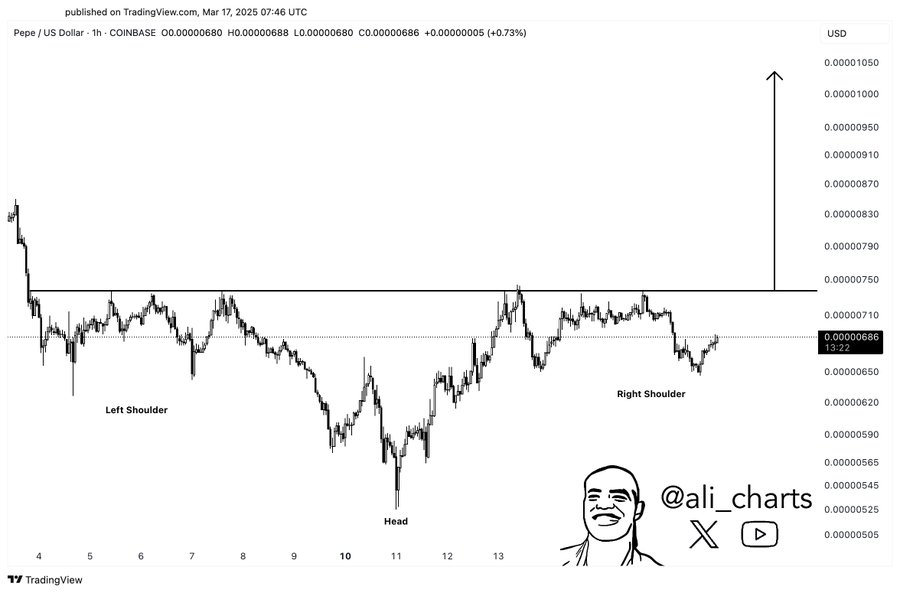

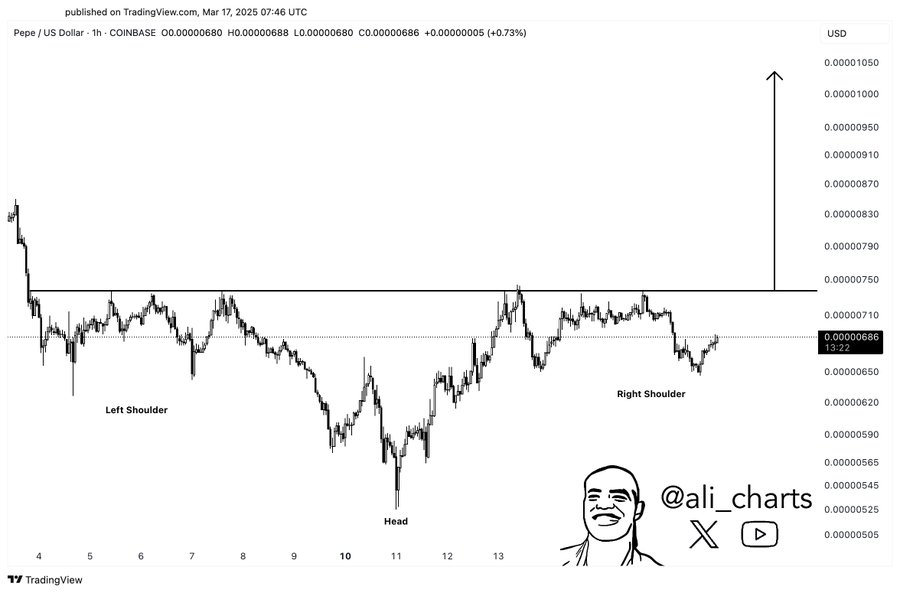

- Pepe was a bullish inverse main and shoulder pattern, aimed at $ 0.000010.

- Despite the sale, the Pepe market showed potential for a breakout over $ 0.0000070.

Pepe [PEPE] is currently the third largest meme token due to market capitalization and attracts considerable attention from cryptocurrency investors. At the time of the press, Pepe traded at $ 0.000006862, which reflected a decrease in a decrease of 3.09% in the last 24 hours.

The Token’s market shows considerable price volatility, supported by a trade volume of $ 819 million. This active market participation emphasizes strong investor’s interests and positions Pepe as a focus for both traders and analysts.

Pepe forms a bullish pattern, what now?

Pepe recently formed a reverse head and shoulder pattern, as noted by Crypto analyst Ali Martinez.

This pattern is generally considered a bullish signal, which indicates the possibility of an upward price drop. The price has tested the right shoulder in recent trade sessions and is approaching an important level of resistance.

If Pepe successfully breaks this resistance, analysts suggest that the currency could rise to $ 0.0000105, which indicates a considerably upward momentum.

Source: X

Martinez also emphasized that if Pepe breaks the resistance of $ 0.0000075, this could cause a collection of up to 40%. With a target price set at $ 0.000010, the currency has a clear potential path for profit.

Pepe is confronted with sale, market sentiment influences price trends

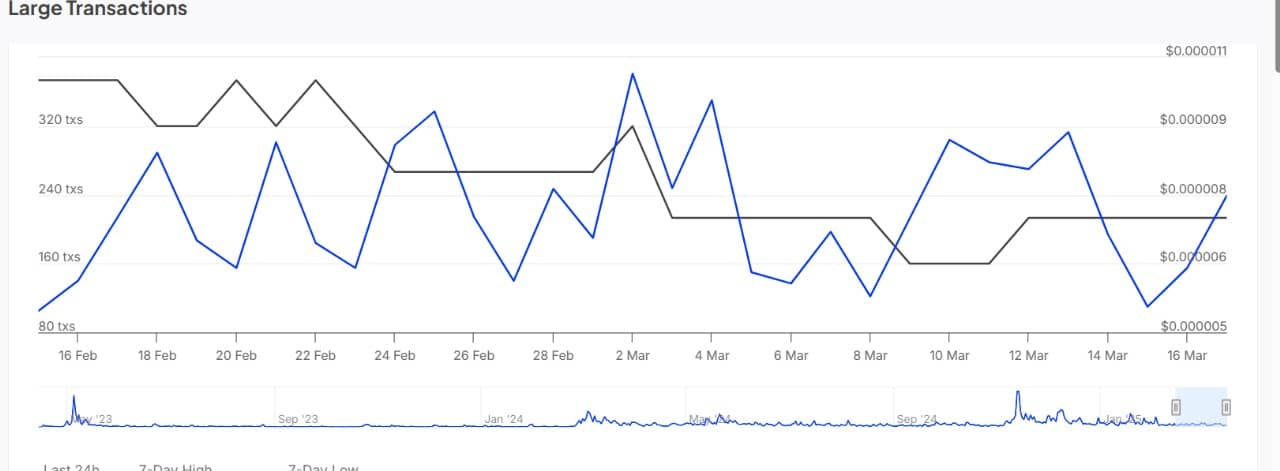

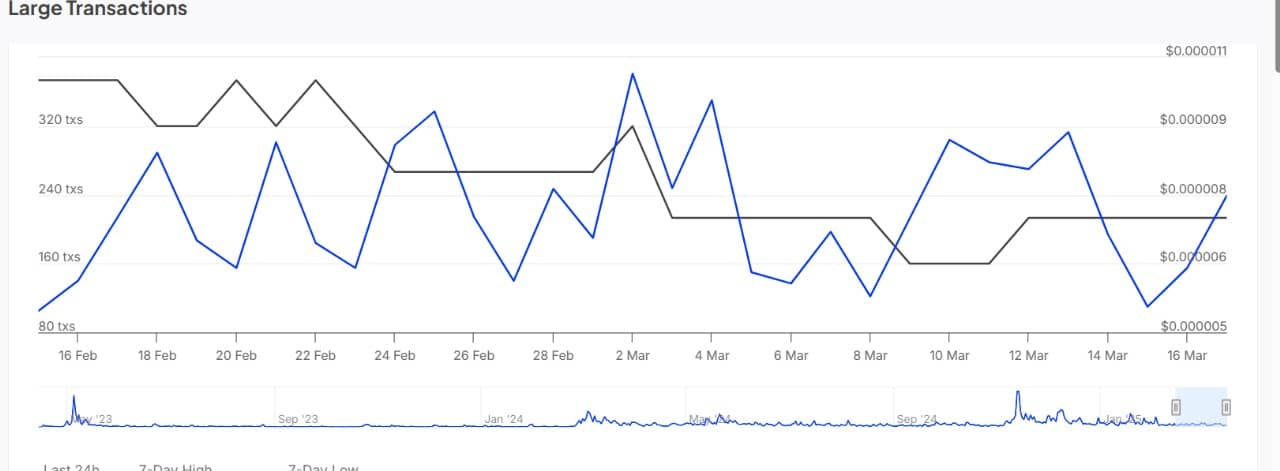

Despite his bullish technical prospects, recent data on chains reveal a considerable shift in the sentiment of investors. Pepe whales, or large holders, have started selling their positions after months of poor market performance.

After a peak at $ 0.00002825 in December 2024, Pepe confronted with a steep decrease of more than 76%.

The sale by large holders has expressed concern about the decreasing trust of investors in the memecoin. Despite the obtaining lists of large exchanges, this considerable fall in price indicates a potential loss of faith.

Transaction data shows that large transactions often coincide with price movements, which reflects shifts in market sentiment. As the transaction volumes rise, the prices usually follow, which suggests that these transactions influence the price trends.

This pattern can indicate the start of a larger meeting, making it essential to follow the power of the Memecoin to maintain Momentum.

Source: Intotheblock

Technicals show a neutral market

At the time of writing, the relative strength index (RSI) was on 51.06, which indicates a neutral market condition. This suggests that neither Pepe is neither overbought nor sold over, making it vulnerable to both bullish and bearish movements.

The advancing average convergence -divigence (MACD) -indicator showed a light bullish momentum, with the MACD line above the signal line.

Source: TradingView

Pepe’s price is currently within a narrow range and is missing a strong momentum. The next resistance level is around $ 0.0000070 USDT and an outbreak can lead to further profit.

If the MACD weakens and the RSI falls below 40, the price can go back to $ 0.000006.