Bitcoin continues to attract the attention of investors while it navigates a critical phase in its price cycle. Entrepreneur and known Crypto analyst Lark Davis Recently shared his perspective on whether the market is approaching its peak or still has room to walk.

Bitcoin’s May performance and the current price overview

From May at around $ 94,146 the price of Bitcoin increased impressively during the month. By 22 May the cryptocurrency reached a new high nearly $ 111,970, which marked an increase of 18.66% within just three weeks. Although the market experienced a slight correction of approximately 3.9% on 23 May, Bullish Momentum quickly resumed, so that the price pushed by more than 1.5% by more than 1.5% the next day.

From now on the price of Bitcoin is around $ 108,789-roughly 2.8% below the all time. This steady price promotion reflects the current investor interest and a careful optimistic market sentiment.

Insights from Lark Davis on market top signals on the market

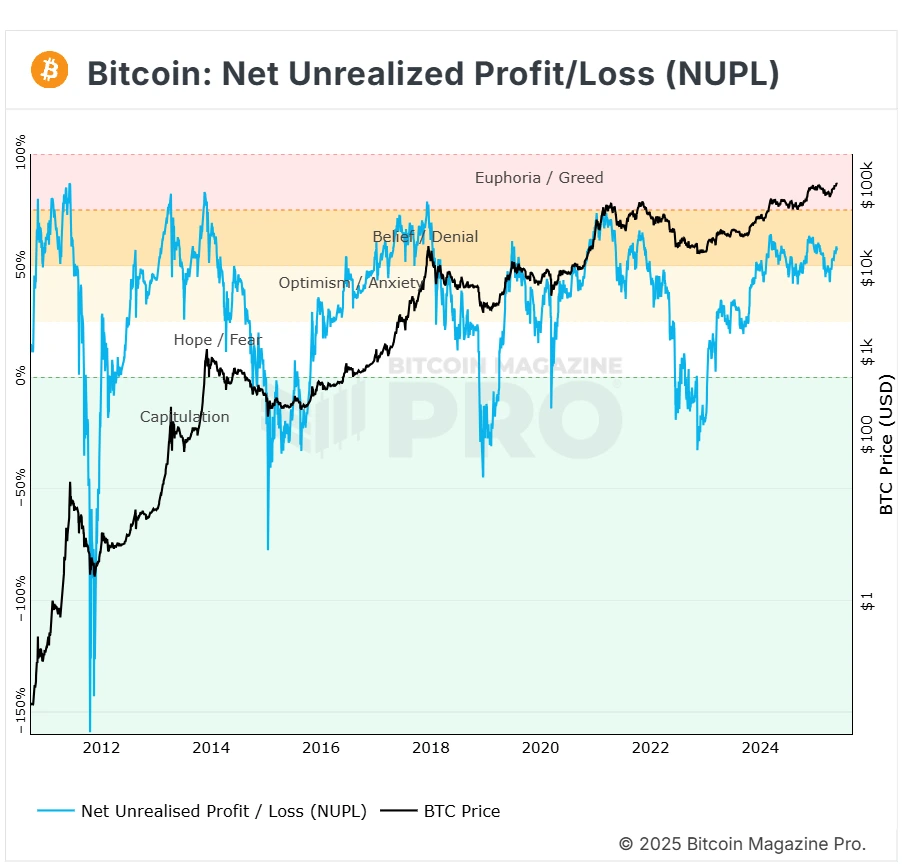

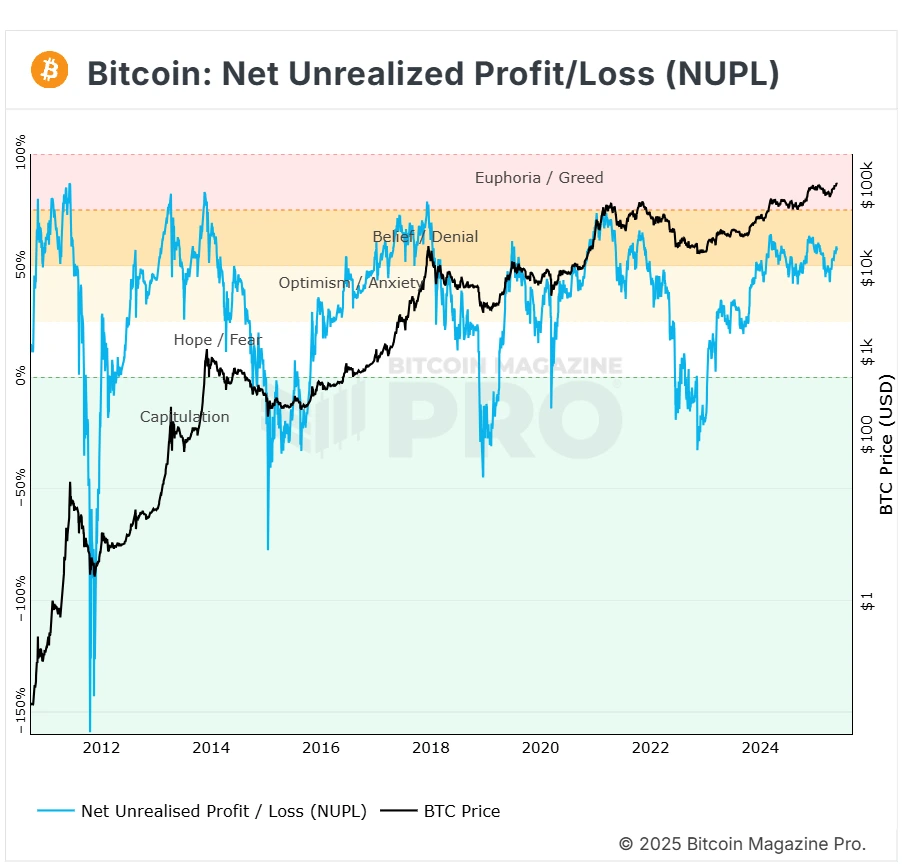

In a recent message on X (formerly Twitter), Lark Davis challenged the common story that the Bitcoin meeting is at the end. He referred to the net realized profit and loss (NPL) indicator to support his opinion that the market still has a considerably upward potential.

The NPL indicator follows the average paper profit for Bitcoin holders. When the value is highly positive, this often means that many investors have realized profit, sometimes preceding market corrections. Davis, however, noted that this indicator is currently not at peak levels, which suggests that a wide -ranging increase increase.

This analysis means that although Bitcoin has been considerably realized, many holders still have a profit, but have not rushed to sell, a condition that can support further price evaluation.

- Also read:

- Robert Kiyosaki warns of ‘Greater Depression’, Bitcoin predicts to $ 1 million

- “

Insight into the net non -realized profit/loss indicator

To clarify, the net non -realized profit/loss (NUPL) Metric measures keep how many profit or loss investors keep on paper without having sold. A positive lecture indicates collective profitability among holders, while a negative value indicates non -realized losses.

The NUPL was at 52.78%on 5 May. When Bitcoin recently reached its peak price, the indicator rose to around 58.7%. These values, although increased, have not yet reached extreme levels that are historically associated with market picks. This is in line with Davis’s view that the rally can still have room to grow for a potential correction.

Balanced perspective and caution of the market

Although Lark Davis offers an optimistic version, it is important for investors to maintain a balanced perspective. Cryptocurrency markets remain volatile and subject to rapid changes based on external factors such as legal developments, macro -economic conditions and a wider market sentiment.

Monitoring important technical indicators such as the NPL and NUPL, in addition to fundamental factors, can offer valuable insights to make informed investment decisions.

Never miss a beat in the crypto world!

Continue to break up news, expert analysis and real -time updates on the latest trends in Bitcoin, Altcoins, Defi, NFTs and more.

FAQs

The NPL indicator follows the total profit achieved by Bitcoin holders; High positive values often identify potential market corrections.

NUPL indicates collective paper profits/losses. Bitcoin’s NUPL has been raised, but not at historical extreme levels for a market top.

Bitcoin is very volatile. Although the current sentiment is cautiously optimistic, you only invest what you can afford to lose and consider long -term goals.

Bitcoin could reach $ 200,000 at the end of the year 2025, driven by ETF inflow and sharpening delivery, although predictions vary. Sources