Data maintained by 21.co shows that $1.08 billion in Treasury bills have been tokenized via public blockchains.

This figure has increased almost tenfold since January 2023, amid rising interest rates globally.

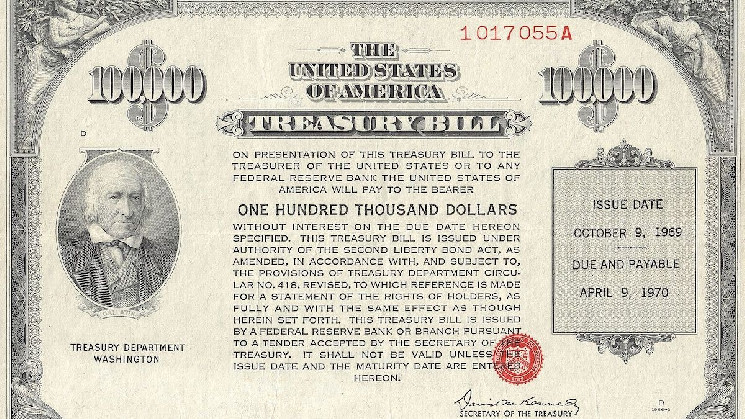

The market for tokenized US government bonds is booming.

The market value of Treasury bills denominated on public blockchains such as Ethereum, Polygon, Valanche, Stellar and others has topped $1 billion for the first time, according to data tracked by Tom Wan, an analyst at crypto firm 21.co.

Tokenized Treasuries are digital representations of US government bonds that can be traded as tokens on the blockchain. Its market value has increased almost tenfold since January last year and by 18% since traditional finance giant BlackRock announced Etheruem-based tokenized fund BUIDL on March 20.

At the time of writing, BUILD is the second largest fund of this type, with a token value of $245 million, trailing only Franklin Templeton’s Franklin OnChain US Government Money Fund (FOBXX) – one share of which is represented by the BENJI -token – which was the leader. with $360.2 million in deposits.

“It just happened, a total of $1 billion in tokenized US Treasuries on public blockchains. Blackrock’s BUIDL rose 400% from 40 million to 240 million supply in a week,” Wan wrote on Now, Ondo’s OUSG is fully supported by BUIDL.”

The rapid rise in government bond yields over the past two years has fueled demand for their tokenized versions. The 10-year yield, the so-called risk-free rate, has risen from 1.69% to 4.22% since March 2022, eroding the appeal of lending and borrowing dollar-pegged stablecoins in the decentralized financial market.

Investing in tokenized Treasuries can help crypto investors diversify their portfolio, allowing them to settle trades on any given day.

“The beauty of tokenization, [is] you can handle the transaction 24/7,” Wan said.