What is the ORC-20 standard?

ORC-20 is an open standard for ordinal tokens on the Bitcoin network, created with the aim of adding new features to the BRC-20. It is intended to be backward compatible with the BRC-20, improving adaptability, scalability, and security, and eliminating double spending, which has been a problem for some. BRC-20 Token.

As with BRC-20 tokens, ORC-20 is an experimental project with no guarantee that tokens generated under this standard will have any value or utility. They may offer new features, but they may also introduce a host of new issues, bugs, and compromises that market participants will naturally exploit.

What is an ORC-20 Token?

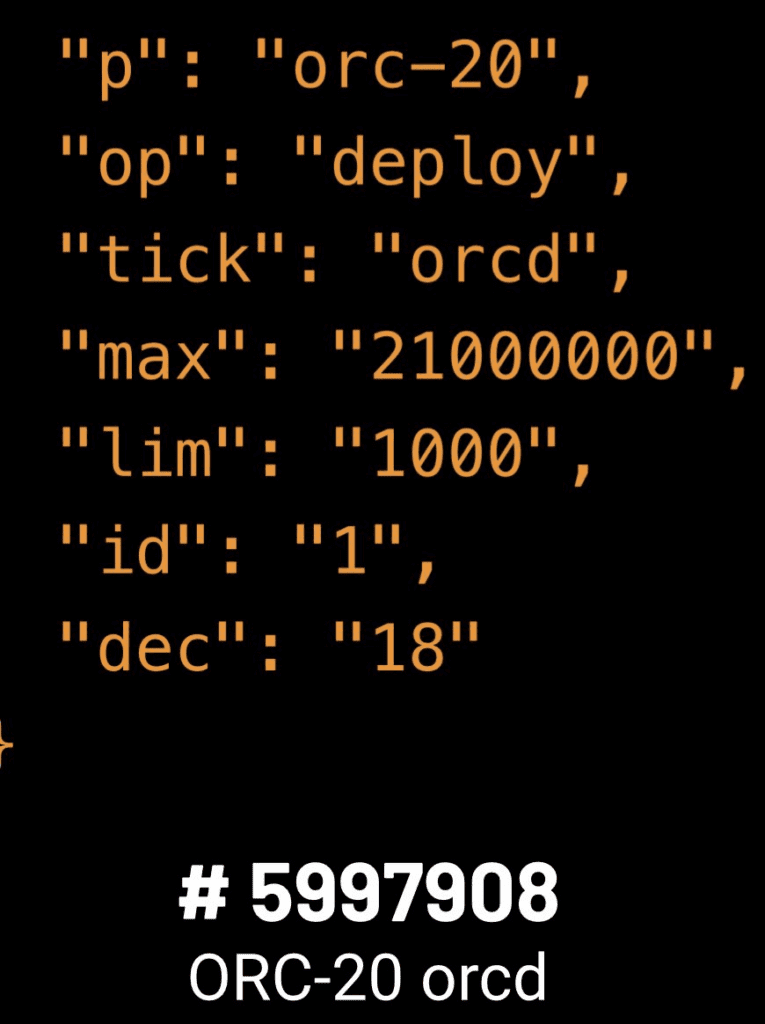

ORC-20s, like BRC-20 tokens, are JSON files added to the Bitcoin blockchain and written to satoshi with an ordinal serial number. The ORC-20 JSON format supports more formats and contains key-value pairs.

All ORC-20 data is case insensitive. These tokens use a transaction model based on the UTXO model. With each transfer, the sender specifies the amount the recipient will receive and the remaining balance is sent to the sender, making it easier for them to transfer.

After completing each transaction, the previously registered balance is no longer valid; hence the UTXO model applies. Each submitted event can contain a nonce and the sender can partially cancel the transaction by specifying the nonce.

How the ORC-20 standard works

ORC-20’s operations include basic events, including deploy, mint, dispatch, cancel, upgrade, and custom events. You can add new keys to the standard event to introduce restrictions, different behaviors, or new operations.

Each operation is enrollment data with a key-value pair, in JSON format by default. Control keys must be lowercase. Value data is not case sensitive.

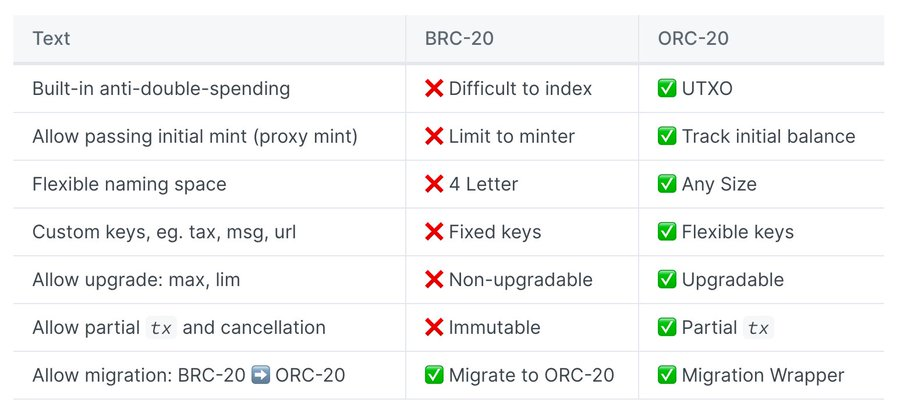

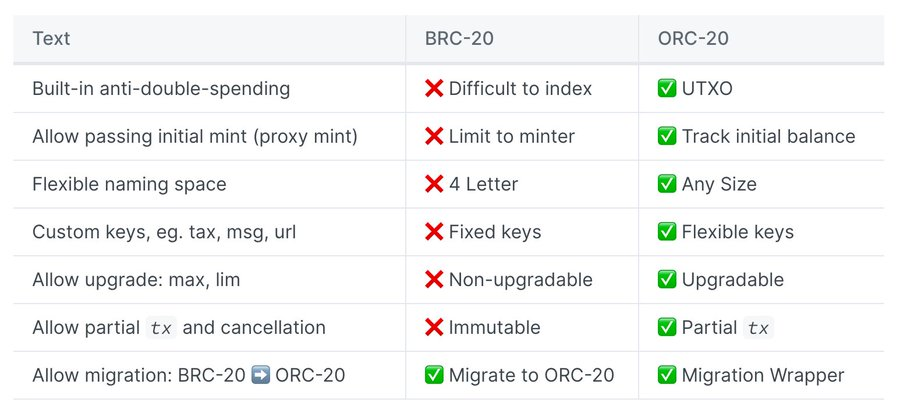

The ORC-20 is backwards compatible with the BRC-20 and eliminates the possibility of double consumption. ORC-20 allows changing the initial and maximum amount that can be spent and has no hard limit on namespaces and names.

The UTXO model is used to ensure that there is no repetitive consumption in transactions and allows canceling transactions using the “on” field.

What are the improvements of ORC 20 over BRC 20?

The main limitations of BRC20 are as follows:

Improvements to the ORC-20

- Deploy a new ORC-20 or migrate an existing BRC-20 with a deployment event.

- Mining ORC-20 tokens with coin event.

- Send ORC-20 token with send event.

- ORC-20 Abort partial transaction with abort event.

- Upgrade an existing ORC-20 (e.g. max supply and coin) with an upgrade event.

How does ORC-20 prevent double spending?

The transaction model used in ORC-20 is based on Bitcoin’s UTXO model. When a transfer takes place, the sender specifies the amount the receiver will receive and specifies the remaining balance to be returned to itself, simplifying the transfer process.

In the UTXO model, the previously registered balance becomes invalid after each transaction is completed, in accordance with the UTXO principle. Each “submit” event in an ORC-20 token can contain a nonce. This allows the sender to include a unique identifier for the transaction, which can be used to partially cancel the transaction if necessary. Specifying a nonce allows the sender to undo and reverse an incompletely processed transaction.

ORC-20 token capabilities

The ORC-20 token standard allows traders to create even more tokens on Bitcoin, add more variations, change supply and release, and create artificial scarcity for these tokens, only to exploit the hype demand by creating new tokens spend to dump into the market. market.

They can make it easier for regular wallets to transfer without users using coin control to protect their coins. This will help get tokens to the secondary market and exchanges before the trading pandemic. This will make it easier for miners to sell their tokens to the market, access liquidity and disappear like bandits with on-chain satoshi that cannot be retrieved once the transaction is confirmed.

Risks of ORC-20 Token

Those planning to invest in ORC-20 tokens should first understand that ORC-20 is an experimental project and there are no guarantees regarding the value or usefulness of tokens produced to the standards of this standard. While ORC-20 may have the potential to improve the Bitcoin network’s token standards, it has drawn a lot of criticism for being complex and offering no significant advantage over existing standards.

The fate of ORC-20 depends on how the community responds to it and its ability to address these concerns. Users should exercise caution and research thoroughly before handling ORC-20.

Move BRC-20 to ORC-20

The ORC-20 protocol also facilitates the migration of existing BRC-20 tokens through the use of wrapper ordering. Using “wrapper order” you can rewrite your previous satoshis and switch to other ordinal token standards, such as from BRC-20 to ORC-20.

To migrate your existing BRC-20 tokens, you need to implement a wrapper sequence to convert them. Only the BRC-20 deployer can perform the migration.

So even if you bought BRC-20 tokens with a fixed supply and thought you owned a certain percentage of the supply, you could still be diluted if miners’ tokens decide they want to capitalize on market demand and move to ORC want to move and give themselves. a new supply of coins to hit the market.

Conclusion

Above is our full share of the ORC-20 Standard and ORC-20 Tokens. The ORC-20 standard helps to overcome all current limitations of the BRC-20. Like the explosion of the BRC-20, the ORC-20 could be the name of the next rocket launcher due to the cheers of the community. But before deciding to invest in ORC-20, users should understand that ORC-20 is an experimental project and there is no guarantee of the value of tokens created using this standard. There is much criticism of the ORC-20 that they need to be simplified and provide a significant advantage over existing standards.

What do you think of the ORC-20 token? Will it take off and move more speculation to Bitcoin? Are the tools used to create these standards widely accepted? Or will this all fail like past attempts to add non-native assets to the Bitcoin backbone?

DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We recommend that you do your own research before investing.