- Crypto -Mijnbouw Shareds have lost $ 12 billion, despite the stability of Bitcoin

- Decoupling between mining shares and Bitcoin can predict volatility and deeper market stress

Crypto -mining shares have taken a sharp hit, which have dropped more than $ 12 billion in market value and return to the beginning of 2024. What is particularly remarkable is not only the scale of the drop, but the timing – despite Bitcoin’s [BTC] Relative price stability. This decoupling between mining stocks and BTC gives concern. Especially since it often precedes periods of market turbulence.

Could this be a sign of raw waters for the crypto sector?

The $ 12 billion retreat

Source: Alfractaal

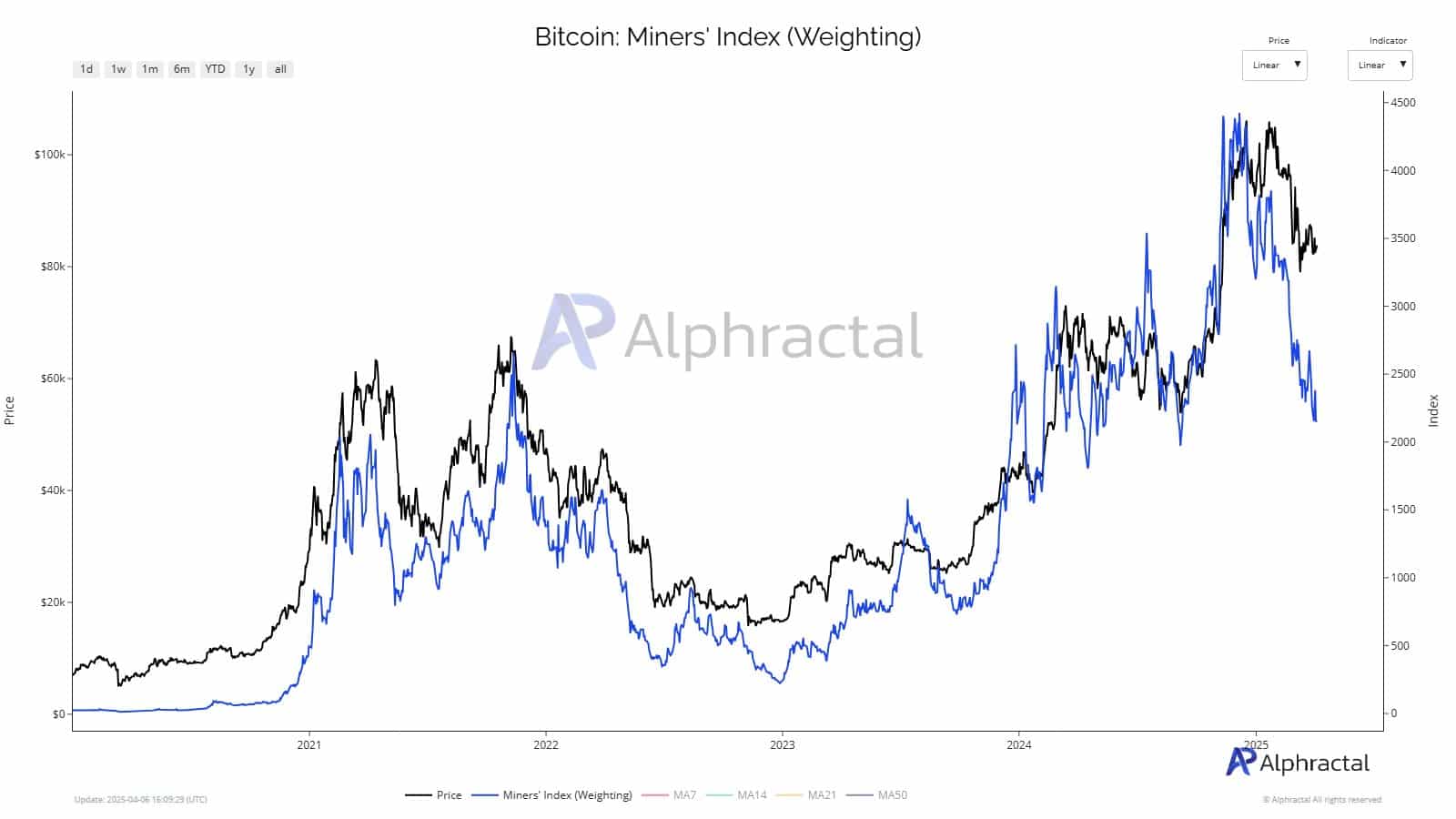

Bitcoin mining shares have lost more than $ 12 billion in market value since February, from more than $ 36 billion to less than $ 24 billion-it-all erases of all profit at the beginning of 2024. The most important miners have seen sharp decreases with double digits.

What is remarkable is that this dive comes, even if the price of Bitcoin remains relatively stable.

Disconnect from BTC – a red flag?

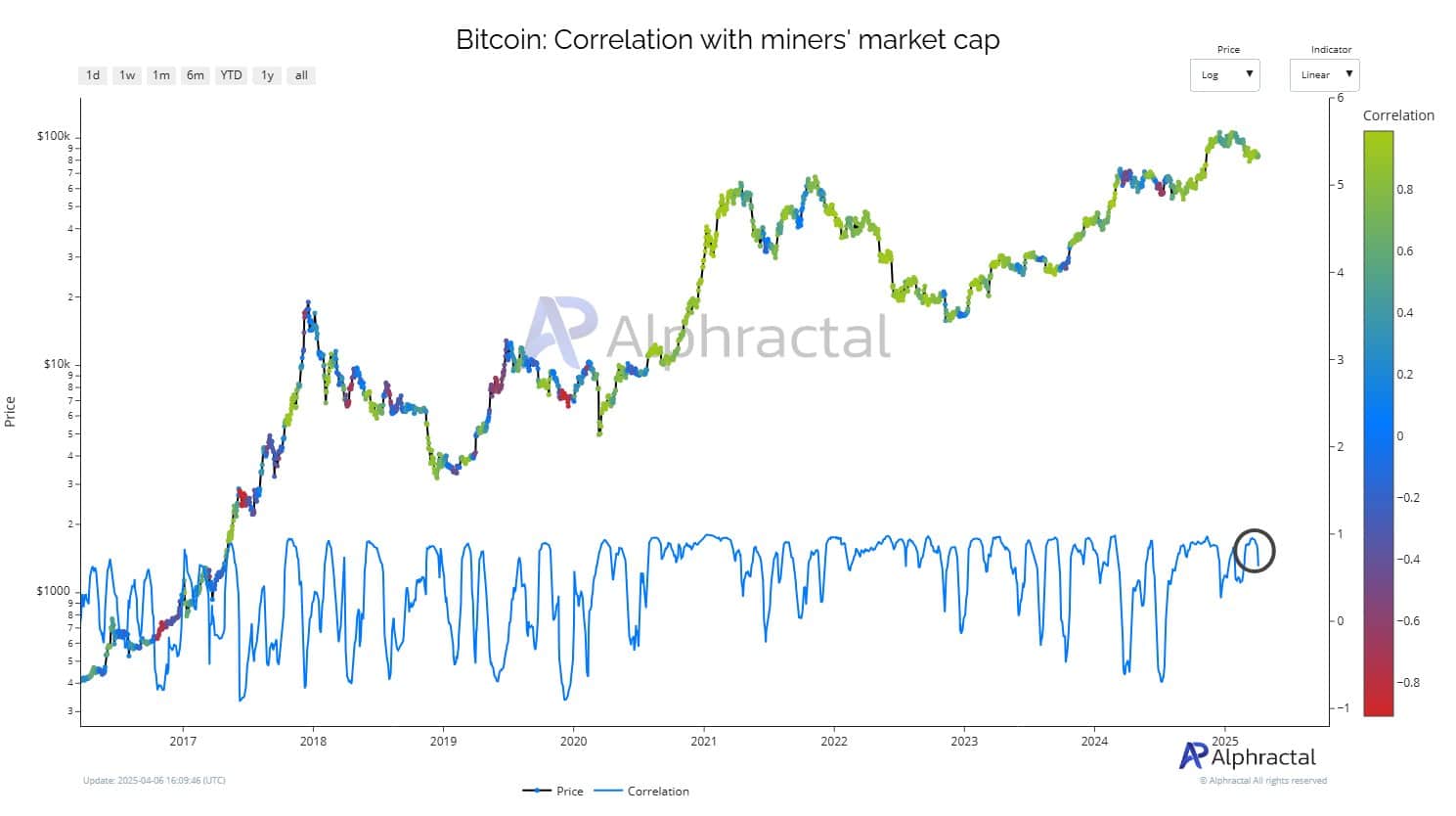

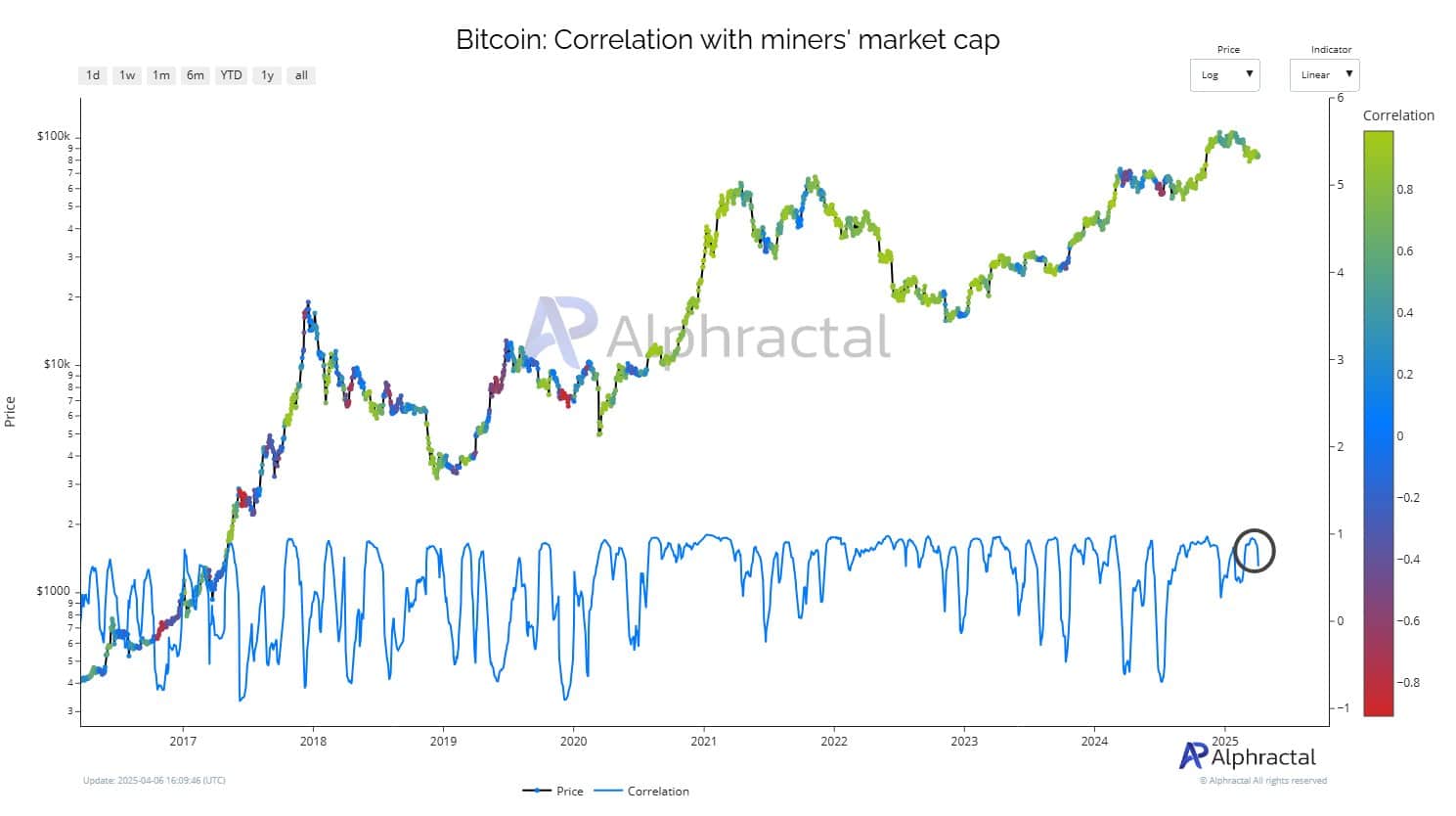

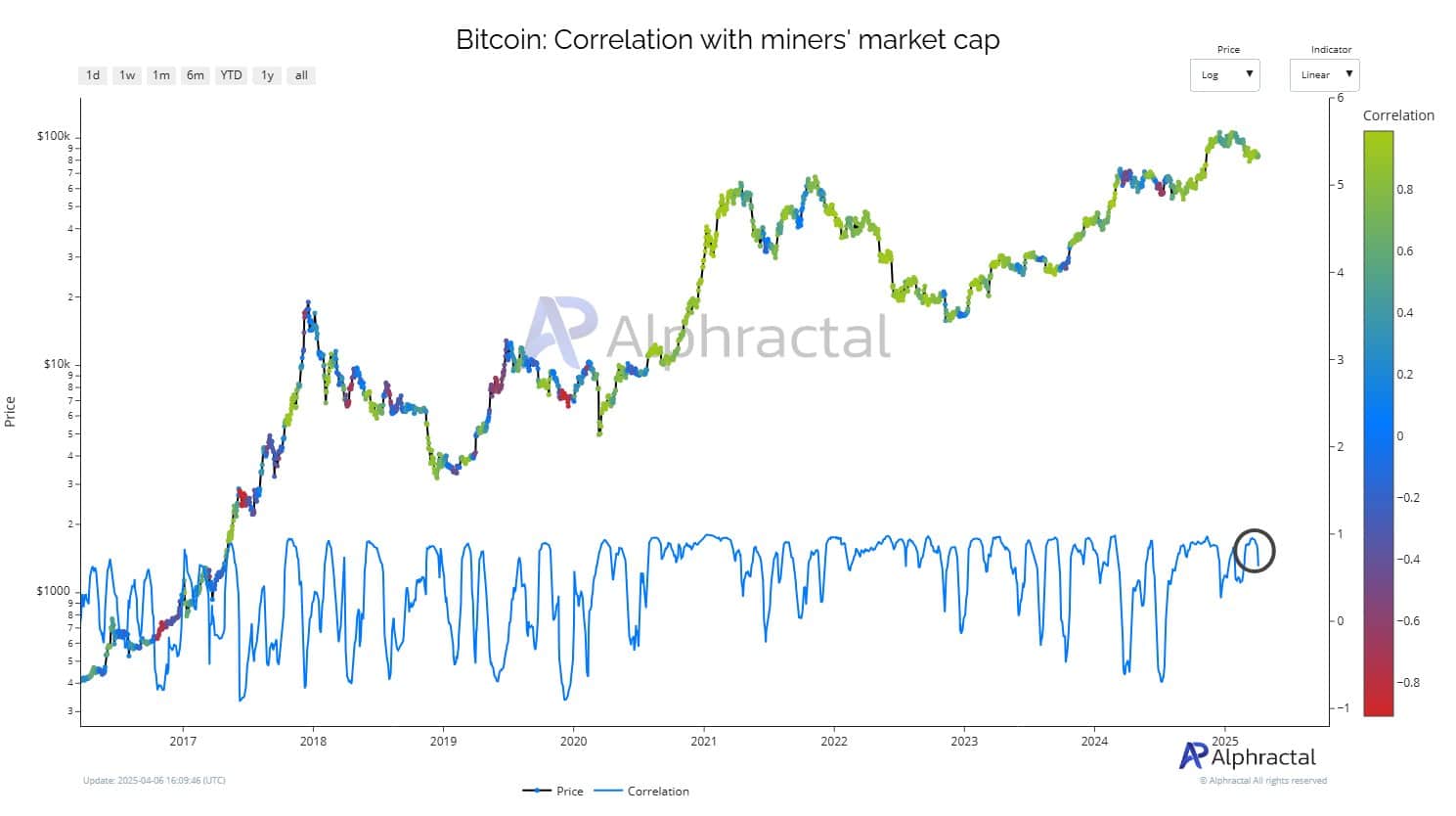

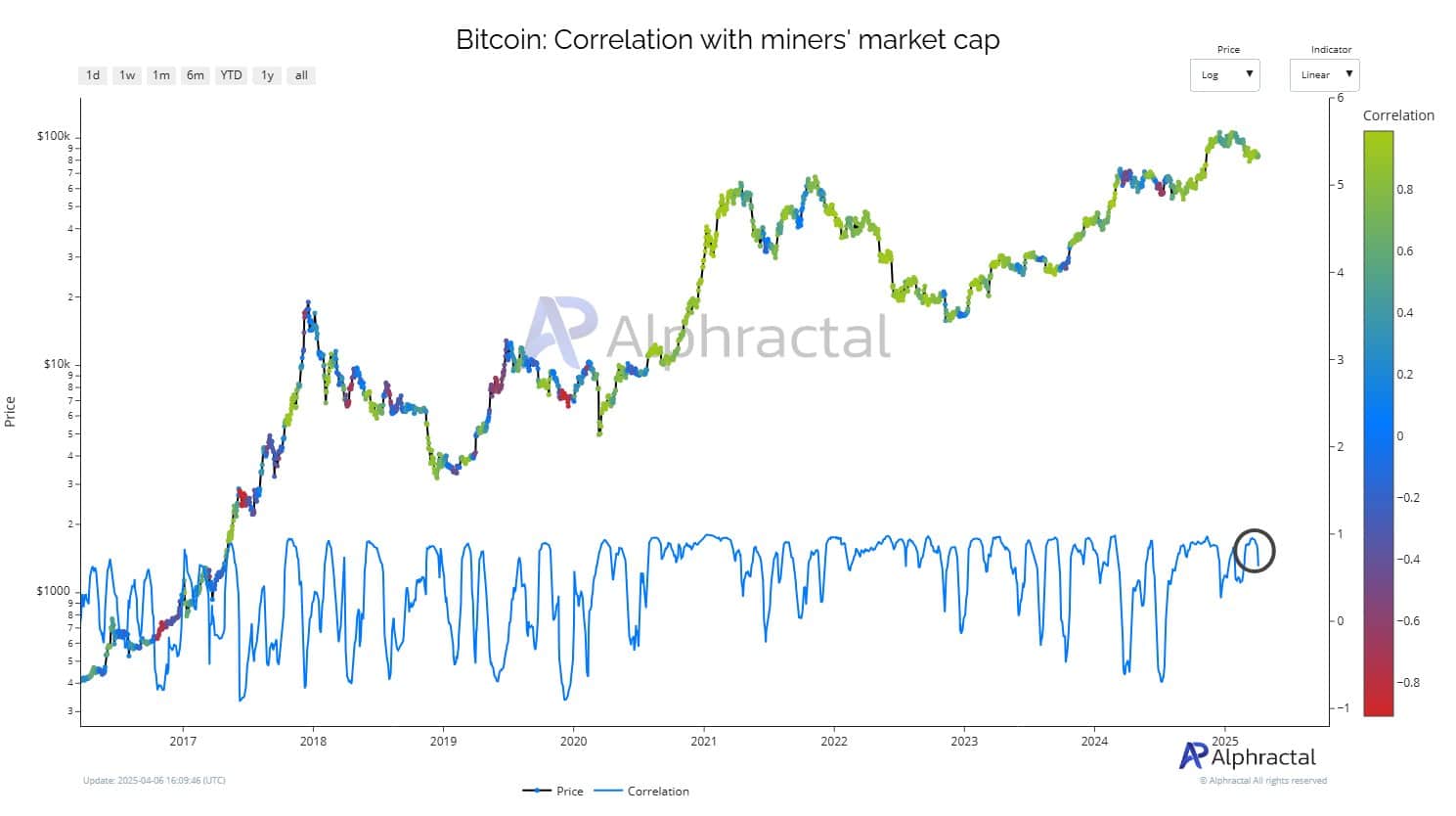

Miners break away From Bitcoin – and not in a good way. Despite the fact that BTC is held above its $ 65k support, the ratings of the miner shares have fallen, causing a steep decrease in correlation.

In fact, the data underlines that the correlation between the price of Bitcoin and the market capitalization of miners fell sharply, approaching for the first time since mid -2022.

Source: Alfractaal

Historically, such deceling preceded Volatility peaks or directional shifts in BTC.

Whether this is a market re-evaluation of miners, structural stress for the halving or wider sentiment cracks indicates this time this time feels different.

The profitability and sentiment of miners under pressure

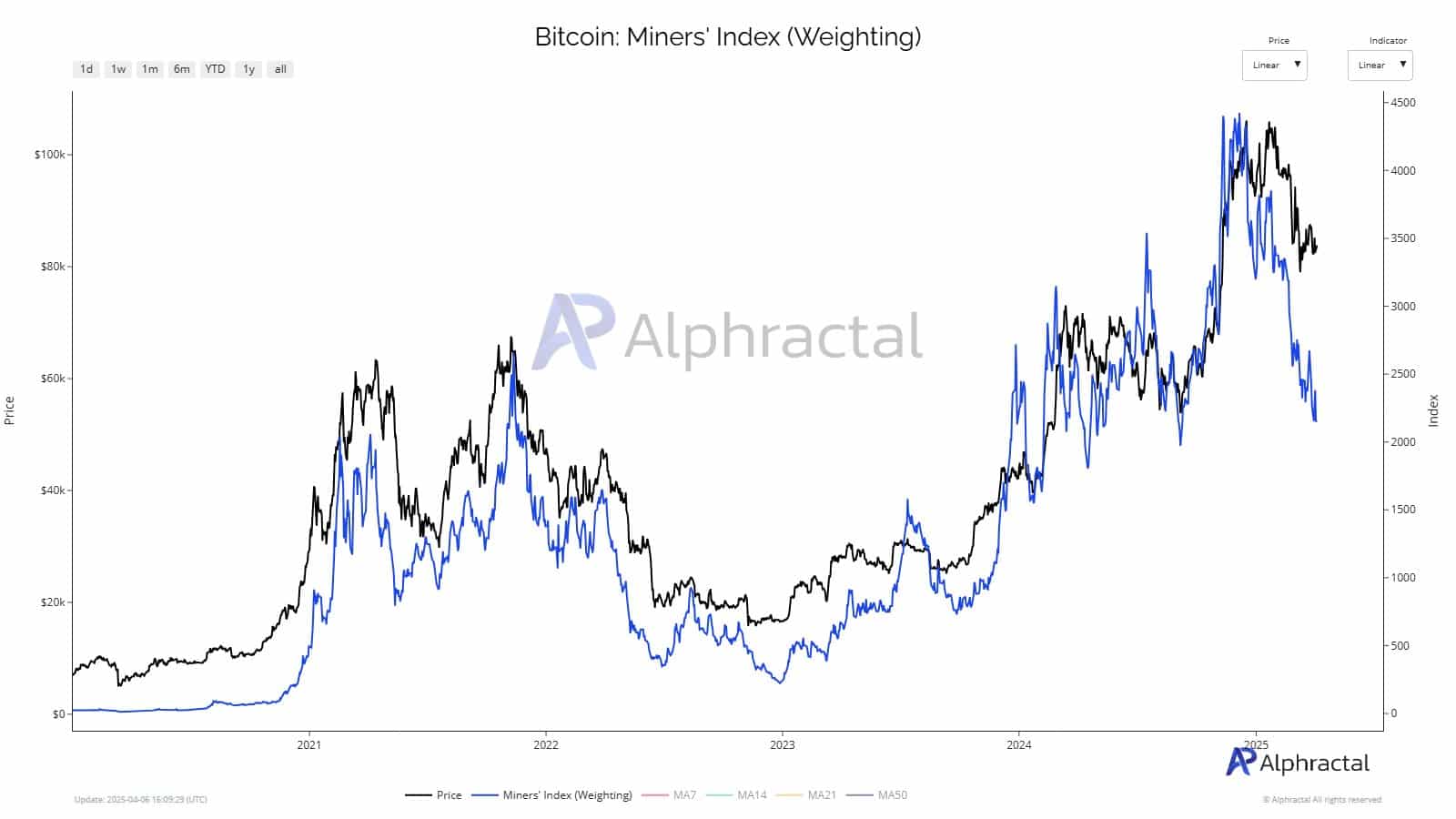

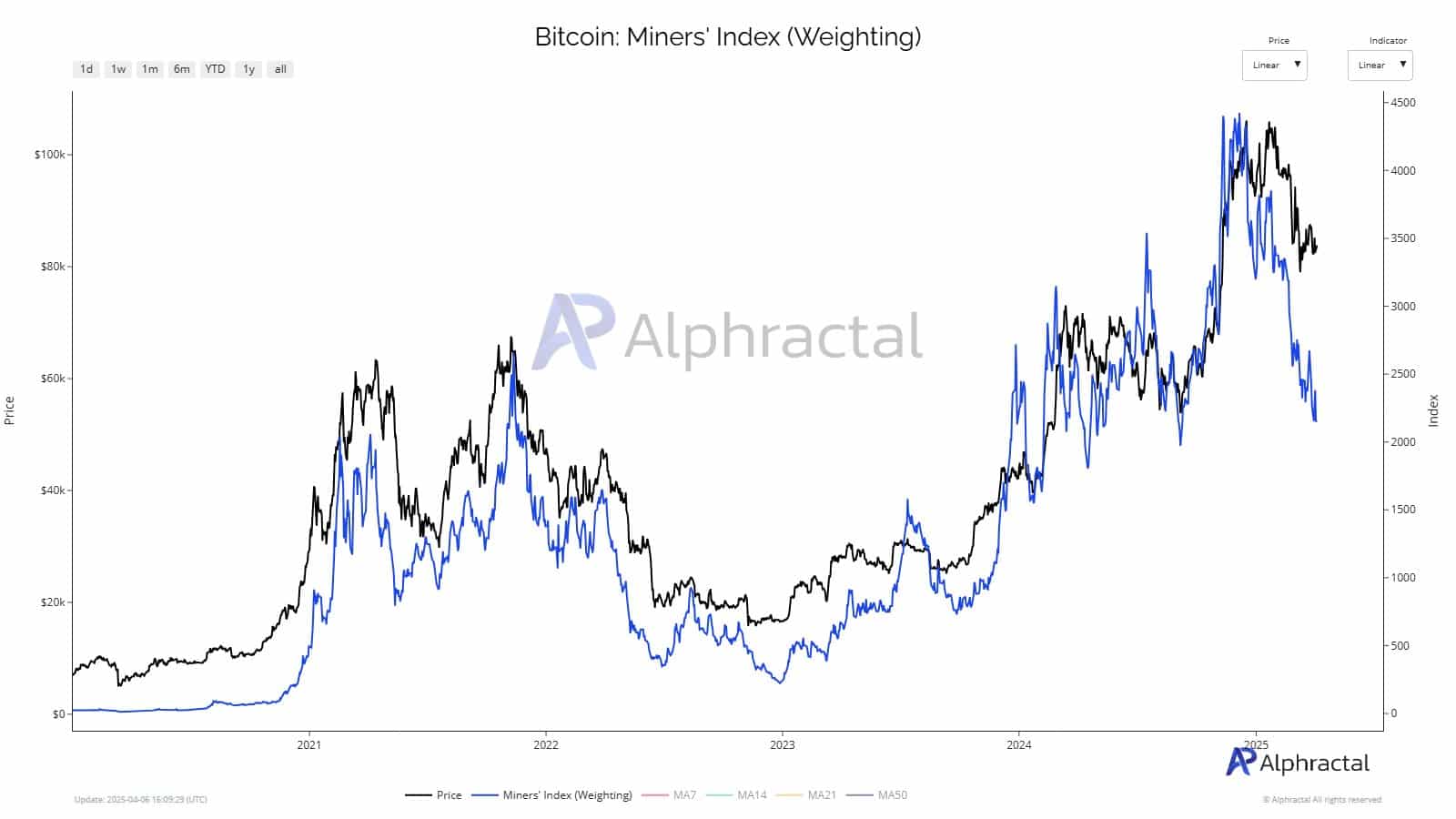

Postal-having economy, rising energy costs and trade-related uncertainty, especially around the tariffhints of President Trump squeezing bitcoin miners. The miners’ index emphasized a competitive decoupling of the price of Bitcoin and reflects deep stress in the sector.

At the same time, the appetite also seems to shift.

Source: Alfractaal

According to Galaxy DigitalFor example, spot Bitcoin ETFs receive favor and offer exposure without the operational and regulatory risks that are linked to mining companies.

CEO Mike Novogratz has also emphasized ETF-driven inflow as an important bullish force for BTC in 2025. With capital that runs from my work resources, miners can be confronted with a sentiment winter, even as Bitcoin meetings.

What this means for the wider market

The decoupling between the shares of Bitcoin Miners and the price of BTC can be a warning signal. Similar differences in the beginning of 2022 preceded broader corrections, which suggests that miners can again be a leading indicator for market stress. Institutions – UnderPerformance in mine -building shares indicate deeper operational and regulatory challenges, so that a possible shift to direct BTC exposure or ETFs is insisted.

Technical shares offer a parallel-recruiting American rates have caused steep losses, with analysts who warn of ten-year setbacks. As with technology, external shocks can reform the crypto dynamics, which means that this divergence turns a signal and not a blip.

Next: Bitcoin’s Road to $ 75k – Is Cryptto’s newest dip a bear staircase in the making?

Source link