In the rapidly evolving landscape of blockchain technology, Neon EVM is a smart contract on Solana (SOL) has emerged as a frontrunner by introducing a groundbreaking parallel processing architecture to its mainnet.

This approach has enabled Neon EVM to achieve improvements in performance, scalability and efficiency, according to a press release with NewsBTC.

Neon EVM dominates transaction processing

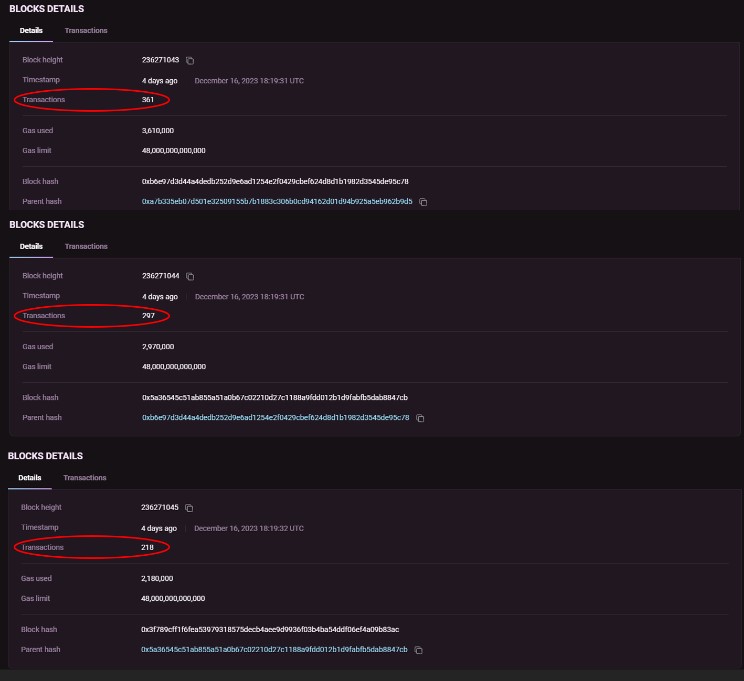

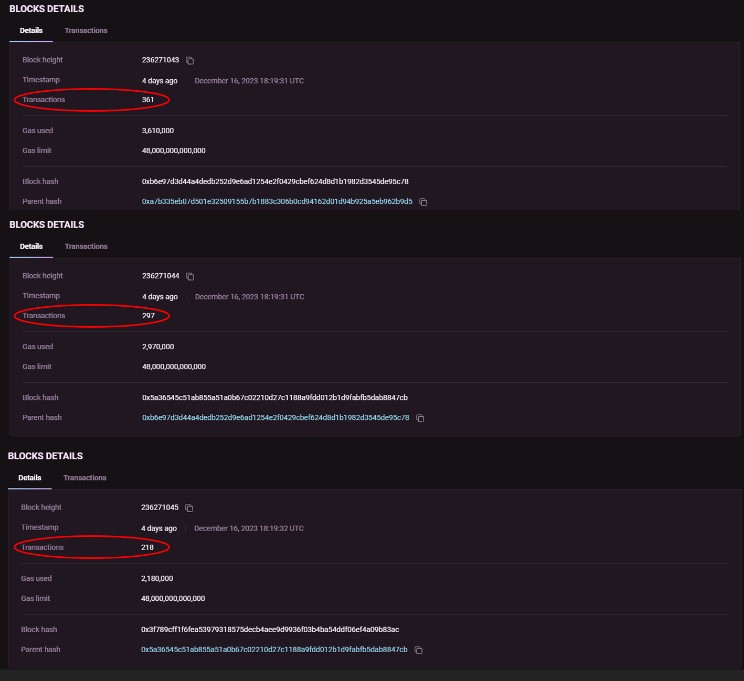

Neon EVM, the first parallel Ethereum virtual machine (EVM) on the mainnet, has reached a record 730 transactions per second (TPS) on its mainnet. Remarkable, this is the first time such high TPS has been achieved on an EVM mainnet.

Related reading: Renewed Hope for Crypto: 2023 Sets the Stage for a Monumental 2024

The milestone was reached on December 16, 2023, when Neon EVM’s mainnet demonstrated its transaction processing capabilities. While many blockchains show high TPS on testnets, Neon EVM stands out by improving its scalability.

Neon EVM, which went live on the mainnet in July 2023, functions as a fully Ethereum-compatible environment on the Solana blockchain. Since its launch, Neon EVM has attracted interest from investors, resulting in multiple listings on platforms such as ByBit, Crypto.com and Gate.io.

Given these developments, the utility token NEON has experienced remarkable growth, with its value increasing from $0.67 to $1.45 in just three days, representing an increase of 116%.

Neon EVM’s success comes as there is growing interest in blockchains with high speed and parallel processing. Currently, Neon EVM is the only parallel processing EVM live on the mainnet, demonstrating its TPS capabilities compared to other blockchain networks.

Exceeds Ethereum’s transaction speed

The fundamental difference between Neon EVM and blockchains such as Bitcoin and Ethereum lies in their transaction processing approach. While Bitcoin and Ethereum process transactions sequentially, Neon EVM enables simultaneous processing of multiple transactions, enabling greater throughput and reducing the likelihood of congestion during periods of high demand.

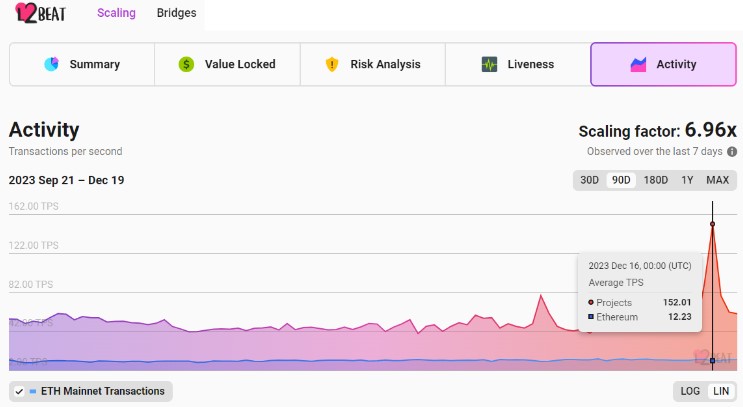

In a notable comparison, Neon EVM’s parallel processing architecture outperformed the combined tps of the entire Ethereum ecosystem on December 16, as reported by L2Beat.

The project’s commitment to Ethereum compatibility on the Solana blockchain and its fast transactions and low-cost benefits position Neon EVM as an interesting project as a new Bull Cycle emerges.

Layer 2 scale solutions emerging

Polygon, the layer 2 scale solution which works alongside the Ethereum blockchain has also demonstrated its capabilities in transaction processing speed.

In a recent one after on X (formerly Twitter), Sandeep Nailwal, the founder of Polygon, shared notable statistics highlighting the network’s performance. According to Nailwal’s post, Polygon’s Proof of Stake (PoS) chain seamlessly processed more than 16 million transactions in a single day, demonstrating its scalability and efficiency.

During the peak period the Polygon PoS chain achieved a throughput of 255 tps. This figure is approximately 2-3 times higher than the combined throughput of the entire Ethereum ecosystem.

Related Reading: XRP Whales Show Currency Inflow Activity, Bad Sign for the Price?

Furthermore, validators on the Polygon network generated approximately €1 million in transaction fees in a single day, reflecting the high level of activity of the network. However, it is worth noting that gas rates spiked during this period, which is a broader issue that impacts the entire Ethereum ecosystem.

In terms of validator rewards, block rewards on the Polygon network amounted to over 155,000 MATIC tokens. This translates into significant revenue for validators, totaling approximately 1.2 million in one day. These rewards incentivize validators and contribute to the overall security and stability of the PoS chain.

The spike in transactions in both Layer-2 networks demonstrates the growing importance of scalability solutions. In the coming months, hundreds of new users could enter the crypto market through one of these solutions, signaling a potential upside for their underlying tokens.

Featured image from Shutterstock, chart from TradingView.com

Disclaimer: The article is for educational purposes only. It does not represent NewsBTC’s views on buying, selling or holding investments and of course investing involves risks. You are advised to conduct your own research before making any investment decisions. Use the information on this website entirely at your own risk.