- Metaplanet increased its Bitcoin holdings to 398.8 BTC amid the price drop, causing its stock price to rise.

- Institutional investors, such as Metaplanet and MicroStrategy, maintained their Bitcoin investments despite market volatility.

Metaplaneta publicly traded investment and advisory firm based in Japan, sticks to its strategy of “buy the dip” amid Bitcoin [BTC]’s recent battle.

As BTC struggles to break the $60,000 barrier, its price recently fell to $56,497.76, reflecting a decline of 0.915% in the past 24 hours, according to CoinMarketCap.

Metaplanet increases its Bitcoin holdings

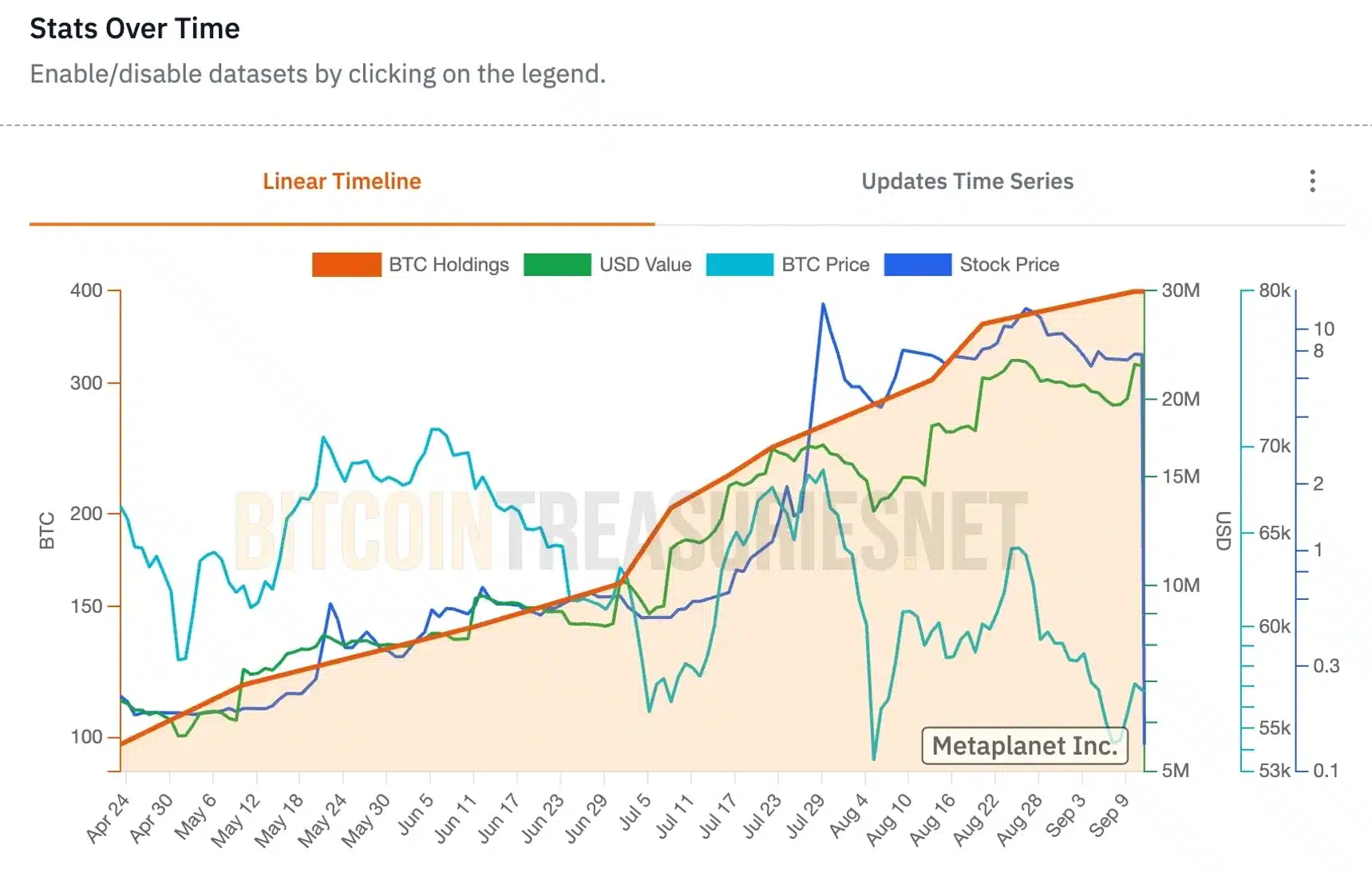

Despite this downturn, Metaplanet has taken the opportunity to increase its Bitcoin holdings to almost 400 BTC.

Source: bitcointreasuries.net

This move has had a positive impact on the share price, which rose 5.9% on the Tokyo Stock Exchange.

Metaplanet’s recent BTC acquisition highlights the investment strategy known as ‘buying the dip’.

This approach involves purchasing assets when their prices fall, with the expectation that their value will rise in the future.

By taking advantage of Bitcoin’s recent decline and adding to its positions, Metaplanet is showing confidence in the cryptocurrency’s long-term potential despite current market volatility.

This strategy shows confidence in the long-term value of BTC and reflects a trend of buying assets during price declines to profit later.

What does the data show?

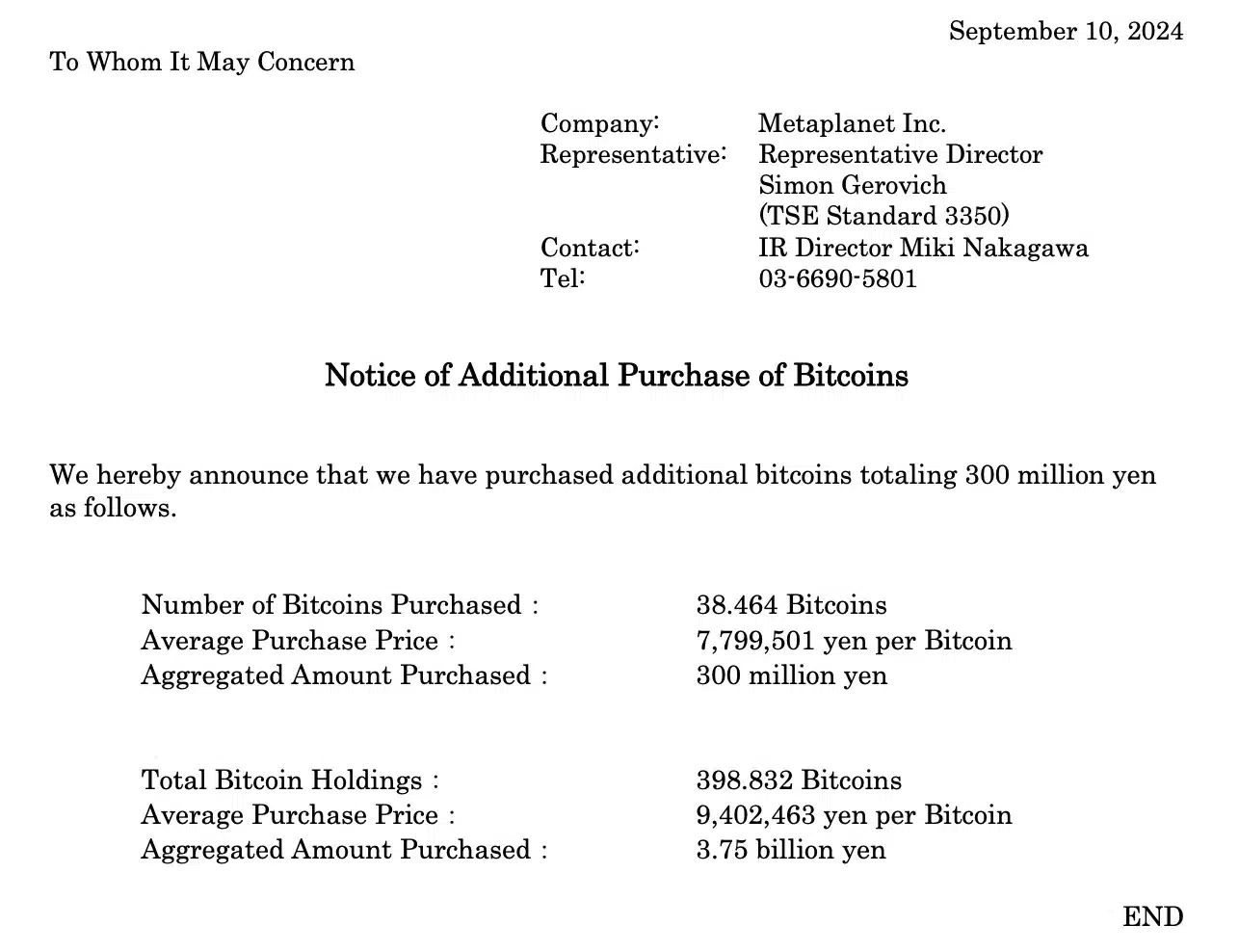

According to the latest report released on September 10, Metaplanet acquired 38.46 Bitcoin for $2.1 million (300 million Japanese Yen).

This purchase increased their total holdings to 398.8 BTC, worth approximately $23 million.

Source: metaplanet.jp

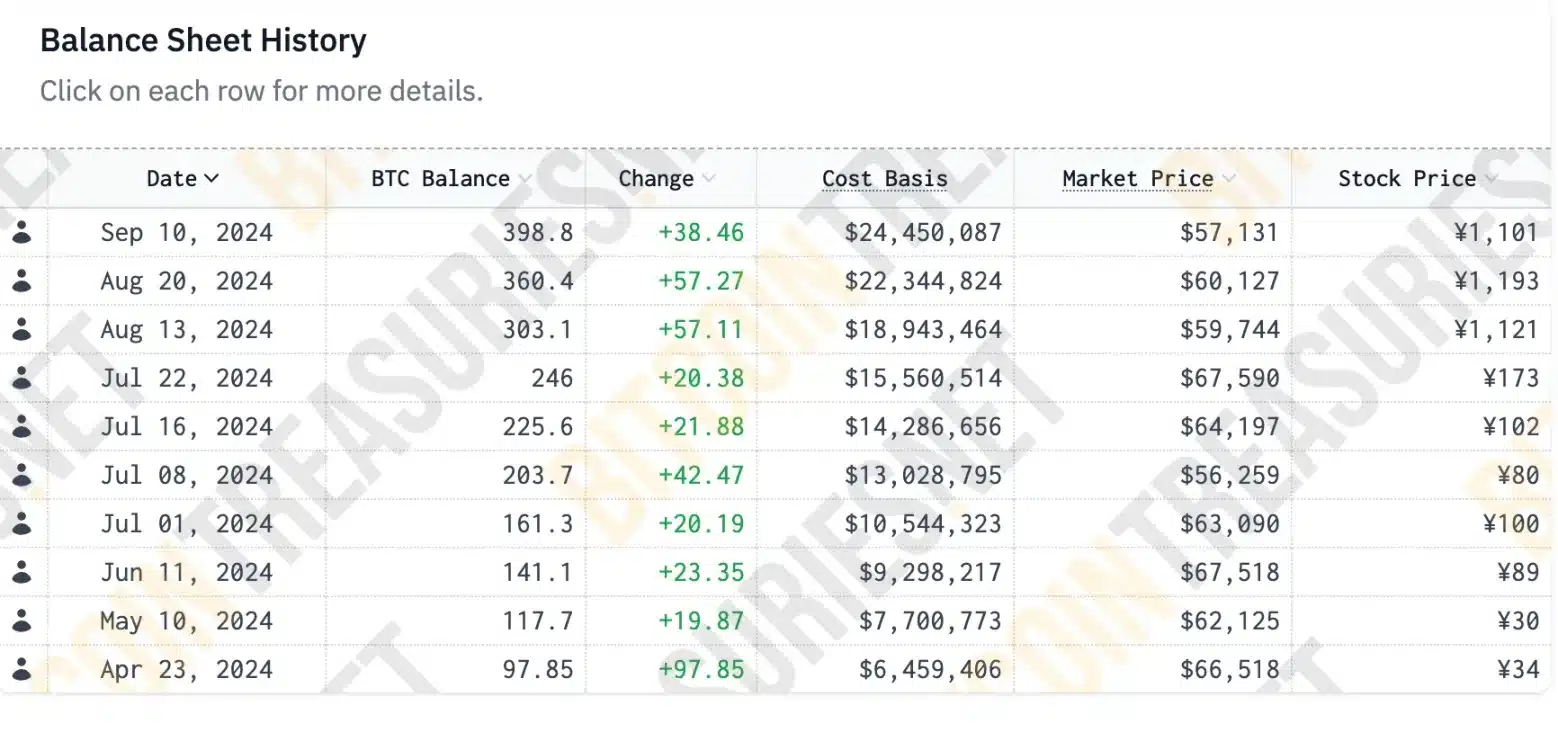

Moreover, according to Bitcoin Treasuries dataMetaplanet began acquiring BTC on April 23 and made its tenth purchase on September 10.

Source: bitcointreasuries.net

As a result, Metaplanet now has the 27th largest corporate Bitcoin reserve in the world and ranks third in Asia.

The impact

Despite this significant increase, the company’s share price saw a small decline of 0.45%, trading at 1,096 JPY, and Bitcoin also saw a downturn.

Source: trading view

However, Metaplanet’s share price has risen 480% since the company first announced its Bitcoin investment strategy in early April. MarketWatch.

In May, Metaplanet unveiled its strategy to grow its BTC reserves by deploying a comprehensive suite of capital market instruments, mirroring MicroStrategy’s approach.

MicroStrategy collects BTC

As expected, MicroStrategy, the largest corporate holder of Bitcoin, recently published the financial results of the second quarter of 2024.

The release highlighted MicroStrategy’s continued commitment to expanding its BTC holdings.

“After another successful quarter for our bitcoin strategy, MicroStrategy today holds 226,500 bitcoins, reflecting a current market value that is 70% higher than our cost base. We remain focused on our Bitcoin development strategy and plan to continue delivering positive ‘BTC returns’.

This trend highlights how institutional investors are adding to their BTC positions despite short-term price fluctuations, suggesting a possible bullish turn for BTC could happen soon.

What lies ahead for Bitcoin?

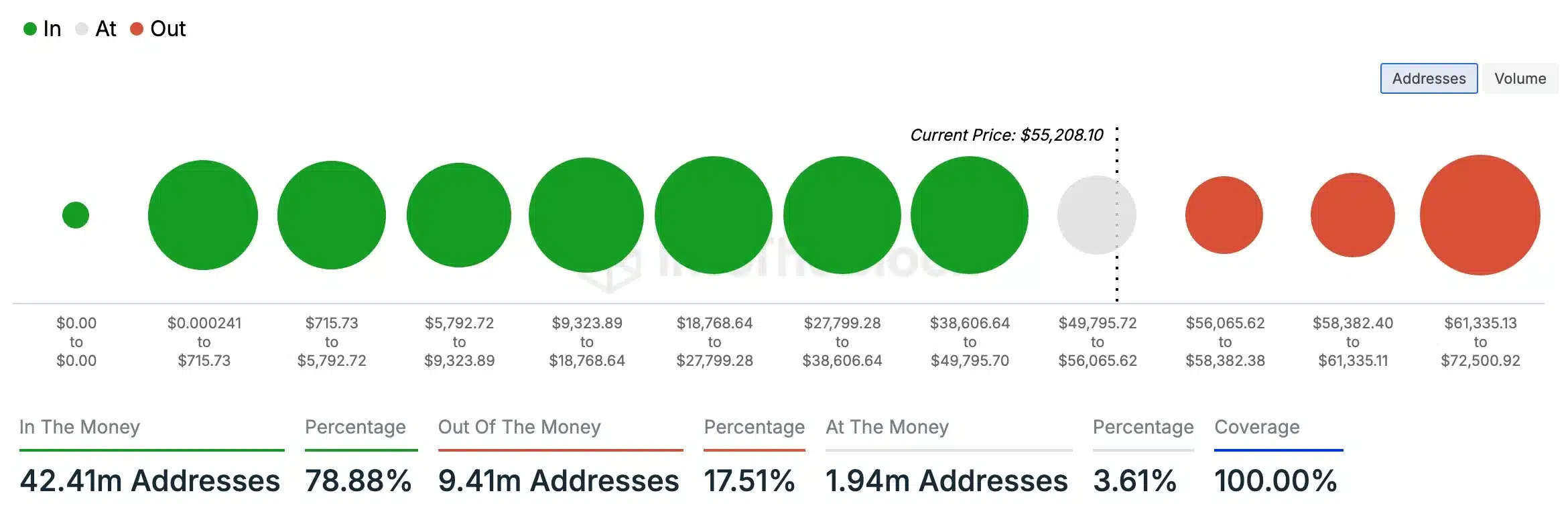

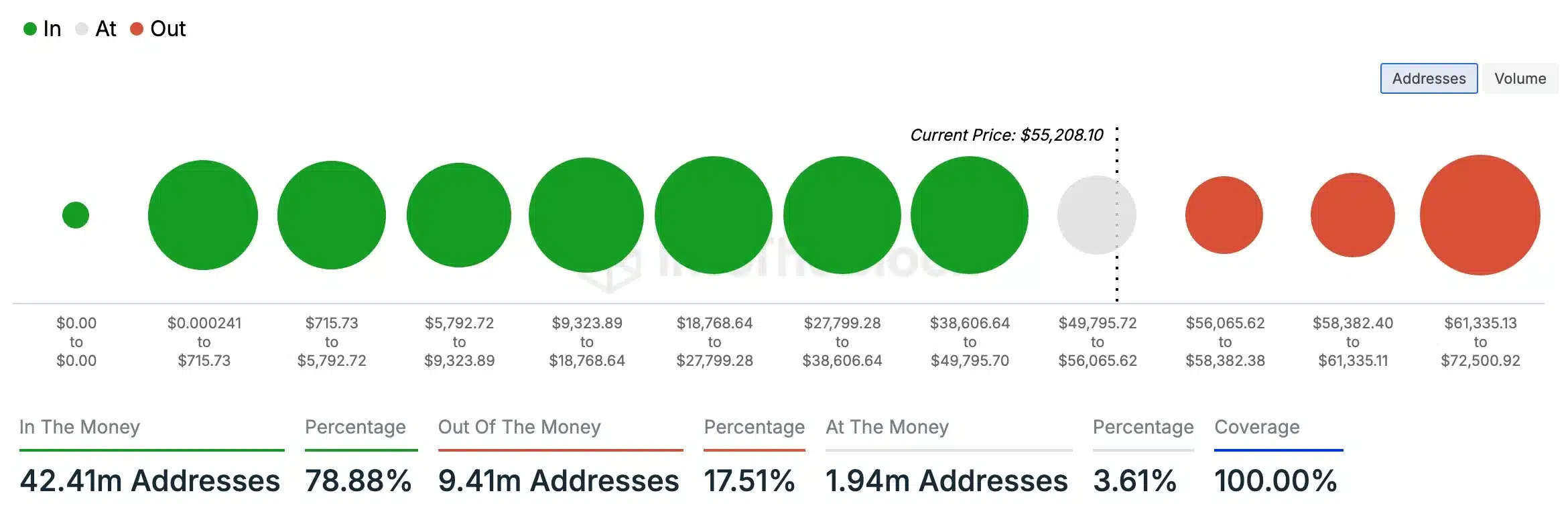

Analysis by AMBCrypto, based on data from IntoTheBlock, shows that a substantial majority (78.88%) of Bitcoin holders are currently in the money, owning tokens valued above their purchase price.

Conversely, only 17.51% of holders are “out of the money,” with tokens worth less than their initial investment.

Source: IntoTheBlock

This data further strengthens the expectation that Bitcoin will soon experience a positive shift in value.