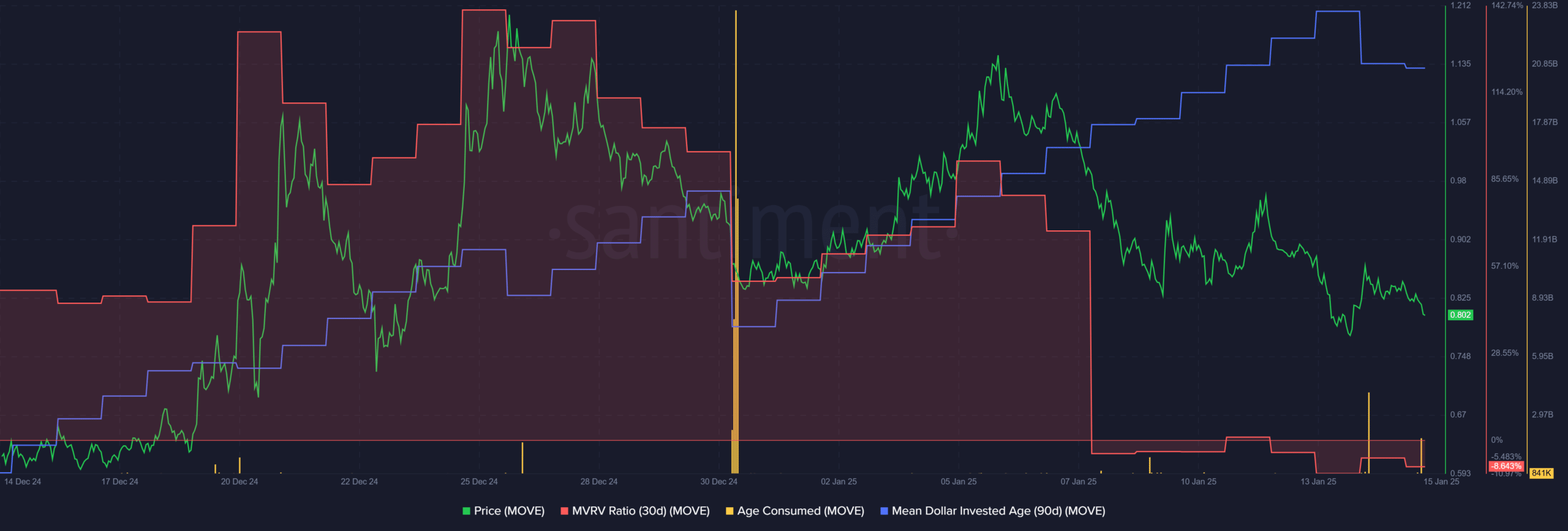

- MOVE fell below short-term lows and has not yet regained it

- The rising MDIA meant no new investments coming in and holders not moving their tokens

Movement [MOVE] saw an 11.16% increase in 16 hours after Monday’s low of $0.786. This was followed by a 9% drop in the last 36 hours. The end result was that MOVE was less than 1% off Monday’s lows at the time of writing.

Meanwhile, Bitcoin [BTC] is up 8.7% from Monday’s low. The $92.4k region was firmly reclaimed as a demand zone and BTC appeared to be heading towards its $102k resistances. The disparity in the price movements of both assets was illuminating. Mainly because it underlined the relative weakness that MOVE showed.

When searching Movement’s signals, the bears have an advantage

Source: MOVE/USDT on TradingView

The 4-hour price chart showed a nearly one-month range from $0.83 to $1.13. As previously highlighted, the recent rebound was not enough to reclaim the range lows as support. The subsequent drop below $0.83 was also a worrying sign.

Over the past two weeks, the A/D indicator has also moved lower. This steady downward trend indicated continued selling pressure and buyer weakness. It seemed likely that MOVE would fall to $0.728 or lower in the coming days.

The on-chain metrics weren’t bullish either. The 30-day MVRV ratio was slightly negative. This meant that short-term holders have less incentive to sell their holdings because they are already making losses. However, this would only be a small consolation.

The age consumed was also quiet in January. The metric spikes when a large number of tokens, or older tokens, are moved. The larger the spike, the larger the collective age of the tokens moved.

Read Movement [MOVE] Price forecast 2025-26

The average investment age of 90 days in dollars also showed a steady upward trend. This hinted at holders not moving their coins, and could be an indication of network stagnation.

Since Movement has only been trading for a little over a month, the MDIA’s uptrend is not a problem for the bulls. However, it is possible that strong price increases will follow the MDIA downturn.

![Movement [MOVE] fails to regain key levels – sell-off looming?](https://free.cc/wp-content/uploads/2025/01/Movement-Featured-1-1000x600.webp)