Non-fungible tokens (NFTs) gained popularity in 2021, generating more than $23 billion in trading volume that year. In addition to impressive market growth, a number of celebrities, major brands, and sports teams launched their own NFTs in 2021.

Unfortunately, the NFT industry saw a major decline after the collapse of crypto exchange FTX and other similar events. According to a 2023 industry report from DappRadar, NFTs became much less valuable in 2023, resulting in a trading volume of $12.6 billion.

Interestingly, the report also points out that a whopping 60 million NFTs were sold last year, resulting in a 445% increase over previous years. Against this backdrop, industry experts predict that NFTs will play an important role for the digital asset industry by 2024.

NFT regulation is becoming a global priority

Cody Carbone, policy lead at The Chamber of Digital Commerce – a US organization that promotes the use of digital assets and blockchain – told Cryptonews that the industry is likely to see more NFT use cases emerge this year. He said:

“I think we’ll see NFTs used for consumer products in real estate, entertainment, healthcare and more. We may not see the popularity from a market perspective, but NFTs will likely be deployed across industries for real-world use.”

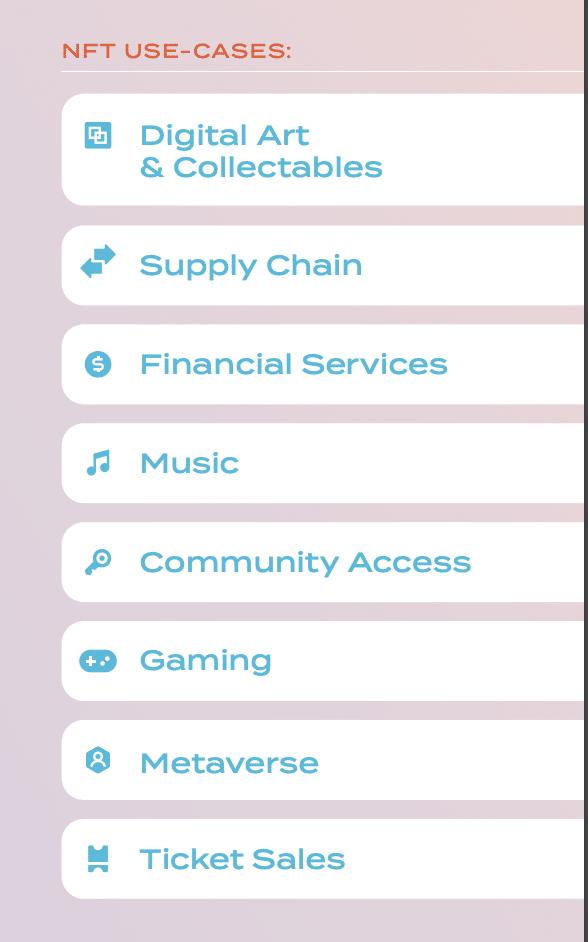

To put this into perspective, the Chamber of Digital Commerce recently published an NFT impact report explaining how NFTs could be used as consumer products across a number of sectors.

Source: The Chamber of Digital Trade

While it is notable that NFTs may see increased adoption this year, understanding how to regulate NFTs has now become a top priority. Andrew Rossow, attorney and CEO of AR Media Consulting, told Cryptonews that there is currently no specific federal legislation in the US that directly addresses NFTs, their governance and their classification.

That’s why industry experts and organizations are striving to shape regulatory frameworks around NFTs. For example, the Chamber of Digital Commerce’s NFT Impact Report states that “NFTs are generally consumer products that should not be regulated in the same way as early, financial applications of blockchain, such as cryptocurrencies.”

However, US lawmakers seem to have a different opinion. For example, the US Securities and Exchange Commission (SEC) has accused media and entertainment company Impact Theory of conducting an unregistered offering of crypto assets in the form of NFTs in August last year. “This set alarm bells ringing for everyone. There are now concerns that the SEC will get involved and regulate NFTs as securities,” Carbone said.

To address these concerns, Carbone shared that the Chamber of Digital Commerce hosted its first-ever “NFT Education Day” on January 31. According to Carbone, the purpose of the event was to bring NFT subject matter experts to Capitol Hill to educate both the SEC and Congress on non-fungible tokens.

In particular, Carbone mentioned that industry experts had met with SEC Commissioner Hester Peirce, along with a number of House of Representatives representatives. According to Carbone, there was an overall general receptiveness to NFTs and their use cases outside of digital collectibles. He said:

“There was agreement across the board that NFTs should not be securities and should be treated as consumer goods. There was a need for specific legislation to exempt consumer NFTs from securities laws, but not add them to something that already exists.”

Chamber executives will meet with SEC Commissioner Peirce on Jan. 31 about NFT-related enforcement actions. Source: The Chamber of Digital Commerce

Carbone added that industry leaders were told several times during the event that collaboration with other committees outside of the financial services industry is crucial to shaping innovative regulations around NFTs.

Perianne Boring, founder and CEO of the Chamber of Digital Commerce, further told Cryptonews that the Chamber is not advocating for specific regulations tailored solely to NFTs, noting that prematurely proposing NFT-specific regulations would increase the complexity and evolving nature of could overlook the landscape. She said:

“As the technology and its applications continue to evolve, we advocate for a measured and comprehensive approach to regulation that takes into account the unique characteristics and potential implications of NFTs within existing regulatory frameworks. Our position prioritizes in-depth analysis and dialogue among stakeholders to ensure that all regulatory actions related to NFTs are informed, balanced and conducive to promoting innovation while protecting consumers.”

While this perspective comes from a US-based organization, Yat Siu, co-founder and executive chairman of Animoca Brands – a gaming software and venture capital firm – told Cryptonews that most countries in Asia do not have specific or advanced regulations for NFTs. “Many jurisdictions are looking to self-governing bodies or associations to help regulate NFTs, or they are waiting for the NFT market to develop further to assess the need for regulation,” he said.

Siu added that he believes NFTs should be treated the same as tangible assets. “For example, there should not be regulation, but more consumer protection,” he said. According to Siu, due to the multifaceted nature of NFTs, coupled with the fact that these digital assets can represent many different things, a regulatory framework must be flexible enough to take this diversity into account. He said:

“Context is crucial – it’s not just about regulating NFTs because they are NFTs, but about understanding what those NFTs represent on a case-by-case basis. For example, selling an NFT is not the same as selling a security, but selling partial ownership of an NFT may be categorized by regulation as selling a security.”

Industry experts in Europe are also aiming to bring regulatory clarity around NFTs. Elisenda Fabrega, head of legal at Brickken – a tokenization platform – told Cryptonews that in the European Union (EU), the regulatory scenario for NFTs remains complicated, mainly due to the lack of specific regulations. It’s also important to note that while the European Union’s Markets in Crypto Assets regulations – also known as MiCA – will come into effect at the end of this year, the commission will likely report on NFT laws in 2025.

In the meantime, Fabrega believes that the characteristics of NFTs may give rise to specific rights and obligations, necessitating the application of different legal frameworks. She said:

“For example, in contexts where NFTs serve as contracts or embody contractual rights, the significance of contract law is magnified. Yet an NFT that resembles traditional financial instruments could be classified as a ‘security token’, subject to European and national financial regulations, such as MiFID II.”

Fabrega further explained that consumer protection remains a key focus for NFT regulation in the EU. “As more consumers engage with NFTs, the EU has placed increasing emphasis on protecting their interests. This includes ensuring transparency in transactions, providing clear information about the rights and restrictions associated with NFT purchases and protecting against misleading practices,” she said.

Ongoing challenges surrounding NFT regulations

While it is notable that organizations want to help implement regulatory frameworks for NFTs, confusion surrounding these digital assets remains.

For example, Carbone said the best advice he received during NFT Education Day was to avoid using the term “NFTs” because of its association with cryptocurrency. “We need to find a new name for NFTs moving forward,” he said.

Siu further shared that while there are NFT whitepapers in regions like Japan, this does not mean that NFTs are regulated under those documents. “In my opinion, it is unlikely that NFTs themselves will ever be regulated,” Siu noted.

Yet the diverse and versatile nature of non-fungible tokens may be the biggest challenge to consider when it comes to establishing a regulatory framework for these assets. According to Fabrega, the diverse use cases of NFTs pose a formidable obstacle to the implementation of a unified regulatory framework. “This diversity requires a careful and tailored approach to regulation, as different categories of NFTs intersect with different legal domains, including intellectual property law, contract law and financial regulation,” she said.

To address this, Fabrega believes that a well-structured regulatory approach is critical to maintaining a reliable and sustainable market for NFTs. “This will stimulate innovation while carefully protecting the interests of all stakeholders involved.”