- In accordance with knowledge from Bloomberg, cash flowing out of crypto exchange-traded funds has slowed down by 97% in Q3 in comparison with Q2.

- Traders pulled $17.6 million from crypto ETFs in Q3 compared to a document withdrawal of $683.4 million from the ETF in Q2.

The second quarter of 2022 noticed document withdrawals from crypto exchange-traded funds with a withdrawal of $683.4 million, which affected the value of Bitcoin and different cryptocurrencies. Bitcoin’s value has seen a 60% lower that quarter, posting a document low of $17,785 on June 17 based on knowledge from Coingecko.

Bloomberg knowledge reviews that Q3 of 2022 noticed a lot fewer gross sales, indicating that capitulation could have occurred and bearish buyers at the moment are already out of dangerous belongings reminiscent of BTC, Ethereum, and others.

ETF Strategist at Strategas securities acknowledged for Bloomberg:

“I’m wondering if the second quarter was the ‘get me out a part of these funds,”

In accordance with Sohn, the third quarter could have been the place the “laggards” and buyers who had been “preserving the religion mentality” at the moment are out.

Markets have declined in latest months as central banks have elevated rates of interest to curb inflation.

Bitcoin Witnessed An Improve In Quantity This Quarter In opposition to GBP

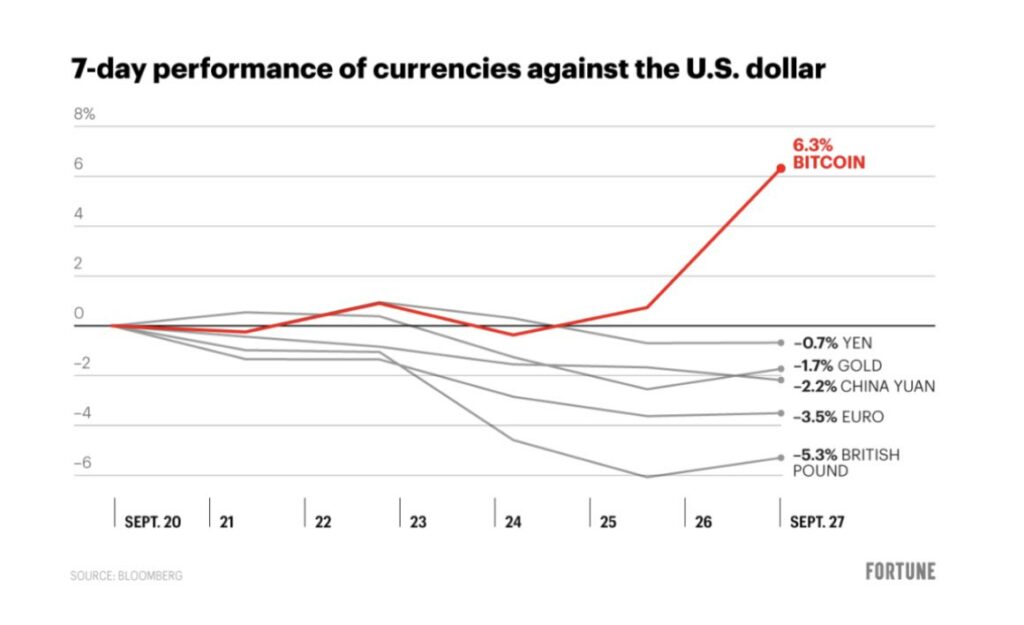

Bitcoin lately witnessed elevated buying and selling quantity in opposition to GBP because the fiat currencies confirmed weak spot. Bitcoin buying and selling quantity recorded an all-time excessive on Sep 28, 2022, because the UK’s fiat forex was threatened.

Bitcoin has been outperforming different main currencies previously week, with a constructive improve of 6.3%. Will this outperformance proceed to carry, and are buyers getting “orange-pilled” on Bitcoin whereas shedding religion in fiat forex? That is one thing we are going to proceed monitoring and see the way it unfolds.