NFT

NFT marketplace Blur is growing by leaps and bounds.

Another milestone has been reached with the launch of Blend, Blur’s new lending platform.

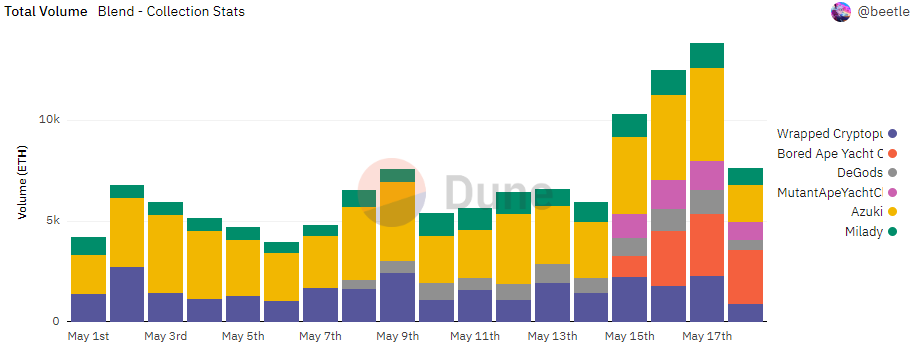

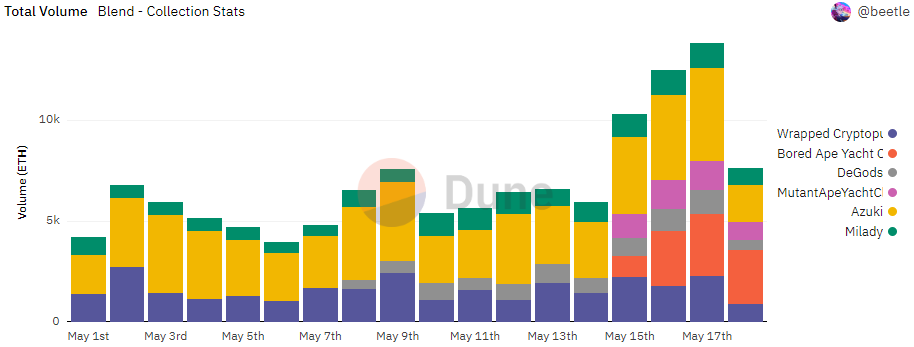

Data per Dune now shows that Blend has facilitated more than 100,000 ETH in total volume, or approximately $181 million, just 17 days since launch.

Blend allows users to take out Ethereum loans by placing their NFTs as collateral. They can then use this loan to buy new NFTs on the Blur marketplace. In return, liquidity providers receive interest, a mechanism that spawned the “NFTfi” niche in crypto.

Total volume on Blend in ETH. Source: Dune.

While the project generated more than 3,000 loans from 900 unique lenders, the addition of Bored Apes Yacht Club (BAYC) and Mutant Ape Yacht Clube (MAYC) collections on Monday sparked even more enthusiasm among NFT collectors.

These collections have been added to the four collections previously available, Azuki, Wrapped Cryptopunks, DeGods, and Miladys.

BAYC and MAYC accounted for a total volume of 2,267 ETH on the first day. On Wednesday, BAYC was the third most traded collection on the platform with a volume of 3,082 ETH, just behind Azuki (4,616 ETH) and Wrapped Cryptopunks (2,260 ETH).

Azuki remains the top collection in total volume, with over 50,000 ETH, which is almost half of the total volume since the service was created.

Currently, Blend does not charge borrowers or lenders. However, Blur has indicated that token holders could vote to introduce fees after a period of 180 days.

Blur’s bumpy start

Launched last fall, Blur quickly became the most popular NFT marketplace, accounting for nearly 59% of the total NFT transaction volume to date.

However, some suspect that the platform is harboring wash trading activity, especially during the token launch of the platform.

Indeed, according to analyst Hildhobby, Blur only accounted for 14,575 traders, compared to 46,353 on Opensea.

Blur Launches Highly Anticipated Token Airdrop for Ethereum NFT Traders

In late February, CryptoSlam, an NFT sales tracking platform, announced that it would remove $577 million worth of Blur transactions from its data due to “market manipulation”. The platform also said it will filter future Blur transactions on its platform through an updated algorithm that excludes what it considers suspicious sales.

Nevertheless, Blend’s success only strengthens Blur’s position, which looks set to establish itself as a major player in the NFT ecosystem in the long run.