- Metaplanet raises 10 billion yen to expand its Bitcoin holdings, following in the footsteps of MicroStrategy.

- Despite a share decline of 5.85%, Metaplanet has posted a gain of 644% since the beginning of the year.

Japanese company Metaplanet has recently gained attention for significantly increasing its Bitcoin [BTC] possessions.

Since the last update, Metaplanet, also known as Asia’s MicroStrategy, has done just that increased 10 billion yen in fresh capital through the recent share sale under the 11th series of share acquisition rights.

Metaplanet’s New Bitcoin Strategy

According to the latest data from Bitcoin treasuriesMetaplanet recently made two substantial BTC acquisitions on October 15 and 16, bringing the company’s total Bitcoin balance to 861.4 BTC.

This highlights the company’s plans to follow MicroStrategy’s lead by using these funds to expand its Bitcoin holdings.

With 13,774 participating shareholders, the exercise of these rights was fully supported by EVO FUND, resulting in significant returns.

Meanwhile, Bitcoin saw a price drop of more than 2% after encountering resistance near the $69,000 mark, reflecting continued volatility in the market.

From the last update of CoinMarketCapBTC was trading at $66,942.

Metaplanet’s CEO weighs in

I notice the same, CEO of Metaplanet Somin Gerovich noted,

“Metaplanet Inc. has completed the exercise period for its 11th share acquisition rights and has achieved an exercise percentage of 72.8% with the participation of 13,774 individual shareholders.”

He added:

“The company has also approved the transfer of unexercised rights to EVO FUND, which has committed to exercise all transferred rights by October 22, 2024.”

Gerovich explained that once the process of issuing stock acquisition rights is fully completed, Metaplanet will have successfully raised a total of 10 billion yen.

He further expressed his gratitude to his shareholders for their support and financial contributions, which are crucial to the goal of becoming a major holder of BTC.

The “end results” refer to the complete accounting and reporting of the funds raised after EVO FUND (the entity involved in the exercise of these share acquisition rights) has completed the transaction.

Overall, Metaplanet is keeping its shareholders informed of progress and reaffirming its commitment to using the capital to further its Bitcoin-focused mission.

Impact on Metaplanet’s share price

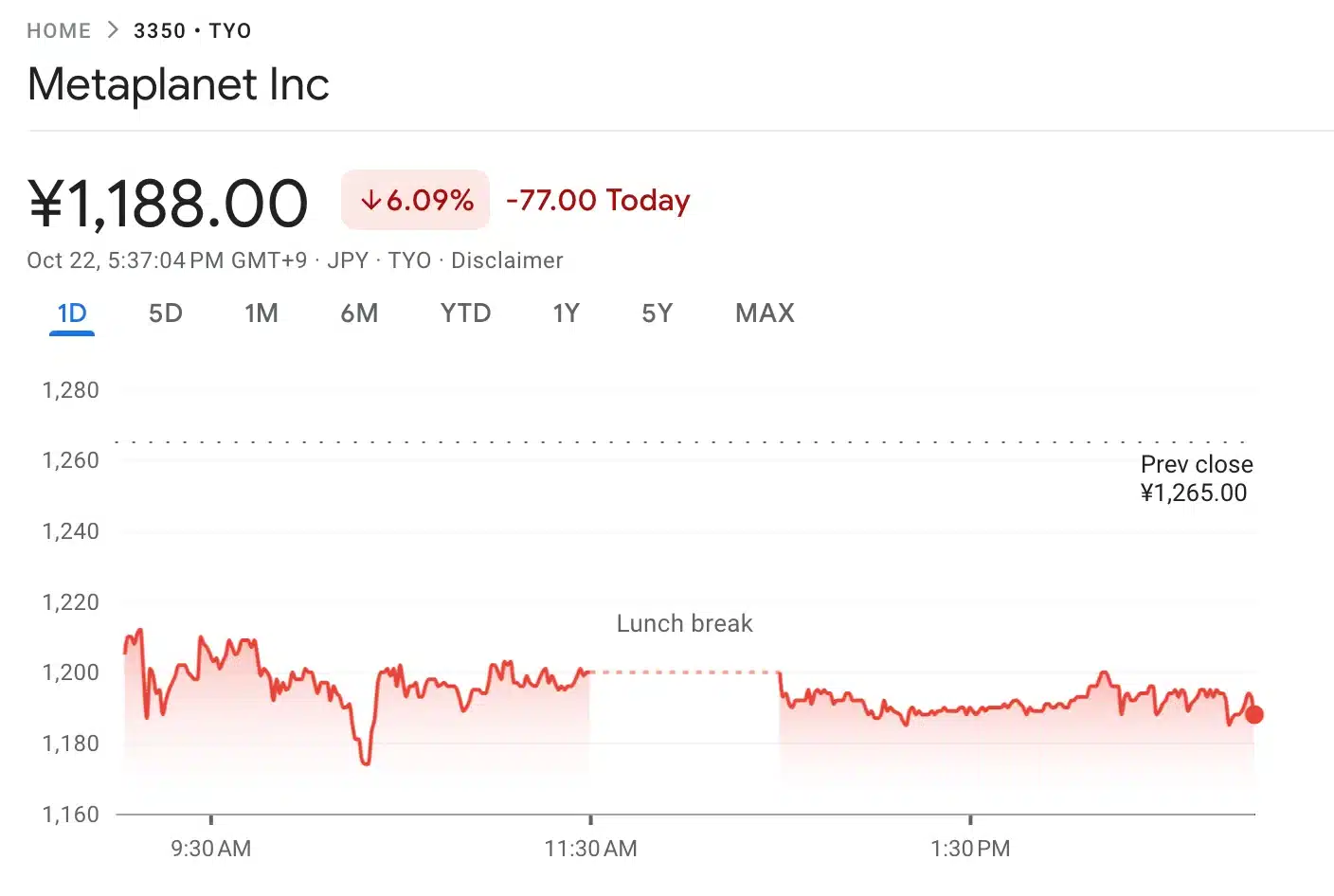

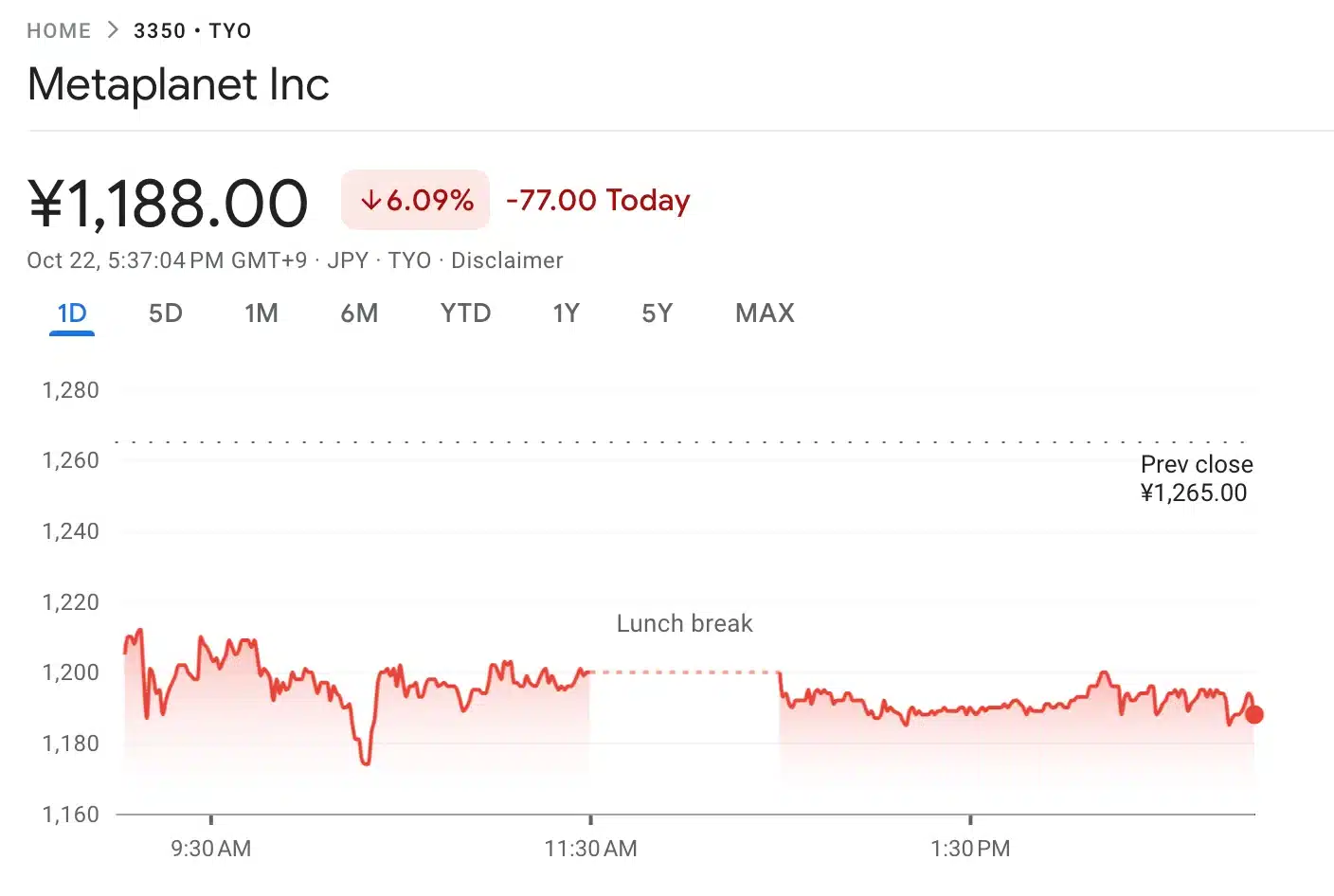

After today’s share sale, Metaplanet’s share price experienced a significant decline, falling 5.85% to below 1,200 JPY.

Despite this decline, the company remains strong, with a notable 644% increase in profits since the start of the year.

As of the last update, Metaplanet’s share price fell further by 6.09%, trading at 1,188 JPY.

Source: Google Finance

This volatility reflects the market’s immediate reaction to the stock sale, yet the company’s overall performance continues to show impressive growth over the longer term.

Thus, by embracing BTC, Metaplanet aims to cope with Japan’s challenging economic conditions, characterized by negative interest rates and quantitative easing.

This bold approach positions the company to hedge against the country’s financial challenges while aligning with the global shift to digital assets.