Crypto and NFT payment infrastructure company Transak has partnered with Visa to integrate Visa debit capabilities into its global off-ramp service. This move expands the possibilities for crypto-to-fiat exits, allowing users to enter more than 145 countries to convert their crypto holdings into local fiat currency.

Using a product called Visa Direct, Transak will enable the smooth conversion of digital assets to fiat currency across the industry. This partnership addresses a critical gap in the market: the ease of crypto-to-fiat conversion. Historically, the focus has been on facilitating the flow from fiat to crypto, leaving the reverse process, from crypto back to fiat, less developed and often cumbersome.

This has led to a reliance on stablecoins or alternative, less regulated conversion methods, which could be problematic in terms of local compliance. The partnership between Transak and Visa introduces a solution to this challenge and provides real-time card withdrawals through Visa Direct. Yanilsa Gonzalez-Ore, head of Visa Direct in North America, emphasized the importance of this integration and highlighted its role in providing a more connected and efficient experience for users.

“By enabling real-time card withdrawals through Visa Direct, Transak delivers a faster, simpler and more connected experience for its users – making it easier to convert crypto balances into fiat, which can be spent at the more than 130 million merchant locations where Visa is accepted.”

A key feature of Visa Direct is its real-time transaction processing capability, potentially completing transfers within 30 minutes – a stark contrast to the often lengthy procedures of traditional banking. Furthermore, most off-ramps today are limited to centralized exchanges, meaning investors must undergo at least a temporary move to centralized custody before withdrawing.

The ability to convert crypto to fiat directly from a wallet allows users to maintain the self-sovereign aspect of self-governance in crypto. Transak is integrated into more than “350 leading Web3 wallets and games, such as MetaMask, Trust Wallet, Coinbase Wallet and Ledger.”

Sami Start, CEO of Transak, sees this partnership as a pivotal moment for Web3 and says:

“We believe this partnership is a turning point for Web3 as a whole. Now millions of people around the world have an easy way to cash out their digital asset holdings in real time and intuitively in their local currency.

They no longer have to walk the treacherous path of compliance uncertainty or risk fraud – Transak and Visa have them covered for more than 40 cryptocurrencies.”

Testing the wallet-based fiat-off ramp.

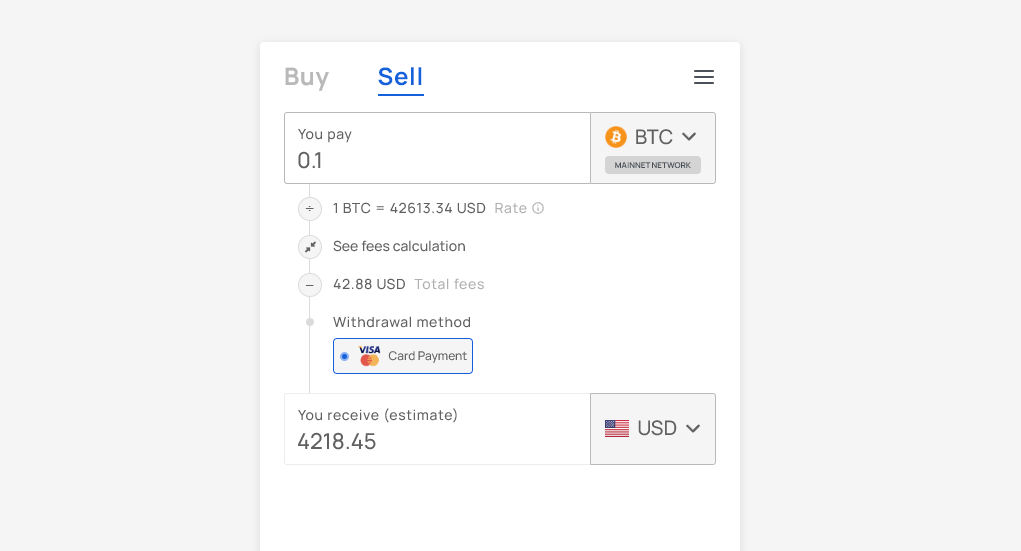

However, such a revelation is not without its downside. At the time of writing, the price of Bitcoin is $43,497. However, withdrawing 0.1 BTC would result in only $4,218 in fiat ending up in an investor’s bank account, a 3% haircut on the current value. Transak charges a 1% fee and a nominal processing fee to ‘service providers’. However, an information bubble on the page does indicate that the price quoted is an estimate, so it is currently unclear whether there is a spread beyond the fee.

The difference between the estimated price and the current market price is approximately 2% across all assessed assets. A 2% spread is also shown for Visa Card, ApplePay, GooglePay, Cash App and bank transfer ‘buy’ transactions, again with a 0.99% transaction fee.

While the Transak website lists a flat rate of 1%, the partner documents describe this the price mechanism more detailed. The spread is intended to cover network costs and “a small slippage percentage.” Combining fees into a single variable can make such transactions seem easier for non-native crypto users. However, everyday users may prefer more finite control over costs. Ultimately, there is a cost to convenience.

Harshit Gangwar, Marketing Head & Investor Relations Lead at Transak, confirms this CryptoSlate that the “spread fluctuates based on factors such as the complexity of obtaining liquidity and the risks associated with storing different cryptocurrencies.” Specifically he said:

“[The spread is] variable and determined by our systems and team based on the challenges of storing and acquiring cryptocurrencies.

For example, if a cryptocurrency available for off-ramping suddenly drops significantly, this signals to our team the increased risk of holding it for an extended period of time, which could impact the spread rate for that specific cryptocurrency.”

Furthermore, this does not seem to be the case for those hoping that the process would eliminate the need for KYC steps. Name, address, date of birth, ID and a selfie are all required when creating an account for the Transak withdrawal service. So if you buy or sell through this non-custodial place, your personal information will be linked to your wallet address.

Those looking for a fully compatible method to buy and sell crypto with fiat without using centralized exchanges now have a method that costs between 0.99% and 3%, which can be significantly less than other peer-to- peer options.

Ultimately, the partnership between Transak and Visa Direct is a decisive step forward towards mainstream digital currency adoption. It seeks to simplify the conversion of crypto to fiat and remove barriers of complexity and uncertainty, potentially accelerating crypto adoption among the general population.

Editor’s note: I attempted to execute a trade to test the process and verify if there was a 2% spread. I was planning to purchase $100 worth of MATIC but this was the screen I was shown after completing the KYC process due to new FCA promotion rules.