The non-fungal token (NFT) sector experienced explosive growth in 2021. Artists, investors and collectors were all swept into razoria. Nevertheless, the meteoric rise was followed by a recession, which had questions about the sustainability of the sector.

Alexander Salnikov, co-founder of Rary, believes that the market is not confronted with a collapse but rather a shift. In an exclusive interview with Beincrypto, Salnikov offered his perspective on the state of NFTs in 2025 and their role ahead.

Are NFTs still relevant in 2025, or have they followed their course?

The rise of NFTs, fed by excitement and speculation, was inevitable for a market that experienced such rapid innovation. Nevertheless, this early increase, like many emerging technologies, was followed by a correction. The hype made way for the reality of market maturation and sustainability.

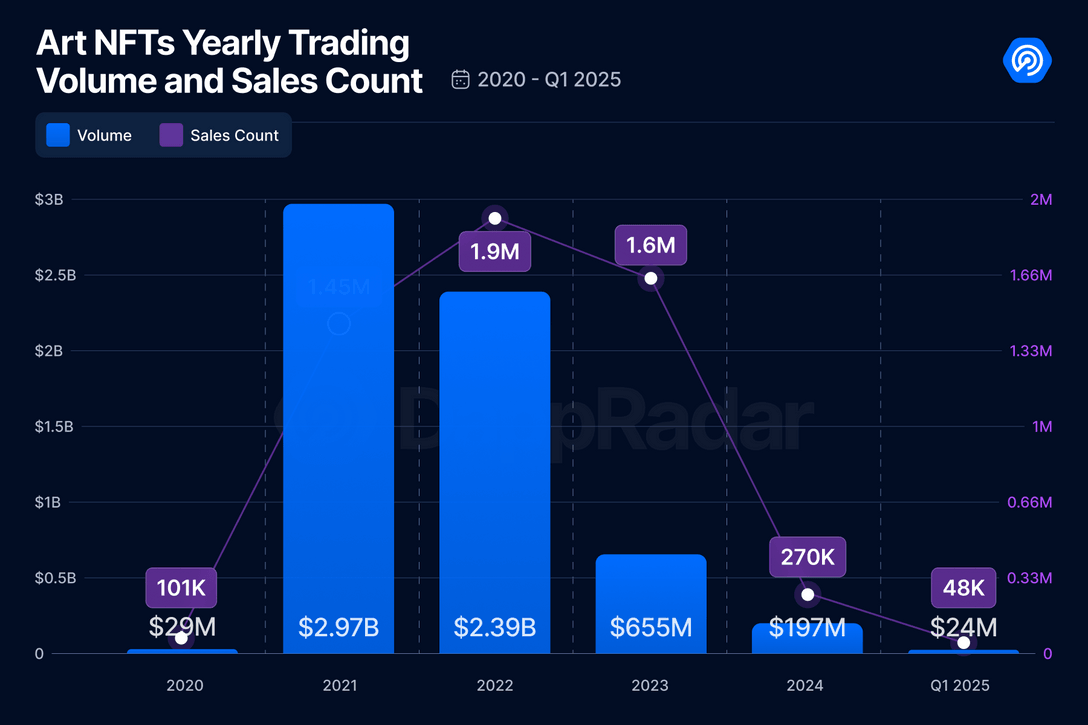

According to the latest report from Dappadar, the Art NFT market saw an impressive increase in 2021, with trade volumes that reached $ 2.9 billion. However, by the first quarter of 2025, the trade volume was registered at only $ 23.8 million, which marked a decrease of 93%.

NFT’s trade volume over the years. Source: D -appadar

Similarly, the number of active traders peaked at a record high of 529,101 in 2022. Yet this figure fell sharply by 96%, with only 19,575 active traders who remain against Q1 2025.

An earlier report from the industry of D-Appadar showed that the Underwhelming performance was not only a trend in 2025. In fact, 2024 was one of the worst performing years for the NFT market since 2020. Moreover, Beincrypto also reported on a study that was unveiled 98% of the NFT projects in 2024.

Despite the decline, Salnikov Van Rarable has retained a positive view of the sector. He emphasized the importance of a clear goal when it comes to NFTs.

“Once, after the .comburst, the headlines called that the internet was only a whim. But as more companies integrated the technology into everyday use cases, it was ingrained as part of life,” he said Beincrypto.

Salnikov fed that trust quickly when NFTs are only seen as speculative assets. Projects, on the other hand, are rooted in real community involvement or the provision of tangible utilities a clear value, making their value easily understood.

In the meantime, instead of considering the decline of the sector as a collapse, the executive power sees it as a market recovery, whereby the focus shifts from speculative hype to projects with more sustainable value.

“The speculative phase had its moment, but now we look at NFTs that evolve at the actual infrastructure – use tools -makers to build communities, products and new digital economies,” he said.

NFT’s Beyond the Hype: Unlocking Real-World Utility

Salnikov emphasized that use in the NFT room is no longer a distant concept – it is now happening. Makers use NFTs for membership, brands for loyalty programs and games for player identity.

He pointed to a growing convergence between the digital and physical worlds, where NFTs were bound to merchandise, events and even real assets. Binance Research’s report of April 2025 further confirms this trend.

The report has brought various Real-World partnerships to the attention, which points to interest in NFTs. Examples are Azuki’s physical NFT with Michael Lau, the Sandbox’s Jurassic World collaboration, Eggryptos Anime characters with Eparida and Sony’s Soneium platform together with Line to make web3 mini apps.

“The next wave of growth is not about chasing a trend – it is about unlocking new types of property and access that feel native to the internet generation,” Salnikov noted.

Although this perspective offers optimism, the reality is very different for many companies. Due to low trade volumes, large platforms such as Bybit, X2Y2 and Kraken have resorted to stop their NFT services.

Those who have not explored alternative roads. Magic Eden, for example, further expanded NFTs with the acquisition of Slingshot. Nevertheless, Salnikov rejected this strategy in which he noticed,

“We are not trying to shoot at non-NFT functions to just keep working NFT trade that actually fits the communities.”

He explained that this approach uses modular, adjustable on-chain marketplaces. Makers can adjust them to their specific target groups, whether it is a gaming project, an L3 or a Legacy brand.

“NFTs are the function they only need the right framing,” said the Raarable Co-founder.

When Fame Fades: The decreasing return of NFTs supported by celebrities

Returning was an interesting trend during the NFT -Hype era the involvement of celebrities. High -profile figures such as Justin Bieber, Madonna and Neymar jumped on the bandwagon and attracted considerable attention to the sector. Nevertheless, their investment strategies did not do very well.

In January 2022, Bieber spent 500 ETH (at that time about $ 1.3 million) on bored monkey #3001. This NFT is from the bored Ape Yacht Club (Bayc) collection of Yuga Labs.

However, according to the latest data, the NFT is only worth 13.51 WYH (around $ 24,174), a decrease of 98.1%. Although the singer has not sold his NFT, it has received little attention lately, without promotional efforts or remarkable discussions around it.

Although celebrities can draw attention to NFTs, this emphasizes the need for substance outside the name itself. As Salnikov noted, the involvement of celebrities in the sector is volatile.

According to him, a name of celebrities alone cannot replace a real creative direction or a strong community.

“Famous drops will come and go – it is the culture behind those who determine whether they are stuck,” he noticed.

He argued that celebrities who treat NFTs as purely merchandise are tracing the public. Nevertheless, when an NFT drop is intentional and is really meaningful, such as music, fashion or fandom, that is where the lasting value is found.

“We are much more interested in working with makers who build for the long term than just chasing headlines,” Salnikov revealed to Beincrypto.

The director also outlined the need for a more accessible and user -friendly approach for attracting interested users. He described that users should not feel onboarding ‘as a technical demo’. Salnikov pointed to Rariba as an example.

According to him, Rary focuses on ensuring that every marketplace built on its platform is a product that people really want to use. This includes functions such as Fiat OnRamps, cheap coins, a clean user interface and, especially, content that resonates with users.

“We don’t sell NFTs – we are experiences that happen to be Onchain,” concluded Salnikov.

Although the NFT market stands for continuous challenges, it is still to be seen whether the industry is going into a new phase of growth means or whether further obstacles will lie in its evolution.