- MicroStrategy plans a $700 million convertible bond amid Bitcoin market uncertainty.

- MicroStrategy now controls 1.17% of the total Bitcoin supply, increasing crypto dominance.

MicroStrategy, a prominent Bitcoin [BTC] development company listed on the Nasdaq, announced plans to offer $700 million of convertible senior notes due 2028.

This announcement comes at a time when the price of BTC is encountering resistance around $60,000.

Despite this, the cryptocurrency showed positive movement, with its value rising 1.02% to $59,173 over the past 24 hours.

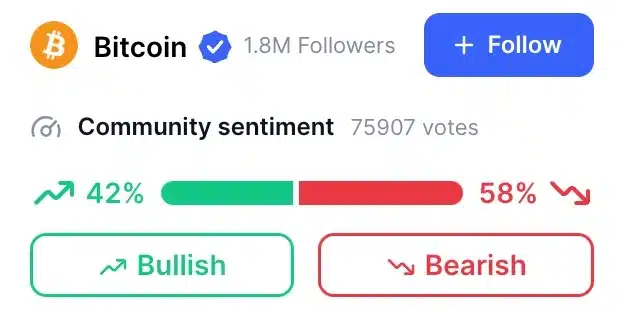

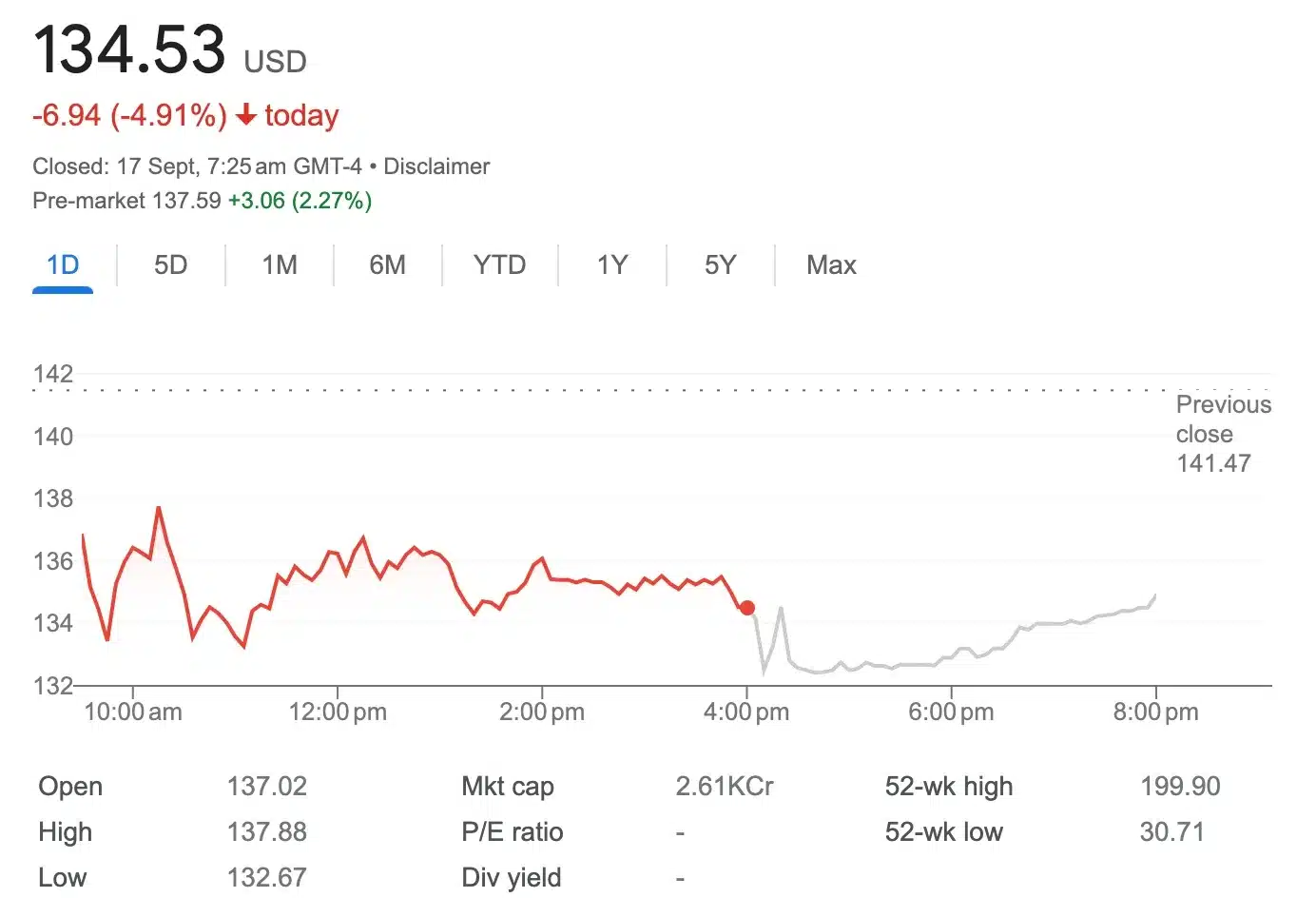

However, sentiment within the Bitcoin community remains divided.

According to CoinMarketCap42% of investors maintain a bullish view on BTC, while 58% have a bearish perspective, reflecting the uncertainty in the market.

Source: CoinMarketCap

Microstrategy’s Bitcoin Strategy

According to the press release these notes will be offered in a private sale to institutional investors who qualify under Rule 144A under the Securities Act of 1933.

Convertible senior notes are a form of debt that can later be converted into equity (shares of the company) under certain conditions. Because they are ‘senior’, they have priority over other debts in the event of liquidation.

The private nature of this offering, aimed at qualified institutional buyers, allows the company to bypass more extensive public offering rules, with the aim of securing funds through this debt instrument while giving investors the opportunity to convert it into company shares .

Community responds

However, Bitcoin critic Peter Schiff seemed unimpressed by this development, as evidenced by his post on X, where he noted:

“Not again. What happens if MSTR is the only buyer left? There is a limit to the amount of debt MSTR can issue to prevent the pyramid from collapsing.”

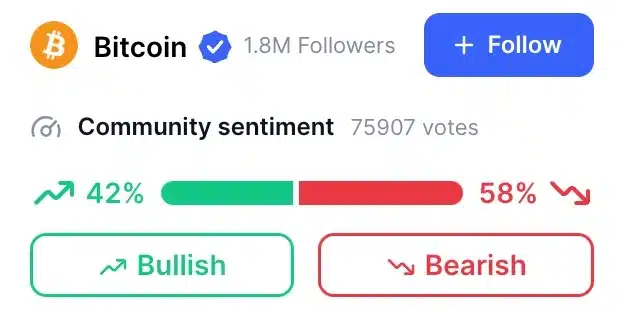

Amidst the ongoing developments, Ecoinometry also reported that MicroStrategy now controls an impressive 1.17% of the entire BTC supply.

The company continues to steadily grow its Bitcoin reserves, positioning itself ahead of most BTC ETFs in terms of holdings.

Source: Ecoinometry/X

Other companies following Microstrategy’s path

Following MicroStrategy’s bold Bitcoin strategy, other companies have begun to take similar approaches.

Metaplanet, a publicly traded investment and advisory firm based in Japan, continues its ‘buy the dip’ approach despite BTC’s recent troubles.

The company recently acquired another 38.46 BTC for $2.1 million, bringing its total Bitcoin holdings to almost 400 BTC, worth approximately $23 million.

Since Metaplanet started its BTC investment strategy in April, its stock price has risen 480%, according to MarketWatch.

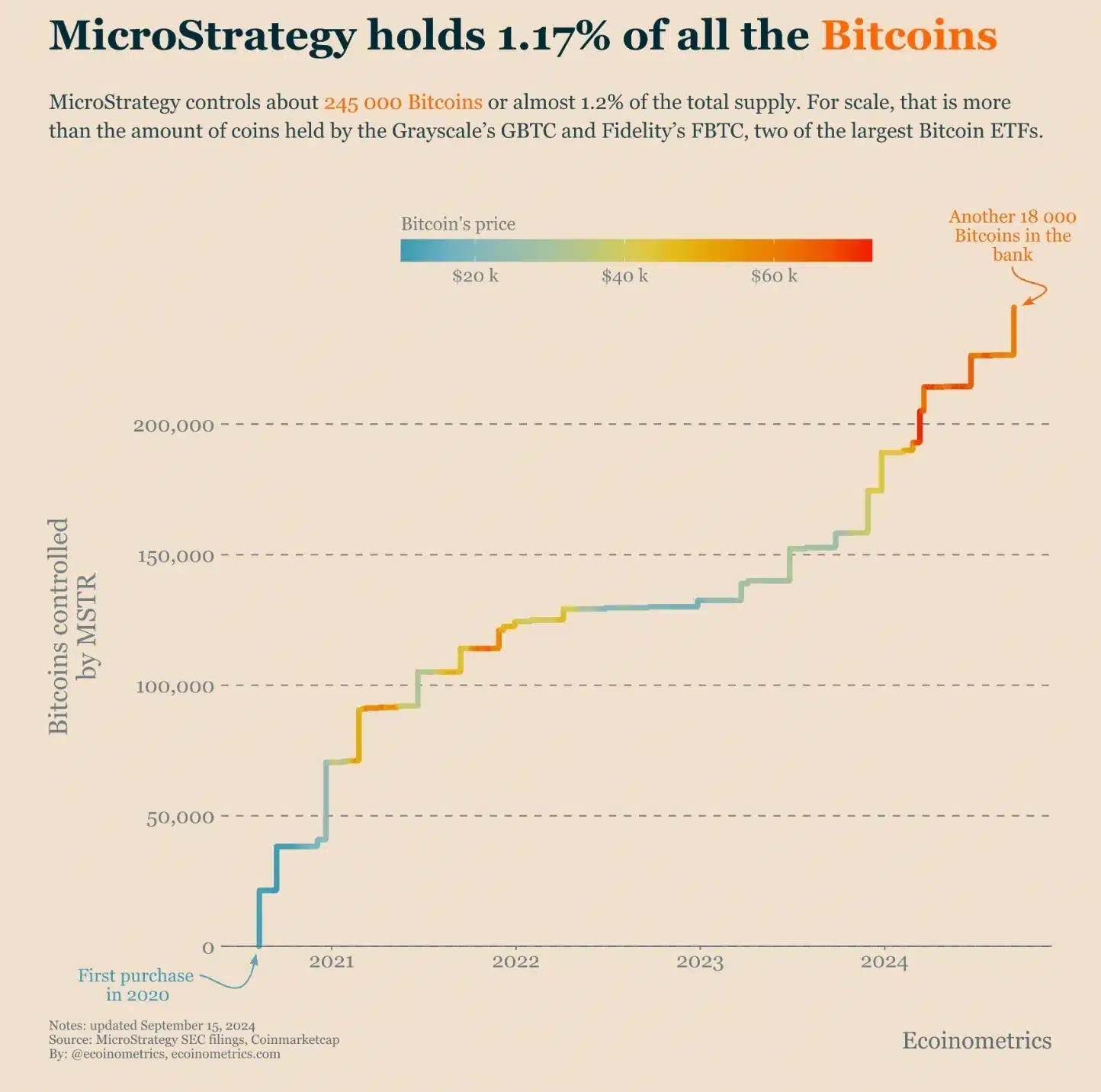

In contrast, shares of MicroStrategy saw a decline of 4.91% on September 17, even though they are up 294.98% over the past year, as reported by Google Finance.

Source: Google Finance

Therefore, MicroStrategy’s consistent accumulation of Bitcoin strengthens its long-term commitment to the cryptocurrency, cementing its presence as one of the key institutional players in the digital asset space.