- Co-founder Michael Saylor teased more Bitcoin purchases for MicroStrategy.

- The BitwiseInvest director also called MSTR essential for high-reward strategies.

If Bitcoin [BTC] peaked at new highs above $90,000, MicroStrategy co-founder Michael Saylor has strongly hinted at future Bitcoin buying. In a recent social media after on the X platform, Saylor said:

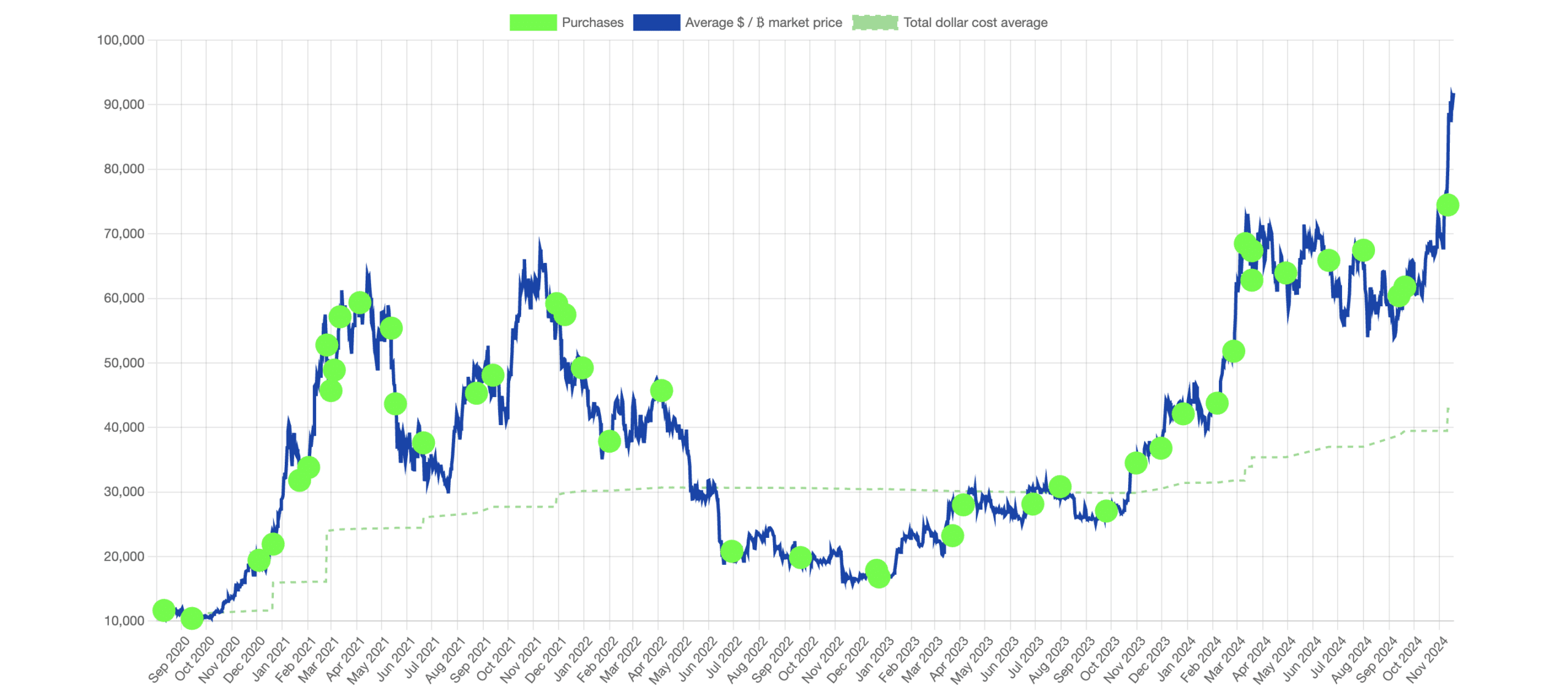

“I think Saylortracker.com needs even more green dots.”

Source: Saylortracker.com

The comment was accompanied by a screenshot of the company’s Bitcoin portfolio tracker, which visually displayed MicroStrategy’s Bitcoin purchases as green dots.

At the time of writing, the value of the portfolio was a staggering $25.7 billion. Meanwhile, Bitcoin traded at $91,935.03, up 2.38% in the past day. according to to Google Finance.

MicroStrategy’s Bitcoin buying spree

While the latest bull run has led to FOMO among some investors, it has also raised concerns about whether it is too late to get into Bitcoin.

However, Saylor has shown continued interest and belief in the cryptocurrency, having bought consistently since 2020.

According to SaylortrackerMicroStrategy has made eleven Bitcoin purchases in 2024 alone.

In the most recent acquisition on November 11, the company purchased 27,200 BTC for approximately $2.03 billion at an average price of $74,463 per Bitcoin.

MSTR surpasses Berkshire Hathaway

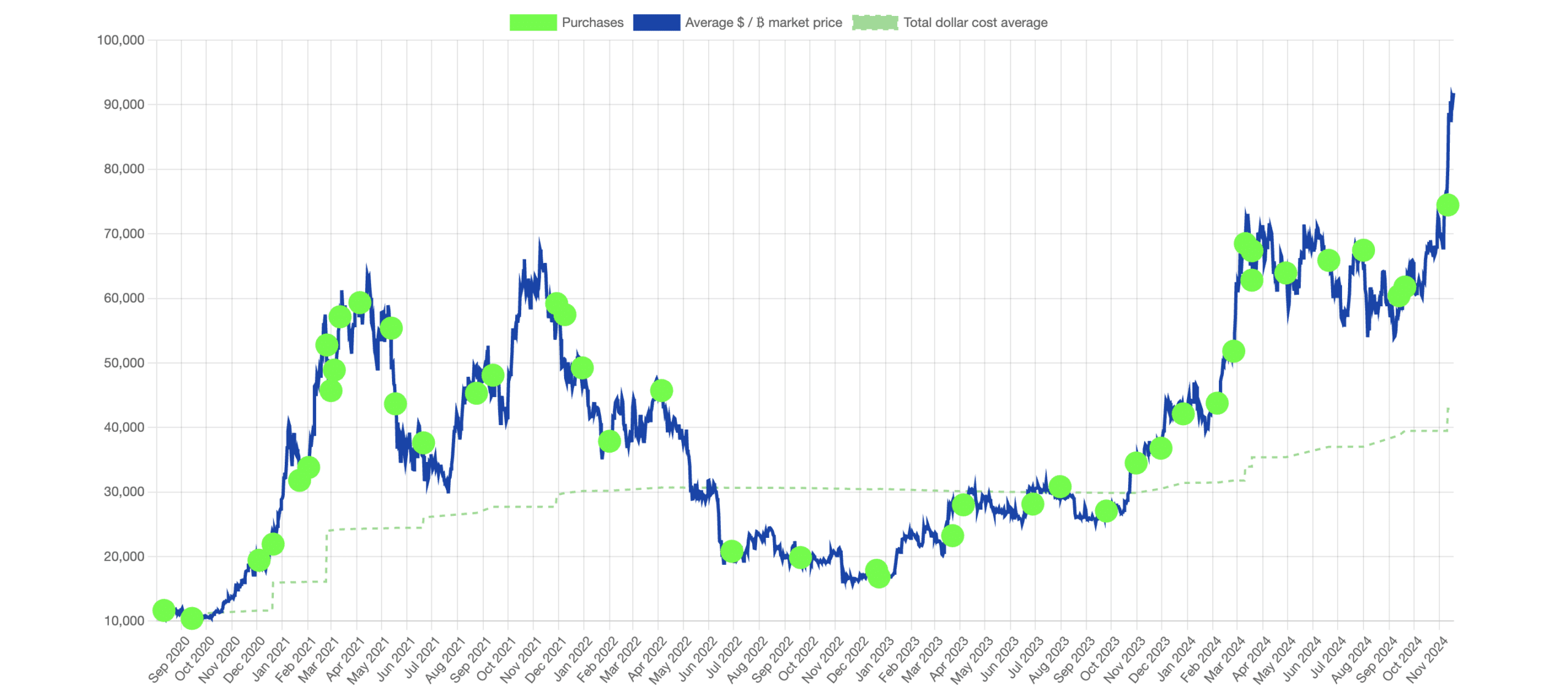

MicroStrategy’s Bitcoin strategy is paying off not only in crypto holdings, but also in stock performance. A graphic shared by financial markets tracker Barchart showed MSTR stock outperformed Warren Buffett’s Berkshire Hathaway [BRK].

Berkshire Hathaway’s MSTR shares and BRK Class B shares showed a ratio of 0.72, quickly approaching dot-com bubble levels.

Source: bar chart/X

For those unfamiliar, the dot-com bubble refers to the meteoric rise and subsequent fall of Internet-based corporate stocks in the late 1990s.

Previously, AMBCrypto reported that MicroStrategy shares had hit a 25-year high, evidence of the market’s recognition of its Bitcoin-focused strategy.

Bitcoin Volatility: A Strategic Opportunity

Meanwhile, Jeff Park, head of Alpha Strategies at Bitwise Invest, recently expressed his thoughts on the synergy between Bitcoin and MicroStrategy on X. He declared,

“Bitcoin and MSTR fit perfectly with volatility strategies, but only if you know how to respond to them.”

Park emphasized the importance of quantitative methods in navigating the probabilistic nature of market movements.

The case for MSTR

In another post, the director offered a more direct endorsement of MicroStrategy stock, noticing That,

“Everyone must have at least €34,065 in €MSTR.”

He argued that owning MSTR offers investors a unique opportunity to earn exceptional returns, making it a must-have for high reward seekers.

As Bitcoin continues to rise and institutional interest deepens, MicroStrategy’s aggressive strategy positions it as a central player in the evolving cryptocurrency landscape.

With the dual momentum of Bitcoin’s price rise and MSTR’s stock performance, the company’s bold gamble appears to be paying off.