Non-fungible tokens (NFTs) emerged as the poster children of a digital renaissance. As the hype reached its peak during the 2021 bull run, the NFT market saw a monthly trading volume of nearly $2.8 billion in August 2021. But in July 2023, the tone has changed dramatically.

Weekly traded values fell to around $80 million, marking a significant contraction. Against this backdrop, recent research has revealed a surprising reality. Most NFTs trade at a zero Ethereum (ETH) market cap, making them “worthless.”

NFTs are becoming “worthless”

The meteoric rise of NFTs has been hailed as a new frontier for the cryptocurrency industry. However, now that the dust has settled, the market is in a bear run. Many NFT projects are struggling to find buyers amid a bleak view of future values.

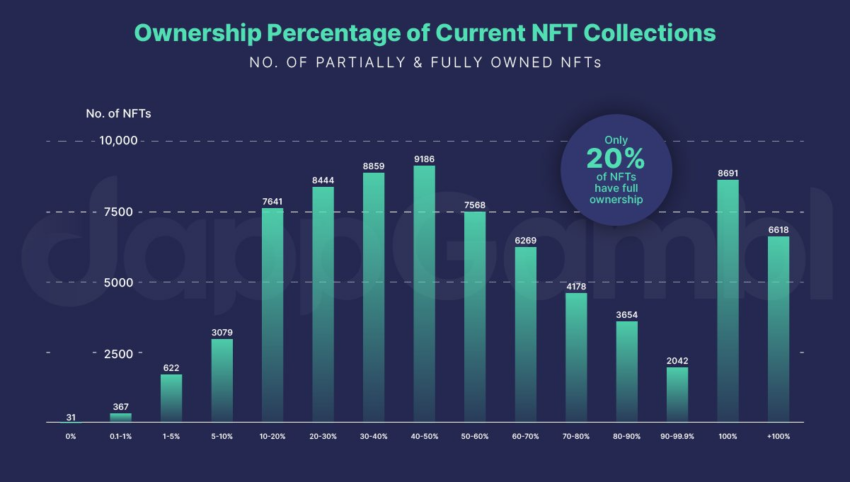

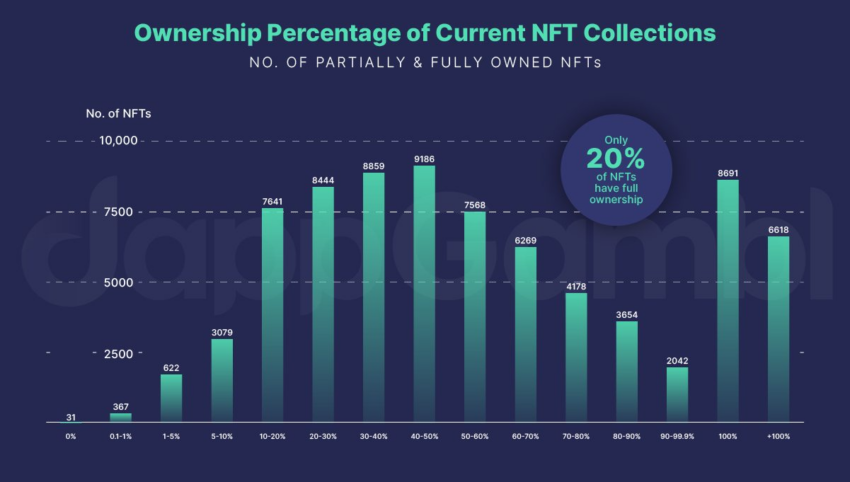

The data, derived from extensive analysis of more than 73,000 NFT collections, reveals a sobering story that stands in stark contrast to stories of multimillion-dollar deals and overnight success. Of the NFT collections analyzed, only a paltry 21% were fully claimed or had greater than 100% ownership, leaving 79% unsold.

“Almost four in five do [NFTs] remained unsold. This situation indicates a significant imbalance between the creation of new Non Fungible Tokens (NFTs) and the actual demand for these digital assets,” the report said.

Read more: Where to Sell NFTs: Top 15 NFT Marketplaces

This imbalance between the wave of new NFTs and actual demand represents a critical problem of oversupply, creating a buyers’ market. In such an environment, discerning investors are increasingly examining the uniqueness, potential value and story behind NFT projects before taking the plunge.

“95% of people who own NFT collections are currently holding worthless investments. Looking at these figures, we estimate that this 95% includes more than 23 million people whose investments are now worthless,” the report said.

NFTs property. Source: DappGambl

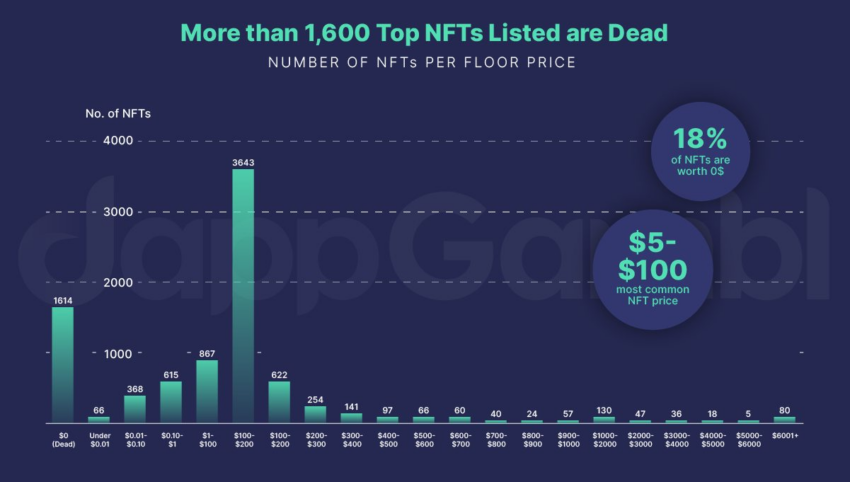

A closer look at the top 8,850 NFT collections, as listed on CoinMarketCap, revealed a continuation of this disturbing trend.

Even among these successful projects, 18% have a floor price of zero, while only 1% have a price above $6,000. This reality is a far cry from the ridiculous multi-million dollar deals that once dominated the headlines. It then spotlights the nature of value in a market driven by speculation and volatile trends.

Read more: 7 Most Common NFT Scams

MacContract on Ethereum, a project with a floor price of $13,234,204.2 but with a paltry all-time revenue of $18, is an example of a glaring gap between quoted prices and real-world transactions. Such fissures expose the speculative vein that runs through parts of the NFT market. Essentially, quoted prices often lack tangible demand or trading history.

This trend, which is indicative of speculative and hopeful prices that are alienated from actual trading dynamics, could potentially mislead new or uninformed investors.

Are NFTs dead too?

The study also spotlighted the carbon footprint of NFTs. The energy consumed in manufacturing the assets of 195,699 NFT collections with no clear owners or market share equated to a carbon footprint comparable to the annual emissions of 2,048 homes.

As the story around sustainable digital technologies grows louder, the NFT space is under the scanner. Particularly NFTs that have no apparent utility or real artistic value.

The rise and subsequent fall of NFTs provide a cautionary tale of hype cycles in the crypto market. As speculators look for the next gold rush, the question remains whether these NFTs didn’t have a real use case that killed them.

Read more: How to Start NFT Trading: A Step-by-Step Guide

NFTs listed. Source: DappGambl

Amid the allure and glitz, the story of NFTs is a stark reminder to creators and investors. It is an example of meaningful value and the dangers of speculative madness.