Reason to trust

Strictly editorial policy that focuses on accuracy, relevance and impartiality

Made by experts from the industry and carefully assessed

The highest standards in reporting and publishing

Strictly editorial policy that focuses on accuracy, relevance and impartiality

Morbi Pretium Leo et Nisl Aliquam Mollis. Quisque Arcu Lorem, Ultricies Quis Pellentesque NEC, Ullamcorper Eu Odio.

Este Artículo También Está Disponible and Español.

ONDO Finance (ONDO) has experienced heavy sales pressure and increased volatility, because the wider cryptomarkt continues its downward trend. Since the beginning of March, ONDO has lost more than 40% of its value, which reflects the total risk-off sentiment on the market. With fear that dominates the price action, analysts warn of further falls, because investors hesitate to re -introduce long positions.

Related lecture

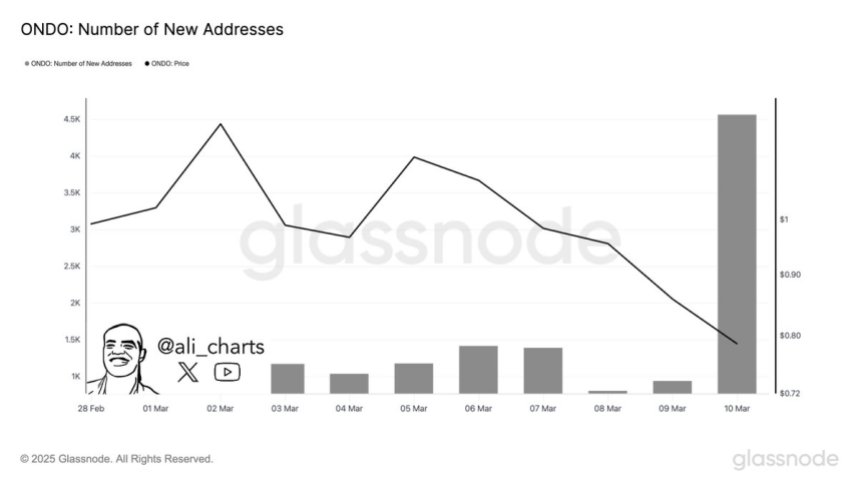

Despite the current downward trend, data about chains from Glassnode reveals a remarkable shift in network activity. New ONDO addresses rose with 390%in the last 24 hours. This peak in new addresses suggests that interest in ONDO financing is growing even if a price promotion remains weak. Historically, increased network activity can be a forerunner for stronger acceptance, which may make it possible to determine the price in the long term.

With the market sentiment that still leans Bearish, will be crucial in the coming days for the Short -term Procedure of ONGO. Investors follow the question of whether the rising network activity translates into renewed question whether that sales pressure will continue to weigh on price action.

ONDO leads the RWA market despite volatility

In the past year, ONDO Finance has established itself as one of the leading crypto projects, so that his position such as the Real-World Assets (RWA) market leader is safeguarded. The project has been given a considerable traction by offering tokenized financial products, whereby traditional finances with blockchain technology bridge.

They have recently taken an important step forward by revealing the ONDO chain, designed a permitted low-1 blockchain for institutional financing. This innovation is intended to bring regulated institutions into the digital assets space, to improve efficiency and security and at the same time guarantee compliance with financial regulations.

Top analyst Ali Martinez shared insights on XRevealing that new ONDO addresses have risen by 390% in just 24 hours, from 935 to 4,559. This peak in network activity may indicate a shift in the sentiment of investors, which suggests that ONDO can be achieved for strong performance as soon as the market stabilizes. Historically, increasing the acceptance of network was a bullish signal, often prior to price recovery.

Despite the current decline of the market, the basic principles remain strong. The project continues to expand, attracting institutional importance and strengthening his role as an important player in the growing RWA sector.

Related lecture

With institutional financing that embraces blockchain solutions and network activity, ONDO remains a strong competition for future growth. If market conditions become favorable, the project could arise as one of the best artists in the next bull cycle, powered by the continuous innovation and expansion of the ecosystem.

Bulls Monitor Key Support

ONDO is currently being traded at $ 0.83, after he has erased all the profit from the rally after the elections that started in November 2024. After months of steady growth, ONDO is imprisoned in the wider market, confronted with sales pressure and uncertainty if investors reconsider the risk.

For bulls to get the check back, ONDO must retain above the support level of $ 0.75 to create a strong basis for recovery. Consolidation at these levels can help stabilize the price promotion, but with the market still down, this process can take longer than expected. If buyers do not have $ 0.75, ONDO further downward risks can be confronted, thereby extending the correction.

Related lecture

However, if ONDO applies above the level of $ 0.80, Bulls must strive for a push to $ 0.95, an important level of resistance that can indicate the start of a recovery phase. With new address growth, which points to increased network activity, ONDO can be well positioned for a rebound as soon as market sentiment improves. For the time being, traders or ONDO can defend his support levels or that continuous weakness will send it lower in the short term.

Featured image of Dall-E, graph of TradingView