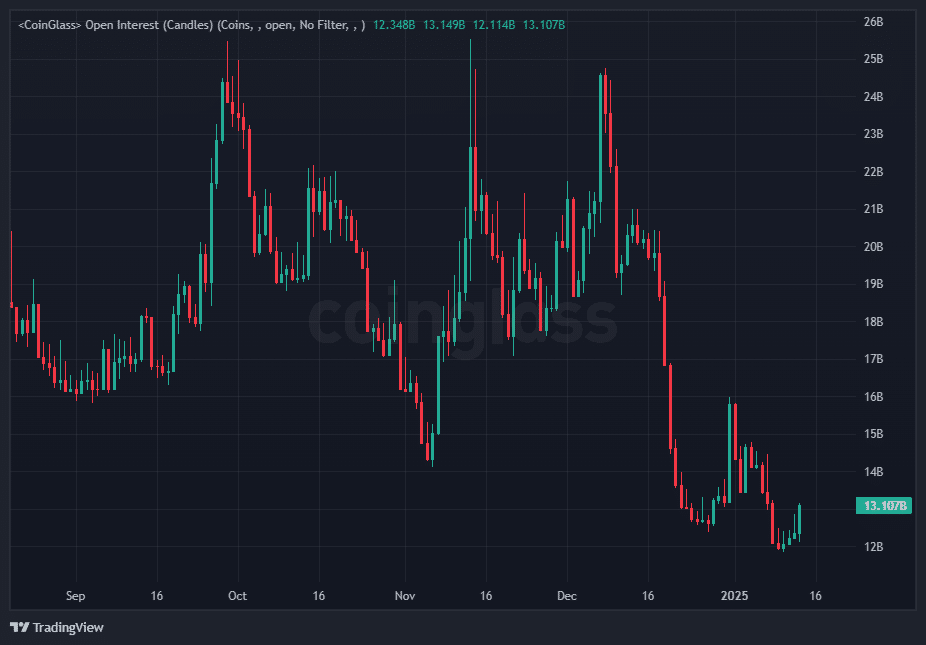

Open interest analysis

The open interest (OI) for PEPE Futures contracts has increased by 18% in the last 48 hours. This can be interpreted as a sign of an increase in speculative activity.

Source: Coinglass

At the time of writing, long positions appeared to dominate the market, accounting for 62% of total OI, highlighting the optimism among traders.

If PEPE rises above its resistance levels, the OI could continue to rise, potentially triggering a rally. Conversely, a drop below support could lead to extended liquidations, amplifying downward pressure.

Now, neutral financing rates indicate a balanced market for now, but traders should watch for shifts in these interest rates. Especially because these can indicate growing bullish or bearish sentiment

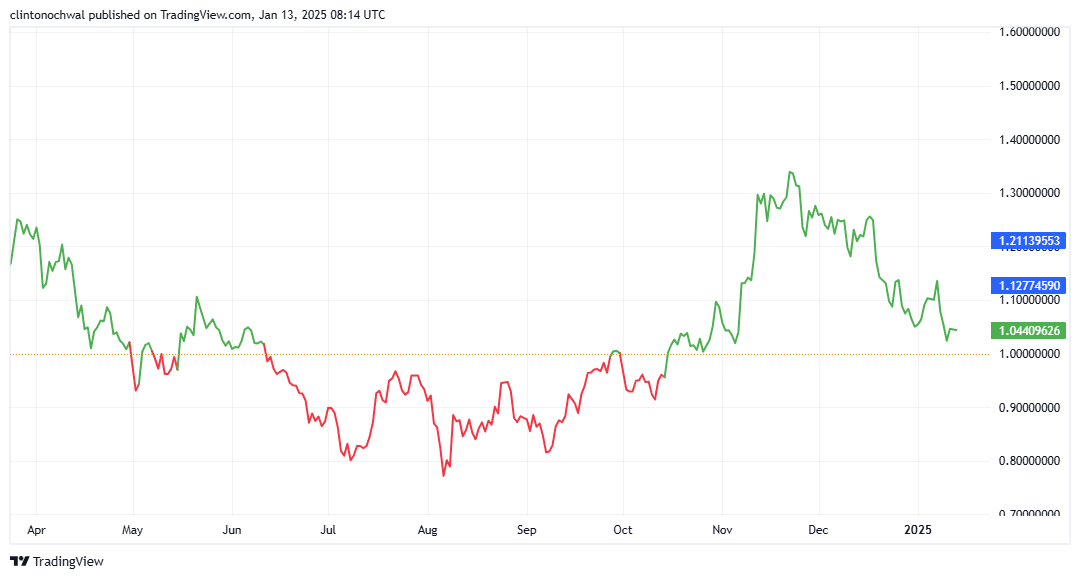

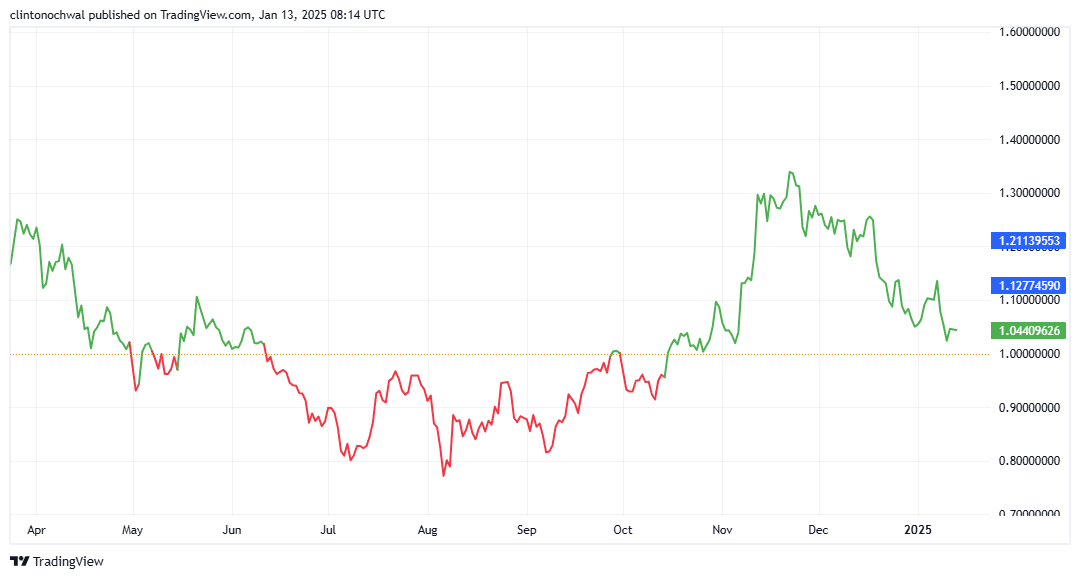

MVRV analysis

Finally, the MVRV (Market Value to Realized Value) ratio revealed an interesting difference between short- and long-term holders. At the time of writing, short-term holders were running at an average loss of -8%, while long-term holders continued to make a gain of 12%.

Source: TradingView

This difference can be seen as reduced selling pressure from weak hands, potentially paving the way for a price recovery.

If the MVRV ratio turns positive in the short term, it could indicate renewed buying interest, which could trigger a rally. However, a breakdown below key support levels could increase losses for short-term holders, leading to further market uncertainty.

Overall, PEPE’s market position is still at a critical juncture. The accumulation of whales, the increasing number of active addresses and the increasing Open Interest all pointed to increased market activity. However, the token’s ability to hold key support levels will determine its next move.

Cautious optimism remains warranted as both bullish and bearish scenarios remain applicable depending on market dynamics and broader crypto sentiment.