- Declines in financing rates, OI indicated a shakeout of over-indebted bullish traders

- The market mood changed from extreme greed to avarice

Bitcoin [BTC] retreated from its previous all-time highs (ATH) this week, falling 3.23% to the $67k zone, according to CoinMarketCap. Right now, bullish market participants are eagerly awaiting a recovery to $73,000 – a level last reached in mid-March.

Although the King Coin is languishing on the charts, some market indicators are still flashing green.

Normalize financing rates

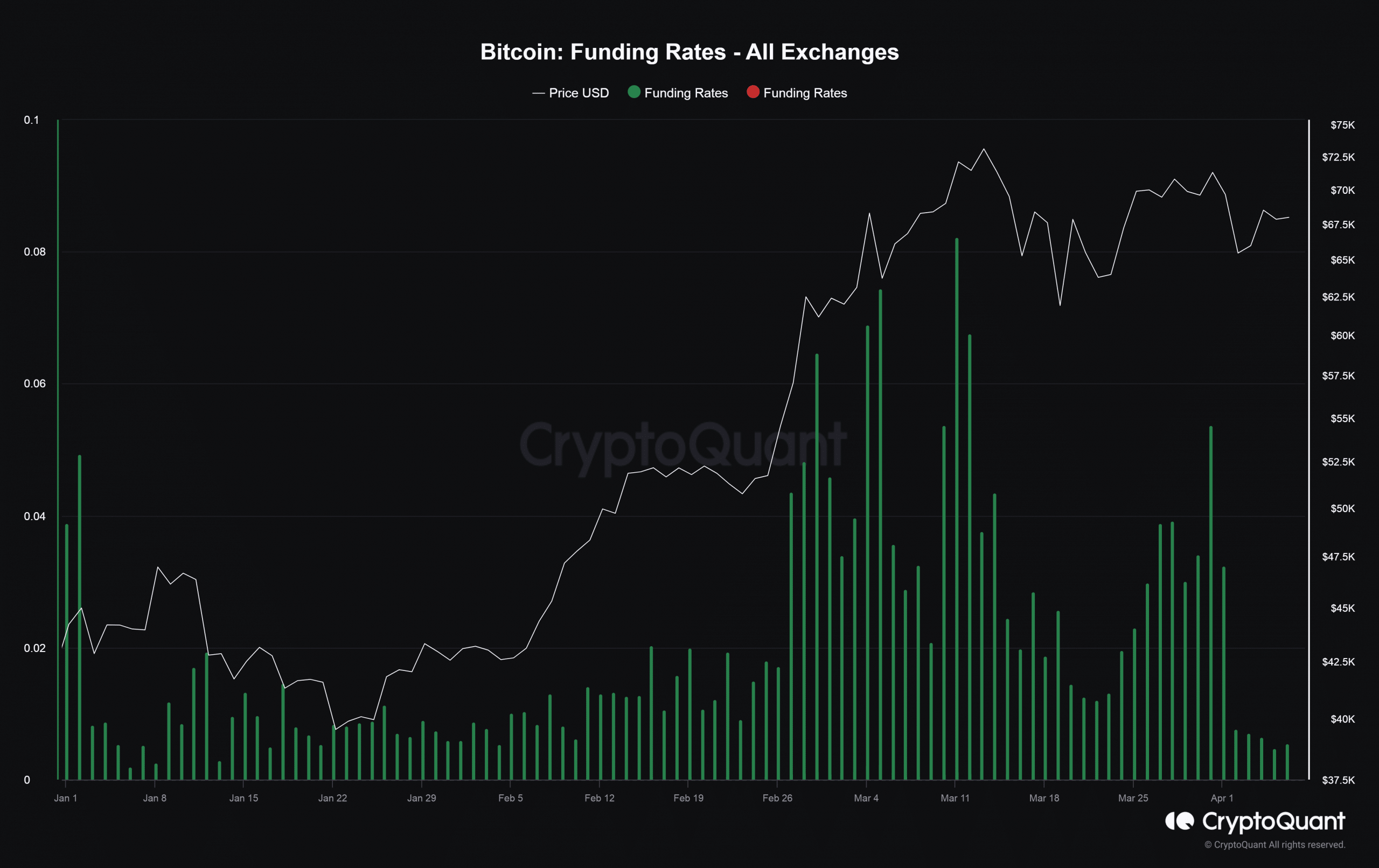

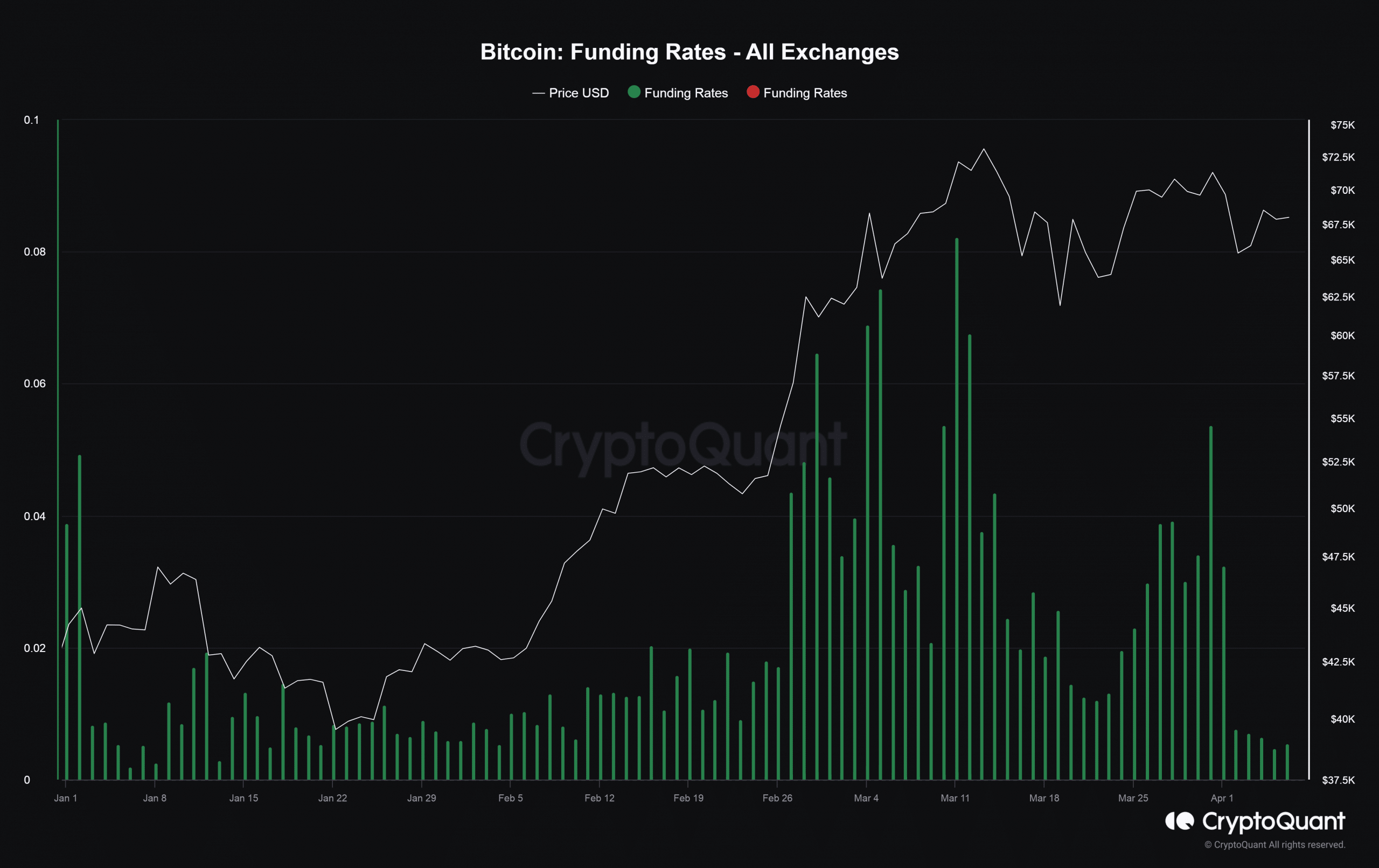

According to YES Marchunn, a contributor to on-chain analytics platform CryptoQuant, Bitcoin funding rates fell sharply over the course of the week. In fact, at the time of writing this was at a level he considered ‘neutral’.

Source: CryptoQuant

Declines in funding rates generally signal a push-out of over-indebted bullish traders. Funding rates soared when BTC hit its new ATH in mid-March, a sign of an overheated market. With financing rates normalizing and prices still around $67,000, there is now room for new long positions to enter the market, paving the way for a continued move north.

The 11% drop in Open Interest (OI) in Bitcoin futures during the week, according to AMBCrypto’s analysis of Mint glass‘ data also reflected the exit from long positions with excessive debt.

The euphoria starts to fade

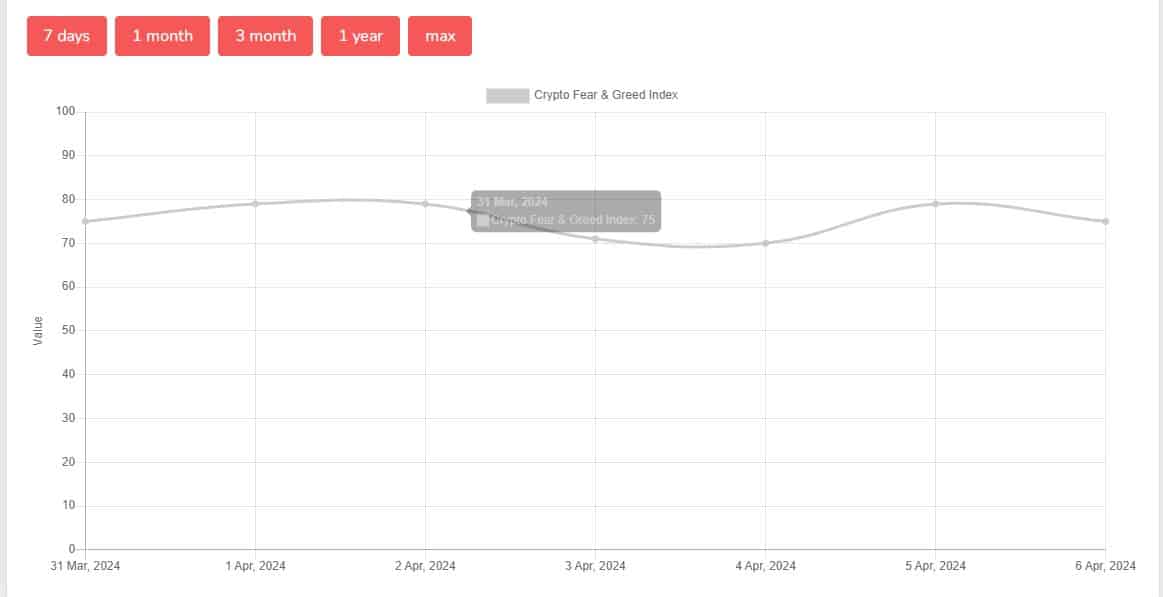

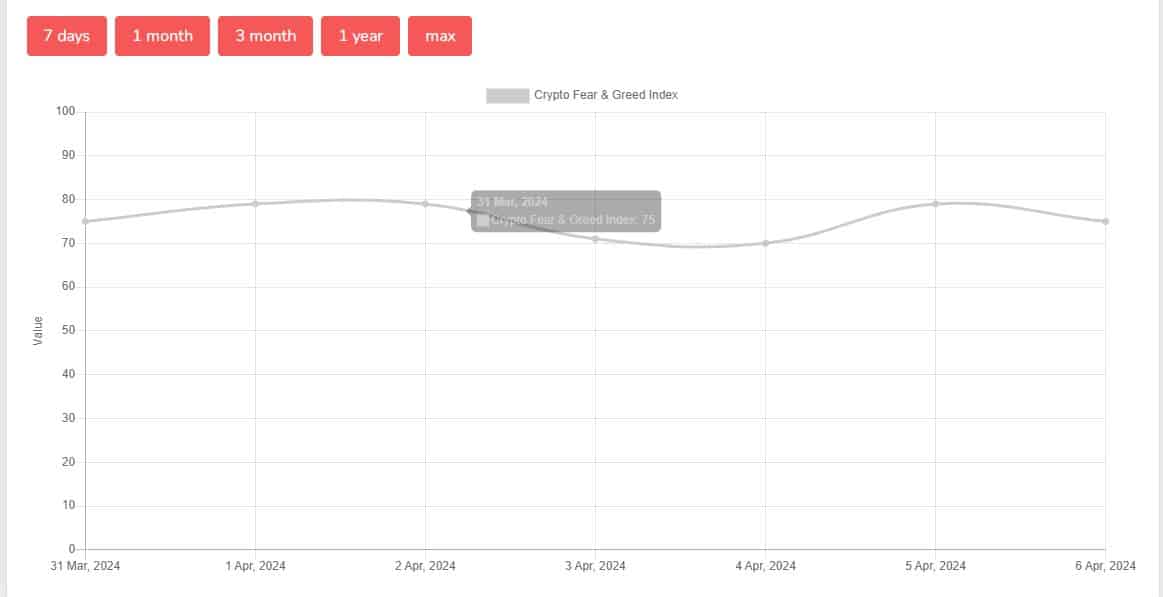

The cooldown was further evidenced by the shift in market sentiment from ‘extreme greed’ to ‘greed’ during the week, according to the Crypto Fear and Greed Index. When the market becomes extremely greedy, it usually means a correction is needed.

Source: Crypto and Fear Index

Read BTC price forecast for 2024-2025

Another Bullish Trigger for Bitcoin?

What could work in Bitcoin’s favor is bankrupt crypto lender Genesis done selling over $2 billion in Grayscale Bitcoin ETF (GBTC) shares. Genesis mainly caused the outflow from GBTC in recent weeks, which resulted in the correction of Bitcoin.

However, with a delay to the end of Genesis, GBTC’s outflows could slow significantly, allowing other ETFs to compensate with high inflows, potentially leading to Bitcoin’s rise again.