Blockchain bonds are becoming increasingly popular as more and more financial industry players look to improve efficiency and transparency in the $130 trillion sector. The latest is the island nation of Palau, which has issued a blockchain bond to tap local capital for infrastructure projects.

In Germany, regional lender WIBank tested the waters with a €5 million ($5.4 million) blockchain bond as part of the region’s DLT (Distributed Ledger Technology) trials.

Palau uses blockchain savings bonds

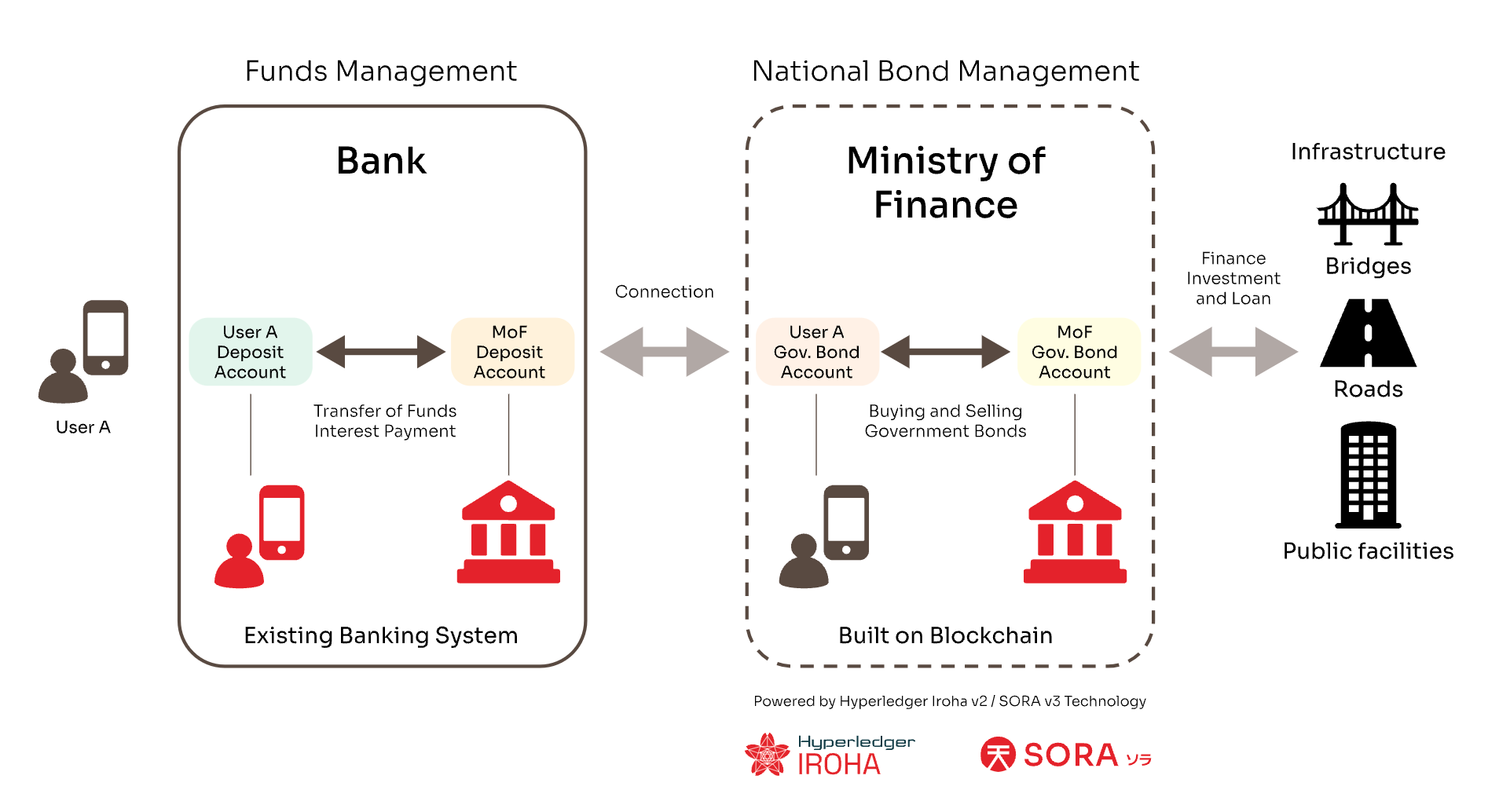

Palau is exploring blockchain savings bonds to raise capital for its infrastructure projects. It has partnered with Soramitsu, a Tokyo, Japan-based blockchain services company, for this initiative. The Japanese Ministry of Economy, Trade and Industry (METI) also participated.

Palau is an island nation in the western Pacific Ocean. It consists of 500 small islands and has approximately 20,000 inhabitants. Tourism is the main industry. Palau’s economy is closely intertwined with the United States, with the Bank of Hawaii being one of the most popular banks on the island. This inevitably leads to the channeling of capital from locals via bank deposits to the US and other countries in Micronesia.

The Palau government wants to tap this market and reduce capital outflows with the new blockchain savings bonds, called Palau Invest.

“The savings bond initiative allows us to finance critical projects such as housing, small and medium enterprise development and infrastructure with domestic capital,” said President Surangel Whipps Jr.

“By investing in these areas, we will stimulate job creation, expand business opportunities and promote a vibrant economy.”

The project starts with a prototype of a savings bond, which will introduce local investors to the system and how it works. Neither Soramitsu nor the Palauan government have revealed how long this process will take before they fully issue the bonds. But once they launch, investors can buy them through an app on their phone.

The bond will be issued on a Hyperledger Iroha 2-based permissioned blockchain network developed by Soramitsu. The company has extensive experience in creating blockchain applications for governments. It has been working with the Central Bank of Cambodia for years, culminating in the launch of Bakong, a blockchain-based payment system, in 2020. It is also working on a similar project with the Central Bank of Laos and on the central bank’s digital currency bank (CBDC). feasibility studies with the Philippines, Papua New Guinea and Vietnam.

Germany’s WIBank issues a €5 million blockchain bond

In Germany, regional development bank Wirtschafts und Infrastrukturbank Hessen (WIBank) has issued a €5 million bond on a public blockchain.

WIBank is a subsidiary of Landesbank Hessen-Thuringia, popularly known as Helaba, a regional bank that serves almost half of all German savings banks as a central clearing house.

The bond was settled using Trigger, a system developed by the German central bank to enable the settlement of DLT-based securities transactions with central bank money. Trigger connects the blockchain containing the tokenized assets (in this case the Ethereum Layer-2 network Polygon) to the traditional payment infrastructure, known in Germany as TARGET2, for atomic transactions. Trigger enjoys the benefits of DLT technology without the risk of digital currency.

The atomicity of the process, achieved through delivery versus payment transactions, eliminates counterparty risk. Because the transaction relies on central bank money instead of digital assets, credit risk is also reduced.

Helaba, WIBank’s parent company, acted as cash settlement agent, while Bankhaus Metzler, Germany’s second oldest bank, was the sole investor. Deloitte and the Munich law firm Annerton were also involved. Cashlink, a leader in asset tokenization in Germany, tokenized and settled the bond on the public blockchain.

Christian Forma, Head of Finance at WIBank, believes that the experience gained by the lender “opens up new opportunities for the further development of existing financial products in combination with innovative technologies. This minimizes risks and optimizes processes for both us and our investors.”

WIBank joins other German banks exploring blockchain bonds to increase efficiency and increase transparency. Last month, Frankfurt-based KfW, the world’s largest national development bank, issued a €50 million ($54.6 million) bond settled via the Trigger solution. This followed a €100 million ($109.3 million) blockchain bond issued in August.

But while these bonds are becoming increasingly popular, they are still a niche market limited to a few participants. The €100 million ($109.3 million) bond, for example, attracted just six investors, all clients of bookrunner DZ Bank.

In some jurisdictions, bond issuers are integrating their blockchain products with conventional channels to make bonds available to a larger investor base. For example, in Hong Kong, HSBC (NASDAQ: HSBC) recently integrated the HKMA’s Central Moneymarkets Unit (CMU) in issuing a HK$1 billion ($130 million) digital bond on its Orion blockchain platform.

Watch: Liquid Noble democratizes precious metals investing

title=”YouTube video player” frameborder=”0″ allow=”accelerometer; autoplay; clipboard-write; encrypted media; gyroscope; picture-in-picture; web-share” referrerpolicy=”strict-origin-when-cross- origin ” allowfullscreen=””>