Over the past week, sales of non-fungible tokens (NFTs) have fallen by 12.26%, totaling $463.87 million, marking a decline from the previous week. NFTs around Bitcoin topped the list, reaching $265.61 million in sales, despite a 13.71% decline from the previous week. Meanwhile, Solana NFTs climbed to second place, demoting Ethereum to third place in this week’s sales.

NFT Market Update: Sales of digital collectibles fall 12.26% lower than last week

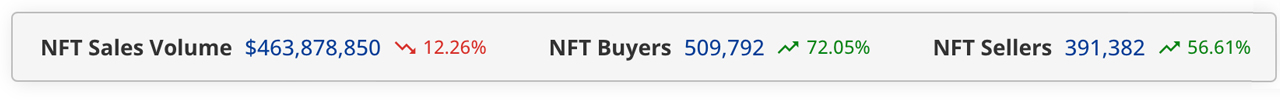

As NFT sales started to rise again and Bitcoin came to prominence since early November, this week witnessed a 12.26% drop in sales, according to figures from cryptoslam.io. Conversely, the number of NFT buyers increased by 72.05% and the number of sellers increased by 56.61%.

Seven-day statistics via cryptoslam.io.

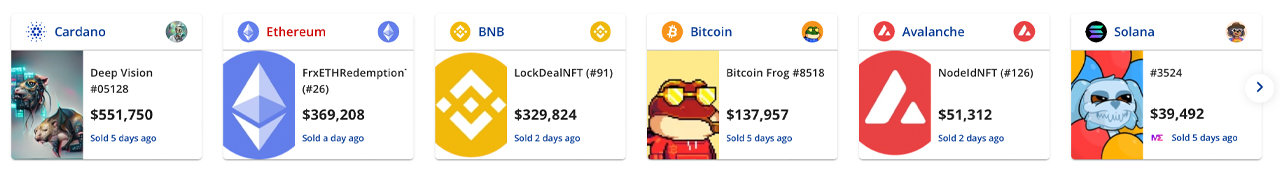

This week’s most expensive NFT, “Deep Vision #05128” on Cardano, fetched $551,750. Ethereum’s “Frxethredemption T” followed with a sale price of $369,208, and BNB’s “Lockdealnft #91” closed at $329,824.

The top six most expensive NFTs sold last week.

Bitcoin’s “Bitcoin Frog #8518” fetched $137,957, while Avalanche’s “Nodeldnft #126” and Solana’s “#3524” fetched $51,312 and $39,492 respectively, rounding out the top six most expensive blockchain NFT sales.

Of the ten leading NFT collections last week, nine came from the Bitcoin blockchain, trailing only Solana’s “Open Solmap” compilation in fifth place, with $10.24 million in sales.

Previously, Ethereum-based blue chip NFT collections such as Cryptopunks and Bored Ape Yacht Club (BAYC) dominated the sales charts. Still, BAYC dropped to 27th this week and Cryptopunks to 45th, while Bitcoin once again led the way with $265.61 million in sales, representing 57.25% of all NFT transactions this week.

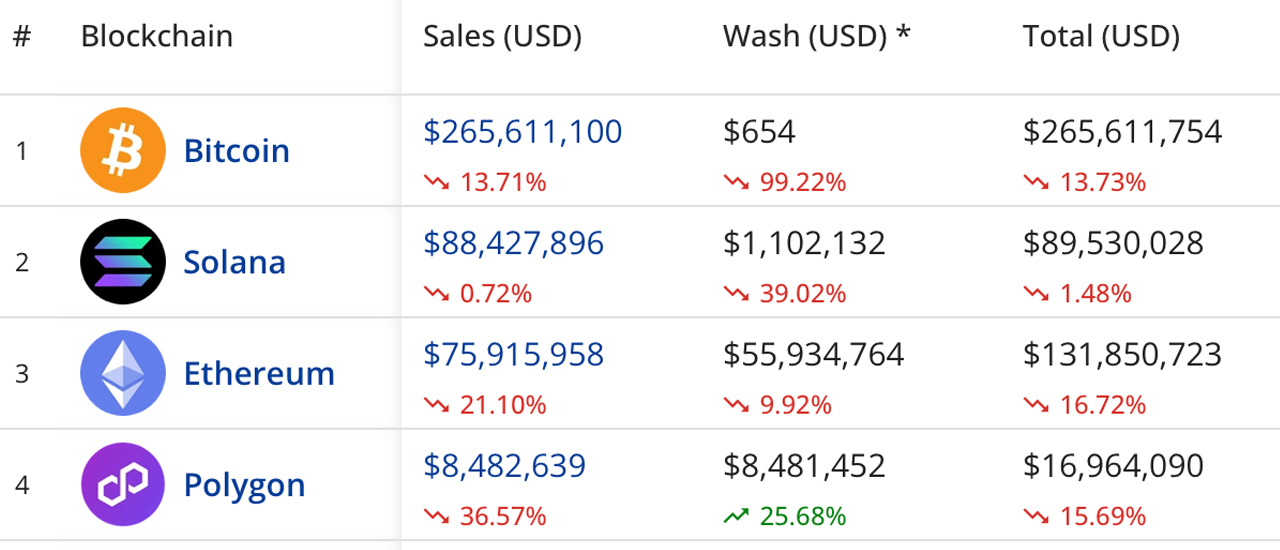

The top four blockchain networks in terms of NFT sales according to cryptoslam.io.

Solana recorded revenues of $88.42 million, while Ethereum raked in $75.91 million. A while ago, Ethereum used to enjoy the majority of NFT sales, but this week Solana’s share saw 19.06% and Ethereum’s 16.36%.

Additionally, NFT transactions on the BNB chain rose 118.84%, with Arbitrum recording a spike of 39.48% and Avalanche experiencing a 28.74% increase compared to last week. Despite the modest decline in NFT sales this week, the rise of Bitcoin-focused NFTs highlights the dynamic and ever-changing nature of the digital collectibles space.

Solana’s climb to second place further underlines the changing landscape as Ethereum takes a step back in the rankings. The recent drop in the rankings for BAYC and Cryptopunks certainly raises an intriguing question: are these once dominant blue chip NFT collections facing a significant shift in the NFT landscape, or is this just a temporary setback?

What do you think of this week’s seven-day NFT sales statistics? What are your thoughts on Ethereum NFTs taking a step back compared to Bitcoin and Solana? Share your thoughts and opinions on this topic in the comments below.