NFT

There has not been a day since the beginning of April where the total number of sellers in the NFT market has not surpassed the total number of buyers.

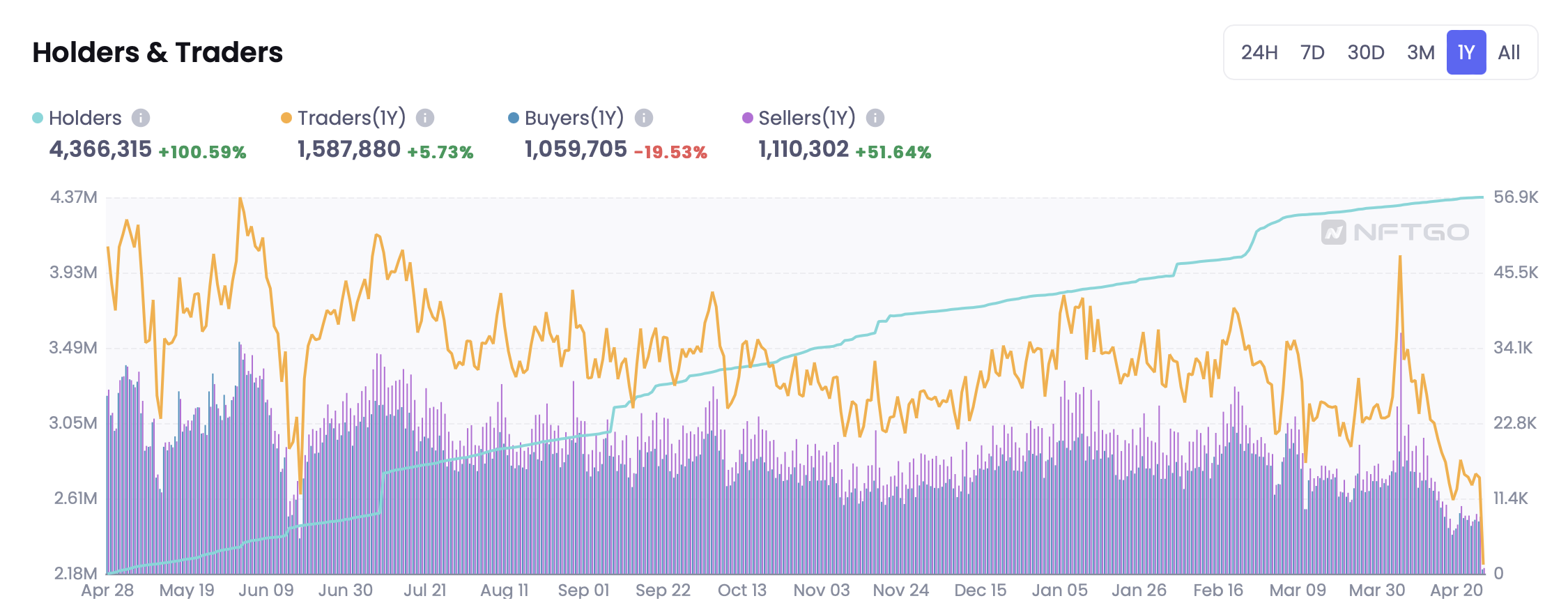

Recent market data has shown that the nonfungible token (NFT) market has consistently seen a lot of sellers during this month, without a single exception so far. Based on data from analytics platform NFTGo, there were only 7,907 buyers as of April 26, while 8,641 were trying to sell their NFTs.

A few days earlier, on April 19, the NFT market recorded its second lowest of the past year, with just 5,893 buyers – a small increase from the lowest recorded date in the past 12 months, which was June 18, 2022 was, with 5,343 buyers.

On April 5, there were many more buyers on the market – 18,495 – but there were also 36,423 sellers.

According to the NFTGo data, there has not been a day where the total number of buyers has exceeded the number of sellers within the NFT space, indicating a potential lack of demand that could be of concern to those planning to sell their NFT soon . .

The last recorded day when buyers outnumbered sellers was March 11, when there were 9,756 buyers and 9,754 sellers.

Chart showing the total number of daily buyers, sellers and holders in the NFT market. Source: NFTGo

The turbulent market conditions have been met with several community responses on Twitter so far.

In that context, Canary Labs co-founder Ovie Faruq said in a tweet on April 26 that the NFT market is currently “not functioning.”

Over the past year, daily NFT traders ranged from 20-60,000.

In the last few days it dropped to 7k

This market is not functioning. pic.twitter.com/akqKuWHmxr

— Mando (@rektmando) Apr 26, 2023

Earlier reports emerged that the NFT market recorded a significant decline on March 12, after the abrupt collapse of Silicon Valley Bank sparked much fear among traders.

Before the bank collapse, NFT trading volumes on March 10 were between $68 million and $74 million. But on March 12, they dropped to $36 million.

That drop was also accompanied by a 27.9% drop in daily NFT sales between March 9 and March 11.

Based on a March 20 CoinGecko report, the six largest NFT marketplaces saw a fourth consecutive month of wax trading increases in February, with total volume reaching $580 million.

This report indicated that the NFT market saw a 126% increase over the past month’s volume of $250 million – with the data collected attributing the overall recovery of the NFT marketplace as the main reason for that increase.