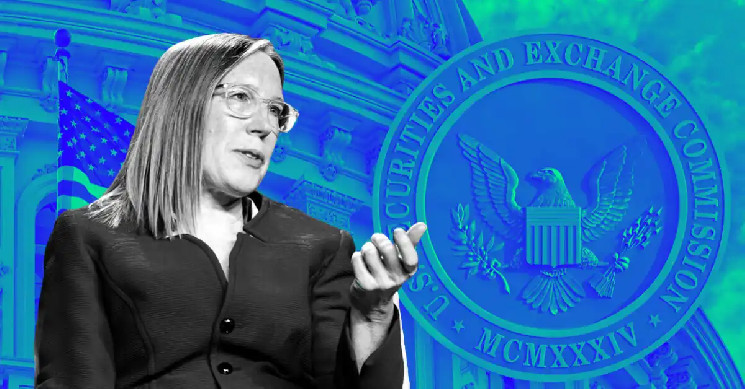

Hester Peirce, a senior commissioner and head of the Crypto Task Force, at the US Securities and Exchange Commission (SEC), has hinted that NFTS could be the next large crypto -activa class that receives regulatory clarity. Peirce, a well -known advocate for crypto, indicated that the SEC can exempt certain types of NFTs from securities instructions, in particular those used by companies for fundraising.

As reported by Sander Lutz van Decrypt, Peirce specifically mentioned projects such as Stoner cats And Fly fishing club As examples of NFTs that the SEC could harden from securities instructions. Both projects have collected millions of dollars by the sale of membership NFTs before they are confronted with legal steps of the SEC during the BIDEN administration.

SCOOP: SEC Commissioner Hester Peirce tells me that NFTs can be the following crypto -activa class that exempts the agency from securities rules via a statement -in particular types of NFTs used by companies to insert fundraising

Peirce mentioned Stoner Cats and Flyfish Club as the exact type of NFTs … https://t.co/ynbd2AWQFZ

– Sander Lutz (@s_lutz95) March 21, 2025

This development is on the heels of the recent efforts of the SEC to provide more clarity around crypto -my -construction and meme coins, which states that these activities do not fall under securities instructions. With NFTs that stand up as the next logical step, many see this as a positive sign for the industry. Industry experts are positive, in which some suggest that the evolving attitude of the SEC can indicate a more crypto-friendly regulatory environment.

During a recent meeting, Peirce criticized the former SEC approach, and called it unfair and emphasized the need for fair regulations. She suggested that elections can influence the legal policy, and showed that the SEC could change its attitude towards crypto. Her comments offer hope for a more transparent and balanced way to regulate digital assets.

She said, “Spring means a new beginning and we have a restart of the approach of the Crypto Commission.”