- Pepe has entered a new accumulation phase, where investors are steadily increasing their investments in anticipation of a big rally.

- Despite signs that a rally is coming, on-chain data shows that active addresses still need to fully commit to buying.

Over the past month, PEPE stood out among memecoins, with a gain of 30.13%. Recently, it continued its positive trajectory with an additional 3.90% increase.

The potential for further gains is significant, with forecasts suggesting PEPE could trade as high as $0.00001725, representing a potential upside of 60% from the current price.

A double bullish pattern could trigger PEPE’s rally

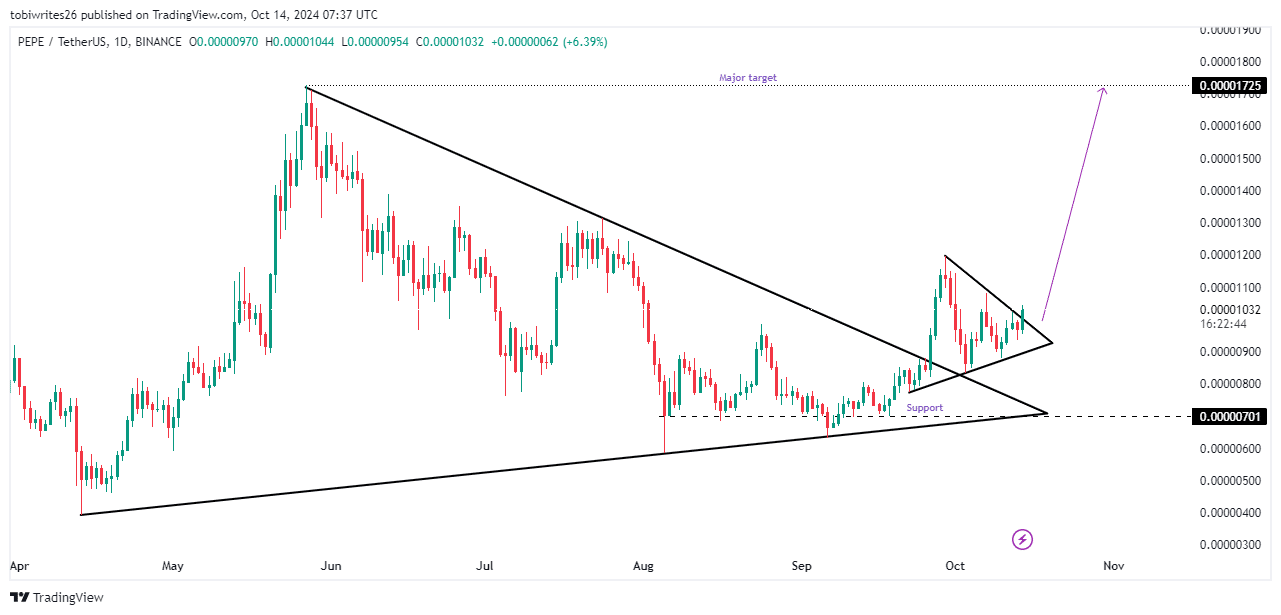

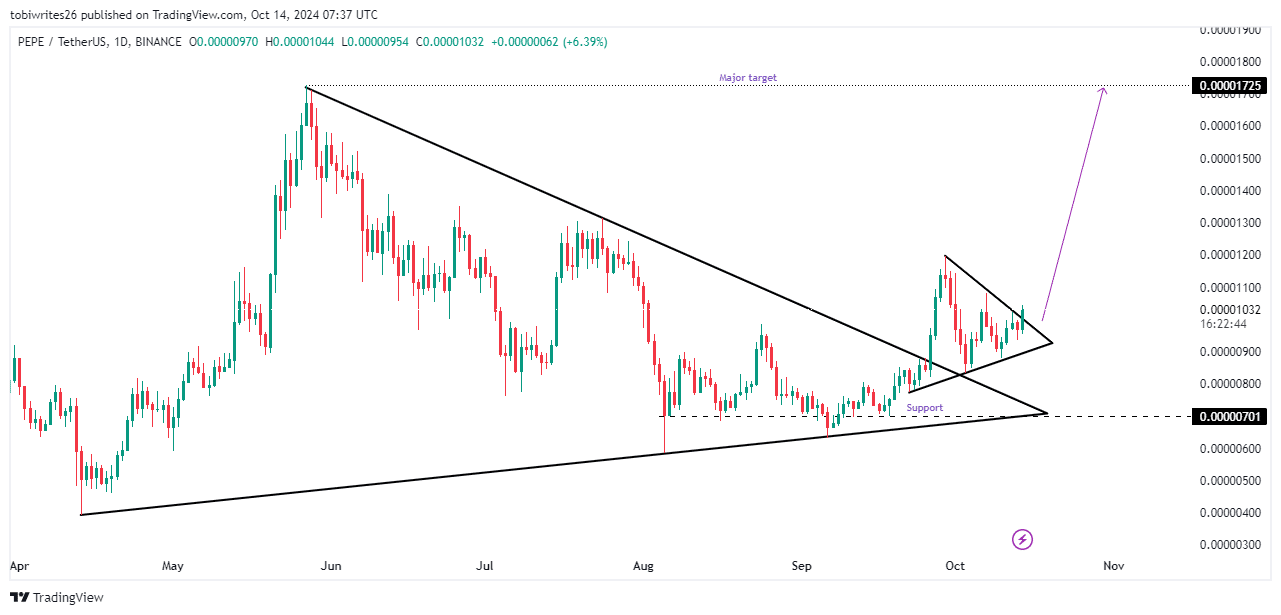

PEPE has once again formed a bullish technical pattern and is currently trading within a symmetrical triangle – a continuation of the breakout from a previously formed larger symmetrical triangle.

This new formation indicates that PEPE has entered a new accumulation phase, with buyers gradually increasing their positions in anticipation of a possible rally.

If a confirmed breakout from this pattern occurs, the next price target for PEPE would be $0.00001725, the peak of the previous symmetrical triangle. Otherwise, PEPE will continue to trade within the symmetrical pattern for longer.

Source: trading view

According to AMBCrypto’s analysis, technical indicators suggest that a breakout from this accumulation phase is imminent.

The outbreak of PEPE seems imminent

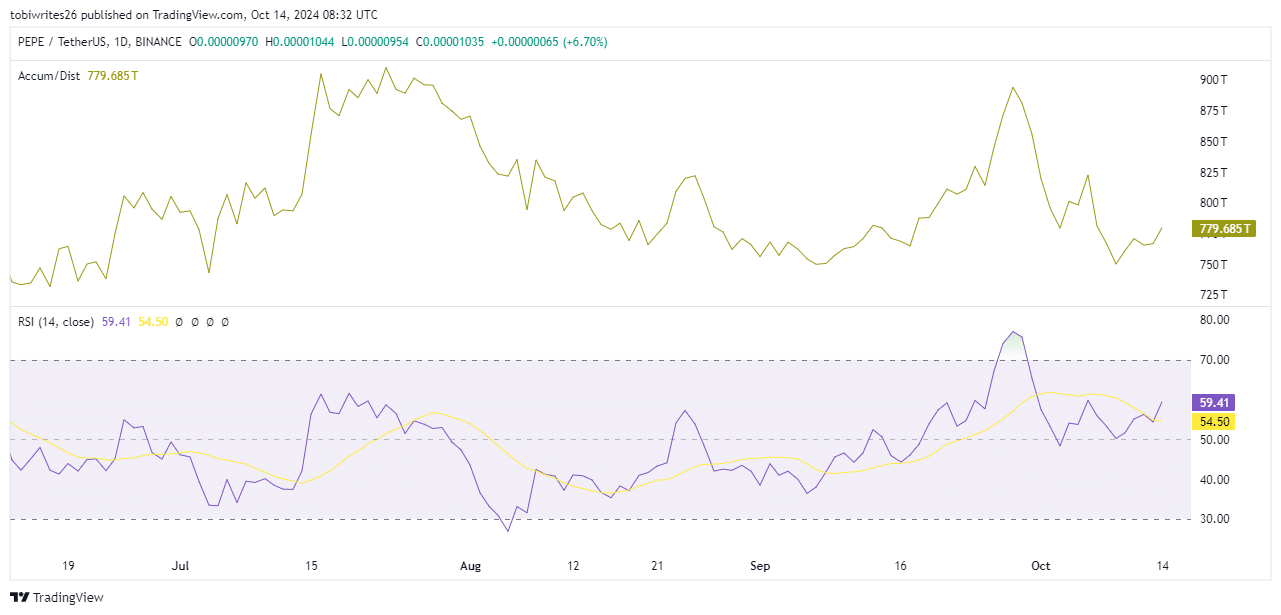

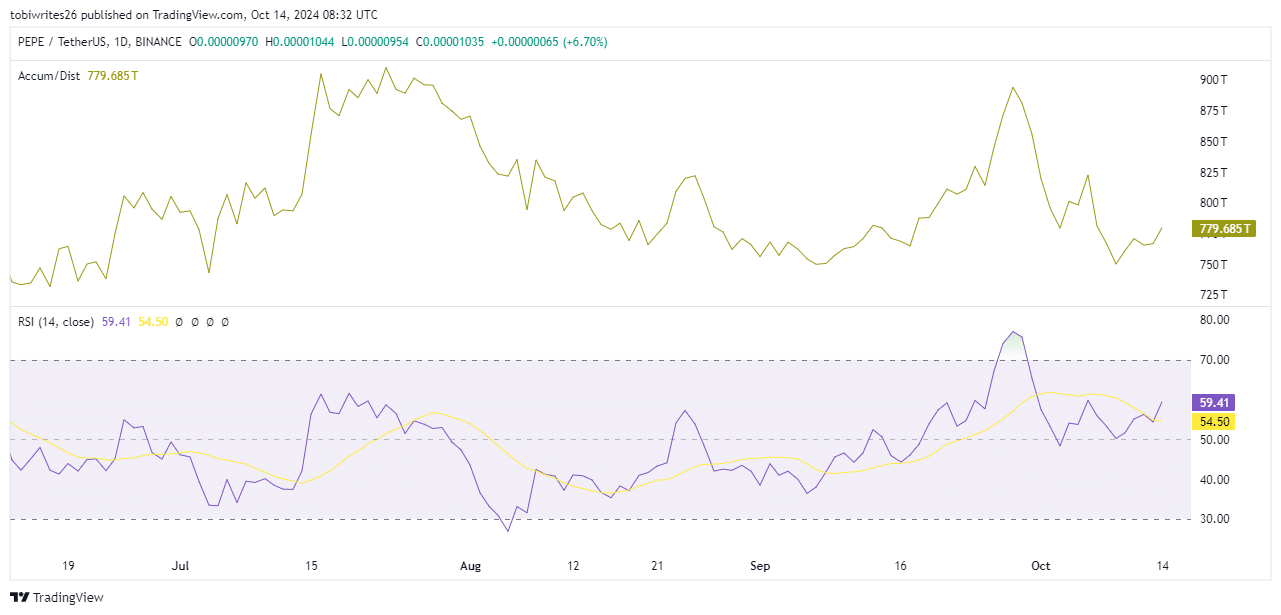

The Accumulation/Distribution (A/D) indicator, which tracks whether traders are buying or selling, shows that PEPE is in a buying phase.

This is confirmed by an upward movement in the A/D line, which indicates accumulation and bullish sentiment in the market. Such activity could drive the price to the next target.

Further supporting this trend is the Relative Strength Index (RSI), which has started to rise, indicating a strong buyer presence. With a current reading of 59.41, the RSI suggests that buyers are gaining control, pushing PEPE deeper into bullish territory.

Source: trading view

The RSI measures the speed and direction of price movements, and its upward trend usually indicates continued strength in the asset’s price.

A sharp drop in the number of active addresses could slow the outbreak of PEPE

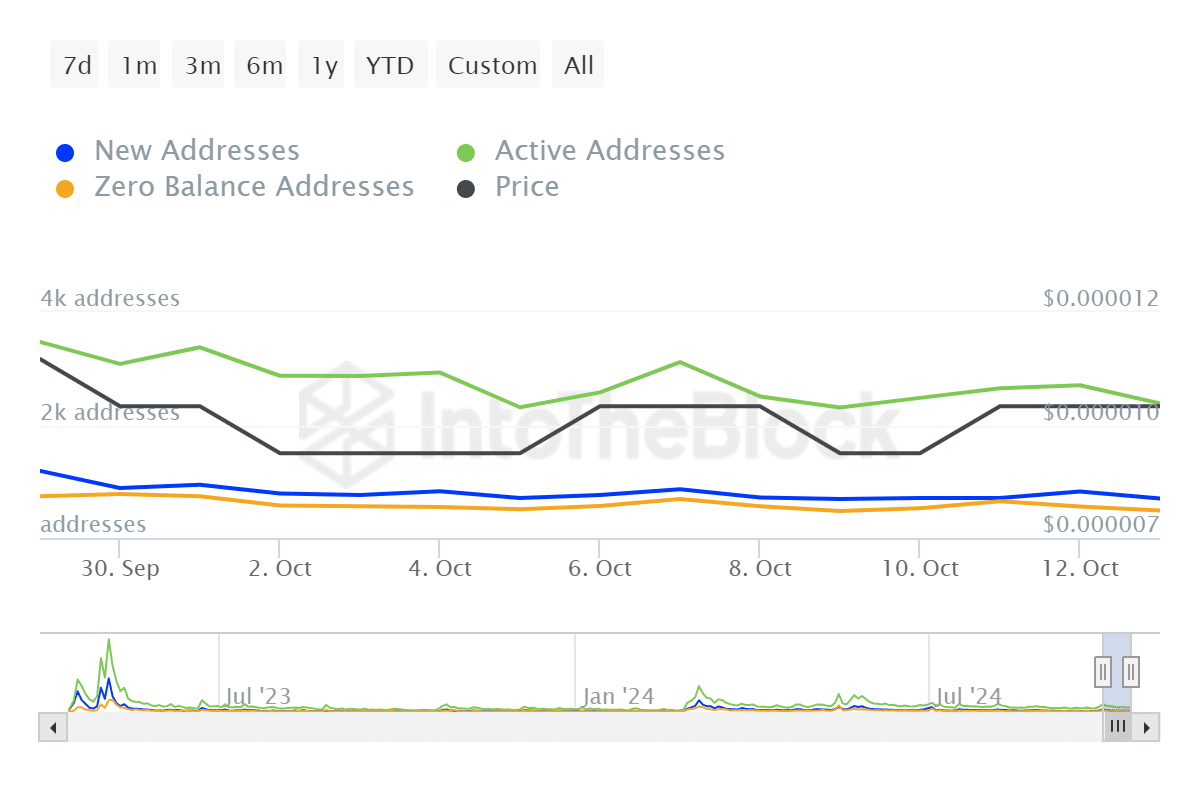

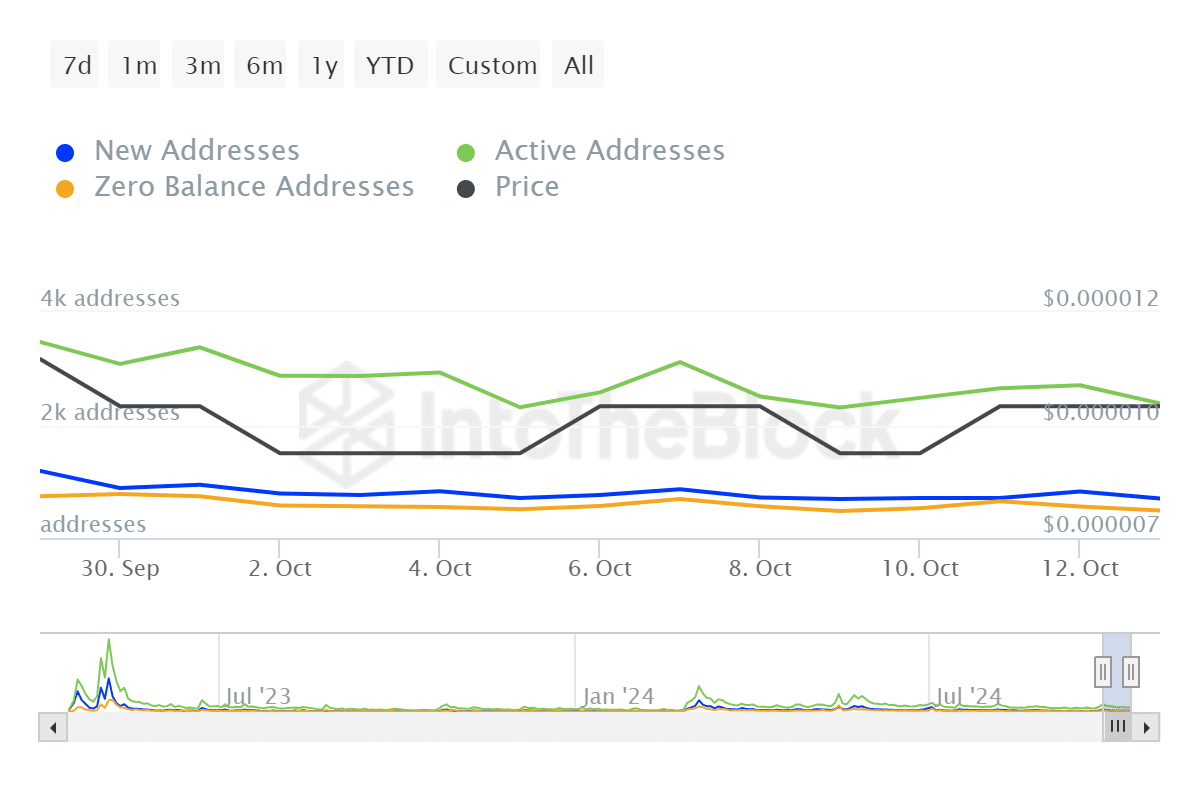

According to data from InTheBlokthe number of active addresses (AA) interacting with the memecoin has fallen by 7.89% over the past week.

Realistic or not, here is the market cap of PEPE in terms of BTC

The AA metric measures traders’ involvement in an asset and a decline if it indicates reduced buying activity despite the bullish trajectory.

Source: IntoTheBlock

This decline in active participation suggests that the expected breakout may be delayed or lack the strong momentum needed to produce significant price movements.